Crypto Weekly Wrap: 19th January 2024

BlackRock's Bitcoin ETF Hits $1B AUM in One Week

BlackRock's iShares Bitcoin Trust (IBIT) has reached a significant milestone, surpassing $1 billion in assets under management within its first week of trading. This accomplishment positions IBIT as the first among the recent wave of Bitcoin ETF providers to achieve such a feat. The fund, comprised of 99% bitcoin and around $60,000 in fiat, has recorded an average daily trading volume of 14 million shares. Its success reflects strong investor demand, according to Robert Mitchnick, Head of Digital Assets at BlackRock.

Tether's Strategic Bitcoin Accumulation and Asset Allocation

Tether, the stablecoin issuer, has reportedly acquired 8,888 additional bitcoins for $380 million, further solidifying its position as the 11th-largest holder of the cryptocurrency. This move aligns with Tether's strategy announced in May 2023, aiming to diversify its USDT stablecoin backing by allocating up to 15% of profits into bitcoin. Tether's latest attestation report reveals a holding of $1.7 billion in bitcoin alongside substantial government bonds. Despite scrutiny, Cantor Fitzgerald CEO Howard Lutnick vouches for the legitimacy of Tether's assets.

Trump's Firm Stance Against CBDCs and Cryptocurrencies

Former US President Donald Trump reaffirms his disapproval of central bank digital currencies (CBDCs), labelling them a "dangerous threat to freedom." Trump pledges to prevent the creation of a CBDC, citing concerns about government control over citizens' finances. Notably, Trump, despite his past criticisms, holds a significant amount of digital assets, primarily in Ethereum. The ex-President's stance against CBDCs aligns with the sentiment expressed by other politicians, such as Florida Governor Ron DeSantis.

Cristiano Ronaldo Faces Billion-Dollar Lawsuit Over Binance NFT Promotion

Renowned footballer Cristiano Ronaldo is entangled in a billion-dollar class-action lawsuit for allegedly promoting non-fungible tokens (NFTs) linked to exchange Binance. The lawsuit, filed in November, claims that Ronaldo's endorsement led investors into risky investments. Despite Binance's $4 billion penalties and admission of wrongdoing, Ronaldo continues to promote the exchange. Investors seek approval to serve the lawsuit via Elon Musk's social media platform X, formerly Twitter.

