Crypto Weekly Wrap: 16th February 2024

BlackRock's Bitcoin ETF Inflows Surge

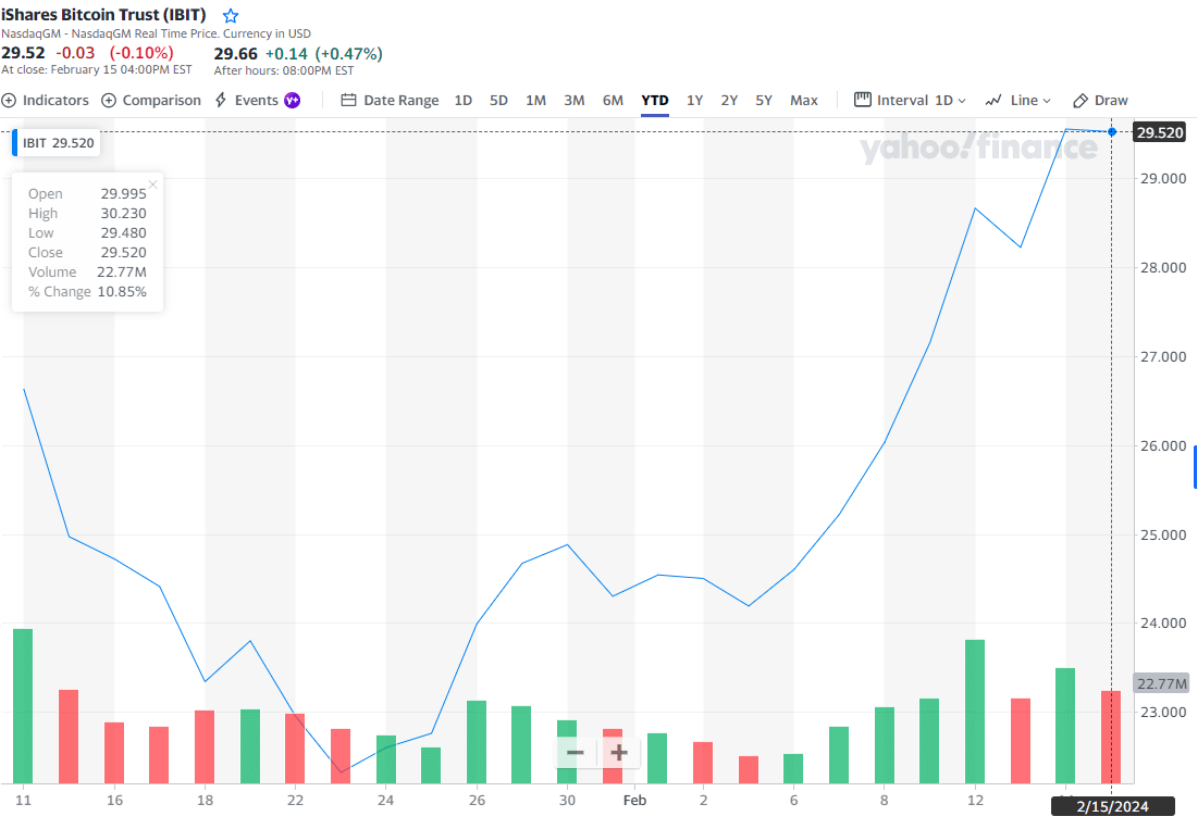

BlackRock's iShares Bitcoin Trust (IBIT) has made a significant impact in the ETF market just 17 days after its launch. With a staggering $3.2 billion in year-to-date inflows, IBIT has quickly climbed to become one of the top five ETFs of 2024, according to Bloomberg Intelligence data. This achievement places IBIT in the league of mammoth index ETFs like iShares Core S&P 500 ETF (IVV) and Vanguard 500 Index Fund ETF (VOO), highlighting the growing interest in Bitcoin among investors.

