Crypto Weekly Wrap: 8th December 2023

BlackRock's Bitcoin ETF Gains Momentum with $100K Seed Funding

BlackRock is making significant strides in the cryptocurrency space as it recently disclosed receiving $100,000 in seed funding for its proposed Bitcoin exchange-traded fund (ETF). The seed investor, who remains undisclosed, purchased $100,000 worth of shares on October 27, 2023, marking a pivotal step in BlackRock's pursuit of launching the "iShares Bitcoin Trust."

This move is distinct from other ETFs as it will directly invest in Bitcoin rather than Bitcoin futures. Currently, 13 applications, including BlackRock's, are awaiting regulatory approval, with the SEC expected to greenlight one or more spot ETFs early next year, with a high probability of approval in January, according to Bloomberg analysts.

U.S. SEC Faces Criticism and Legal Setbacks in Cryptocurrency Lawsuits

The U.S. SEC faces criticism and legal setbacks as a federal judge reprimands the agency for its handling of a lawsuit involving a cryptocurrency company named Debt Box. The court found that the SEC used "materially false and misleading representations" to freeze assets valued at millions of dollars.

This adds to a series of recent defeats for the SEC, including a ruling in the XRP case that partially sided with Ripple, challenging the SEC's enforcement tactics. The judge's decision underscores concerns about the SEC's approach and its impact on the cryptocurrency sector in the United States.

JPMorgan's Jamie Dimon Advocates for Cryptocurrency Shutdown

During a Senate Banking Committee hearing, JPMorgan Chase CEO Jamie Dimon expressed strong opposition to cryptocurrencies, particularly Bitcoin. Dimon's comments align with his historical scepticism towards digital currencies, as he referred to Bitcoin as a "hyped-up fraud" and suggested that cryptocurrencies are primarily used by criminals. Despite Dimon's negative stance, JPMorgan has actively engaged with blockchain technology.

The hearing also highlighted common ground between Dimon and Senator Elizabeth Warren on the need for crypto companies to adhere to anti-money laundering regulations. Warren emphasised the importance of national security in preventing illicit use of cryptocurrencies.

