Crypto Weekly Wrap: 9th February 2024

Cryptomarket Update

Amidst the current volatility in the crypto market, Bitcoin has shown resilience by attempting to push past the $46,000 mark, marking a nearly 5% gain for the day. Spot trading volumes on centralised exchanges saw a notable rise in January for the fourth consecutive month, reaching levels last seen in June 2022. This surge in trading activity comes amidst growing interest sparked by the approval of Bitcoin ETFs. Notably, BlackRock and Fidelity's spot bitcoin ETFs are gaining traction and are perceived to have an advantage over Grayscale, according to JPMorgan. This shift in investor preferences towards ETFs highlights evolving trends in the crypto investment landscape.

Grayscale Bitcoin Trust Conversion to ETF

Grayscale Bitcoin Trust (GBTC) has undergone a significant transformation, transitioning into an ETF structure. Initially established in 2013, GBTC has played a pivotal role in providing investors with secure access to Bitcoin. With assets under management (AUM) amounting to $26.6 billion as of January 11, 2024, GBTC stands as the world's largest Bitcoin ETF. Investors seeking exposure to the leading cryptocurrency can now access GBTC conveniently through brokerage accounts or with the assistance of financial advisors. However, it's crucial for investors to conduct thorough due diligence and review the prospectus before making investment decisions, as highlighted by regulatory requirements.

Ripple's Legal Battle and Regulatory Scrutiny

Ripple Labs faces ongoing legal challenges as a New York judge orders the production of financial statements related to the institutional sale of XRP tokens in response to the U.S. Securities and Exchange Commission's (SEC) request. This development follows a pivotal ruling last July, which found Ripple liable for violating U.S. securities laws in its institutional sales of XRP. The SEC's continued scrutiny underscores the regulatory complexities surrounding digital asset offerings and highlights the need for clarity in regulatory frameworks.

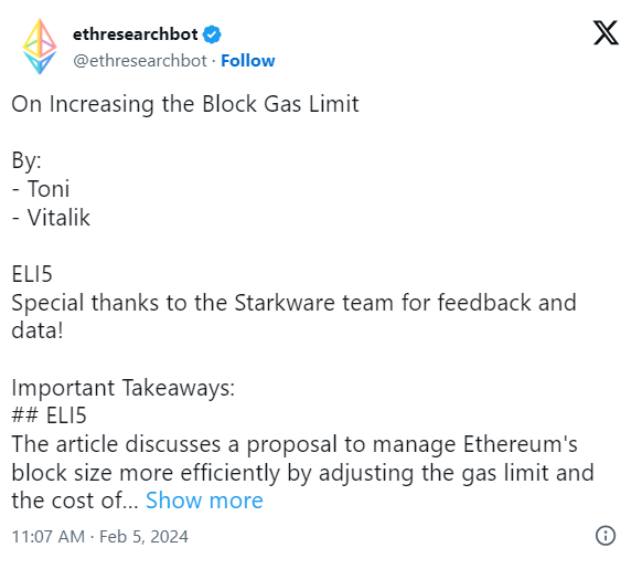

Ethereum's Scalability Optimization Strategies

Vitalik Buterin and the Ethereum Foundation are actively exploring strategies to optimise Ethereum's blockchain for scalability, particularly focusing on the rollup-centric roadmap. With Ethereum's effective block size doubling over the past year, Buterin proposes several solutions to manage block space effectively. These solutions include adjusting the cost of calldata, capping calldata per block, and implementing separate fee markets. Balancing the incentivization of calldata usage while optimising gas costs remains a priority to enhance Ethereum's scalability and efficiency.

