The ICONOMI Crypto June Review

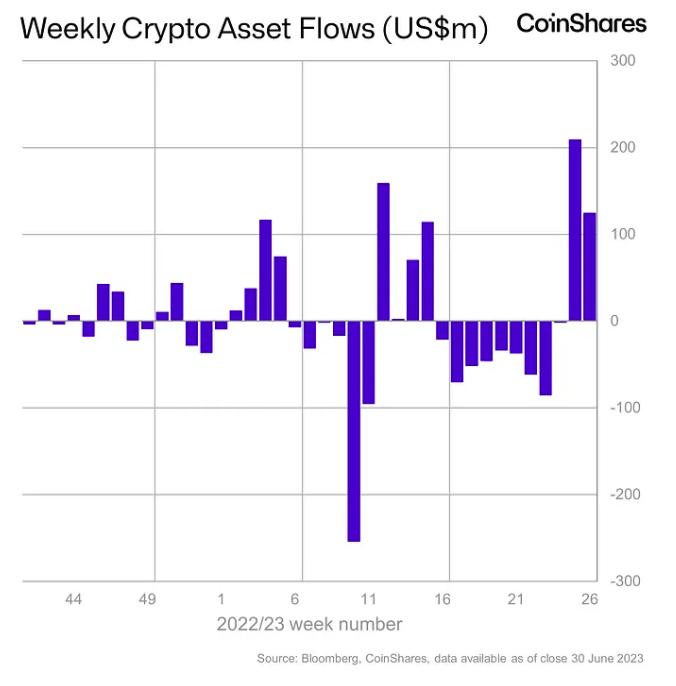

Digital Asset Institutional Inflows

Following 8 weeks of institutional withdrawals from digital asset-related investment products, the market experienced its greatest institutional weekly inflows in over a year, totalling U$199 million. Because of the several Bitcoin spot ETF applications in the US, institutional inflows have recovered to the tune of $334 million in the last two weeks (data courtesy of Coinshares).

Bitcoin has received the most institutional inflows, with a whopping 98% of inflows going straight into Bitcoin-related products. Short Bitcoin investment products continued to see withdrawals of approximately U$0.9 million, marking the tenth week of outflows. At current levels, institutional sentiment is definitely trending bullish. Germany has been one of the largest contributors at the institutional level over the past month, with U$137.5 million of inflows into digital asset investment products.

The remainder of the cryptocurrency market is now trailing BTC, although this is normal during the early stages of a bull market cycle. In general, Bitcoin will lead the market higher, and later in the cycle, liquidity will rotate into the Alt-coin market.

Ethereum, for example, has witnessed institutional outflows of U$-29.7 million MTD, but U$2.7 million has poured back into the cryptocurrency in the last week.

What is driving the fresh round of liquidity?

In 2017, Larry Fink the BlackRock CEO, labelled Bitcoin an "index of money laundering". In a major U-turn from 2017, this week Larry Fink said Bitcoin is an “international asset” in an interview that comes just weeks after the world’s largest asset manager applied to the SEC for a Bitcoin spot ETF. Larry Fink says ‘crypto is digitizing gold’ and that BlackRock’s Bitcoin ETF could help make the sector ‘more democratized’.

Bitcoin hit a new one-year high just days after BlackRocks's Bitcoin spot ETF application. Other institutions have also applied to the SEC for BTC spot ETFs over the past couple of weeks, including ARK, Fidelity and Invesco. The reason this is such a major event for Bitcoin is the ETFs would be physically backed by Bitcoin.

While the SEC has yet to approve any Bitcoin ETF applications, institutional investors clearly expect a favourable conclusion in the near future. BlackRock, Fidelity Investments, and other potential spot Bitcoin ETF issuers are ready to meet with the SEC. This critical discussion follows the resubmission of their applications, which now include essential information concerning surveillance-sharing partners as well as other necessary elements. Any outcome of the BTC ETF applications will result in volatility across the market.

Under Chair Gary Gensler, the SEC has consistently rejected spot Bitcoin ETFs while permitting similar offerings. The recent SEC approval of the Volatility Shares 2x Bitcoin Strategy ETF, the first leveraged Bitcoin futures ETF, may, however, signify a shift in the regulatory environment.

