Blog and Learning Center

Learn how to invest in crypto and how to use our platform

News

Crypto Weekly Wrap: 26th April 2024

The cryptocurrency market is abuzz with activity as investors navigate through a series of ups and downs. Amidst the volatility, various developments have emerged, shaping the trajectory of digital assets. FTX to Auction Remaining SOL Tokens FTX, a bankrupt cryptocurrency exchange, has opted to auction off its remaining Solana (SOL) tokens rather than pursue direct sales.

Apr 26, 2024

News

Latest News: Ripple Challenges SEC’s $2 Billion Penalty Demand

Ripple, the blockchain company behind XRP, has contested the Securities and Exchange Commission's (SEC) request for a hefty $2 billion penalty. In a recent filing, Ripple argued that the proposed fine is excessively punitive and disproportionate to the alleged violations. Instead, Ripple proposed a much lower penalty of $10 million, emphasising that this amount is more in line with the nature of the alleged violations and the company's actual conduct.

Apr 24, 2024

Business

Crypto Financial Advisors — Everything You Need in 2024

As the crypto market continues to gain further momentum and interest in 2024, more and more investors are looking to crypto-financial advisors to help them navigate this complex market, and will often pay handsomely for their help. So, with digital currencies like Bitcoin and Ethereum now firmly embedded in mainstream finance, expert guidance is becoming increasingly sought after, and this has opened up a whole new subsection within the financial services industry; and a lucrative one at that.

Apr 22, 2024

News

Crypto Weekly Wrap: 19th April 2024

Tether Expands Beyond Stablecoins Tether, the pioneering force behind the world's largest stablecoin, USDT, has announced a significant restructuring to accommodate its expanding presence within the digital asset landscape. With a mission extending beyond stablecoins, the company has reorganised into four distinct divisions: Data, Finance, Power, and Education.

Apr 19, 2024

Investing 101

Latest News: Shiba Inu (SHIB) Soars Amidst Record Transaction Surge

Shiba Inu (SHIB), has experienced a surge in transaction volume on its layer-2 blockchain, Shibarium. Recent data reveals an unprecedented increase, nearing the one million transaction mark within a 24-hour period. This remarkable spike, amounting to a 229% surge, underscores growing interest in Shiba Inu's ecosystem, particularly in its decentralised transaction capabilities.

Apr 17, 2024

Business

Turnkey Asset Management Platform (TAMP) — What and Why

For many financial professionals, navigating through an ever-evolving asset management industry can be a challenging task; especially given ever-evolving market conditions, and the constant demand for efficient and transparent services. This is where Turnkey Asset Management Platforms (TAMPs) can make a real difference, as they offer a powerful and streamlined solution that can help financial advisors manage and grow their client portfolios.

Apr 15, 2024

News

Crypto Weekly Wrap: 12th April 2024

UNI Holder Crushed as Market Downturn and SEC Action Amplify Sell-Off The recent crypto market downturn hit UNI holders hard. The United States SEC's impending action against Uniswap Labs exacerbated the situation, triggering panic selling by major UNI holders. Three whales collectively dumped over $20 million worth of UNI, amplifying the price slide.

Apr 12, 2024

Investing 101

Latest News on Cardano (ADA)

Cardano (ADA) experienced a slight downturn, slipping by 4% as the broader market also saw a slight decline. This decline led ADA to drop out of the top 10 crypto rankings, with its former position now occupied by Toncoin due to rumours of a Tether partnership.

Apr 10, 2024

Business

How to Start an Investment Company in 2024

Starting an investment company in 2024 is a great opportunity for those who believe they can capitalise on a rapidly changing financial landscape, including the rise of technology, and evolving investor preferences. But like with most startups, success begins with a solid business plan, and aspiring investing entrepreneurs will also need to have more than a solid grasp of effective investment strategies.

Apr 8, 2024

News

Crypto Weekly Wrap: 5th April 2024

Spot ETH ETFs Under SEC Scrutiny The Securities and Exchange Commission (SEC) has initiated a comment period for three ether spot exchange traded fund (ETF) proposals, signalling a potential shift in regulatory stance towards Ethereum (ETH). The applications from Grayscale Investments, Fidelity, and Bitwise are now subject to a three-week comment period, as announced by the SEC.

Apr 5, 2024

Investing 101

Latest News: Litecoin's Surge and Regulatory Developments

Litecoin (LTC) has recently experienced a significant surge in value, positioning itself as one of the top-performing cryptocurrencies in the market. This surge, which saw LTC surpassing the $100 mark, comes amidst pivotal regulatory developments that have reshaped the landscape for Litecoin and the broader crypto market.

Apr 3, 2024

Business

6 Ways To Manage Surplus Cash in Your Limited Company

If you are a UK business that has made a nice profit for the financial year, the odds are you are having an internal discussion on what to best do with your surplus cash, and are exploring both traditional and modern approaches to cash management.

Apr 2, 2024

Business

Does Your Business Need a Digital Asset Strategy

MicroStrategy implemented a digital asset strategy in 2020 when Chairman and Co-founder Michael Sayler decided to purchase Bitcoin as a hedge against inflation and an alternative to cash on the balance sheet. MicroStrategy has emerged as a prominent participant in the cryptocurrency space.

Apr 2, 2024

News

Crypto Weekly Wrap: 29th March 2024

London Stock Exchange's Bitcoin ETN Market Launch The London Stock Exchange is gearing up to launch a market for Bitcoin Exchange-Traded Notes (ETNs) in May. Issuers intending to introduce Bitcoin ETNs on the Main Market need to submit their applications by April 15. The exchange has set the date of April 8, 2024, to start accepting applications, following its earlier announcement on March 11 regarding the intention to permit trading of Crypto ETNs in the second quarter of the year.

Mar 29, 2024

Investing 101

Ethereum (ETH) News and Price Analysis

Ethereum (ETH) Price Surges Amid Market Momentum Ethereum (ETH) has experienced a significant surge, rising by 11% in the last week to reach $3,569 demonstrating its resilience and attractiveness to investors. This jump comes as the broader cryptocurrency market gains momentum, with a 5.5%

Mar 27, 2024

News

Crypto Weekly Wrap: 22nd March 2024

Latest Developments on the Crypto Market The cryptocurrency market recently witnessed BlackRock, a major asset management giant, delving into asset tokenization by launching a fund on the Ethereum network. This move highlights the increasing interest of traditional finance giants in blockchain technology. Moreover, Starknet, an Ethereum Layer 2 network, plans to introduce "parallel execution" to enhance transaction throughput and speed, mirroring features seen in competing blockchains like Solana.

Mar 22, 2024

Investing 101

Avalanche (AVAX) Soars Amidst Market Volatility: Latest News and Technical Analysis

Latest Developments in Avalanche (AVAX) Price Movement: Avalanche (AVAX) has experienced a notable surge of 42% in its price over the past month, outpacing many other cryptocurrencies within the top fifty despite a general market pullback. Currently priced at $56.26, AVAX has seen a decline of about 10% in the last 24 hours.

Mar 20, 2024

![How To Buy Crypto With A Business Account [2024]](/kpm/assets/7ecdb7ca-8389-4eac-b69e-6bf38d9b03ad.webp?)

Business

How To Buy Crypto With A Business Account [2024]

In an era where digital assets are increasingly becoming a part of the global financial landscape, and where cryptocurrencies like Bitcoin and Ethereum have seen impressive growth, more and more businesses are looking to add cryptocurrency to their balance sheets. The problem, however, is that most mainstream businesses are still not sure on how to buy cryptocurrency in a way that is efficient and stress free.

Mar 18, 2024

News

Crypto Weekly Wrap: 15th March 2024

Latest News and Developments in the Crypto Market In a recent report by blockchain intelligence firm Chainalysis, it was revealed that global crypto gains surged to $37.6 billion in 2023, marking a significant recovery from the losses experienced in 2022. The United States led in total crypto gains, with $9.36

Mar 15, 2024

Investing 101

The Ripple (XRP) Phenomenon: Latest News and Technical Analysis

Latest News: XRP Price Surge Amid Whale Activity and Capital Rotation Ripple (XRP) has experienced a notable surge in price recently, attributed to several significant factors in the crypto market. One of the key drivers behind this surge is the activity of large-scale XRP holders, commonly referred to as "whales."

Mar 13, 2024

Business

Investing as a Business — Opportunities & Challenges

If you are a business owner and happen to be reading this article, then the odds are that you are looking for alternative revenue streams outside of your business, or are looking to implement investment vehicles within your business. Either way, you are looking to make additional income alongside the profit generated by your business.

Mar 11, 2024

News

Crypto Weekly Wrap: 8th March 2024

SEC Delays BlackRock and Fidelity Spot Ethereum ETF Proposals The United States Securities and Exchange Commission (SEC) has once again delayed its decision on spot Ethereum ETF applications from BlackRock and Fidelity, adding another layer of uncertainty to the cryptocurrency market. This delay comes after the SEC approved several spot Bitcoin ETFs earlier, signalling ongoing regulatory scrutiny of cryptocurrency-related investment products.

