Next Bitcoin Halving Date 2024 — Countdown Clock & Prediction

Bitcoin Halving Clock

What Is The Bitcoin Halving, And Why Is It Important?

Put simply, a Bitcoin halving is when the reward for mining new blocks is cut in half, which then leads to a reduction of the supply of new Bitcoins that enter the market. The halving happens approximately every four years, and is a feature that is coded into the Bitcoin protocol in order to control inflation and promote scarcity. Understanding how this all works is vital, given that it not only affects those mining the new Bitcoin, but also has an impact on the supply, demand, and value of the number one cryptocurrency.

When the next Bitcoin (BTC) halving happens in April of 2024, there is likely to be a huge amount of excitement and anticipation inside the crypto community, and potentially even in the mainstream. The reason is simple - for every one of Bitcoin's past cycles, the halving event has proved to be a pivotal occurrence that has led to a large price increase and an eventual market top for the number one cryptocurrency.

Let's have a look at what is involved in a BTC halving.

Understanding the Bitcoin Block Reward System

In terms of its inner workings, the Bitcoin blockchain operates within a decentralised network, where the transactions are verified by individuals and companies called Bitcoin miners, who operate specialised computers called mining rigs. The computers are required to solve complex mathematical problems in order to have the right to add new transaction blocks to the blockchain, and be rewarded with a certain number of Bitcoins; which is their incentive to continue participating in the network.

Back in 2009 when the Bitcoin network first started operating, the Bitcoin mining reward was set at 50 BTC per block. Each subsequent halving, reached at every 210,000 blocks mined, has reduced the amount of BTC rewards, thereby helping to make Bitcoin become an even more finite and scarce resource than gold.

Predicted to take place in April of 2024, the next halving will see the miner's block reward diminish from 6.25 to 3.125 BTC. The event remains a key point of discussion, as BTC holders and those looking to buy weigh up the impact and adapt their strategies.

The Impact of the Halving on Bitcoin's Value and Ecosystem

Many believe that Bitcoin's halvings have the potential to substantially affect the market value of Bitcoin, and that this is due to simple mathematical mechanics.

By decreasing the block reward, the number of new Bitcoins being created and released into circulation is being reduced. This supply shock can result in an increased demand, and a possible subsequent rise in the price of Bitcoin. In this way, the halving acts as a balancing mechanism for the Bitcoin ecosystem, as it continues to incentivise the miners, while ensuring scarcity and maintaining value. To date, more than 19 million Bitcoins have been mined, which leaves fewer than 2 million to be mined over the coming decades, until the final date of 2140. This is expected to be when the last halving occurs, and the year when all 21 million coins will have been mined.

When is The Next Bitcoin Halving Date

The next Bitcoin halving is eagerly anticipated by both investors and enthusiasts alike as it marks a major milestone in the cryptocurrency's life cycle, and can result in significant implications for the market.

Below are the key dates and milestones:

Countdown to April 2024: Key Dates and Milestones

As April 2024 draws nearer, the crypto community is starting to concentrate on a date that could potentially have a huge impact on the landscape of digital currency investments. Whilst the precise halving date cannot be determined as of yet due to the nature of mining, predictions suggest that the next Bitcoin halving is expected sometime between 18th to 25th April 2024.

Key Milestones:

- 95 days (as an estimate) to halving: Anticipation increases as the event draws closer.

- Halving week: Intense speculation and analysis by the Bitcoin community.

Historical Patterns and Predictions for the 2024 Halving

An analysis of previous Bitcoin halvings can give a good idea of what might happen in the upcoming halving. Thus far, in all three previous halvings, there have been substantial fluctuations in the BTC price leading up to, and following these events. The next halving in 2024 will be the fourth such event in Bitcoin's history, and if the same price patterns are repeated, there is likely to be a lot of volatility in the market. While the use of previous history cannot guarantee any particular future outcome, previous halving events can provide a decent point of reference for the coming halving.

Historical Patterns:

- Past halvings: Post-halving periods have generally been followed by bullish market behaviour.

- Market anticipation: Speculation runs high as many investors and traders decide their moves based on historical data.

Previous Bitcoin Halving Dates

An analysis of previous Bitcoin halvings can give a good idea of what might happen in the upcoming halving.

Thus far, in all three previous halvings, there have been substantial fluctuations in the BTC price leading up to, and following these events. The next halving in 2024 will be the fourth such event in Bitcoin's history, and if the same price patterns are repeated, there is likely to be a lot of volatility in the market. While the use of previous history cannot guarantee any particular future outcome, previous halving events can provide a decent point of reference for the coming halving.Let’s have a look at the previous three halvings.