Technical Deep Dive:

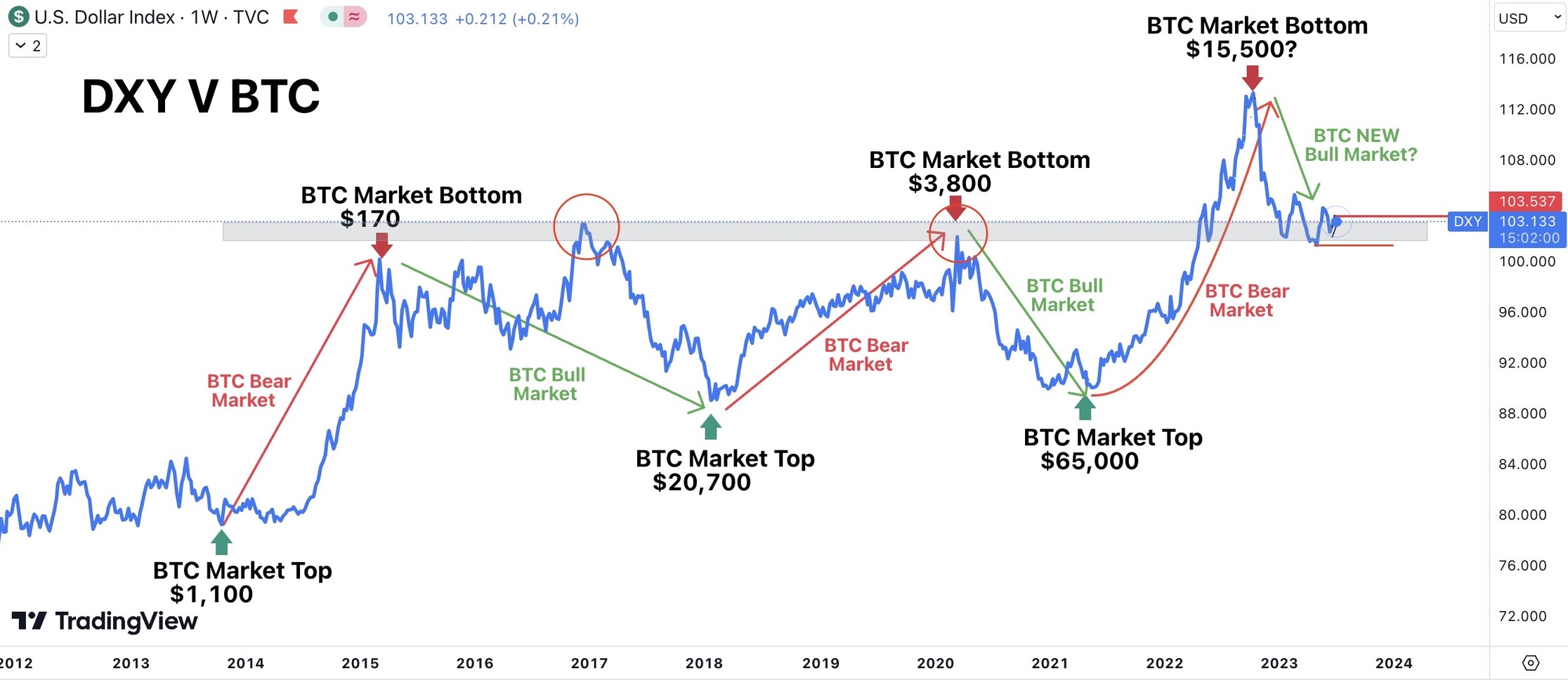

Bitcoin has benefited immensely from a shift away from the global reserve currency and towards risk assets. The US Dollar Index (DXY) has fallen sharply on concerns that the Federal Reserve is nearing the end of its rate-hiking cycle, with many analysts now anticipating interest rate cuts in 2024. This has not been confirmed, as FED Chair Jerome Powell has repeatedly maintained that interest rates will remain high for some years. However, with inflation falling swiftly, the market is pricing in a near-term interest rate peak, which is evident due to the rotation out of the US dollar.