Source: Yahoo Finance

Fidelity's Spot ETF Makes Top 10

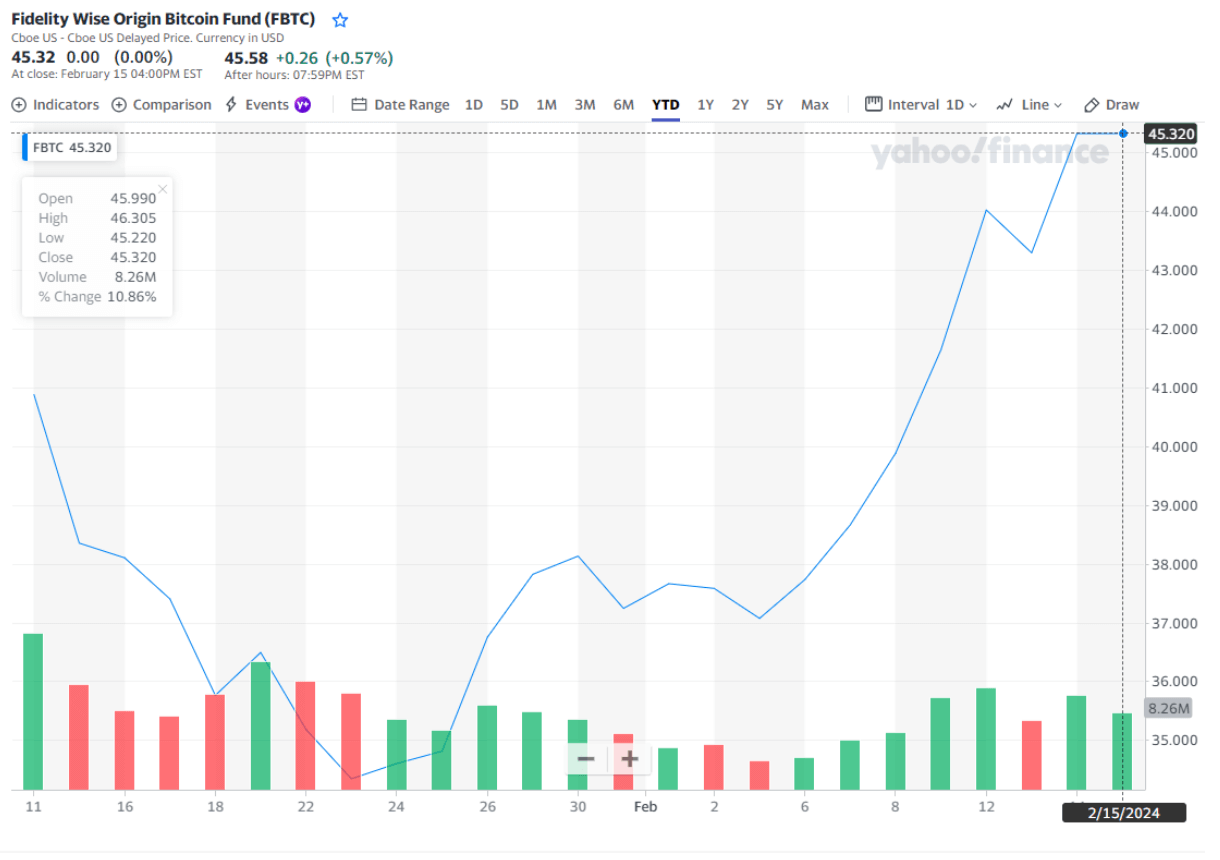

Fidelity's Wise Origin Bitcoin Fund (FBTC) also secured a spot in the top 10 ETF asset gatherers of the year, with $2.7 billion in inflows, showcasing the broadening appeal of Bitcoin-related investment products. Despite a slowdown in overall investment into new spot Bitcoin ETFs, both BlackRock's IBIT and Fidelity's FBTC stand out as the only two funds consistently experiencing positive flows since their launch, reflecting sustained investor interest in the cryptocurrency market.