Mar 8, 2024

Investing 101

JasmyCoin: Riding the Waves of Opportunity - Latest News, Price History, and Technical Analysis

Latest News on JasmyCoin JasmyCoin has recently experienced a surge in its market value, capturing the attention of both investors and analysts. Over the past week, JasmyCoin's price has surged by an impressive 66% maximum, reaching $0.026428, with a 300% growth recorded in the previous month.

Mar 6, 2024

![Best Crypto Exchanges UK — Ultimate Guide [2024]](/kpm/assets/318c78b9-0ba6-4c2a-9475-8918d398e82e.webp?)

Investing 101

Best Crypto Exchanges UK — Ultimate Guide [2024]

In the bustling world of crypto, choosing the right exchange in 2024 is like finding the perfect pair of shoes; it needs to fit your needs, offer comfort, and most importantly, it should make you feel secure. For UK investors, this decision is even more important given the regulatory landscape and the multitude of crypto trading platforms available.

Mar 5, 2024

![How are Investments Taxed in the UK [incl. Crypto]](/kpm/assets/36855014-455e-414e-a511-981303655441.webp?)

Business

How are Investments Taxed in the UK [incl. Crypto]

Whether you are investing in crypto, stocks, or any other asset class, it's fundamental to be aware of your tax obligations. Failure to do so can result in HM Revenue & Customs (HMRC) charging you a penalty fine, and what's more, these fines can accrue interest on the outstanding amount if obligations haven't been met on time.

Mar 4, 2024

News

Crypto Weekly Wrap: 1st March 2024

Bitcoin Miner Sell-Off and Market Dynamics: Bitcoin miners have been actively reducing their inventories amidst a bullish market sentiment. Data from Glassnode indicates a decline of 8,426 BTC (approximately $530 million) in the BTC holdings of miner wallets since the beginning of the year, bringing the total to 1,812,482 BTC.

Mar 1, 2024

![Crypto Index Funds & Strategies - Ultimate Guide [2024]](/kpm/assets/9fc9cb88-d102-4ed3-ad7d-5b3922c6beb1.webp?)

Investing 101

Crypto Index Funds & Strategies - Ultimate Guide [2024]

In the bustling world of crypto and blockchain, finding a solid investment strategy can be a little daunting for new investors, especially given the frequent volatility of the market. In addition to this, new entrants may also find the rapid evolution of the crypto space to be a potential barrier to entry, and this is mainly due to the time commitment needed to keep adequately informed on all the new opportunities out there.

Feb 28, 2024

Investing 101

Ripple's Market Movement, and Analysis

XRP, the cryptocurrency associated with Ripple Labs, has witnessed notable market activity, particularly in light of recent whale movements and regulatory developments. A significant transaction involving the transfer of around $16 million worth of XRP sparked anticipation among holders, although the intention behind the transfer remains unclear.

Feb 28, 2024

Investing 101

Best Crypto Fund Option in the UK 2024

Best Crypto Fund Option in the UK [2024] Unless you’ve been hiding under a rock in 2024, it's hard to overlook the fact that cryptocurrencies are becoming an increasingly appealing asset class for institutional and individual investors to invest in, and more and more people are starting to allocate a portion of their portfolio to crypto funds and ETFs in order to take full advantage of the many passive income opportunities.

Feb 27, 2024

![The Best Ethereum ETF in the UK [2024]](/kpm/assets/1816289b-5f0a-4038-8855-73cb701accb9.webp?)

Investing 101

The Best Ethereum ETF in the UK [2024]

Following the recent approval of the first Bitcoin ETFs in the US, people's attention has since turned towards the possibility of a spot Ethereum (ETH) ETF coming to market, especially given the news of recent ETF applications from investment powerhouses such as Fidelity and BlackRock.

Feb 26, 2024

News

Crypto Weekly Wrap: 23rd February 2024

The crypto market has been abuzz with a flurry of activities and significant developments in recent times. One of the notable developments is Reddit's disclosure of its investment in cryptocurrencies like bitcoin (BTC), ether (ETH), and Polygon (MATIC). This move not only demonstrates Reddit's forward-thinking approach in diversifying its investment portfolio but also signifies a broader acceptance of cryptocurrencies as legitimate assets by mainstream entities.

Feb 23, 2024

Investing 101

The Crypto Bull Run of 2024: What Does it Mean for Bitcoin and the Market?

In February, Bitcoin (BTC) surged past the $50,000 mark, marking a significant milestone in the crypto market. This surge has sparked expectations for a bullish trend in 2024, with key factors contributing to the optimistic outlook. The recent approval of BTC exchange-traded funds (ETFs) has unleashed institutional demand for the cryptocurrency, setting the stage for further growth.

Feb 22, 2024

Investing 101

Ethereum's Price Surges Amidst Anticipation of Spot ETF Approval

Ethereum (ETH) has experienced a significant surge in its price, reaching levels not seen in nearly two years. On Monday, ETH climbed to $3,024, marking its highest level since April 26, 2022. This surge comes as investors anticipate the approval of spot ether exchange-traded funds (ETFs) in the U.S.

Feb 21, 2024

News

Crypto Weekly Wrap: 16th February 2024

BlackRock's Bitcoin ETF Inflows Surge BlackRock's iShares Bitcoin Trust (IBIT) has made a significant impact in the ETF market just 17 days after its launch. With a staggering $3.2 billion in year-to-date inflows, IBIT has quickly climbed to become one of the top five ETFs of 2024, according to Bloomberg Intelligence data.

Feb 16, 2024

News

Solana's Second Phone Surpasses 100,000 Preorders

Solana has recently achieved a significant milestone with its second smartphone, garnering over 100,000 pre-orders and securing a substantial $45 million for further development. This achievement marks a notable contrast to its first crypto-enabled phone, which took nearly a year to sell 20,000 units.

Feb 14, 2024

![9 Best Bitcoin & Crypto Affiliate Programs - Ultimate Guide [2024]](/kpm/assets/1b230124-6786-4b5f-9309-2627ca121153.webp?)

Investing 101

9 Best Bitcoin & Crypto Affiliate Programs - Ultimate Guide [2024]

Ever since they first exploded onto the world stage, cryptocurrencies like Bitcoin and Ethereum have increasingly become sought-after assets due to their appealing value propositions. For example, when one looks at Bitcoin, it has performed better than gold many times throughout the past few years.

Feb 12, 2024

News

Crypto Weekly Wrap: 9th February 2024

Cryptomarket Update Amidst the current volatility in the crypto market, Bitcoin has shown resilience by attempting to push past the $46,000 mark, marking a nearly 5% gain for the day. Spot trading volumes on centralised exchanges saw a notable rise in January for the fourth consecutive month, reaching levels last seen in June 2022.

Feb 9, 2024

Investing 101

ICONOMI's Evolution: From ICO to Today

At ICONOMI, we've not only witnessed the meteoric rise of cryptocurrencies but have also played a pivotal role in making this dynamic asset class accessible to a broader audience. From our groundbreaking ICO in 2016 to becoming a leader in social crypto copy trading, our journey is intertwined with the evolution of the cryptocurrency market itself.

Feb 7, 2024

News

Latest News: Chainlink (LINK) Surges Amidst Market Volatility

Chainlink's native token, LINK, experienced a notable surge of 16 % over the past 7 days, reaching a 22-month high. This surge comes amidst a relatively stable Bitcoin (BTC) trading around $43,000, while altcoins, including LINK, showed gains. The surge in LINK marks an end to a three-month period of consolidation, positioning it as one of the leading decentralised oracle networks in the cryptocurrency market.

Feb 7, 2024

![The Best Bitcoin ETFs in the UK [2024]](/kpm/assets/075367aa-b0fe-4afd-a54c-928b7edefa6b.webp?)

Investing 101

The Best Bitcoin ETFs in the UK [2024]

Ever since the recent news of the first Bitcoin ETF being approved in the US, many investors are looking to see if the UK has any Bitcoin (BTC) ETFs that they can invest into; for the purpose of gaining exposure to the digital currency market.

Feb 5, 2024

News

Crypto Weekly Wrap: 2nd February 2024

FTX Repayment Expectation and FTT Token Fluctuation FTX is anticipated to repay its customers fully as per a court hearing. However, the full recovery of customer assets hinges on the date of FTX's bankruptcy, sparking debate among claimants due to market fluctuations. While the expectation of full repayment offers a glimmer of hope to affected users, the uncertainty surrounding the timing and method of reimbursement has contributed to market volatility.

Feb 2, 2024

Investing 101

Exploring Stellar (XLM)'s Latest Developments and Analysis

Stellar (XLM) is a blockchain network that was established in 2014 as a fork of the Ripple protocol. It's primarily focused on facilitating payments and operates with its native token, XLM. The network distinguishes itself with features like fast transaction speeds and low fees. Recently, Stellar has been gearing up for a significant upgrade known as Protocol 20, aimed at introducing smart contract functionality similar to Ethereum's.

Jan 31, 2024

![The Best Crypto & Blockchain ETFs in the UK [2024]](/kpm/assets/27a4824f-6da0-42af-8057-208e616d7c91.webp?)