Since 2014, Bitcoin has had an inverse relationship with the US Dollar Index. The value of the US Dollar index rises during periods of economic uncertainty and falls during times of risk-on market sentiment. With the DXY potentially topping out, it portrays a positive picture for Bitcoin and the rest of the cryptocurrency market. In the short term, the DXY is trading in a significant support zone that was previously a resistance level. A break below 101.20 should confirm a continuation to the downside, favouring BTC and other risk assets.

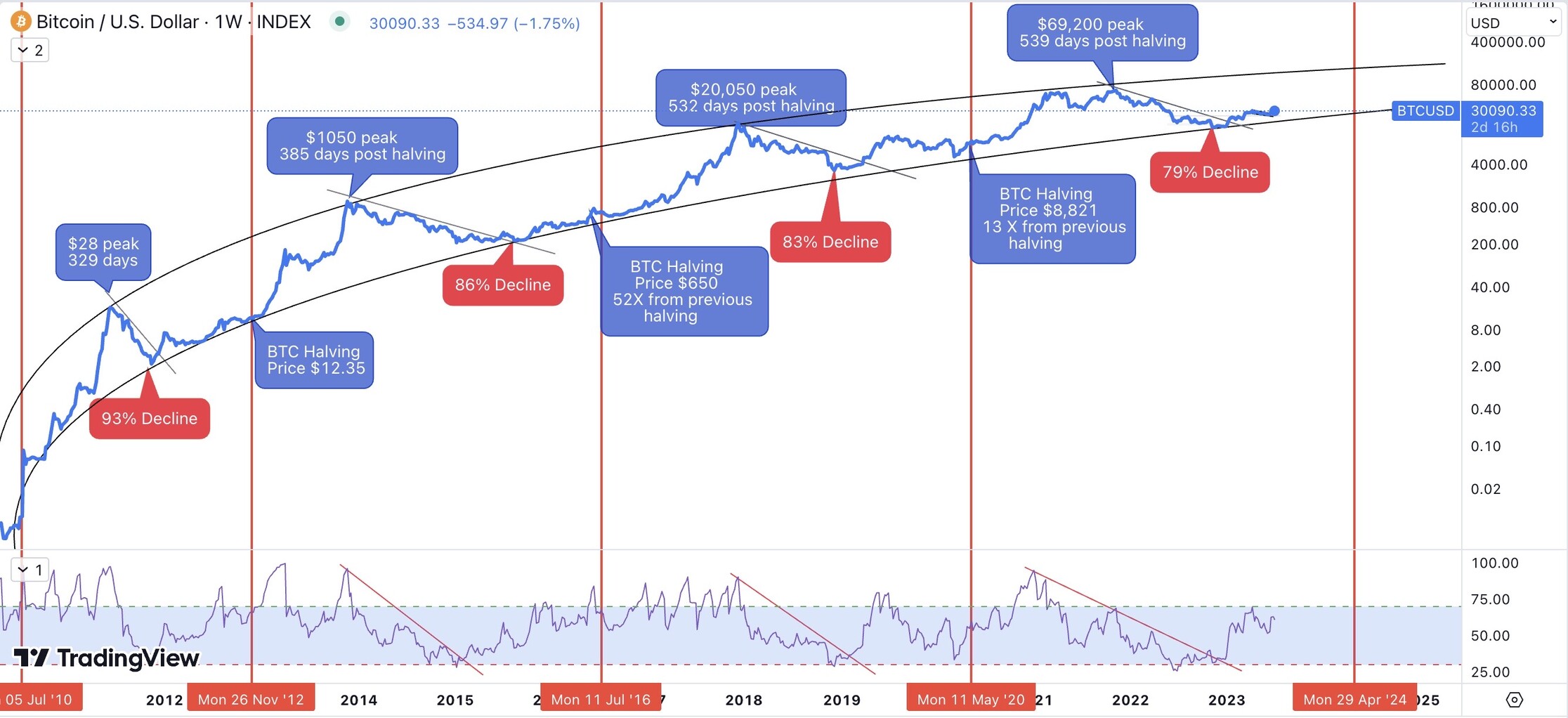

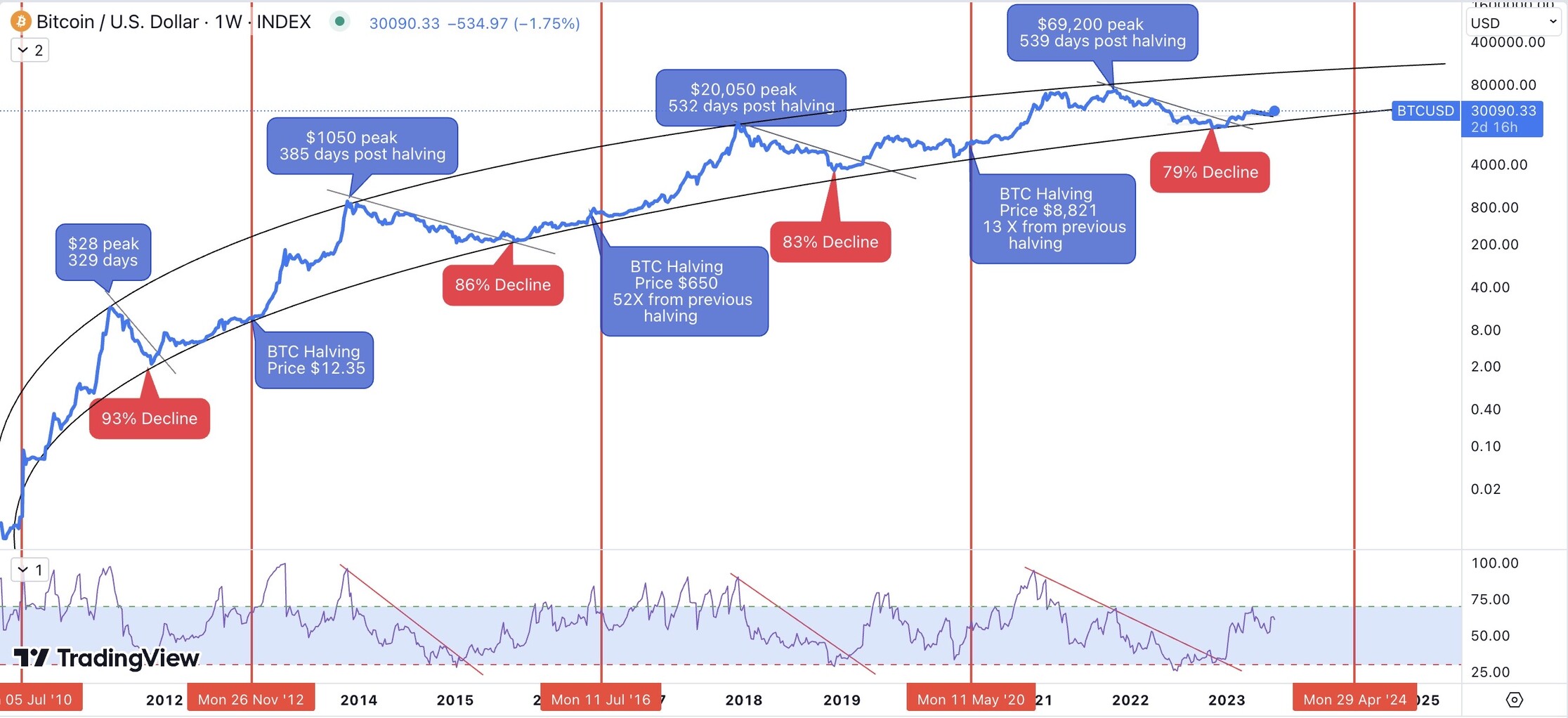

We can estimate the bottom of the Bitcoin market if we continue to observe the Bitcoin cycle. We may take an educated guess based on the prior bull and bear market statistics, as well as the future Bitcoin halving event in May 2024, that Bitcoin has indeed bottomed in November 2022.

