Ethereum's Price Surges Amidst Anticipation of Spot ETF Approval

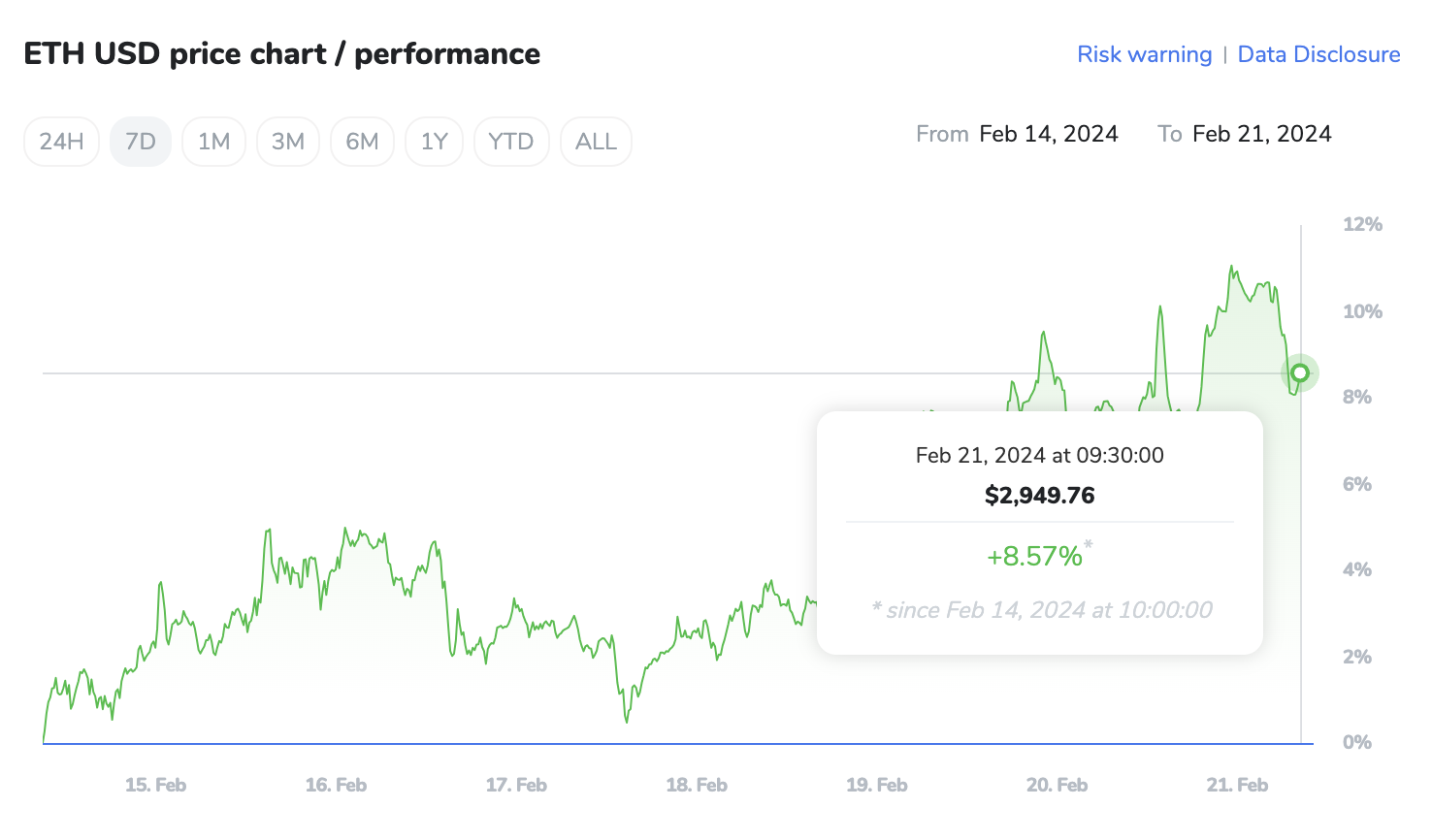

Ethereum (ETH) has experienced a significant surge in its price, reaching levels not seen in nearly two years. On Monday, ETH climbed to $3,024, marking its highest level since April 26, 2022. This surge comes as investors anticipate the approval of spot ether exchange-traded funds (ETFs) in the U.S. Analysts predict further upward movement for ETH in the short term, with expectations of surpassing $3,100.