Investing 101

The Best Crypto & Blockchain ETFs in the UK [2024]

Following the recent news of the US Securities and Exchange Commission's (SEC) historical approval of the first Bitcoin spot exchange-traded funds (ETFs), there has been a wave of global interest and speculation about whether these crypto investment vehicles will be readily available elsewhere; including in the UK.However,

Jan 29, 2024

Investing 101

Crypto Weekly Wrap: 26th January 2024

Bitcoin Price Surges Amid ETF Approvals and Regulatory Trends: Bitcoin's price settling at the $40,000 mark has been a focal point in the cryptocurrency market, particularly in light of the approval of several Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

Jan 26, 2024

![Crypto Business Accounts You Should Know About [2024]](/kpm/assets/dbbecf10-a8b1-4764-bfb8-c72a8661912f.webp?)

Investing 101

Crypto Business Accounts You Should Know About [2024]

Whether you're a company looking to have cryptocurrency on the balance sheet, a family office intending to diversify into Bitcoin and Ethereum, or a Web3 enthusiast who's recently set up a limited company, opening an account that is designed for crypto is a must-have.

Jan 25, 2024

Investing 101

Unlocking the Potential: Exploring the Latest Developments in UMA

Understanding UMA: A Decentralised Financial System UMA, short for Universal Market Access, operates as an Ethereum token and an open-source protocol, empowering developers to create financial contracts and synthetic assets. The project, founded in 2018 by Allison Lu and Hart Lambur, aims to achieve universal market access through its optimistic oracle (OO) system.

Jan 24, 2024

Investing 101

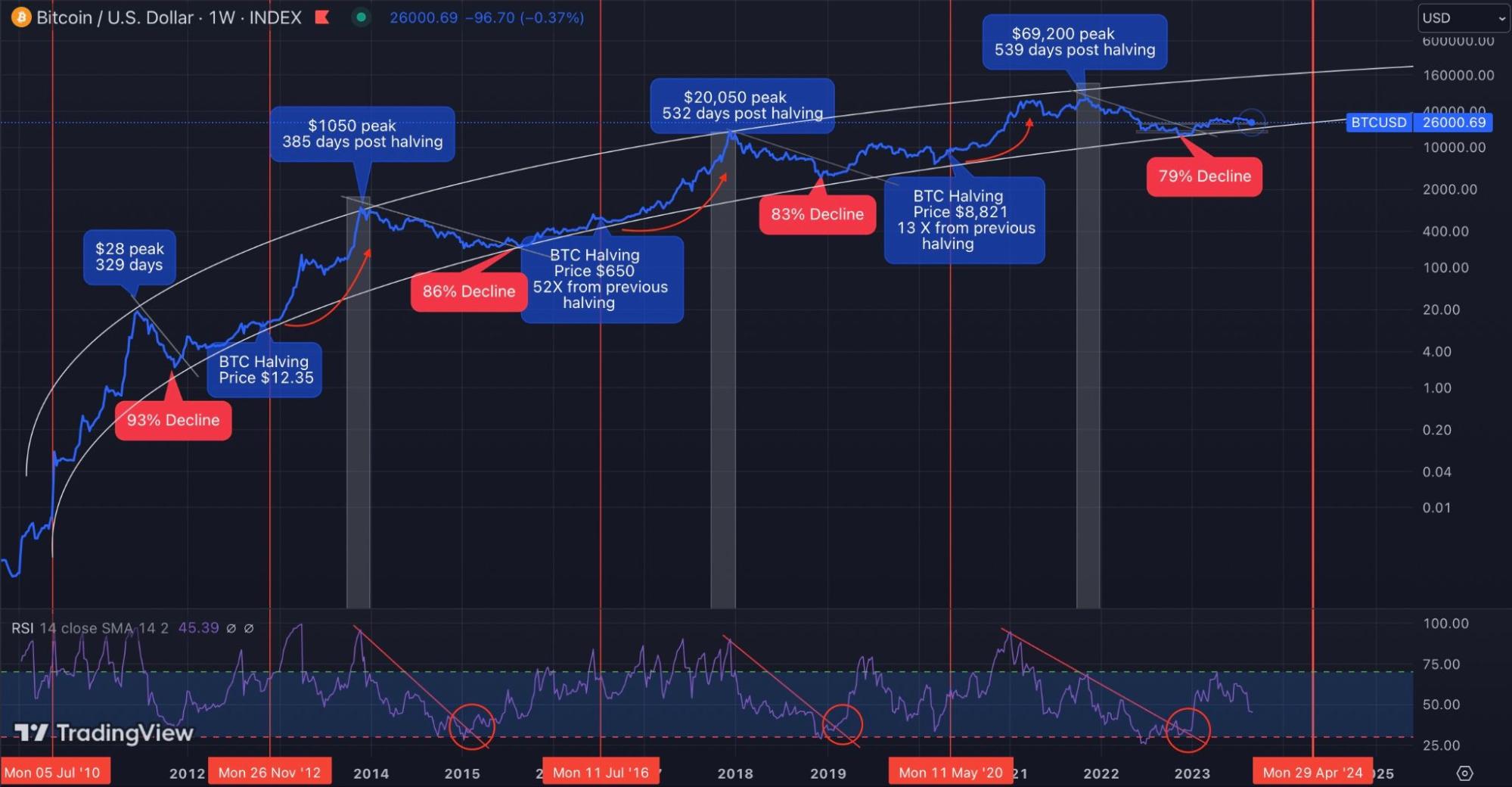

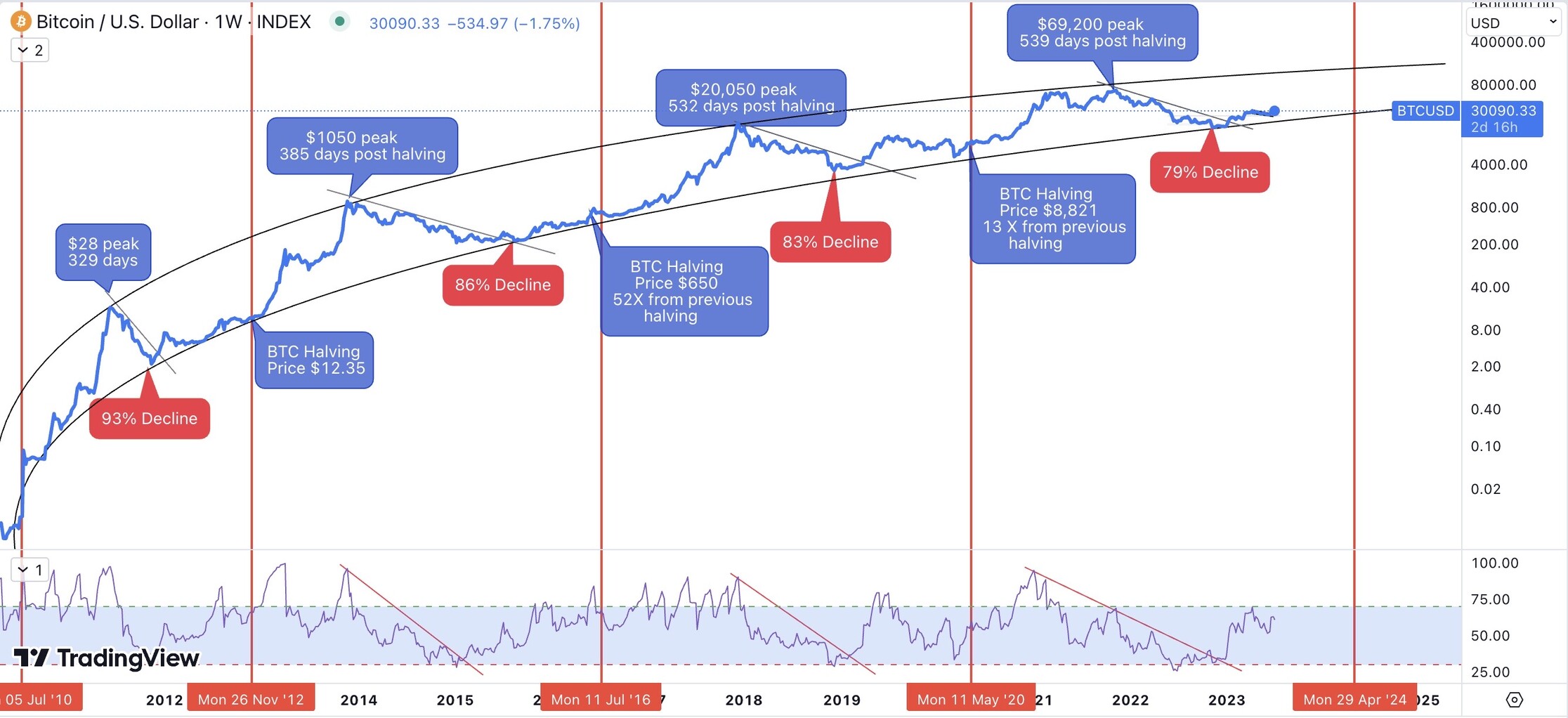

Next Bitcoin Halving Date 2024 — Countdown Clock & Prediction

Bitcoin Halving Clock What Is The Bitcoin Halving, And Why Is It Important? Put simply, a Bitcoin halving is when the reward for mining new blocks is cut in half, which then leads to a reduction of the supply of new Bitcoins that enter the market.