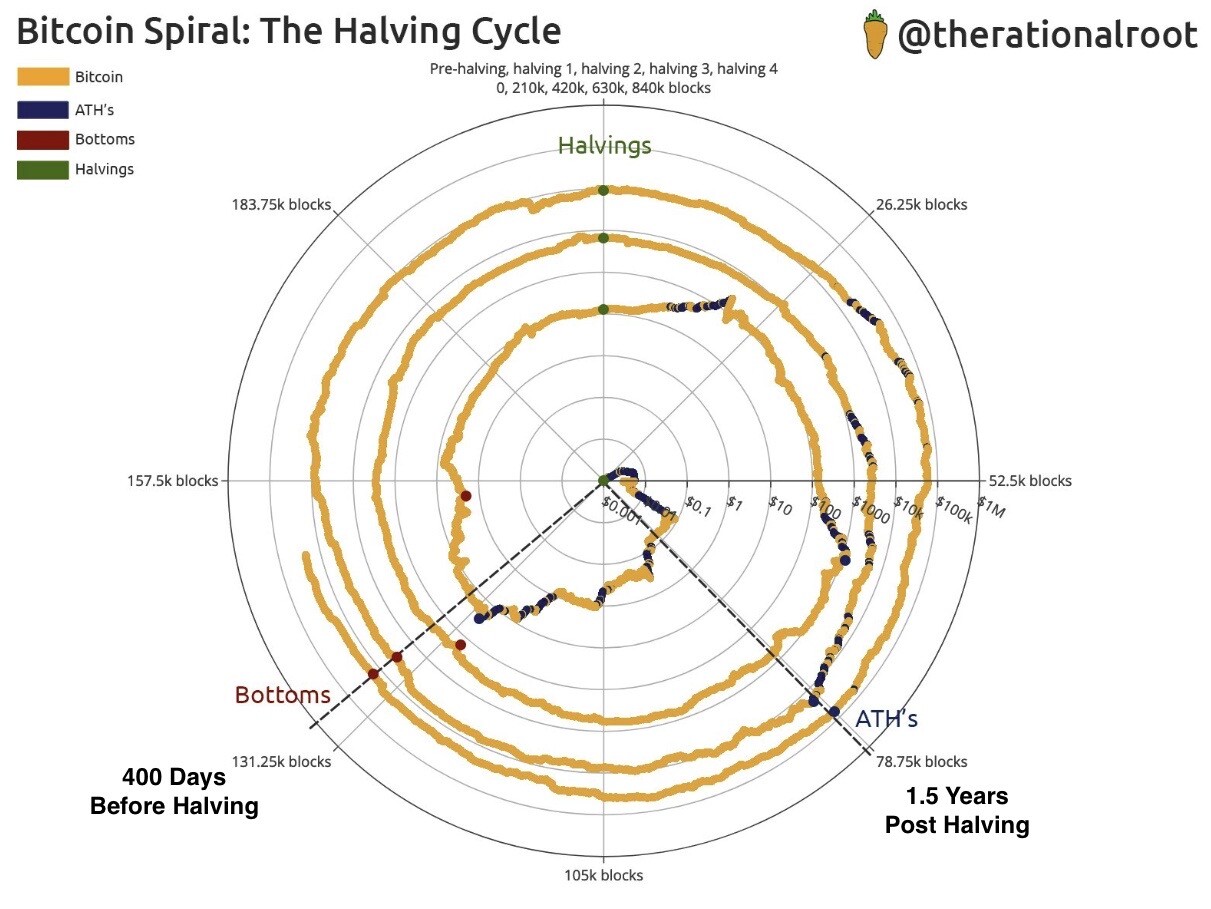

The Bitcoin cycles are depicted in this spiral study by @rationalroot. On average, 1.5 years after halving, Bitcoin reaches a bull market peak. This implies that the next Bitcoin market high will occur in November/December 2025. Furthermore, Bitcoin bottoms on average 400 days before a halving event. This implies that the market low for Bitcoin should have occurred in late 2022 or early 2023, based on the next halving in May 2024.

Bitcoin's weekly log chart also indicates the trend is still intact, and a continuation to the upside should unfold. Whilst BTC has reached a fresh 1-year high, expect volatility and a potential pullback in the market. Any pushback from the SEC regarding the Bitcoin ETF applications may result in short-term volatility. However, with the next BTC halving due in less than 1 year, and institutional inflows into digital asset investment products reaching record levels, the outlook remains favourable.