Financial services firm Bernstein highlighted Ethereum as "probably the only other digital asset likely to get a spot ETF approval by the SEC," citing its staking yield dynamics, environmentally friendly design, and institutional utility. Additionally, the significant reduction in ether supply following Ethereum's transition to a proof-of-stake consensus mechanism in September 2022 has contributed to bullish sentiment surrounding the cryptocurrency.

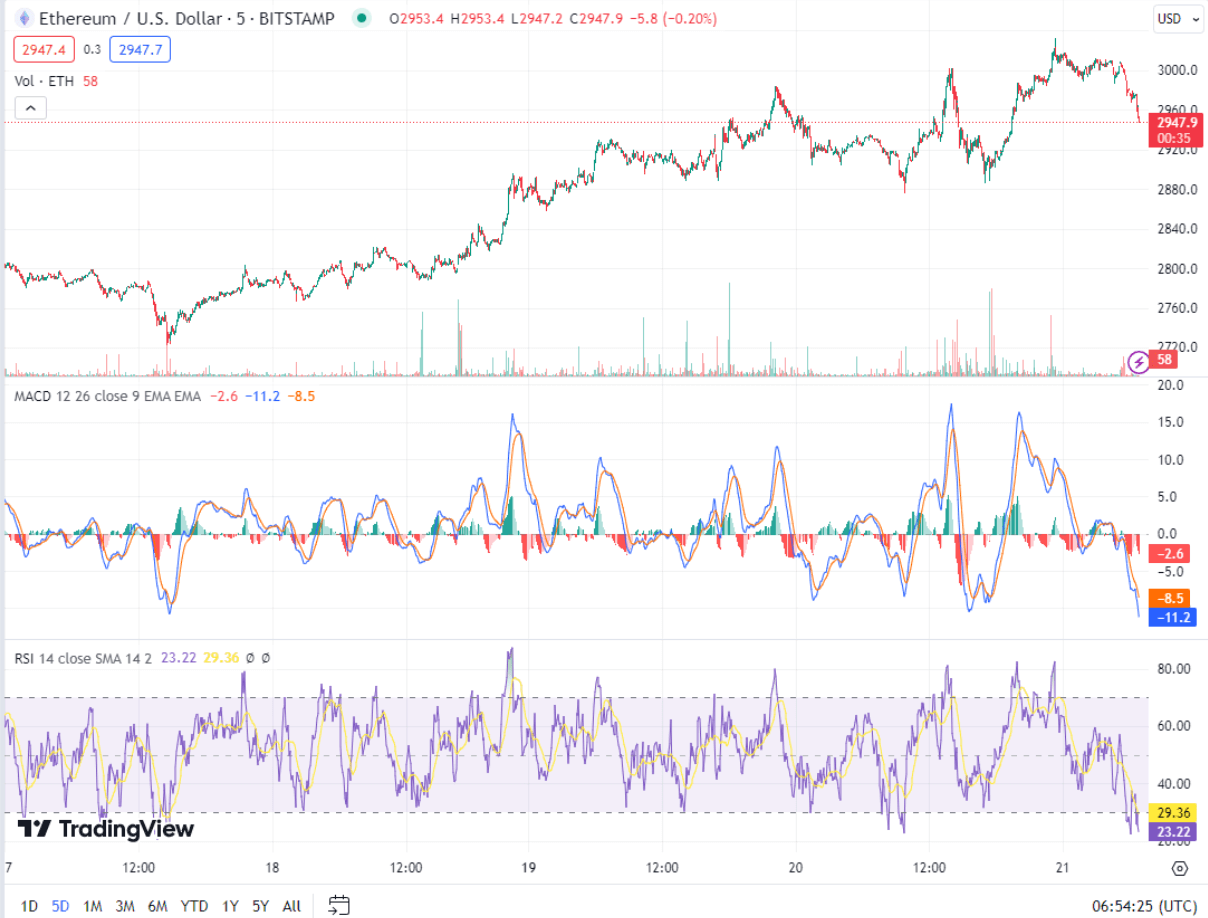

Technical Analysis of Ethereum

Over the past few weeks, Ethereum (ETH) has experienced a notable uptrend, with its price surpassing the key psychological level of $3,000. However, recent indicators suggest that the cryptocurrency may be due for a short-term correction before resuming its upward trajectory.