Source: Yahoo Finance

Bitcoin Price Analysis Amid Market Volatility

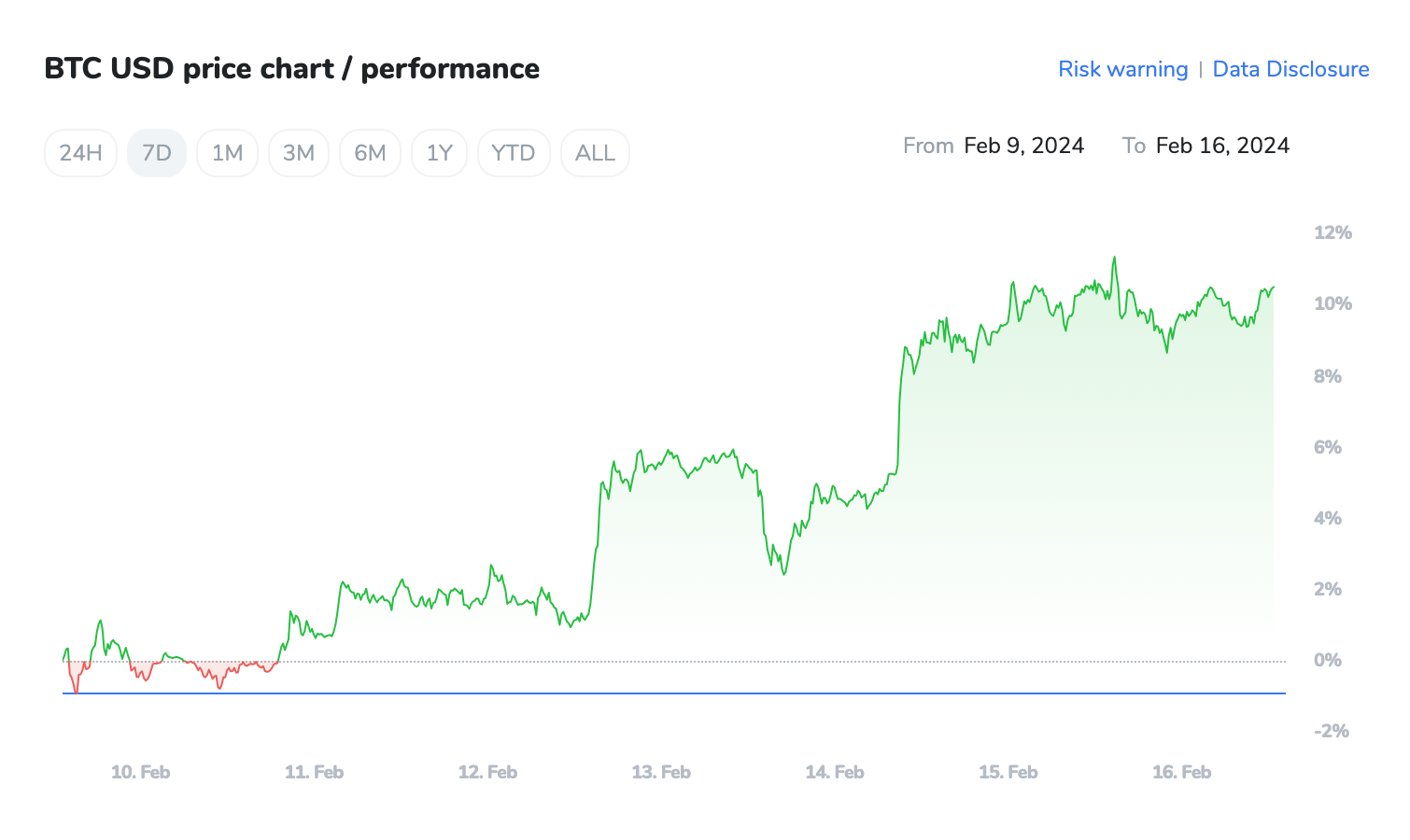

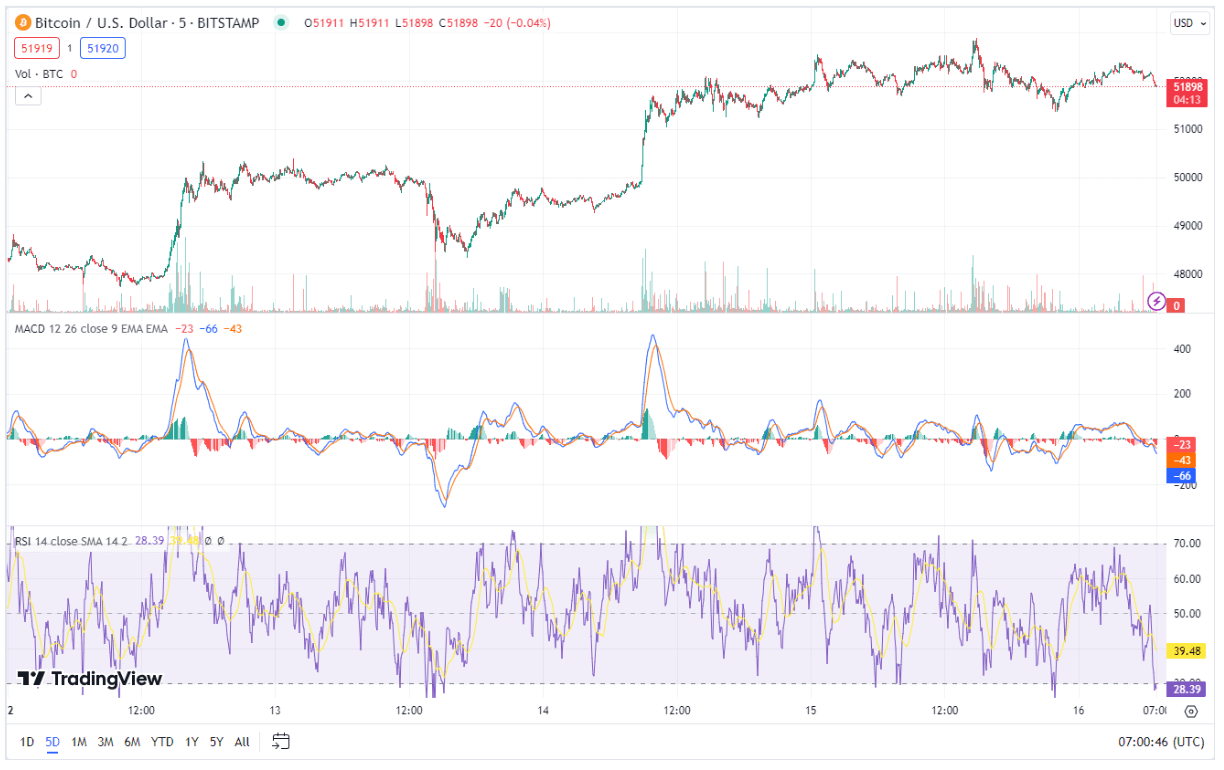

Bitcoin's recent price surge of 12% in just seven days has propelled its valuation to around $52,000, maintaining its status as the market leader with a valuation surpassing $1 trillion. This period of growth, coupled with a trading volume of $37.66 billion, underscores the cautious optimism prevailing in the crypto market. However, technical indicators such as the Relative Strength Index (RSI) hovering around 30 suggest a potential oversold condition, signalling the need for vigilance among investors. Support and resistance levels at key price points provide insights into potential price movements, with the $52,375 level emerging as a critical threshold for Bitcoin's short-term trajectory.

Chart created using TradingView

Mixed Economic Indicators Impact Bitcoin's Market Outlook

A nuanced view of the market emerges from recent US economic data, with implications for Bitcoin's value. While indicators like unemployment claims hint at a robust labour market and increased import prices signal inflationary pressures that historically drive investors towards Bitcoin as a hedge, challenges within the industrial sector and mixed retail sales data introduce uncertainty. Indicators like the Core Producer Price Index (PPI) and Building Permits releases are poised to offer further insights into inflation trends and the housing market's health, shaping Bitcoin's valuation amidst a complex economic landscape.

SEC Chair Gensler's Remarks on Ethereum ETFs and Bitcoin Regulation

SEC Chair Gary Gensler's recent comments shed light on the agency's stance regarding Ethereum ETFs and Bitcoin's regulatory landscape. Gensler has refrained from providing specific details or a timeline for approving spot Ethereum (ETH) exchange-traded funds (ETFs), citing a similar approach to that of Bitcoin (BTC) ETFs. The SEC's postponement of decisions on various Ethereum ETF applications, including those from Grayscale, Fidelity, and BlackRock, indicates ongoing regulatory scrutiny in the cryptocurrency space. Despite approving Bitcoin spot ETFs, Gensler emphasised that this decision was prompted by a court ruling rather than a shift in the SEC's perception of Bitcoin's risks. He expressed concerns about Bitcoin's association with illicit activities and the lack of oversight on crypto exchanges. Meanwhile, Ethereum's network is witnessing increased interest in staking, with a surge in validators seeking to participate in running Ethereum's proof-of-stake consensus blockchain, highlighting growing confidence in Ethereum's ecosystem despite regulatory uncertainties surrounding ETF approvals.