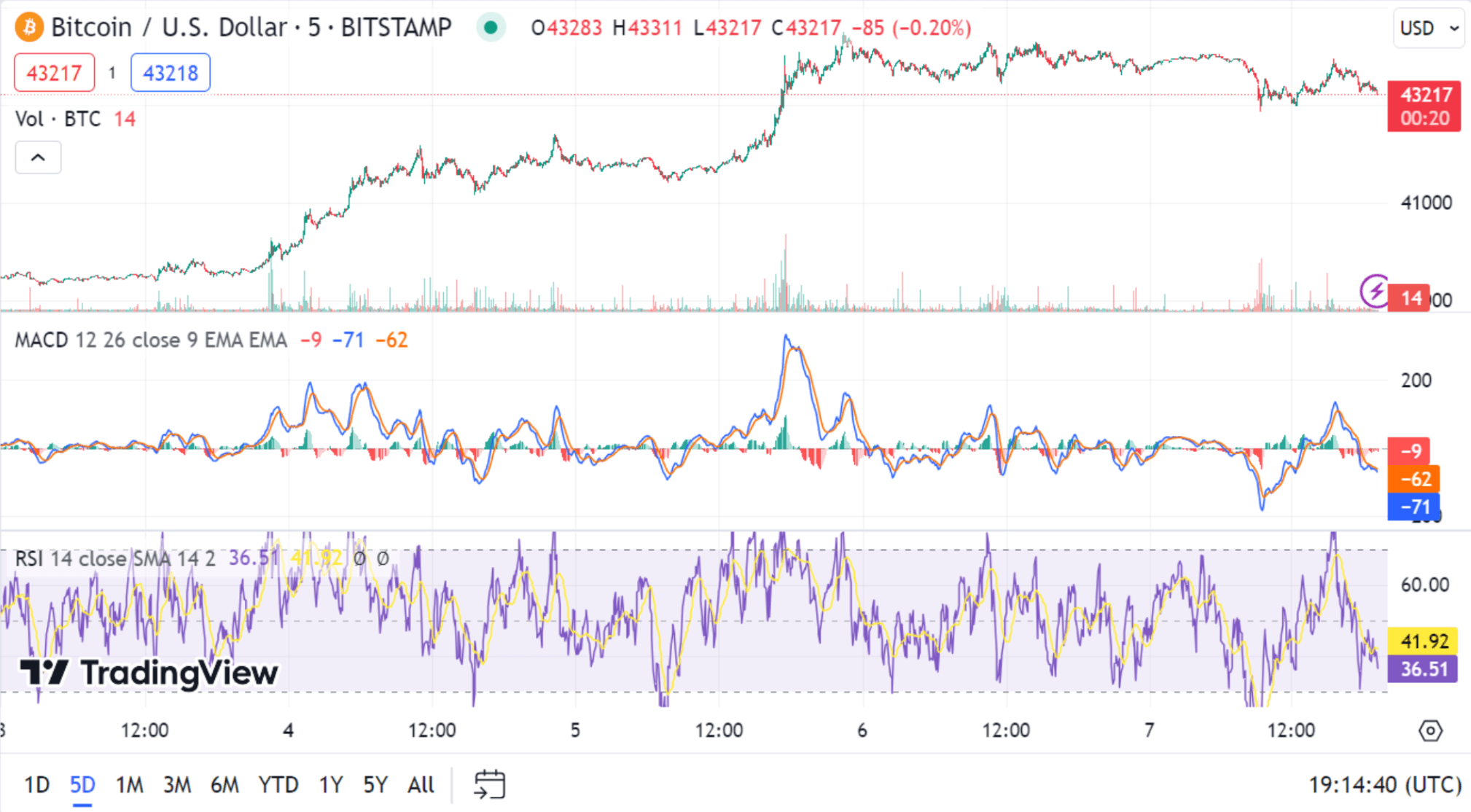

Bitcoin Surges Beyond $43K Amid ETF Expectations

Bitcoin's upward trajectory continues, surpassing $43,000 and marking a significant milestone in its rally. The cryptocurrency has shown resilience over the past two days, achieving a price level not seen since May 2022. The year-to-date gains for Bitcoin stand at an impressive 157%. Market analysts attribute this bullish momentum to the anticipation of the U.S. Securities and Exchange Commission (SEC) approving a spot Bitcoin exchange-traded fund. While other major cryptocurrencies like Ethereum experienced positive movement, Bitcoin's surge remains unparalleled.

Bitcoin and Market Dynamics

Bitcoin's current price at $43,274 reflects an increase of 15%, maintaining its position as a focal point in the cryptocurrency market. The recent release of Bitcoin's core version, v26.0, introduces enhancements such as defence against attacks and support for a new transport protocol. Market dynamics, including the anticipation of Bitcoin halving, potential ETF approvals, and updates from institutions like BlackRock, contribute to a bullish trajectory.

Technical analysis indicates an uptrend within an ascending channel, with resistance levels at $45,000 and $46,000. While caution is advised due to overbought conditions, support levels at $42,000 and $41,000 provide safety nets for potential retracements.

Stablecoin Market Resurgence Signals Positive Trends

A notable development in the cryptocurrency market is the resurgence of stablecoins after an 18-month downtrend. Tether's USDT, in particular, has added $7 billion to its market cap since September, reaching an all-time high of $89 billion. This reversal indicates fresh capital entering the crypto market and improved liquidity.

The combined market capitalization of stablecoins, including USDT, has increased by almost $5 billion in the past month, reaching $124 billion. This upward trend is seen as a positive signal for the overall health of the recent crypto rally, suggesting a more favourable environment for capital deployment.