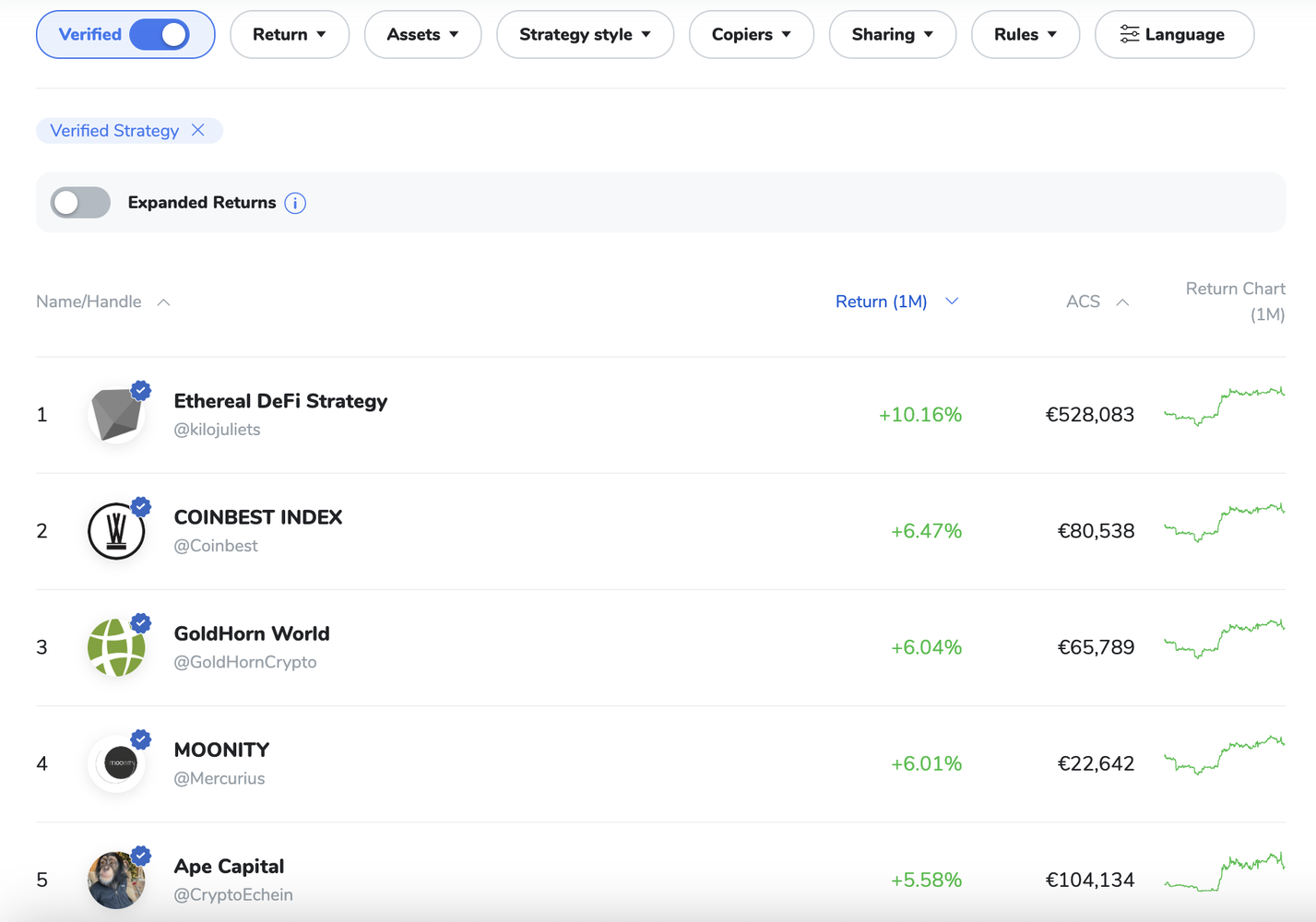

Top 5 Performing Strategies on the ICONOMI Platform

Ethereal DeFi Strategy has been a stand-out performer over the past month, despite the sharp decline in BTC over the past 24 hours from 31,450 to 30,000. Ethereal DeFi Strategy has provided its investors with a +10.16% ROI. All of the top 5 strategies on the ICONOMI platform have recorded gains of above 5% ROI.

To learn more about the cryptocurrency market or discuss the ICONOMI portfolios/strategies:

Book a call: https://calendar.app.google/6XCpBo7Kfyf9u2XX7

ICONOMI B2B crypto solutions: https://www.iconomi.com/for-business