Source: X

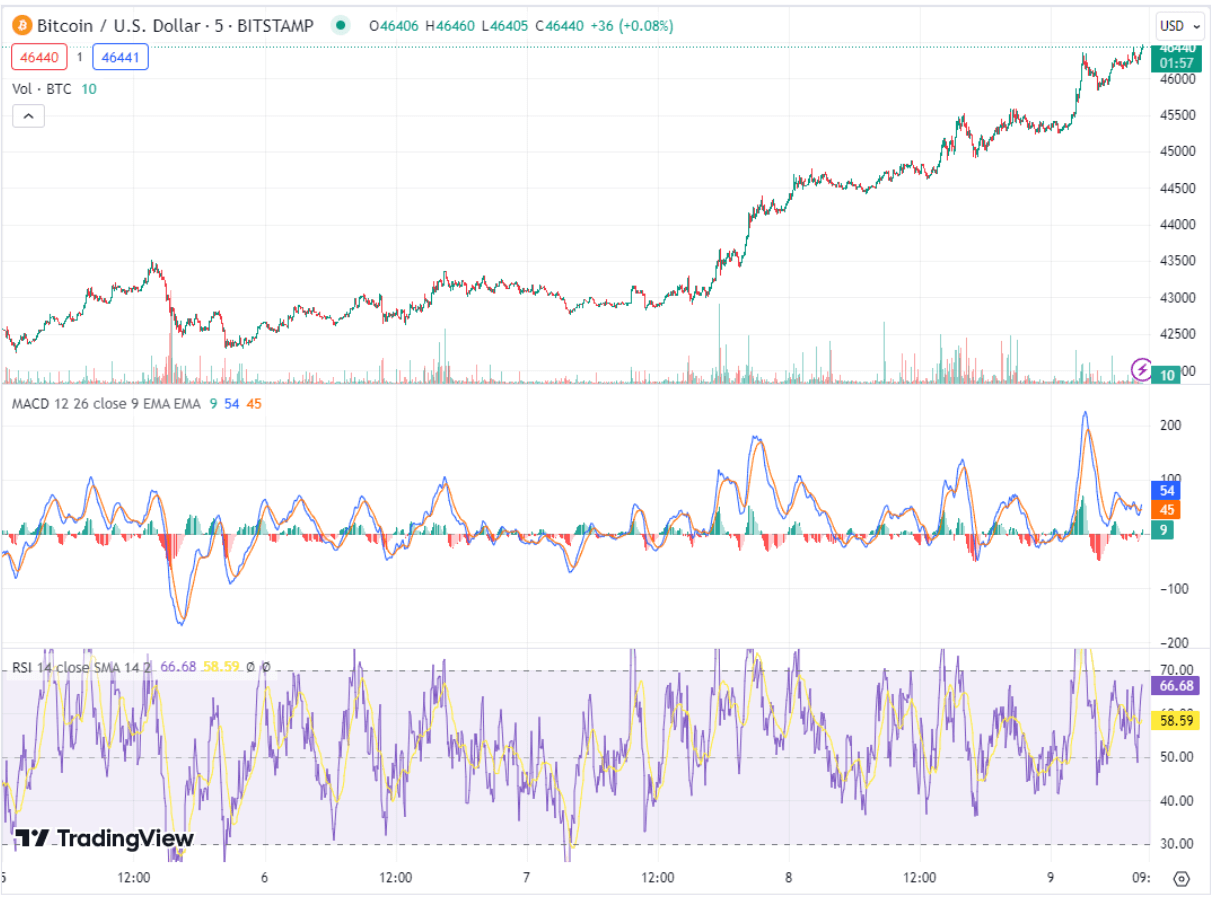

Bitcoin Technical Analysis and Market Outlook

Bitcoin's price trajectory remains a focal point amidst evolving market dynamics. Currently consolidating near $46,420, Bitcoin faces resistance levels at $46,709, and $47,394, with pivotal support levels at $45,943, and $44,628. Technical indicators present a mixed view, with the Relative Strength Index (RSI) around 59 suggesting a slightly bullish market stance and the Moving Average Convergence Divergence (MACD) indicating neutral momentum. The 50-day Exponential Moving Average (EMA) aligns with the first resistance level, signalling a crucial zone for potential price movements. Despite the current consolidation phase, Bitcoin's overall trend leans bullish above the pivot point of $46,700, reflecting potential upward momentum if this level is sustained. As influential voices like Cathie Wood champion Bitcoin as the new gold and regulatory scrutiny intensifies, market sentiment remains cautiously optimistic, underscoring the need for investors to closely monitor developments in the cryptomarket.

Chart created using TradingView

Latest on DeFi

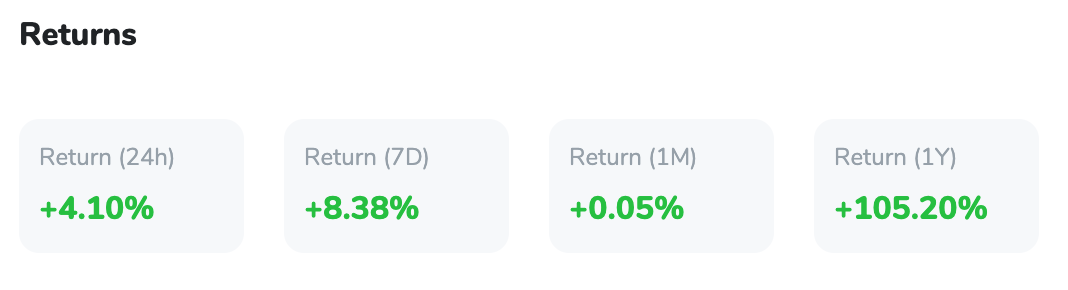

Decentralised Finance (DeFi) has emerged as a disruptive force in the financial landscape, revolutionising traditional finance by leveraging blockchain technology to create decentralised protocols and applications. In the DeFi ecosystem, financial services such as lending, borrowing, trading, and asset management are facilitated through smart contracts, enabling peer-to-peer transactions without intermediaries like banks or brokers. With the total value locked (TVL) in DeFi protocols reaching $60 billion, DeFi is experiencing a surge in popularity, driven by the promise of higher yields and greater financial inclusivity. The recent increase in TVL coincides with a rise in daily trading volumes and market capitalization of DeFi-linked crypto tokens, indicating growing investor confidence and interest. Despite concerns about price volatility and regulatory uncertainties, DeFi continues to attract capital as investors seek alternative avenues for generating returns in a rapidly evolving financial landscape.

Source: DeFiLlama