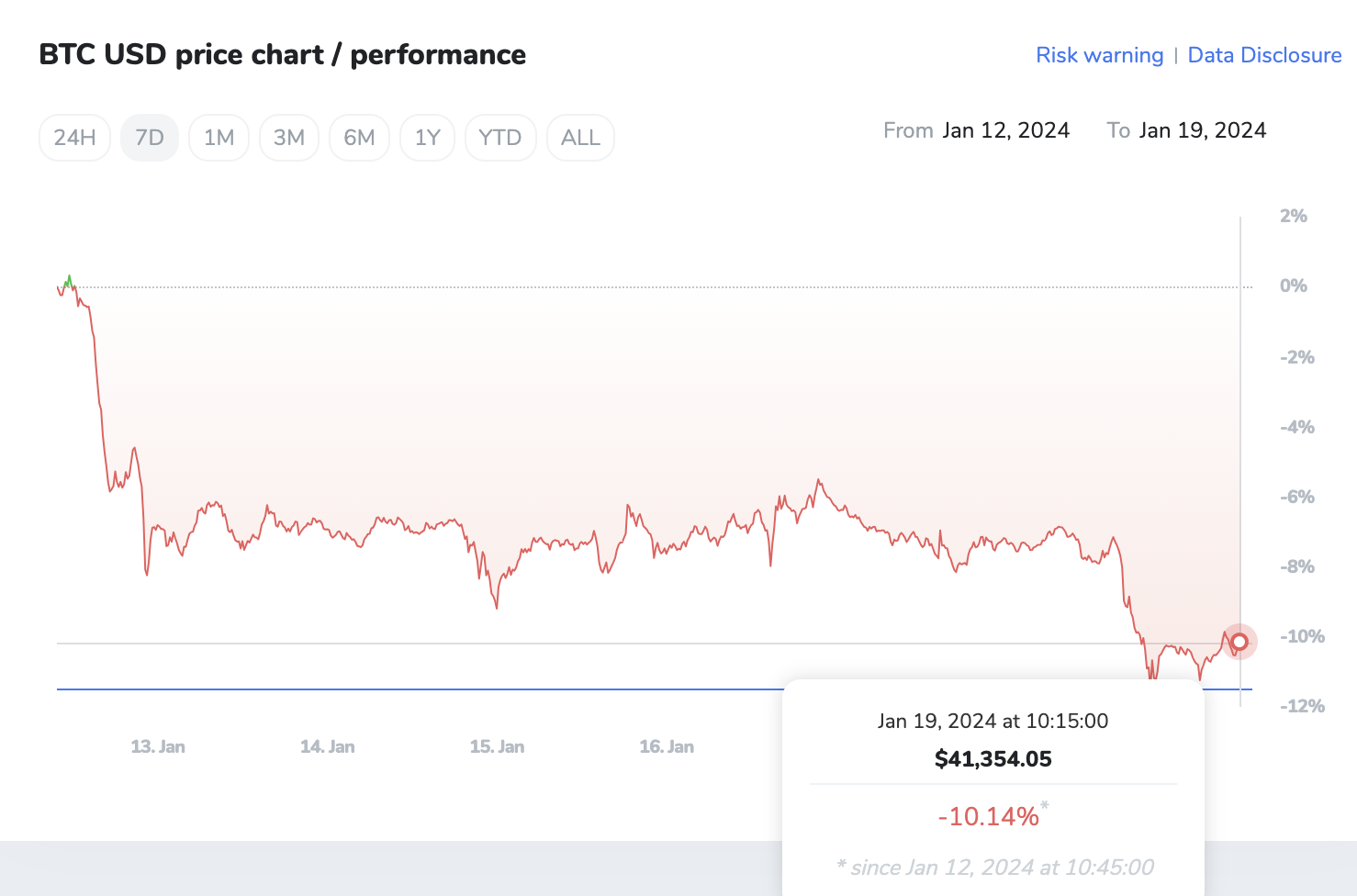

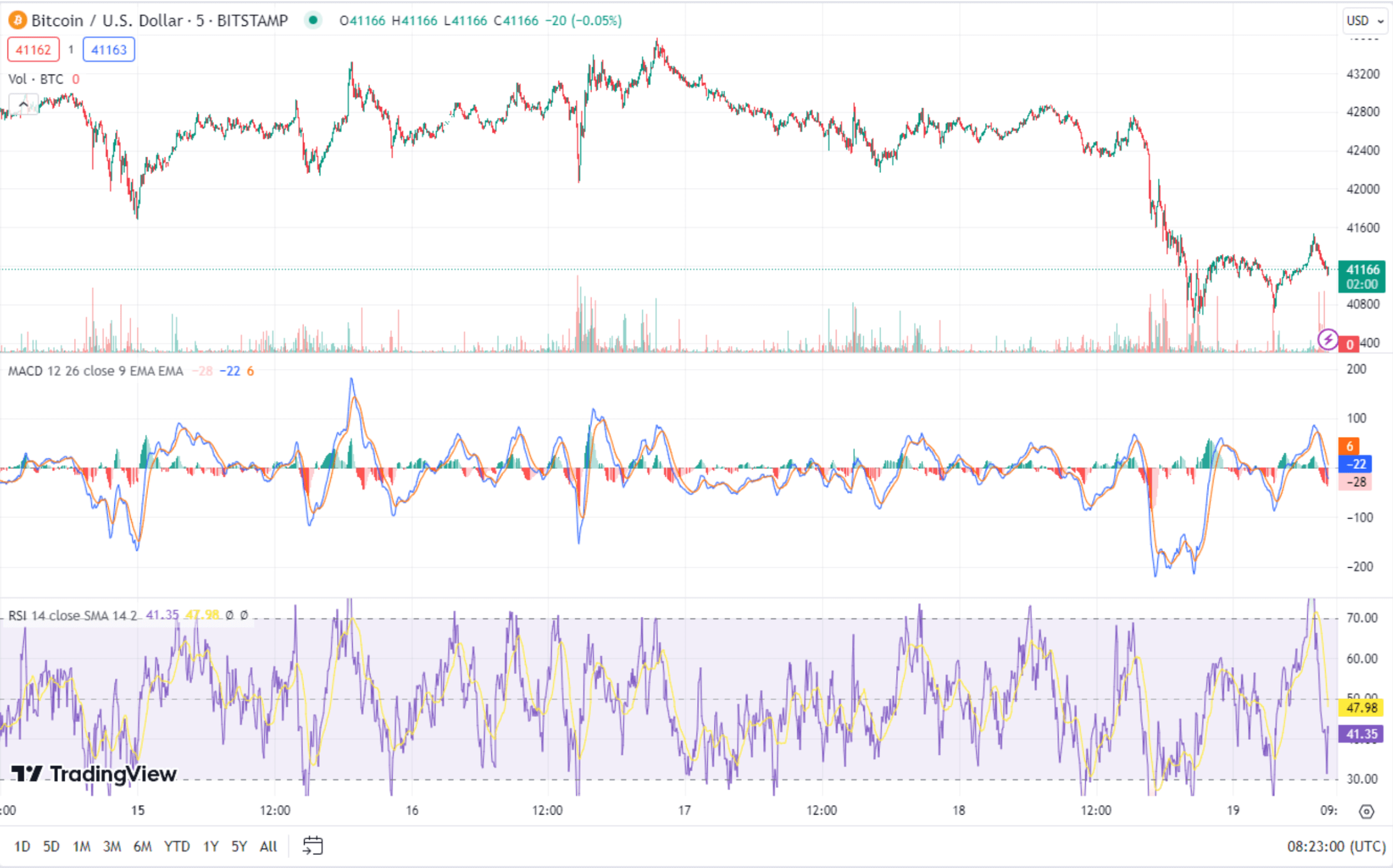

Bitcoin Analysis

As Bitcoin's price hovers around $41,200, recent market developments include nearly $1 billion inflows into Bitcoin ETFs, a 34% drop in the hash rate due to a Texas cold snap, and VanEck's decision to delist its Bitcoin Strategy ETF. Despite a 10% price drop since ETF launches, they have generated $10 billion in trading volume, sparking debates about Bitcoin's future. Technical analysis suggests a bearish trend below $43,400, with resistance levels at $44,380 and $45,260, while support is found at $41,050 and $40,470. The RSI at 41 signals a neutral market sentiment, with a potential resistance at the 50-Day EMA of $43,408. Currently, Bitcoin consolidates between $41,200 and $43,400, indicating indecision among traders. The overall outlook suggests a bearish trend unless the $43,700 level is breached, potentially altering sentiment.