Ether's Resurgence and Market Optimism

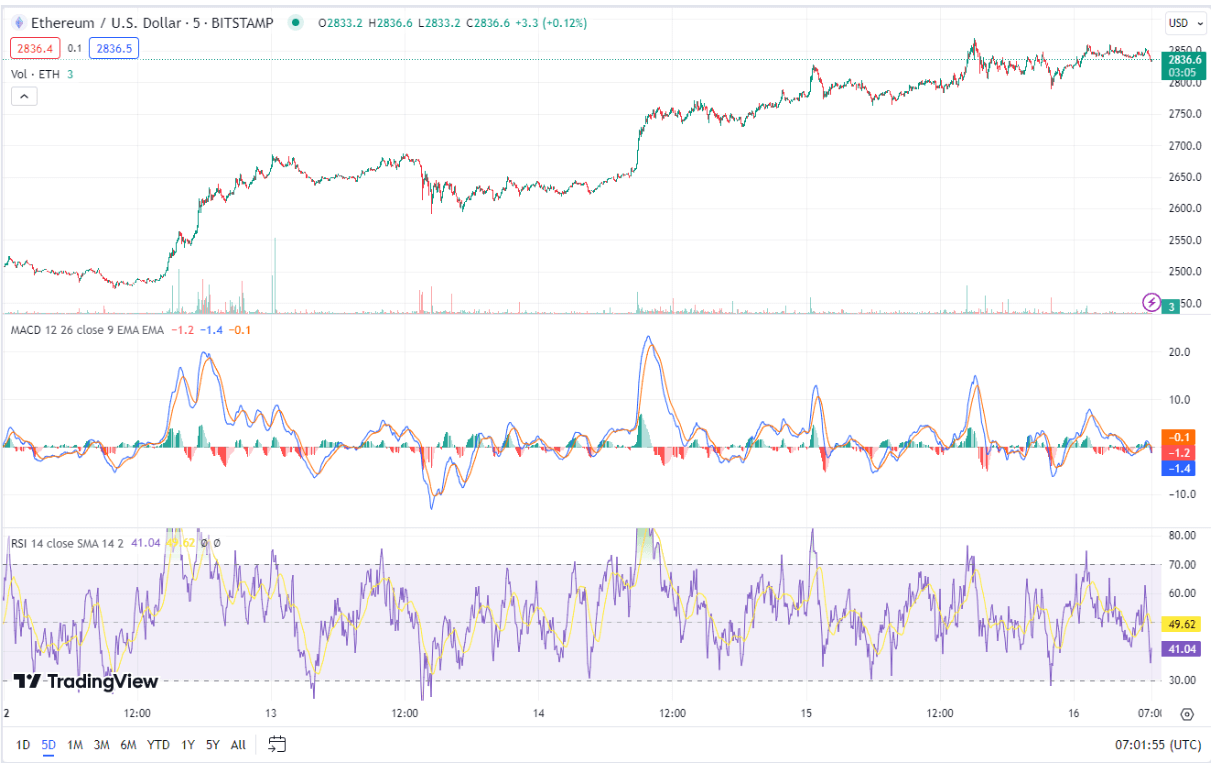

Ether's price surge above $2,800, driven by speculation around a potential spot ETH exchange-traded fund approval in the US, signals growing institutional interest in cryptocurrencies beyond Bitcoin. Applications from various firms for an ether ETF, alongside substantial inflows into Bitcoin ETFs, reflect a broader trend of increasing institutional participation in the cryptocurrency market. Telecommunication giant Telefónica's partnership with Chainlink to enhance security against Web3-related hacks further underscores the growing integration of blockchain technology into traditional industries, contributing to the overall optimism surrounding the cryptocurrency market's future.

Chart created using TradingView