Lessons Learned from Past Bitcoin Halvings

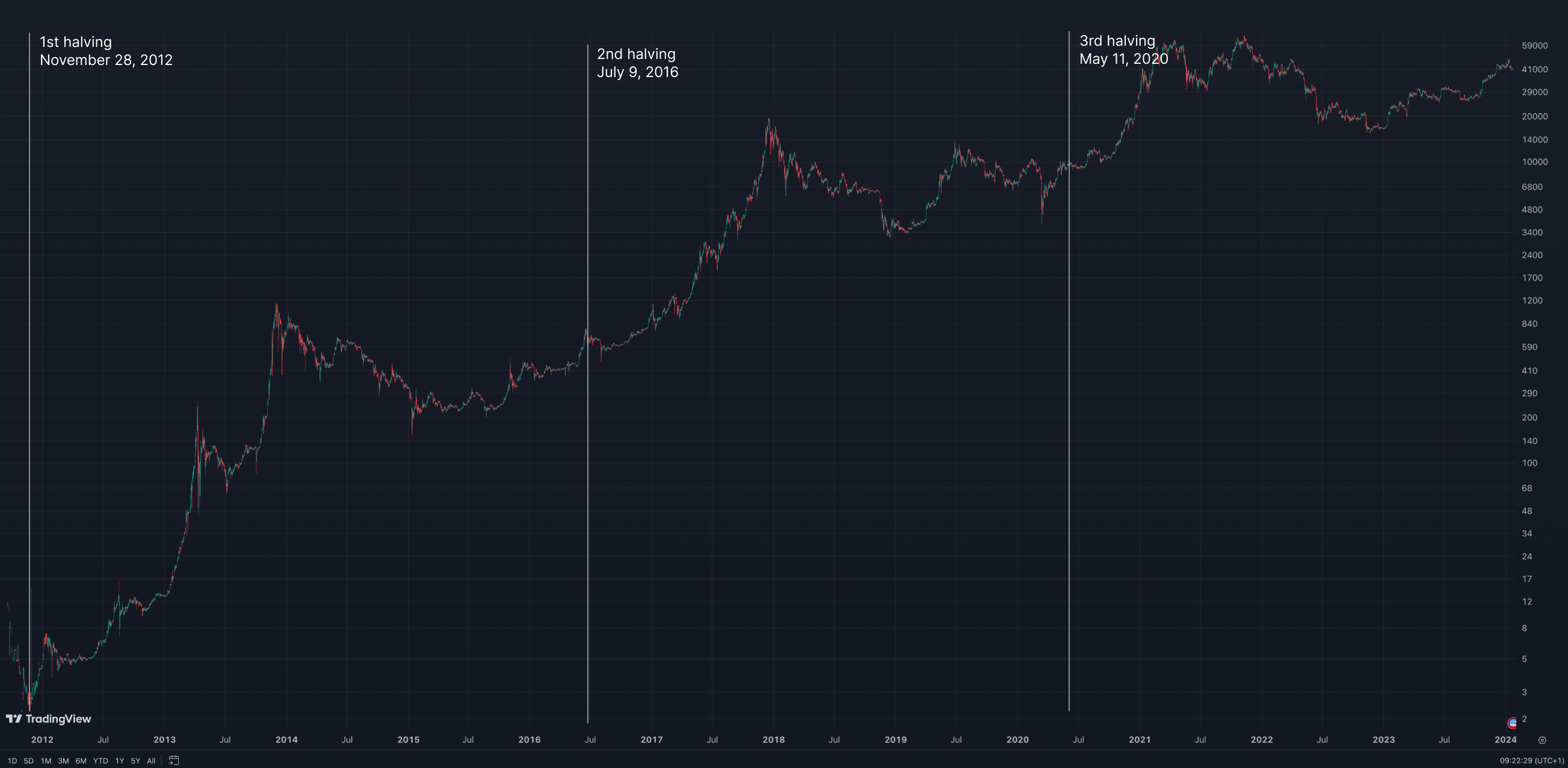

The first Bitcoin halving took place on 28 November 2012, where the incentive for miners was halved from 50 BTC to 25 BTC. After an initial period of uncertainty, this event was then followed by an intense increase in the BTC price, which reached $1,170 within the following year.

The second halving took place on 9 July 2016, with the price of Bitcoin at approximately $640 at the time of the event. The reward dropped from 25 BTC to 12.5 BTC, and the following bull run saw price peak at around $19,650 in December 2017.

The third Bitcoin halving event occurred on 11 May 2020, when the BTC price was about $8,600. This cycle saw Bitcoin reach its highest price of $67,500 in November 2021, following a reduction in block rewards to 6.25 BTC.

By looking closely at price behaviour over previous halvings, it can be seen that although they are generally bullish, they are initially followed by a dip in price. Each halving was followed by its own particular price fluctuations, but they all demonstrated eventual price growth.

Bitcoin Halving Chart

A great tool that enables one to see the impact of the Bitcoin halving events is a comprehensive Bitcoin halving chart. This visual not only gives the timeline and reduction in block rewards, but also provides a context for BTC price movements around the halving events.

Below is a halving chart that highlights Bitcoin’s supply and demand dynamics.