Jan 22, 2024

News

Crypto Weekly Wrap: 19th January 2024

BlackRock's Bitcoin ETF Hits $1B AUM in One Week BlackRock's iShares Bitcoin Trust (IBIT) has reached a significant milestone, surpassing $1 billion in assets under management within its first week of trading. This accomplishment positions IBIT as the first among the recent wave of Bitcoin ETF providers to achieve such a feat.

Jan 19, 2024

Investing 101

Oasis Network (ROSE): Analysis and Latest Developments

Introduction to Oasis Network (ROSE) Oasis Network (ROSE) stands as a pioneering privacy-enabled and scalable layer-1 blockchain network, redefining the landscape of decentralised applications (DApps). Developed by Oasis Labs and launched in 2020, ROSE operates on a Proof-of-Stake (PoS) consensus mechanism, where block validators are chosen based on their holdings of ROSE.

Jan 17, 2024

![Investing in Cryptocurrency for Beginners — Ultimate Guide [2024]](/kpm/assets/6f6070cb-7bc7-4316-a71f-6bd0a1653724.webp?)

Academy

Investing in Cryptocurrency for Beginners — Ultimate Guide [2024]

Cryptocurrency has come a long way since it first burst onto the scene back in 2009, and has evolved from a niche cypherpunk concept to an influential force that is transforming the global financial landscape. It's now 2024, and crypto has continued to gain worldwide interest and adoption, with individuals and institutions showing more willingness to invest their hard-earned capital into this exciting asset class.

Jan 12, 2024

News

Crypto Weekly Wrap: 12th January 2024

Gary Gensler's Cautionary Stance Despite SEC's Approval of Spot Bitcoin ETFs Gary Gensler, the Chair of the Securities and Exchange Commission (SEC), remains cautious about the crypto market, despite the recent approval of spot Bitcoin exchange-traded funds (ETFs) by the SEC. In a statement on the SEC's website, Gensler clarified that the approval does not imply an endorsement of Bitcoin or a shift in the SEC's broader views on crypto assets.

Jan 12, 2024

News

The SEC gives Bitcoin spot ETFs the green light. Will Ethereum be next?

Bitcoin Spot ETF Approval: In an important step that cryptocurrency enthusiasts believe will bring more individual and institutional investors into the market, the US Securities and Exchange Commission has approved the first Bitcoin spot ETFs. Eleven proposals for Bitcoin spot ETFs, including those from BlackRock, Graysclae, Fidelity, and Ark, were authorised by the SEC, and trading could start this week.

Jan 11, 2024

Investing 101

Cardano (ADA): Recent Developments and Technical Analysis

ADA Witnesses a Surge in Trading Volume and Price Recovery In the latest market update, Cardano's native token, ADA, has experienced an impressive surge in trading volume within the last few days. This surge has pushed the total turnover to surpass $900 million. Despite a recent 17.30%

Jan 10, 2024

Academy

Understanding Blockchain Security

As blockchain technology continues to revolutionize various industries, understanding and implementing robust security measures becomes imperative. With the value of assets on blockchain networks exceeding $1 trillion, the significance of blockchain security cannot be overstated. This article delves into the various aspects of blockchain security, exploring its importance, challenges, and future trajectory.

Jan 8, 2024

Academy

What Gives Cryptocurrencies Their Value?

Unlike traditional currencies, cryptocurrencies operate without a central authority and are not backed by a physical commodity. This article delves into the factors that give cryptocurrencies their value, exploring the intricacies of this modern financial phenomenon. The Dynamics of Supply and Demand The value of cryptocurrencies, much like any commodity or currency, is largely driven by the principles of supply and demand.

Jan 8, 2024

Academy

What are Altcoins?

The cryptocurrency landscape is vast and varied, with Bitcoin (BTC) leading the pack as the first and most well-known digital currency. However, the emergence of altcoins, or alternative coins, has introduced a new layer of complexity and opportunity to the crypto world. More Than Just Bitcoin Alternatives The Genesis and Evolution of Altcoins Altcoins, a blend of "alternative" and "coin," encompasses all cryptocurrencies that are not Bitcoin.

Jan 8, 2024

Academy

Risks of Cryptocurrency Investing

Cryptocurrency, a digital or virtual currency secured by cryptography, has emerged as a revolutionary financial instrument, challenging traditional monetary systems. While it offers numerous advantages, investing in cryptocurrency carries significant risks that potential investors must carefully consider. Understanding Cryptocurrency and Blockchain Technology Cryptocurrencies operate on decentralized networks using blockchain technology, a distributed ledger enforced by a network of computers.

Jan 8, 2024

Academy

Why is Crypto Volatile?

Supply and Demand Dynamics Like traditional commodities, the price of Bitcoin is heavily influenced by supply and demand. A unique aspect of Bitcoin is its supply cap at 21 million coins. As the circulating supply inches closer to this limit, and with the increasing difficulty of mining new coins, the price of Bitcoin is likely to escalate.

Jan 8, 2024

Academy

What Are Crypto Exchanges And How Do They Work

The cryptocurrency market, now valued at over one trillion dollars, has become a beacon for digital currency enthusiasts and decentralized finance advocates. As the number of virtual currencies continues to rise, the need for a reliable trading platform becomes increasingly vital for investors. Cryptocurrency exchanges serve this purpose, much like traditional stock and commodities exchanges, by offering a platform for trading various cryptocurrencies.

Jan 8, 2024

Academy

Crypto Liquidity Explained

Crypto Liquidity plays a pivotal role in determining the efficiency and stability of the crypto market. In simple terms, liquidity in cryptocurrency refers to the ease and speed with which one can convert a digital token for fiat or another digital asset, without causing a significant impact on the asset's market price.

Jan 8, 2024

Academy

How is Cryptocurrency Regulated

Cryptocurrency, a digital or virtual form of currency, has emerged as a notable addition to the global financial landscape. Its growing popularity demands a closer look at how it is regulated, especially in regions like the United Kingdom and the European Union. The European Union's Regulatory Framework The European Union (EU) has been at the forefront of regulating cryptocurrencies.

Jan 8, 2024

Academy

Hot and Cold Crypto Wallets Explained

The cryptocurrency landscape is a complex and ever-changing environment where the security and management of digital assets are paramount. At the heart of this ecosystem are two primary tools for asset management: hot and cold wallets. These wallets, each with their distinct characteristics and functionalities, play a crucial role in how individuals store, access, and secure their digital currencies.

Jan 8, 2024

Academy

What are Stablecoins?

Stablecoins have emerged as a significant innovation, blending the stability of traditional assets with the flexibility of cryptocurrencies. Unlike the high volatility characteristic of popular cryptocurrencies like Bitcoin, stablecoins offer a steadier and more predictable digital currency option. Understanding Stablecoins Stablecoins are cryptocurrencies, but with a twist.

Jan 8, 2024

Academy

Recognising common crypto scams and how to avoid them

The surge in popularity and value of digital currencies like Bitcoin and Ethereum has, unfortunately, also attracted the attention of scammers. These fraudsters are continually developing new methods to exploit the relatively unregulated nature of the crypto market. Crypto Investment Schemes In these schemes, fraudsters pose as investment managers and contact potential investors with promises of high returns on Bitcoin investments.

Jan 8, 2024

News

Crypto Weekly Wrap: 5th January 2024

Battle for Dominance: Bitcoin ETFs and Management Fees Trillion-dollar asset managers are on the brink of obtaining approval for their Bitcoin ETFs, sparking fierce competition for market share. A pivotal factor in this race is the management fees, representing the annual cost for handling the BTC backing clients' shares.

Jan 5, 2024

Investing 101

Injective (INJ): Overview and Analysis

Navigating the Crypto Wave with AI Integration Injective (INJ) has emerged as a prominent player in the cryptocurrency space, specifically within the decentralised finance (DeFi) realm, since its inception in 2018. Centred around optimising DeFi, Injective operates on a decentralised network that provides scalable Web3 modules.

Jan 3, 2024

Investing 101

2023/2024 In Crypto - ICONOMI Yearly Wrap

What a year it's been for the cryptocurrency market, Bitcoin is up 169% from its bear market low and Solana is up 684% YTD - to name a couple... Significant gains were made this year before the Bitcoin halving event in April 2024, and the potential approval of a Bitcoin Spot ETF in January 2024.

Dec 22, 2023

![Best Crypto to Buy Now For 2024 [According To Social Media]](/kpm/assets/5d75a42d-7f42-4c9f-82f0-62771db5d27f.webp?)

Investing 101

Best Crypto to Buy Now For 2024 [According To Social Media]

As we head into 2024, the question on most people's mind is whether the crypto market will fare any better than in 2023, and if certain cryptocurrencies will experience a significant rise in price. This not only revolves around the big players like Bitcoin (BTC) and Ethereum (ETH), but also extends to various altcoins and blockchains with smaller market caps.

