Crypto Weekly Wrap: 15th December 2023

Ethereum's Buterin Explores Changes in Layer-2 Functions

Vitalik Buterin, co-founder of Ethereum, has proposed a shift in the blockchain's computational load, suggesting the integration of some layer-2 functions back onto the main chain. This proposal introduces the concept of an "enshrined zkEVM," combining zero-knowledge cryptography (zk) with Ethereum Virtual Machine (EVM). While layer-2 networks like ZK-rollups from Polygon, Matter Labs, and Scroll have invested significantly in their current roadmap, Buterin's proposal aims to streamline the verification process and enhance efficiency. Despite potential disruptions, Buterin acknowledges the continued relevance of layer-2 networks for functions such as fast pre-confirmations, MEV mitigation, EVM extensions, and user-facing conveniences.

Security Breach Affects Multiple Decentralised Applications (dApps)

Several popular decentralised applications (dApps) faced compromise following a hack targeting the Ledger Connector, a widely used tool allowing connections between mobile wallets and dApps. Notably, SushiSwap, Zapper, and Revoke.cash were affected. Ledger confirmed the compromise but assured users that the malicious code had been identified and removed. The incident raises concerns about the security of web3 connectors and emphasises the importance of cautious interaction with dApps. Polygon Labs VP Hudson Jameson urged users to refrain from using dApps until the situation is thoroughly addressed, underlining the potential risks associated with compromised backend libraries.

SEC Delays Decision on Invesco Galaxy's Ethereum ETF

The U.S. Securities and Exchange Commission (SEC) has postponed its decision on Invesco Galaxy's spot Ethereum exchange-traded fund (ETF) application. Initially expected by December 23, 2023, the new deadline is now set for February 6, 2024. The SEC cites the need for additional time to review the proposal thoroughly. This delay aligns with a broader trend of Ethereum ETF applications, with major institutions like BlackRock, ARK, Fidelity, VanEck, and Hashdex awaiting final decisions. Recent SEC meetings with prominent Bitcoin ETF issuers indicate a renewed focus on regulatory considerations, potentially influencing the broader cryptocurrency market.