The relative strength index (RSI), a momentum oscillator, has surged to 80 in recent days, which indicated overbought conditions, but there has been a significant reversal in the last 24 hours. This suggests that there may be a period of consolidation or pullback in the near future as the market adjusts.

Additionally, the 30-day average has been steadily rising, entering overbought territory. This signals a potential cooling-off period as ETH corrects to more sustainable levels.

Despite these short-term indicators, Ethereum remains in a strong position for long-term growth. Its dominance within the crypto ecosystem, particularly in terms of usage and transactions, continues to bolster its value. Furthermore, the anticipation surrounding April's Bitcoin halving and the potential approval and launch of spot-based Ethereum ETFs could provide additional momentum for ETH.

Looking ahead, if Ethereum successfully navigates a short-term correction, it could resume its upward trajectory towards $3,500 by the summer and potentially surpass its previous all-time high by the end of 2024. However, traders should remain vigilant for any signs of a deeper correction or shifts in market sentiment.

Chart created using TradingView

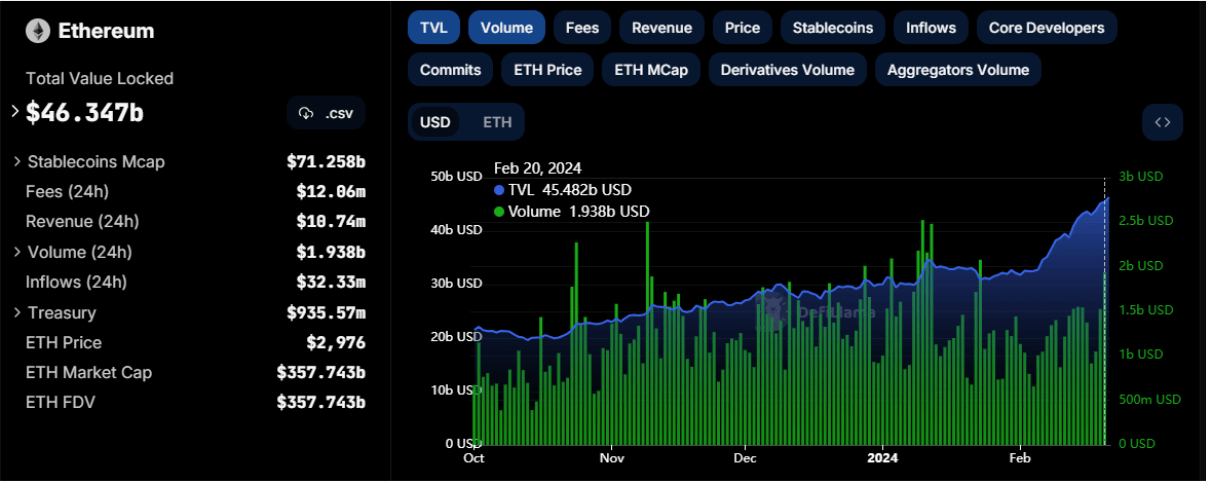

Market Sentiment

Ethereum's recent price surge and reclaiming of crucial resistance levels signify strong buyer confidence and a sustainable bullish trend. The cryptocurrency has approached a significant multi-year resistance zone at $2.9K and successfully surpassed it, indicating prevailing bullish sentiment among market participants. With eyes set on surpassing the major yearly swing high at $3.6K, Ethereum's trajectory is expected to remain bullish with intermittent downward corrections. On-chain analysis reveals a surge in open interest among futures traders, indicating sustained confidence in Ethereum's current uptrend. However, traders should remain cautious of potential sudden liquidation events that could trigger short to mid-term price declines.

Source: DefiLlama

Potential Risks: Considerations for Ethereum Investors

While Ethereum's technical indicators and market sentiment suggest a bullish outlook, investors should consider potential risks and challenges. The emergence of an expanded bearish divergence between the price and the RSI indicator could signal a short to mid-term correction or consolidation phase. Ethereum fails to maintain support above key levels, such as $2,700, it could be vulnerable to a significant pullback. Despite these considerations, Ethereum's fundamentals, including its reduced supply and anticipation of spot ETF approval, provide reasons for optimism among investors. As the cryptocurrency market continues to evolve, staying informed and monitoring key technical indicators remains crucial for navigating Ethereum's price movements effectively.