Dec 22, 2023

News

Crypto Weekly Wrap: 22nd December 2023

Ethereum's Dencun Upgrade Targets January Testnet Deployment Ethereum developers are gearing up for a significant milestone in the new year with the Dencun upgrade. Initially slated for the last quarter of 2023, the upgrade has been rescheduled for 2024 due to engineering complexities. The Dencun upgrade introduces "proto-danksharding," a process designed to enhance data storage capacity through layer 2 rollups, reducing fees and scaling the blockchain by accommodating more data "blobs."

Dec 22, 2023

Business

Ready to Tap into Digital Assets? Navigating Costs and Complexities

In the world of investing, something new is happening. Cryptocurrency is becoming a big deal, and everyone from hedge funds, financial advisors to asset managers are starting to pay attention. Unlike the stock market, which opens and closes each day, the world of cryptocurrency is always on, always moving.

Dec 20, 2023

Business

Institutional Investor Digital Assets Outlook

The financial landscape is witnessing a paradigm shift with the integration of digital assets into traditional investment portfolios. As we navigate through this transformative era, it's crucial to understand the current trends and future projections in the realm of crypto hedge funds. The Resilience and Strategic Evolution of Crypto Hedge Funds Despite facing a tumultuous period characterized by market volatility and valuation dips, crypto hedge funds have showcased an enduring appeal among investors.

Dec 20, 2023

Investing 101

Shiba Inu (SHIB) Analysis

The Shiba Inu (SHIB) market as it continues to show signs of strength. A recent technical analysis indicates a promising trade setup, with the price breaking above the $0.000010 resistance. Traders are eyeing a potential swing trade entry opportunity as the price pulled back to $0.0000010,

Dec 20, 2023

News

Crypto Weekly Wrap: 15th December 2023

Ethereum's Buterin Explores Changes in Layer-2 Functions Vitalik Buterin, co-founder of Ethereum, has proposed a shift in the blockchain's computational load, suggesting the integration of some layer-2 functions back onto the main chain. This proposal introduces the concept of an "enshrined zkEVM," combining zero-knowledge cryptography (zk) with Ethereum Virtual Machine (EVM).

Dec 15, 2023

News

10 Crypto Conferences & Events in 2024

Following the crypto market’s increasing momentum in recent days, 2024 is expected to be a year of excitement for many professionals and businesses; all of whom are looking to keep up-to-date with the rapidly evolving blockchain landscape, and the opportunities on offer with Bitcoin and Ethereum; to name a few.

Dec 14, 2023

Investing 101

Avalanche's Success Amidst Market Turmoil

Cryptocurrency enthusiasts are closely monitoring the impressive performance of Avalanche's native token, AVAX, which has exhibited remarkable resilience, standing out with a 36.5% weekly gain amidst a broader market correction. Even as the broader cryptocurrency market experiences a downturn, AVAX has defied the odds.

Dec 13, 2023

Business

Should You Invest in Crypto Through Your Business

Individual businesses may consider retaining digital assets as part of their strategy for a variety of reasons, including: Excess cash reserves Companies with excess cash reserves may want to explore owning digital assets such as Bitcoin as a hedge against inflation. Because of scarcity and supply/demand dynamics, Bitcoin's purchasing value has historically increased over time.

Dec 12, 2023

News

Crypto Weekly Wrap: 8th December 2023

BlackRock's Bitcoin ETF Gains Momentum with $100K Seed Funding BlackRock is making significant strides in the cryptocurrency space as it recently disclosed receiving $100,000 in seed funding for its proposed Bitcoin exchange-traded fund (ETF). The seed investor, who remains undisclosed, purchased $100,000 worth of shares on October 27, 2023, marking a pivotal step in BlackRock's pursuit of launching the "iShares Bitcoin Trust."

Dec 8, 2023

![4 Best Altcoins To Watch For The Next Bullrun [2024]](/kpm/assets/5125d989-bc65-4fdd-a202-e4d425167957.webp?)

Investing 101

4 Best Altcoins To Watch For The Next Bullrun [2024]

It's coming to that time of year when cryptocurrency investors are looking to plan ahead for the following year. A lot has happened in 2023 that may or may not influence investment decisions in 2024 and beyond. However, although it's nice in theory to use past indicators as a barometer for future success, it's important to acknowledge that the crypto market (and any speculative market for that matter) isn't linear.

Dec 7, 2023

News

Shiba Inu's Notable Surge

Shiba Inu (SHIB) has stood out with an impressive 12% price surge over the last day, as observed on the SHIB/USDT chart. The surge in SHIB's price coincides with a substantial increase in the burn rate volume, potentially marking the most significant burn of the year.

Dec 6, 2023

![How to Best Prepare For The Next Crypto Bull Run [2024]](/kpm/assets/651381ab-1c9f-44f8-a541-d083f2ffa53f.webp?)

How To Guides

How to Best Prepare For The Next Crypto Bull Run [2024]

The new year is almost upon us, and many people are looking forward to enjoying festivities and a break from work. It's also the time of year when crypto enthusiasts, founders and analysts start to speculate on how they think the crypto market will perform next year, and whether the next bull run will finally arrive after a persistent bear market in 2023.

Dec 5, 2023

News

Bitcoin hits $41,600, up 169% from its bear market low.

We have now seen 9 consecutive weeks of positive institutional inflows into digital asset-related investment products, indicating a strong demand for digital assets at the institutional level. This year, more than $1.5 billion of institutional liquidity has flowed directly into Bitcoin-related investment products.

Dec 4, 2023

News

Crypto Weekly Wrap: 1st December 2023

BlackRock's Revised Bitcoin ETF Model: A Strategic Compromise with the SEC BlackRock, a global asset manager, recently engaged in discussions with the Securities and Exchange Commission (SEC) regarding its application to launch a Bitcoin spot ETF in the United States. In response to SEC concerns, BlackRock has adjusted its ETF blueprint to find common ground on the Bitcoin redemption model.

Dec 1, 2023

News

Dogecoin (DOGE): A Comprehensive Update

In a significant milestone, Dogecoin (DOGE) has exceeded five million wallet addresses with a balance, aligning with a surge in user activity. Over 168,000 active addresses in the last day mark the highest level of involvement since March 2022. While the total number of addresses with a balance provides a positive outlook, concerns about ownership concentration persist.

Nov 29, 2023

Investing 101

How to Invest with Crypto Investment Strategies

In the evolving world of cryptocurrencies, where the digital market landscape can change as swiftly as the tide, investors are consistently on the lookout for intelligent, efficient ways to manage and grow their digital asset portfolios. The diversity of the cryptocurrency market can often feel overwhelming, especially considering the rapid proliferation of tokens and currencies, each with unique fundamentals and investment logic.

Nov 27, 2023

News

Crypto Weekly Wrap: 24th November 2023

Binance Faces Landmark $4.3 Billion Settlement and Leadership Change Binance is criminally charged with breaking sanctions and money-transmitting laws. The exchange agrees to a historic $4.3 billion settlement, marking one of the largest penalties obtained by the U.S. from a corporate defendant. Founder Changpeng Zhao (CZ) pleads guilty, agreeing to pay a $50 million fine and step down as CEO.

Nov 24, 2023

Investing 101

Ripple (XRP) Rides the Crypto Wave: Banking, Regulation, and Price Trends Unveiled

Ripple (XRP) has recently seized the spotlight, becoming a preferred digital asset among major global central banks. This surge in interest is highlighted in a comprehensive report from the Basel Committee on Banking Supervision (BCBS), shedding light on the growing engagement of 45 member central banks with digital assets.

Nov 22, 2023

Investing 101

Crypto Weekly Wrap: 17th November 2023

SEC's Stance on Hashdex Bitcoin ETF and Grayscale Ethereum Futures Trust ETF The U.S. Securities and Exchange Commission's (SEC) recent decision to postpone the approval of Hashdex Bitcoin ETF and Grayscale Ethereum Futures Trust ETF has drawn attention. The delay until January 1, 2024, signals the SEC's cautious approach, echoing concerns raised by Chairman Gary Gensler about the unregulated nature and potential for fraud in the Bitcoin market.

Nov 17, 2023

Investing 101

10k Crypto Portfolio: How to Invest With ICONOMI

If you have a pile of cash lying around and want to do something with it, it's been common practice for many years to invest in traditional assets such as stocks, government bonds and real estate. But it's now 2023, and the current economic climate has shown that what was once secure and profitable, isn't the case anymore, and is forcing people from all walks of life to find new alternatives to safeguard or grow their wealth.

Nov 16, 2023

Investing 101

Polygon (MATIC): A Resilient Force Shaping the Future of Blockchain

Polygon (MATIC) has emerged as a resilient force, defying market trends and showcasing robust growth and user engagement. A recent technical analysis reveals a compelling trade setup, with a bullish breakout from a sideways channel, surpassing the $0.60 resistance and breaching the 200-day moving average.