Going into 2024

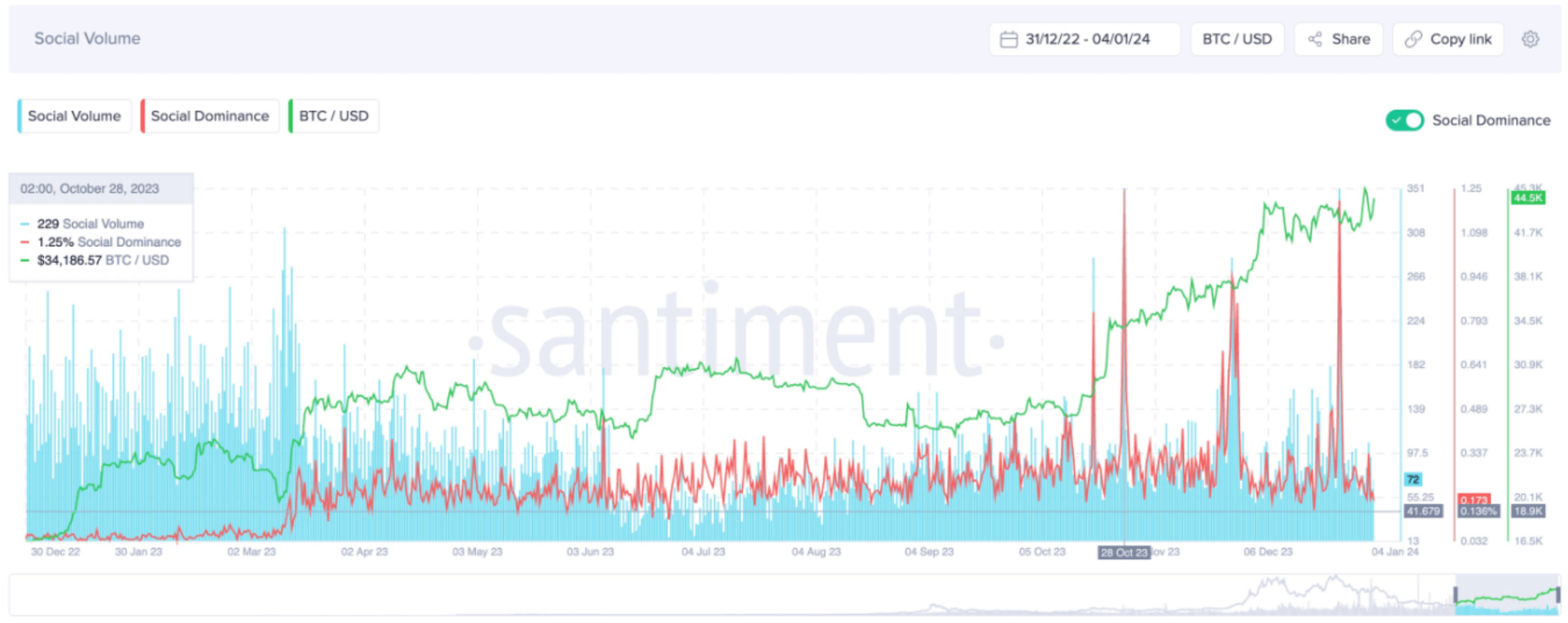

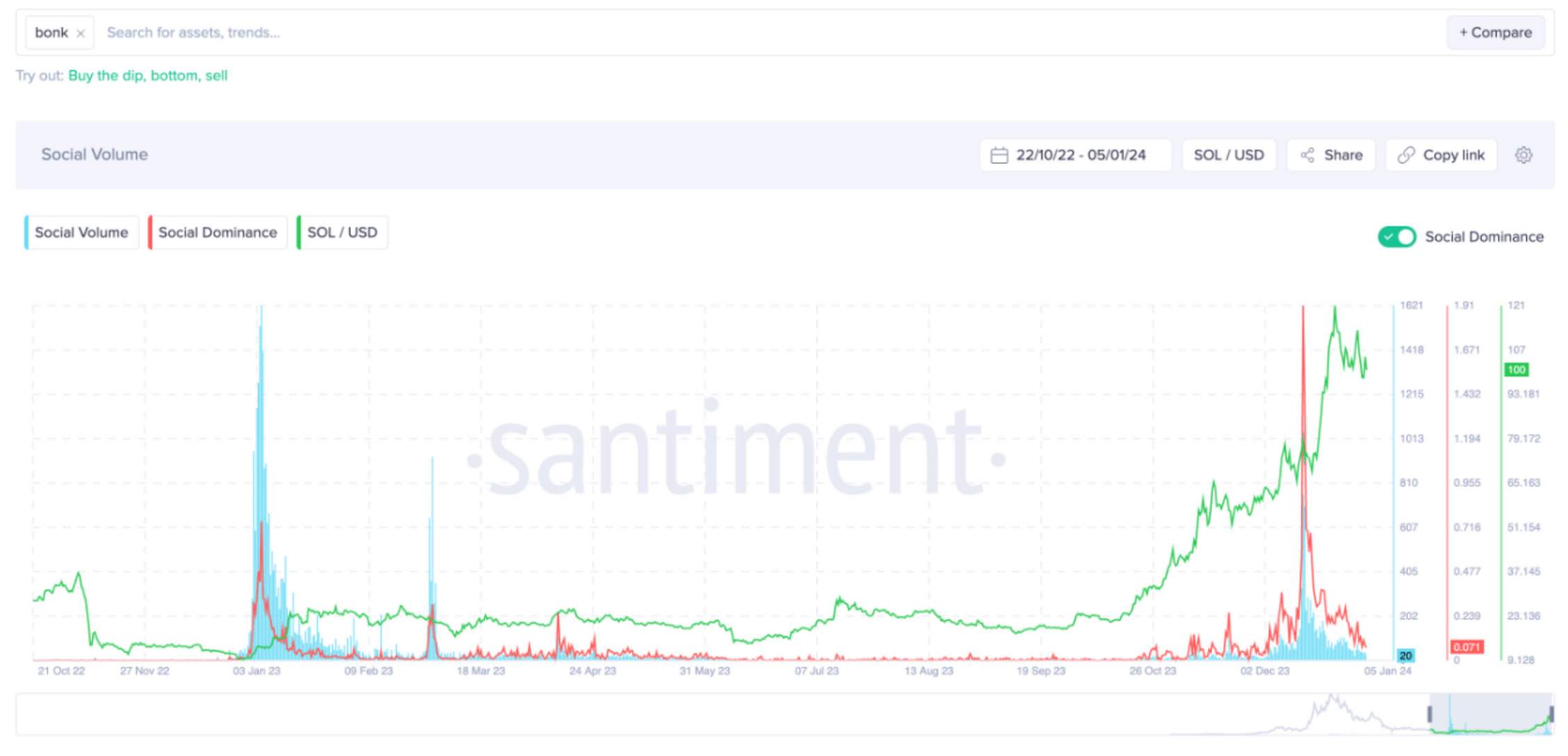

Looking ahead to 2024, Santiment identifies key cryptocurrency market narratives. They highlight the significance of monitoring ETFs and the BTC halving, indicating potential market peaks based on crowd expectations. Stablecoins and regulatory developments are expected to play a continuous role, serving as indicators for market bottoms or tops depending on sentiment. DeFi and DAOs may gain momentum unexpectedly due to ongoing innovations. Santiment also emphasises the importance of Layer 2 solutions, particularly zero-knowledge (ZK) technology, and the ever-present potential for sudden surges of interest in NFTs and memecoins. WEB3's evolution in reshaping social networks stands out as a favourite focus. The traders should expect the unexpected, acknowledging the influence of unforeseen events and macroeconomic trends on the dynamic cryptocurrency landscape.