Avalanche's Success Amidst Market Turmoil

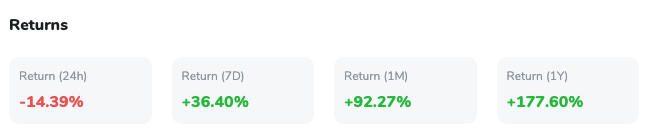

Cryptocurrency enthusiasts are closely monitoring the impressive performance of Avalanche's native token, AVAX, which has exhibited remarkable resilience, standing out with a 36.5% weekly gain amidst a broader market correction.

Even as the broader cryptocurrency market experiences a downturn, AVAX has defied the odds. This resilience is particularly noteworthy considering the liquidation of over $500 million in leveraged positions across bitcoin and major altcoins in the same timeframe.

In a dramatic turn of events, Avalanche has surged to become the 10th largest cryptocurrency by market capitalization, surpassing the meme coin Dogecoin. With a double-digit overnight surge, AVAX now stands at $35, showcasing its strong market position.

Avalanche's recent decision to heavily incentivize validators has sparked a surge in market value, propelling AVAX to new heights. With a market cap surpassing $9.8 billion, Avalanche now ranks among the top 10 for liquidity, outperforming rivals like Polygon and Polkadot.

Avalanche's on-chain metrics paint a compelling picture, reinforcing AVAX's robustness in the face of market volatility. The number of AVAX transactions surpassing $100,000 has surged, nearing 1,000, signalling a positive trend in the midst of the current market dynamics.

Traditional financial heavyweights JPMorgan and Citi have recently joined forces with the Avalanche Foundation for real-world asset (RWA) tokenization initiatives. This strategic move has likely contributed to boosting investor confidence and optimism surrounding Avalanche's future prospects.

Incentivizing Validators

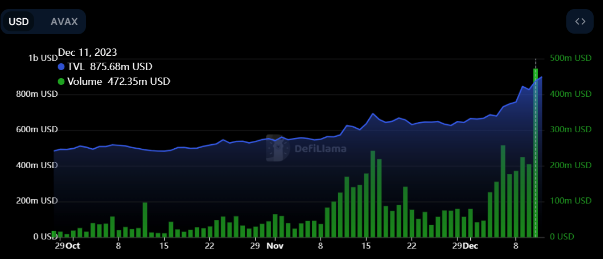

Avalanche's proactive strategy to incentivize its validators has led to a significant uptick in its market value. Additionally, the platform's overall revenue reached $145,000, further underlining the widespread success of the Avalanche system. Analysts attribute AVAX's outperformance to its relative undervaluation and strategic partnerships with major financial institutions. The recent spike in daily transactions, from $200,000 to $4.5 million, coupled with growing total value locked and trading volumes, has added to the excitement surrounding AVAX.

Technical Analysis: Navigating AVAX's Parabolic Rise

Examining the technical aspects of AVAX's recent price movements provides insights into its current trajectory and potential future directions. The token's journey has been nothing short of impressive, with a staggering 336% surge since October.

The recent parabolic rise in AVAX's price is evident when analysing the chart patterns. The token broke out above its multi-year descending trendline, signalling a significant shift in market sentiment. This breakout has been a key factor in the substantial increase, bringing AVAX to its highest point at $42.21 on December 11.

However, the surge has not been without its challenges. A 17% pullback has been observed, prompting questions about whether this correction marks the end of the upward trend. Chart analysis on the 4-hour timeframe reveals that the recent high was part of wave 3 within a lower-degree five-wave impulse.

Zooming into the wave structure of AVAX's last uptrend, the analysis suggests that the current price movement is in its ending wave. Today's high is considered wave 3, with expectations of a minor correction to consolidate the price. The nature of this correction will play a crucial role in determining the future trajectory of AVAX.

Potential Risks and Resistance Levels:

The price potential to the upside hinges on the outcome of the expected downturn. The $40 target, representing an 11% increase, might be surpassed in the next bullish run, paving the way for further gains. In such a scenario, the next significant resistance level to watch would be at $53.

Conversely, a more aggressive downward move during the correction phase could signal the end of the uptrend. This would imply that the price encountered strong resistance, and the recent high of $42.21 could mark the year's peak for AVAX.

Market Sentiment and External Factors:

It's crucial to consider broader market sentiment and external factors influencing AVAX's price movements. While AVAX has shown relative strength compared to major cryptocurrencies like Bitcoin and Ether during recent market declines, it remains susceptible to overall market trends. Analysts advise monitoring any correlation with Bitcoin dynamics, as historical patterns suggest AVAX tends to follow Bitcoin's trajectory with a slight delay.

Inflows of $2 million for crypto investor funds exposed to Avalanche suggest continued interest and confidence in the altcoin sector. In conclusion, Avalanche's recent successes, strategic initiatives, and technical resilience position AVAX as a cryptocurrency to watch. As the market continues to evolve, AVAX's ability to adapt and thrive amid challenges reinforces its standing as a promising player in the crypto space.