Nov 15, 2023

News

Crypto Weekly Wrap: 10th November 2023

The crypto market has experienced significant movements and developments in recent days, with Bitcoin prices surging to near $38,000. This rally probably triggered a "short squeeze," leading to the liquidation of just under $50 million in Bitcoin shorts within a four-hour period. The short squeeze phenomenon occurs when short sellers, anticipating a price drop, are forced to cover their positions, further driving the prices higher.

Nov 10, 2023

Investing 101

Cosmos (ATOM) Gains Momentum with Exciting Developments

Cosmos (ATOM) has been making headlines with a series of significant developments and a surge in its price. This versatile blockchain system, designed for seamless interoperability, has caught the attention of both investors and enthusiasts alike. Recent Developments: dYdX Migration: A major highlight was dYdX's migration from Ethereum (ETH) to Cosmos.

Nov 8, 2023

News

Crypto Weekly Wrap: 3rd November 2023

Bitcoin ETF Prospects: One of the most highly anticipated developments in the crypto market is the potential approval of a Bitcoin Exchange-Traded Fund (ETF). This financial product could provide a significant boost to Bitcoin's adoption among both retail and institutional investors. The involvement of major market-making firms like Jane Street, Virtu Financial, Jump Trading, and Hudson River Trading in discussions with BlackRock is a clear signal of growing interest in cryptocurrencies.

Nov 3, 2023

Investing 101

Tron (TRX) - Comprehensive Overview

Tron (TRX) Surpasses 190 Million Accounts and Gains Momentum Impressive User Base Growth TRON has recently achieved a remarkable milestone by surpassing 190 million total accounts. This significant increase in user accounts signifies the continuous growth of TRON's user base. It's essential to note that TRON reached its annual peak in June 2023 with 3.8

Nov 1, 2023

Investing 101

Crypto Weekly Wrap: 27th October 2023

Unlocking a $244 Million Bitcoin Fortune In a remarkable turn of events, crypto recovery firm Unciphered extended an offer to former Ripple chief technology officer (CTO) Stefan Thomas to unlock a hard drive containing over 7,000 Bitcoin (BTC), valued at approximately $244 million. Thomas, a German-born programmer, had forgotten the password required to access the drive, which is designed to erase its data after ten incorrect attempts.

Oct 27, 2023

Investing 101

Cardano's Critical Levels: Navigating ADA’s Journey from $0.25 to $0.30

Cardano (ADA) Over the past week, ADA has experienced a significant resurgence, starting from a low of $0.247 on October 19. As of the latest update, ADA is trading at $0.280, marking the sixth consecutive day of gains. This recent performance is indeed impressive, with ADA gaining 14.07%

Oct 25, 2023

News

Crypto Weekly Wrap: 20th October 2023

The market has been a hotbed of activity in recent times, with a series of significant developments and events making headlines. From regulatory challenges and legal battles to market optimism and technological advancements, the crypto industry is in a constant state of flux. We will delve into some of the latest news and developments in the crypto space, shedding light on their implications and what they mean for the future of digital assets.

Oct 20, 2023

Investing 101

Do you have GOLD in your digital asset portfolio?

Investing in GOLD might be challenging when done through a bullion broker. You must not only pay a high spread but also wait for the delivery and ensure you have a secure place to store the precious metal. When selling your gold investment, you must also perform the reverse transaction.

Oct 18, 2023

News

Crypto Weekly Wrap: 13th October 2023

Ethereum's Surging Supply Concerns: Ethereum has seen a significant increase in its circulating supply, with over $47 million worth of Ether tokens added within the last month. This development has stirred concerns, especially among those who anticipated Ethereum's shift to proof-of-stake to render it a deflationary asset.

Oct 13, 2023

Investing 101

Solana (SOL): Prices and Overview

Recent Price Movements: Solana has been on a roller coaster in terms of its price in recent weeks. Following a steep decline after the U.S. bankruptcy court approved the sale of a significant chunk of SOL from the defunct exchange FTX, the digital asset rebounded with a fervour.

Oct 11, 2023

News

Crypto Market in Q3 2023

The crypto market in Q3 2023, echoing the broader mood of the year, has been steeped in challenges and caution. The year began with the crypto market recovering from significant losses in 2022, where Bitcoin dropped 64% and many tokens saw a decline of 80-90%.

Oct 10, 2023

News

Crypto Weekly Wrap: 6th October 2023

Ethereum Futures ETFs Debut with Caution The cryptocurrency community witnessed the launch of the first Ethereum futures ETFs, marking a significant step in bringing more institutional investment to the world's second-largest cryptocurrency by market cap. However, these ETFs did not have a dazzling debut, with some of them experiencing a decline in value and limited trading volume on their first day of trading.

Oct 6, 2023

News

Litecoin (LTC) Price Rebounds and Whale Investors' Impact

Litecoin (LTC), one of the first, if not the first, altcoin, has experienced a remarkable resurgence in value, bouncing back from a 2023 low of $58 to retest the $70 mark on October 2, 2023. This resurgence is a noteworthy development in the world of digital currencies and has drawn attention to the role of influential investors known as "whales."

Oct 4, 2023

Investing 101

Bitcoin Halving Countdown: 195 Days…

The 4th halving of Bitcoin is only about 195 days away; here's why this is significant 👇 The rewards Bitcoin miners receive are generally cut in half every four years, resulting in a decline in the supply of new Bitcoin entering the market. This will be the fourth halving event for Bitcoin since its inception in January 2009.

Oct 2, 2023

Investing 101

6 Best Crypto to Buy Now for Best Future Returns in 2023

Despite the volatility of the crypto market, it’s often best to play the long game, wait out the market, and look to invest for the future. So the question is, which is the best crypto to buy to get the best returns down the line? That’s what we’ll try to answer in this blog post by exploring some of the best potential earners for your future.

Oct 2, 2023

News

Crypto Weekly Wrap: 29th September 2023

Binance's Russian Riddle A major development that grabbed headlines is Binance's decision to exit the Russian market amidst looming reports of a U.S. Department of Justice investigation into sanctions violations. Binance's decision has left many in the crypto world puzzled, especially given the emergence of CommEX.

Sep 29, 2023

Investing 101

Ripple (XRP) Technical Analysis and Overview

Recent Performance: The price of XRP has shown notable volatility, with the coin recently surging past the $0.50 mark, a crucial psychological level for traders and investors alike. Currently, it is trading for $0.4969 yet on a monthly scale, the coin is still down by 5.46%.

Sep 27, 2023

News

MicroStrategy buys 5,445 additional Bitcoins for $147 million

According to a Securities and Exchange Commission filing today, Michael Saylor's MicroStrategy purchased an additional 5,445 bitcoins for $147.3 million, at an average price of $27,053 per bitcoin, between Aug. 1 and Sept. 24. With this recent purchase, the company's bitcoin holdings total roughly 158,245 bitcoins, valued at approximately $4.1

Sep 26, 2023

Investing 101

Crypto Weekly Wrap: 22 September 2023

The global crypto market has seen significant volatility and interest over the past week, demonstrating its ever-evolving nature. The total market capitalization began the week at approximately $1.056 trillion and saw a midweek dip to about $1.082 trillion before recovering to close at around $1.055

Sep 22, 2023

Investing 101

Weekly Crypto Wrap: 15th September 2023

Bitcoin Price Surges Amid Whale Activity Bitcoin (BTC) has taken centre stage in the cryptocurrency market as it witnessed a remarkable resurgence. Over the past week, BTC experienced a nearly 1.28% increase in its trading price, reaching $26,587 on Friday morning. This surge in value has raised intriguing questions about the role of whales in the cryptocurrency market.

Sep 15, 2023

Investing 101

Metal (MTL) on the Rise

Metal (MTL) offers a user-friendly platform for peer-to-peer payments. As a utility token, MTL plays a pivotal role in the Metal system, incentivizing users to adopt the Metal Pay app for payments. Notably, holding MTL grants users substantial fee reductions when purchasing other cryptocurrencies through the app, with a remarkable 0% fee structure for those who hold a minimum of 10,000 MTL tokens.

Sep 13, 2023

Investing 101

Solana is becoming an institutional favourite - here's why:

Digital asset investment products saw institutional outflows in the region of $11.2 million this week. Outflows from digital asset investment products appear to be stalling as Bitcoin trades on a crucial support zone. Despite little activity on inflows/ outflows, trading volumes were much higher than average this week, totalling US$2.8bn

Sep 11, 2023

News

Crypto Happenings in early September

Crypto Happenings in early September MetaMask Scams Targeting Government Websites: One of the most concerning developments was the discovery of MetaMask scams infiltrating government-owned websites across multiple countries, including India, Nigeria, Egypt, Colombia, Brazil, and Vietnam. Scammers took advantage of these official platforms to deceive unsuspecting visitors.

Sep 8, 2023

Investing 101

Stellar’s (XLM) Excitement Over Upcoming Announcement

Stellar’s (XLM) Excitement Over Upcoming Announcement Stellar has been making headlines recently with a remarkable surge in its price. Even in the midst of a broader market downturn, XLM defied gravity, skyrocketing by 7,6% during that period. This impressive performance has left many investors and market analysts intrigued, wondering what's behind this remarkable rally.