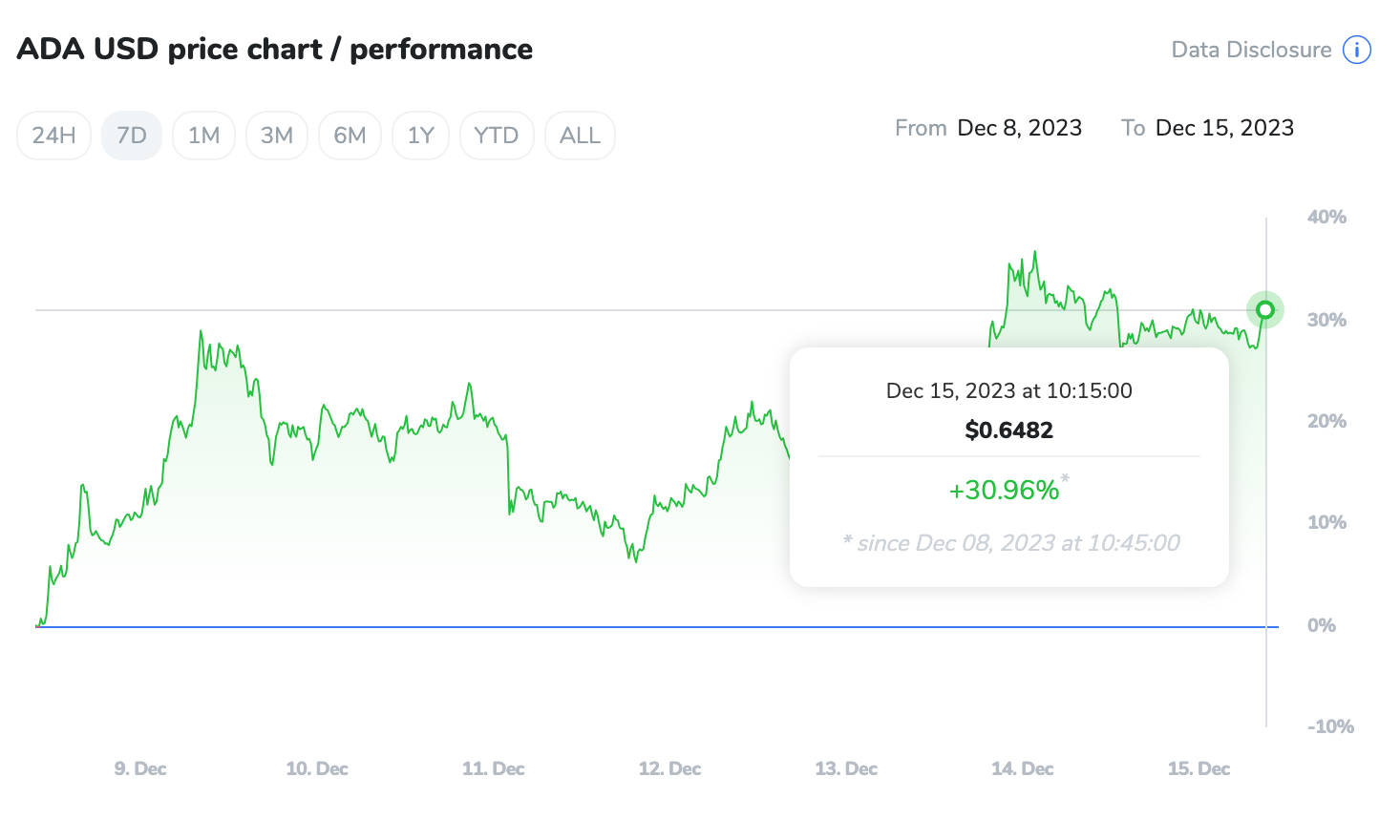

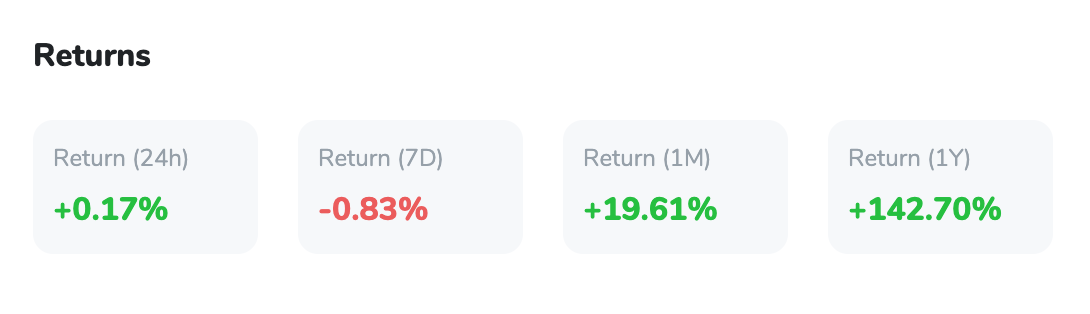

Cardano's DeFi Surges as ADA Rockets 31%

Cardano's decentralised finance (DeFi) system has experienced a substantial surge, reaching a total value locked (TVL) of over $439 million, surpassing the previous peak of $330 million in April. This growth may be attributed to a shift in investor interest from Ethereum alternatives like Solana and Avalanche. Notably, projects like Indigo and Minswap witnessed a TVL surge of over 50%, contributing to the overall growth. The success of Cardano's DeFi ecosystem has propelled ADA token prices, witnessing a 31% surge in the last week and an impressive 80% monthly gain.