Visualising Bitcoin's Supply and Demand Dynamics

A Bitcoin halving chart provides a visualisation of the impact of the halvings on price, plus the balance between the programmed supply of Bitcoin and market demand.

As each halving reduces the rate at which new Bitcoins are created and released into the ecosystem, adjustments in Bitcoin's inflation rate take place. For the miners, this translates into a halving of their rewards every four years, which consequently leads to more scarcity over time. This directly influences miners' profitability and therefore also has a direct impact on the mining landscape overall.

Interpreting Historical Data: Trends and Anomalies

The historical data on the Bitcoin halving charts throw light on past trends and deviations that followed each reduction in mining rewards. The deflationary nature of Bitcoin is plain to see, as the total supply of Bitcoin gets closer to running out at its cap of 21 million. The shifts that take place during the halving cycle manifest themselves in an increase in trading activity and price, as the market adjusts to the new supply rate.

This coming halving event is a continuation of Bitcoin's preprogrammed scarcity model, which many anticipate will cause a similar economic impact to those in the past. Therefore, investors and enthusiasts are watching the charts closely for the next significant trend for BTC.

Bitcoin Halving Price Prediction

Determining how the upcoming Bitcoin halving will influence the Bitcoin price is a prime concern for many. Despite the many predictions that are currently going the rounds, probably the best advice to crypto investors is to approach any Bitcoin halving price prediction with the utmost caution. As the halving event nears, these forecasts can tend to become more speculative and potentially overstated. It is the price action after the halving event has happened that is historically far more significant.

Speculating Future Price Movements Post-2024 Halving

As mentioned previously, if history is anything to go by, halving events have been followed by significant price rallies. However, it's essential to acknowledge that past performance does not necessarily predict future results. As the market continues to mature, changing economic factors can alter outcomes. When attempting to speculate on Bitcoin price movements, multiple scenarios should be considered, including both bullish and bearish outcomes based on the evolving market conditions.

Expert Opinions and Market Analysis for 2024

Expert opinions on the future Bitcoin value in 2024 can differ spectacularly. Some analysts are predicting a meteoric rise that goes well beyond the $100,000 mark, while others expect a more moderate increase to between $50,000 and $80,000, which takes into account the phenomenon of diminishing returns. Factors such as the approval of several Bitcoin ETFs and their anticipated positive impact on the demand for Bitcoin are highlighted. That said, the complex nature of global financial markets and the various regulatory jurisdictions could also play significant roles in damping down Bitcoin's price growth. Experts agree that while excitement about the halving and the ETF approvals have certainly reignited interest in BTC, every prediction remains speculative and the market will always have the last say.

Bitcoin Halving Countdown — What Next?

As we move into 2024 and the Bitcoin halving is only a few months away, anticipation for what comes next is palpable among the Bitcoin and wider crypto community. Many are expecting a similar scenario to past halving events, where a general increase in price follows the halving, with a more accelerated price increase following this as Bitcoin approaches its next market top.

Investors must bear in mind though that Bitcoin bull markets typically suffer price corrections, and some of these can be in the range of 30 to 40% drawdowns. Therefore investors, miners, and the market at large, will need to avoid FOMO (fear of missing out), and recognise that the halving could presage negative as well as positive Bitcoin price action.

Preparing for the Next Phase in the Bitcoin Lifecycle

As the next halving looms into view, various stakeholders will be gearing up for the changes to the Bitcoin network that the halving will bring. Miners will be looking to optimise their operations, given the 50% reduction in their rewards post halving. An investment in more advanced mining rigs, and perhaps moving location to take advantage of more low-cost energy sources, might be crucial in order to maintain profitability.

Investors and traders are likely to be closely monitoring the market and studying the chart patterns from past halvings, enabling them to make more informed decisions regarding the potential for trading Bitcoin. Having said this, all future Bitcoin halving dates are also likely to be focal points that demand an adjustment in investments and strategies.

Potential Market Reactions and Investor Strategies

Market reactions to the upcoming Bitcoin halving in 2024 are as usual the subject of much speculation. Historically, halvings have been associated with increased BTC value over time, as reduced supply meets growing demand. However, it should be noted that nothing in the market is guaranteed. Therefore, many experts advocate that people should diversify their portfolios and make contingency plans in order to mitigate risks and capitalise on potential gains. Finally, it should also be acknowledged that the true impact of the upcoming halving might unfold over years rather than days or months.

Conclusion

And there you have it!

As the countdown to 2024 continues, experts will continue to offer varying price predictions, highlighting the importance of cautious speculation and diversified portfolios. Miners, investors, and traders alike are preparing for the next phase in the Bitcoin lifecycle, recognising that the impact of this halving may unfold over years. Amidst the excitement and anticipation, it's essential to approach the event with both optimism and prudence, acknowledging that the cryptocurrency market always has the final say.

Be sure to keep abreast of updates related to BTC, and adjust strategies accordingly.