Sep 6, 2023

Investing 101

Comparing ICONOMI with Other Platforms

ICONOMI is a UK-registered platform that is designed to make investing in cryptocurrencies as straightforward as possible. The platform offers a copy trading feature where users can replicate the trading strategies of seasoned crypto investors. One of the key features of ICONOMI is the wide variety of Crypto Strategies available; it supports over 300 cryptocurrency strategies and allows users to copy them with just a click.

Sep 5, 2023

Investing 101

Crypto Weekly Wrap: 1st September 2023

Here are this week's key events! 📈 Bitcoin Halving & Cycle Analysis: The next Bitcoin halving will take place in 224 days, where Bitcoin miners' payouts are cut in half. Historically, this has signalled the completion of the accumulation phase and the beginning of a new crypto bull market due to the supply shock.

Sep 1, 2023

Investing 101

Bitcoin Cash's Recent Surge

Bitcoin Cash Going to Zero? Not Bitcoin Cash (BCH) has demonstrated a remarkable surge in value over the past week, showcasing a 15.47% increase in the last 7 days. This positive momentum extended further, with a notable 14.83% uptick in the last 24 hours.

Aug 30, 2023

News

Implementation of the Travel Rule

The UK Crypto Travel Rule came into effect on Friday, 1st of September 2023. As a part of these guidelines, you may have noticed changes in cryptocurrency deposits and withdrawals to and from your ICONOMI account. ICONOMI once again stands at the forefront of compliance.

Aug 29, 2023

Investing 101

Cryptocurrency and Politics

The intertwining of cryptocurrency and politics has become increasingly pronounced as notable figures like Donald Trump and Robert F. Kennedy Jr. make headlines for their involvement in the crypto market. These instances highlight the intriguing dynamic between the crypto sphere and political discourse, shedding light on evolving opinions, potential conflicts of interest, and the broader implications for both domains.

Aug 28, 2023

Investing 101

Meme Coins: The Fun Trend

Meme coins, a distinctive subset of the cryptocurrency, have garnered significant attention due to their amusing and often comical associations with popular internet memes. Meme coins, like Dogecoin and Shiba Inu, are supported by enthusiastic online communities and traders. Their appeal lies in their playful nature and the potential for significant price fluctuations, which can translate into quick profits or losses.

Aug 24, 2023

Investing 101

Week’s Winner: Akropolis (AKRO)

Week’s Winner: Akropolis (AKRO) Empowering DeFi with AKRO Token Akropolis (AKRO) is a decentralised finance (DeFi) platform designed to revolutionise the world of cryptocurrency-based financial services. Developers leverage the platform's infrastructure to create and launch decentralised applications (dApps) that enable users to own and operate their financial services.

Aug 23, 2023

News

Crypto Update 17 August

The past week in the cryptocurrency market has been marked by relatively stable prices. This sustained period of price consolidation could indicate an accumulation phase, potentially setting the stage for a significant price movement in the near future. While Bitcoin remains in a balance between bullish and bearish forces, there have been several noteworthy events and developments within the crypto market.

Aug 17, 2023

News

Fiat Currency Collapse (Argentine Peso)

The Argentine Peso collapsed an additional 22% yesterday, in one day! Year-on-year inflation in Argentina has hit 115%, poverty has soared, and the value of the peso has plummeted. Yesterday, the Argentine central bank made a desperate effort by raising interest rates from 97% to 118% while simultaneously cutting the official dollar exchange rate by 22%.

Aug 16, 2023

Investing 101

TRON's Recent Performance and Key Developments: A Closer Look

Recently, we have witnessed a positive trend of TRON (TRX), a blockchain-based platform focused on decentralised applications and content sharing. Let's delve into TRON's recent performance, notable price changes, and important developments that have caught the attention. TRON has demonstrated its resilience and adaptability. In the past 3 months, TRX has witnessed a 12.35%

Aug 13, 2023

News

Crypto Weekly Wrap: 11th August

Here's what's moving the cryptocurrency market this week 📊 Digital assets are historically known for increased volatility, however, the market is currently experiencing an extreme volatility compression. Fewer than 5% of trading days have a tighter trade range. Bitcoin and the overall cryptocurrency market are in a consolidation phase.

Aug 11, 2023

News

DOGE Price and News

Dogecoin (DOGE) has been making waves in the market, attracting attention from investors, enthusiasts, and the broader public. This playful and meme-inspired digital currency emerged in 2013 and was initially considered a joke. However, its popularity skyrocketed due to widespread social media exposure and the support of influential figures like Elon Musk.

Aug 4, 2023

Investing 101

Stellar (XLM) Analysis - Latest Developments

On July 28 XLM to USD Price was $0.1617 and Stellar Market Cap $4.41B. Return in the last 24 hours was +4.45 %, return in the last month was +57.86%. We can clearly see in the picture below the rising price of XLM from June 1 up to July 27 with Moving Average (50) and trading volume.

Jul 31, 2023

News

Crypto Funds' AUM Growth

We saw a remarkable surge in assets under management (AUM) for crypto funds in recent years. From 2018 to 2022, these funds have experienced substantial growth, and the trend continued with a significant spike in AUM in July 2023. Since the beginning of 2018, the AUM of crypto funds has been on an upward trajectory, reflecting the increasing interest and investment in the digital asset space.

Jul 31, 2023

Investing 101

How BitFolio Switched from Manual Calculations to Automated Portfolio Optimisation with ICONOMI

From Struggle to Streamlined Success: BitFolio's Time-Saving Transformation For our Strategists, navigating the complex financial landscape was a time-consuming and challenging endeavour. The daunting task of manually rebalancing their investment portfolio was constantly consuming their time. However, everything changed with the discovery of ICONOMI, marking the genesis of the now-acclaimed BitFolio Crypto Strategy.

Jul 28, 2023

News

👉 Crypto Weekly Wrap - Here are some of this week's key headlines!

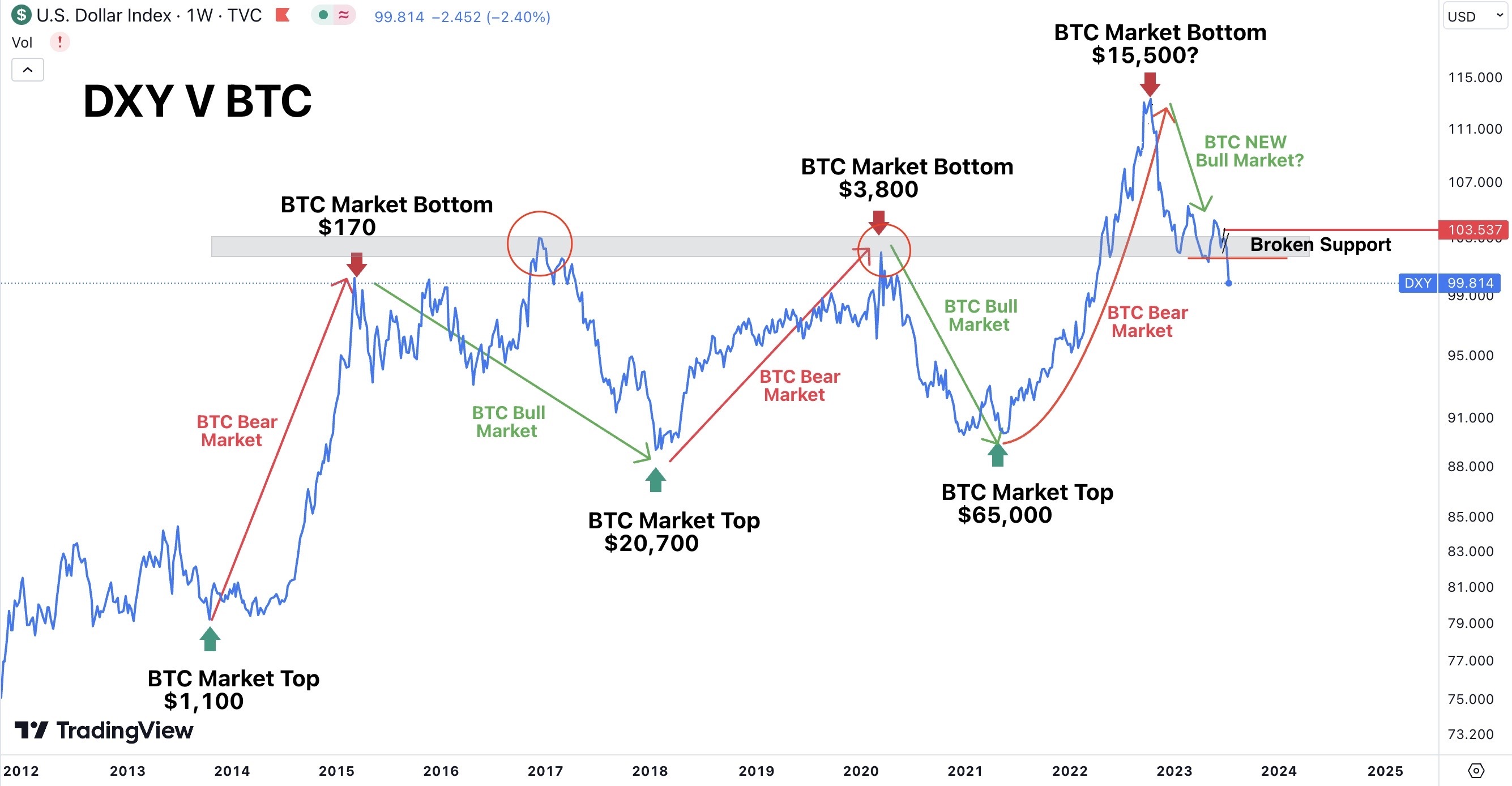

Bitcoin Under Pressure Since Bitcoin printed a new yearly high at roughly $31,800, downside pressure has moved into the cryptocurrency market. Bitcoin is down roughly 2% from Monday's open and 9% since the new yearly high on the 13th of July. At the same time, a rotation into the US Dollar Index can be observed.

