Crypto Weekly Wrap: 19th April 2024

Tether Expands Beyond Stablecoins

Tether, the pioneering force behind the world's largest stablecoin, USDT, has announced a significant restructuring to accommodate its expanding presence within the digital asset landscape. With a mission extending beyond stablecoins, the company has reorganised into four distinct divisions: Data, Finance, Power, and Education. This strategic move underscores Tether's commitment to diversifying its offerings and embracing emerging technologies. The Data division will spearhead strategic investments in cutting-edge technologies like artificial intelligence (AI), while Finance remains dedicated to managing USDT's substantial market cap, exceeding $100 billion. Power will oversee investments in Bitcoin mining operations, emphasising Tether's commitment to sustainable practices. Lastly, the Edu division will serve as a hub for educational initiatives, reflecting Tether's dedication to fostering knowledge and understanding within the crypto community.

Source: X

Worldcoin Introduces Layer-2 Chain for Human-Focused Blockchain

Worldcoin, spearheaded by Sam Altman, is pioneering a novel approach to blockchain technology with the launch of its layer-2 Ethereum blockchain, aptly named World Chain. Building upon Optimism's OP stack framework, this initiative aims to deliver lower fees and faster transaction speeds, catering specifically to verified humans over AI bots and trading algorithms. By prioritising authenticated users through its retina-scanning "orb" device, Worldcoin endeavours to foster an ecosystem focused on genuine human interaction within the realm of cryptocurrencies. The transition to an independent chain grants Worldcoin greater control and flexibility, potentially reducing costs for users while expanding opportunities for developers to create real-world utility applications. With its emphasis on proof of personhood and integration of bot-vetting mechanisms, Worldcoin's World Chain signifies a significant step towards enhancing digital identity and fostering inclusive participation in the evolving landscape of decentralised finance.

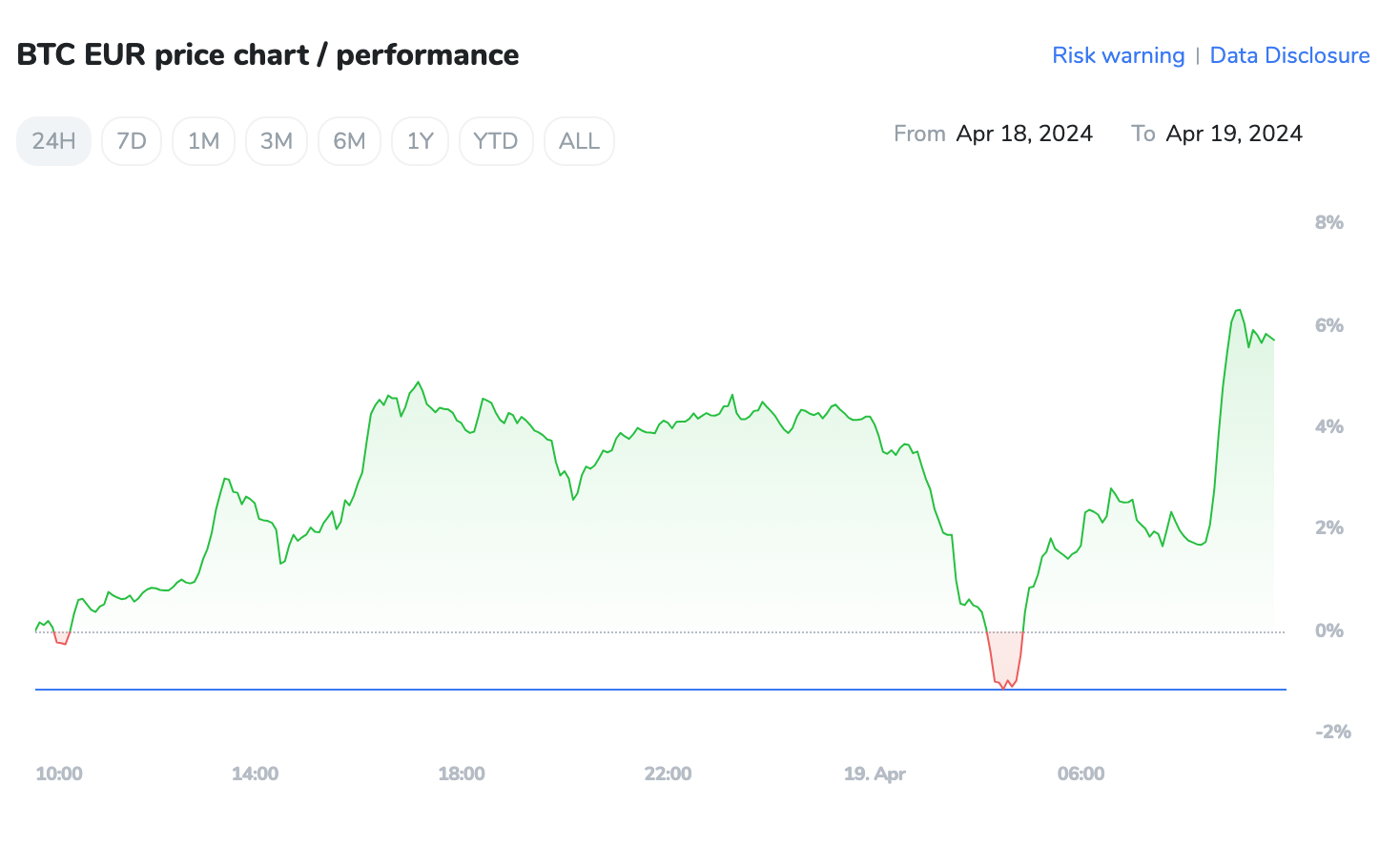

Bitcoin Technical Analysis: Navigating Volatility

Bitcoin is navigating a period of heightened volatility as it hovers around the $62,430 mark. Technical analysis reveals a delicate balance between bullish and bearish forces, with key support and resistance levels guiding price action.