Bitcoin Analysis

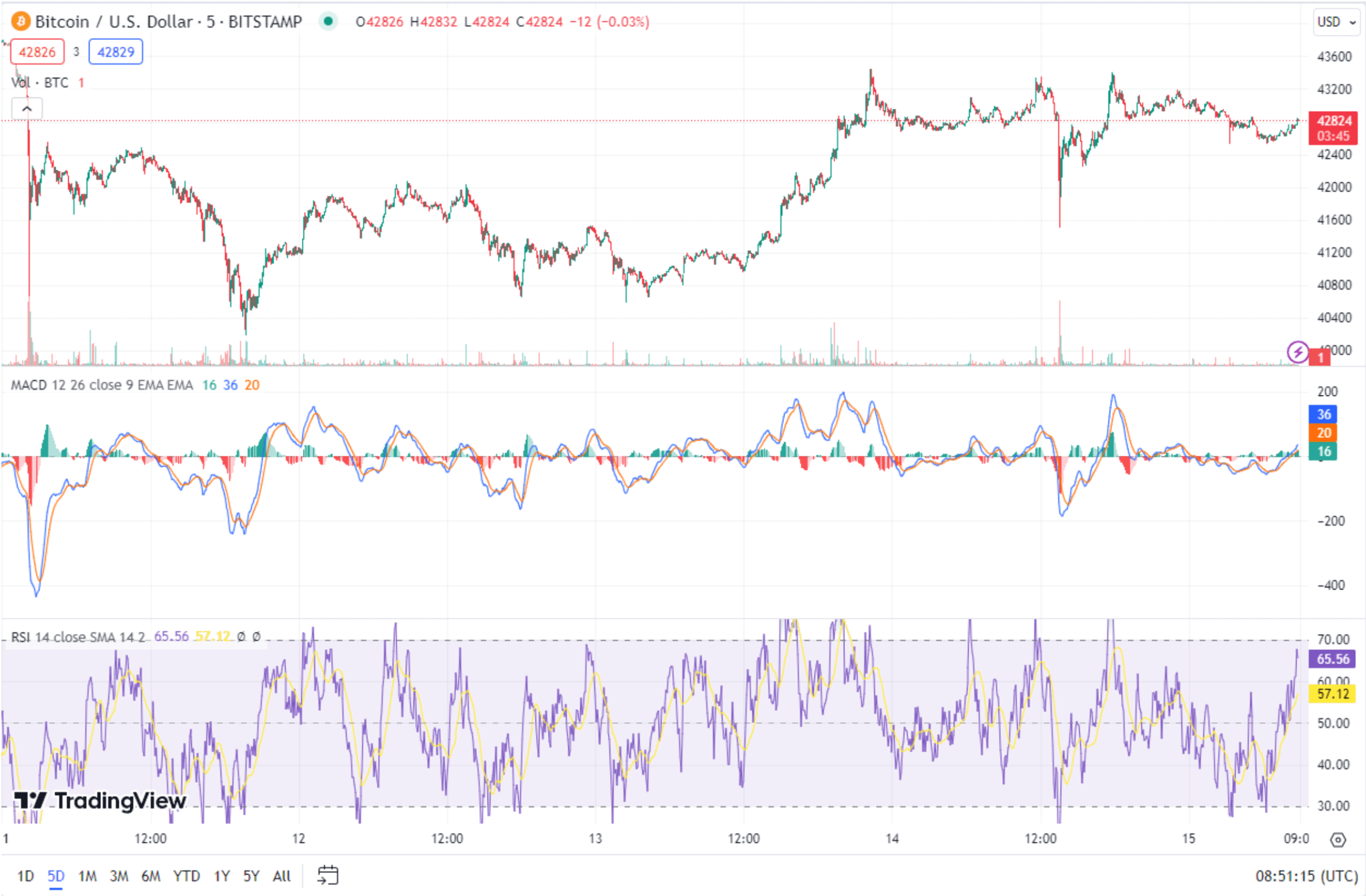

Bitcoin's price has surged to $42,873, driven by a wave of optimism following the Federal Reserve's stance and discussions around the approval of Bitcoin Spot ETFs. BlackRock interprets the FOMC minutes as a 'green light for investors,' contributing to positive market sentiment. The IMF's call for robust crypto regulations adds to the narrative, emphasising the need for infrastructure development. Meanwhile, the US CFTC's approval of Bitnomial's vertical integration strategy marks a significant milestone, potentially enhancing institutional trust in the cryptocurrency market.

Bitcoin maintains a bullish stance, trading around $42,700 with a market capitalization of around 840 billion. The 50 EMA at $42,250 indicates a short-term bullish bias, with the RSI at 65 signalling cautious optimism. Resistance levels at $44,650, and $47,900 are identified, while supports lie at $40,660, and $37,960. The short-term outlook remains bullish, with attention on approaching resistance levels, particularly at $44,650. It's crucial for investors to monitor price action near Fibonacci retracement levels, serving as potential turning points.

Bitcoin's Fundamental Strengths and Market Indicators

Key indicators tracking Bitcoin's blockchain activity, miner flows, and the 200-day moving average suggest robust fundamental strength. The MVRV Z-score, standing at 1.6, indicates that Bitcoin is not overvalued, potentially paving the way for further rallies in 2024. Bitcoin's performance, with a 150% increase this year, surpassing traditional assets, showcases its resilience and potential for continued market value appreciation. The current market dynamics, coupled with favourable regulatory developments, position Bitcoin for ongoing positive momentum in the cryptocurrency landscape.