Jul 28, 2023

News

Crypto Weekly Wrap: 21st July 2023

▶ Institutional Inflows: Over the previous four weeks, institutional inflows into digital asset investment products have increased by more than US$742 million, marking the longest streak of inflows since the fourth quarter of 2021. Last week, Bitcoin witnessed inflows of US$140 million, or 99% of all inflows.

Jul 21, 2023

News

Crypto Weekly Wrap: 14th July 2023

🚀 XRP Takes Center Stage: XRP HODLERS have finally been rewarded, with the crypto closing almost 70% higher than it opened yesterday. XRP touched highs of USD 0.945 before marginally retreating to USD 0.7735. The case between the SEC and Ripple has finally concluded.

Jul 14, 2023

News

The ICONOMI Crypto June Review

Digital Asset Institutional Inflows Following 8 weeks of institutional withdrawals from digital asset-related investment products, the market experienced its greatest institutional weekly inflows in over a year, totalling U$199 million. Because of the several Bitcoin spot ETF applications in the US, institutional inflows have recovered to the tune of $334 million in the last two weeks (data courtesy of Coinshares).

Jul 7, 2023

News

Market Overview in the First Half of 2023: Institutional Interest and Regulatory Challenges

The cryptocurrency market in the first half of 2023 has been a whirlwind of volatility and regulatory scrutiny. Despite the challenges, digital currencies have managed to hold their value and deliver positive price movements. One of the significant events shaping the crypto market was the increased regulatory oversight by the US Securities and Exchange Commission (SEC).

Jul 6, 2023

News

The Bitcoin ETF Race Is On! - Crypto Weekly Wrap: 30th June

After strong gains across the cryptocurrency market the week previous, Bitcoin is currently consolidating around the 31,000 level of resistance. However, over the past week, roughly US$200 million of institutional liquidity flowed into digital asset investment products, the largest weekly inflow since July 2022. The inflows offset more than half of the institutional outflows over the past 9 weeks.

Jun 30, 2023

News

💡 Crypto Weekly Wrap: 23rd June

📈 Institutions are BULLISH on BTC: This week, Bitcoin exploded to the 31K USD resistance level due to news of institutions piling into the cryptocurrency market, despite the ongoing legal battles between the SEC, Binance and CoinSpot. The largest fund on the planet (BlackRock) applied for Bitcoin Spot ETF, highlighted last week.

Jun 23, 2023

News

💡 Crypto Weekly Wrap: 16th June

🏢 Is the FED pivot here? This week, the Federal Reserve decided to keep interest rates on hold for the first time in 15 months. There have been 10 consecutive interest rate hikes in the US. Jerome Powell stated that there would be another 2 possible rate hikes later this year, with analysts calling it a "Hawkish Pivot".

Jun 16, 2023

Investing 101

Investing in AI

Want to invest in AI? Artificial Intelligence (AI) is rapidly expanding and revolutionising various industries, including the crypto market. Its ability to enhance user experience, improve scalability, and strengthen blockchain security has caught the attention of many crypto enthusiasts. The integration of AI and blockchain technologies is a key driving force behind the success of AI in the crypto market.

Jun 12, 2023

Investing 101

Crypto Market Wrap: 9th June 2023

There have been several high-impact news stories impacting both the cryptocurrency market and equity market over the past couple of weeks. In this blog post, we will break down some of the key events: US Regulators At War With Crypto Just this week, the SEC made two announcements indicating legal action against both Coinbase and Binance.

Jun 9, 2023

Academy

Crypto Trading for Beginners

Welcome to our crypto trading for beginners survival guide. If you're a crypto trading beginner looking to dive into the realm of digital assets, you've come to the right place. We understand that starting out the vastness of the crypto trading landscape might feel overwhelming.

Jun 9, 2023

Investing 101

Crypto Market Wrap: 2nd June 2023

Bitcoin Long-term View: Despite the negative market sentiment, the clamp down across the globe on the cryptocurrency industry, the ongoing banking crisis, the looming recession and surging interest rates, BTC is moving as expected. Bitcoin is still trading inside the rising channel formation/structure. After tagging the lower bound of the channel at roughly 15,500 USD in December 2022, BTC reached its first major milestone at 30,000 USD, up roughly 100%.

Jun 2, 2023

News

Crypto Weekly Wrap: 26 May 2023

Here are some of this week's crypto headlines! XRP Gaining Momentum: XRP is on the cusp of another bullish breakout from a bull flag formation. The CEO of Ripple believes that the payment industry giant will win the SEC lawsuit in a landmark manner. In an interview, Brad Garlinghouse expressed his confidence that the SEC vs.

May 26, 2023

Investing 101

Crypto Asset Allocation: A Quick Guide for Investors

While volatile, cryptocurrency has the potential to generate immense returns. Investors who are willing to withstand short-term price swings could potentially benefit from substantial long-term gains. But crypto is not just a financial instrument - many cryptocurrency projects are based on innovative technologies. They might revolutionize various industries, from finance to supply chain management and beyond.

May 25, 2023

Investing 101

💡 Crypto Weekly Wrap: 19 May 2023

📈 XRP gains 8% due to CBDC play: XRP is one of the top-performing cryptocurrencies this week, gaining over 8% from Monday's open. Ripple is pushing further into the CBDC game, unveiling a new platform for creating blockchain-based digital currencies. In Hong Kong, Ripple Labs has introduced a new payment system for a central bank digital currency (CBDC).

May 19, 2023

Investing 101

💡 Crypto Weekly Wrap: 12th May 2023

📉 US Debt Ceiling Weighing On Risk Sentiment The US dollar has found support despite inflation hitting a 2-year low, the rise in the dollar has put downside pressure on all risk assets, including cryptocurrencies. Although this is a low-probability outcome, fears of the US defaulting on its debt obligations due to the debt ceiling have increased.

May 12, 2023

Academy

How Behavioural Biases Influence Our Crypto Trading

Crypto investing holds greater volatility than traditional markets, but it comes with very similar behavioural biases. While the potential rewards are enticing, it’s crucial to understand the potential pitfalls associated with all trading. As we are all human, behavioural biases are a part of our nature, and they impact our decision-making process, which holds true for investing and trading as well.

May 4, 2023

Investing 101

The ICONOMI April Crypto Wrap

The ICONOMI April Crypto Wrap Key Points To Cover: Bitcoin Update: Bitcoin has stalled at the 30k USD resistance level after achieving a 100% return from the 15,500 lows back in November 2022. Bitcoin's dominance increased to 46% of the total cryptocurrency market share, up from roughly 40% at the start of the year.

Apr 28, 2023

News

⚡ April Week 3 Crypto Weekly Wrap

📉 Technical Analysis BTC At $30,000, Bitcoin has attained its first significant milestone. As we can identify an important resistance level, a bearish divergence on the 2-day chart, and a negative trend line resistance, this level may come under renewed selling pressure. Although BTC's 100% YTD gain is encouraging, a stop or correction is likely in the next few days or weeks due to the technical structures.

Apr 21, 2023

Investing 101

Rising Cost of Living in the UK: A Shift Towards Responsible Investing and Cryptocurrency

The cost of living in the UK has been on the rise over the past few years, with soaring energy and fuel prices putting a strain on household budgets, creating a cost of living crisis. These increases are forcing families to re-evaluate their finances and make difficult choices to stay afloat.

Apr 18, 2023

Investing 101

Minutes With the Strategists episode 2

In the ever-evolving world of cryptocurrencies, staying ahead of the game is a challenging task. One way of keeping up is to sit down with the minds who have been actively trading for years on end. I had the privilege of sitting down with the people behind Rational Active Allocation and Mountains and Valleys.

Apr 13, 2023

Investing 101

How to Invest during a Recession?

During an economic downturn, investors must tread carefully, but at the same time, keep a sharp eye on the market for opportunities to acquire high-quality assets at a discounted price. Economic downturns are challenging, but they also present some of the best chances for investment if you know where to invest your money during a recession.

Apr 6, 2023