The Relative Strength Index (RSI) indicates potential oversold conditions, suggesting a temporary pause in selling pressure. However, the 50-Day Exponential Moving Average (EMA) at $66,050 underscores prevailing downward momentum. Immediate resistance lies at $64,610, followed by a barrier at $67,700.

Source: TradingView

Conversely, significant support levels are found at $59,420 and $56,270. A decisive move above $63,000 could signal bullish momentum, while a breach below may intensify selling pressure, prompting deeper corrections. Amidst economic uncertainties and the upcoming April 20 halving event, investors must closely monitor market reactions and indicators for potential trading opportunities.

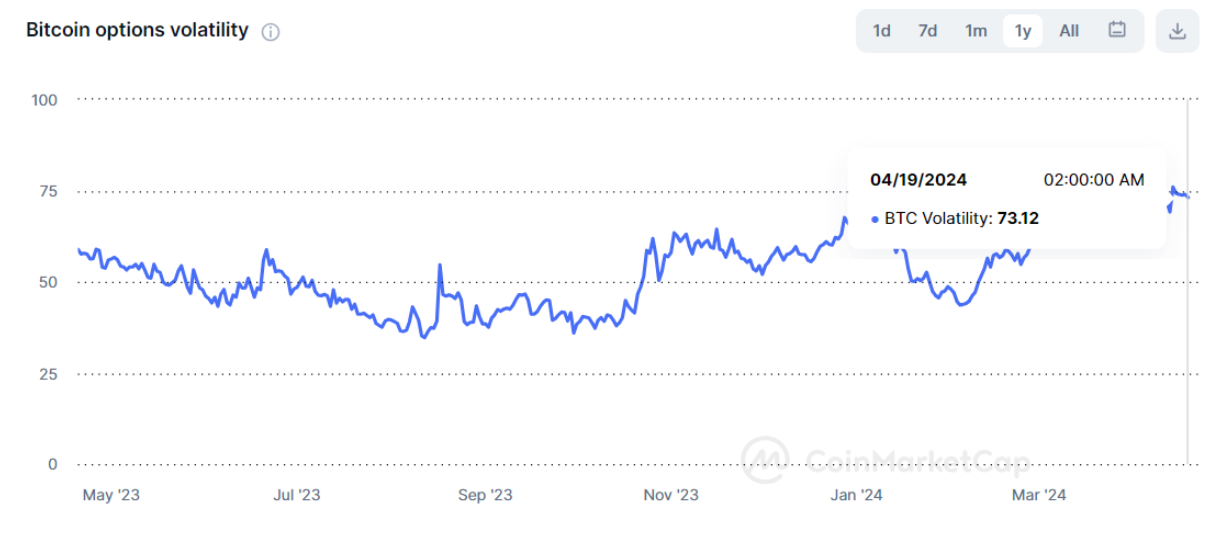

Bitcoin's Role in the Market and Price Dynamics

Bitcoin's price dynamics play a pivotal role in shaping the overall sentiment and performance of the cryptocurrency market. As the pioneering cryptocurrency and the primary driver of market trends, Bitcoin's movements often serve as a barometer for investor sentiment and risk appetite. Given its established history and widespread recognition, Bitcoin's price fluctuations reverberate throughout the entire crypto ecosystem, influencing the valuations of altcoins and shaping market trends.

Source: Coinmarketcap

Moreover, Bitcoin's status as a store of value and digital gold has cemented its position as a hedge against economic uncertainties and inflationary pressures, further enhancing its appeal to institutional and retail investors alike. As such, monitoring Bitcoin's price action provides valuable insights into market trends, investor sentiment, and the broader adoption of cryptocurrencies as a viable asset class in the global financial landscape.

Source: Coinmarketcap

Institutional Adoption and Market Sentiment

The crypto market continues to witness significant developments in institutional adoption and market sentiment. Germany's largest state-backed bank, LBBW, has announced plans to offer cryptocurrency custody services in partnership with Bitpanda, targeting corporate clients. This strategic move reflects growing institutional interest in digital assets like Bitcoin and Ethereum. Additionally, Bitwise Asset Management emphasises the long-term impact of Bitcoin halvings on its value, citing historical trends of significant price appreciation post-halving. While short-term volatility and regulatory uncertainties persist, partnerships like LBBW's and insights from industry experts provide optimism for the future of cryptocurrencies as mainstream asset classes. As the market evolves, investors must remain vigilant, leveraging technical analysis and fundamental insights to navigate dynamic market conditions effectively.

Halving Countdown

Cryptocurrency enthusiasts are on the edge of their seats as the anticipated "halving" event for Bitcoin approaches, marking a scheduled reduction in the rate of new coins entering circulation. With this event recurring roughly every four years, analysts speculate that the tightening supply could lead to a surge in Bitcoin's price, especially as the industry experiences a resurgence following years of market downturns and corporate challenges. Recent record highs in Bitcoin's price, coupled with increased investment spurred by new financial products, have heightened anticipation for the potential impact of the upcoming halving on the cryptocurrency's value.