Does Your Business Need a Digital Asset Strategy

MicroStrategy implemented a digital asset strategy in 2020 when Chairman and Co-founder Michael Sayler decided to purchase Bitcoin as a hedge against inflation and an alternative to cash on the balance sheet.

MicroStrategy has emerged as a prominent participant in the cryptocurrency space. This is primarily due to its significant investment in Bitcoin. MicroStrategy owns 214,246 bitcoins as of March 19, 2024. MicroStrategy is currently making an astounding unrealised profit of $2.65 billion from its Bitcoin assets.

Whilst MicroStrategy is an extreme example of a business purchasing Bitcoin as part of the long-term business strategy, this strategy can be effective on a smaller scale for SMEs. Business owners may consider retaining digital assets as part of their strategy for a variety of reasons, including reducing inflationary pressures from the business.

Excess cash reserves

Companies with extra cash reserves may consider purchasing digital assets like Bitcoin as a hedge against inflation. Because of scarcity and supply/demand dynamics, Bitcoin's purchasing power has historically increased over time. Bitcoin has a limited supply of 21 million.

Fiat currency (GBP, USD, EUR) has historically devalued over time for a variety of reasons, the most prevalent of which is central bank money printing, which increases the supply of fiat currency in circulation. Fiat currency has an infinite supply cap. The supply of fiat currency traditionally expands with time, diminishing its purchasing power.

Holding a portion of your business cash reserves in digital assets might provide a hedge against inflation, which eats away at cash sitting on the sidelines.

Fiat currency price fluctuations

Businesses that import goods or services from international clients will experience fluctuations in fiat currency prices. If the pound's value decreases against the euro, it will become more expensive to import goods from the Eurozone, decreasing firm profit margins if the cost is not passed on to customers.

Businesses that export goods or services to foreign countries may also face issues from fluctuating fiat currency prices. If the GBP's value rises against another fiat currency, the cost of exporting the product to an overseas end-user rises. Cost hikes may result in fewer sales for the organisation, thus reducing revenue.

Businesses exposed to fiat currency price swings can now hedge against inflation with stablecoins such as USDT and USDC, as well as Bitcoin.

Hedge against inflation

Businesses that depend on central bank monetary policy (interest rates) invest in digital assets to hedge against inflation.

When the central bank boosts interest rates, it puts downward pressure on the property market, which hurts real estate developers and agents. Investors and clients are becoming increasingly unwilling to borrow money as interest rates rise, owing to increased financing costs.

Companies in the real estate market are investing in digital assets as part of their long-term strategy and as a hedge against central bank monetary policy.

If the property market cools, Bitcoin serves as a hedge against economic uncertainty while also offering some upside potential. Bitcoin currently has an annualised return of 145% per year.

How does Bitcoin hedge against inflation?

GBP V Bitcoin:

Both of the first two scenarios are on the assumption that fiat currency will fluctuate, but ultimately devalue over time, as it historically does. Business owners who are directly impacted by fiat currency price fluctuation are well aware of currency devaluation.

Bitcoin first went live in January 2009, and over the past 14 years, Bitcoin's purchasing power has increased, with the value moving from 0 to about 70,000 today, and hitting all-time highs recently above $73,000.

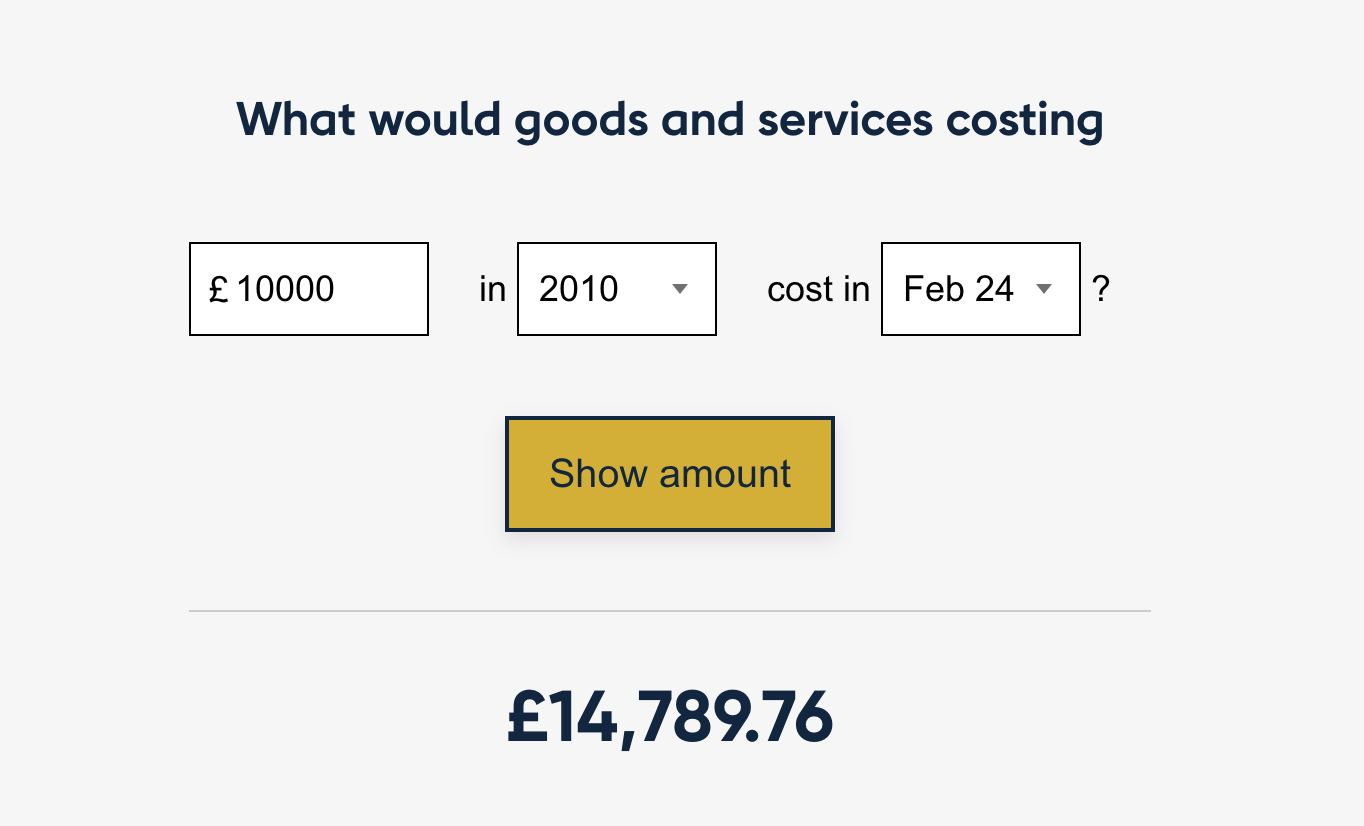

On the other hand, the GBP has continued to devalue, with the purchasing power sliding by more than 50% in that same timeframe. Here is a live example from the Bank of England website:

Source: Bank of England

Goods and services costing £10,000 in 2009, would cost about £15,000 today. A 50% increase in the price of goods and services in only 14 years. This suggests that the GBP’s purchasing power has decreased by 50% since 2009.

Fiat currency devaluation will continue, as it always has done.

Bitcoin and digital assets provide a hedge against this scenario, which has played over and over again throughout time.

ICONOMI Business Account

There is a misconception that only companies working in the digital asset space can hold cryptocurrency as part of their strategy. This is incorrect, ICONOMI is working with business owners from a variety of sectors; property, finance, hospitality, retail, import/export and technology companies. ICONOMI provides business accounts to business owners who require access to cryptocurrency.