Crypto Weekly Wrap: 23th January 2026

The January Jitters: When Stability Becomes the New Volatility

Another week, and it feels like we’re charting a course through choppy waters. The calm, which often precedes a storm, has left many an investor second-guessing.

In a market where yesterday's gains are quickly erased by today's uncertainty, understanding the underlying currents is more crucial than ever.

This week, we saw that volatility isn’t just about dramatic swings; sometimes, it’s the quiet erosion that truly tests our conviction.

The Macro Lens

The broader macroeconomic picture remains mixed. The VIX, often called the "fear index," jumped 3.34% to 12.36. This increase, while still relatively low in historical context, suggests a subtle uptick in investor anxiety in traditional markets. It’s a quiet signal that could translate to tighter liquidity or a more cautious stance across risk assets, including crypto.

Meanwhile, gold surged by 3.75% and silver by 6.51%, indicating a clear flight to perceived safety amid this brewing uncertainty. This dynamic often acts as a bellwether for capital rotation away from more speculative assets, a trend that crypto investors should certainly be watching.

The strength of safe havens amid somewhat muted stock performance points to a growing undercurrent of conservative capital allocation.

The Stocks Lens

Traditional equities closed the week largely flat, with the S&P 500 down a modest -0.31% and the Nasdaq 100 barely registering a change at -0.12%. Even the Dow Jones dipped a mere -0.04%. This relative stagnation in major indices might seem benign, but combined with the rising VIX, it suggests investors are taking a pause.

The "Magnificent Seven" showed a mixed performance: Tesla (TSLA) rallied strongly by 1.85%, alongside Microsoft (MSFT) at 0.79% and Amazon (AMZN) at 0.13%. However, Alphabet (GOOGL) slid -1.17%, and both Apple (AAPL) and Meta (META) were down -0.34%. This divergence suggests that while some tech behemoths maintain momentum, capital is becoming more discerning.

Equity markets are treading water, signalling a cautious mood that often trickles down to temper enthusiasm for higher-risk digital assets. When conviction sags in established markets, it's rare for speculative assets to charge ahead unchecked.

The Crypto Lens

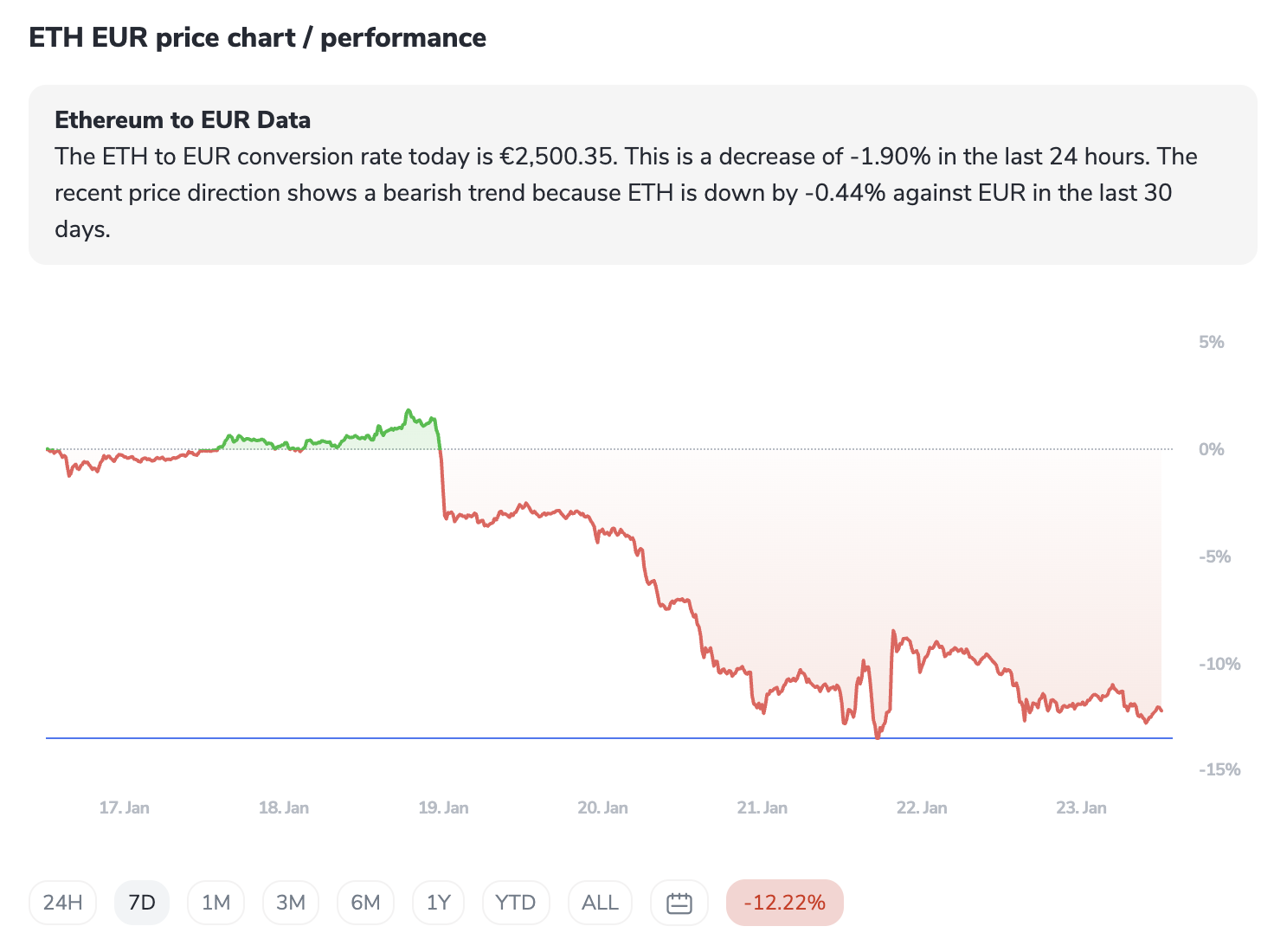

The crypto market experienced a quiet retreat this week after recent peaks, with both Bitcoin and Ethereum facing downward pressure. Bitcoin (BTC) dropped nearly 7% over the last seven days, while Ethereum (ETH) saw an even steeper decline of over 11%.

This market correction comes amid a backdrop of "Extreme Fear," as indicated by the Fear & Greed Index, which is now at 24. For those of us who have been around a few market cycles, this isn't necessarily a cause for panic, but rather a reminder that markets don't only go up. Significant volume still flows through the ecosystem, with Bitcoin's daily volume at $39.8 billion and Ethereum's at $22.3 billion, suggesting sustained interest even with price pullbacks.

The overall sentiment remains cautious, with a clear move away from riskier plays as capital seeks more stable ground, or at least a temporary reprieve from recent froth.

Notable Outliers

While major assets cooled, a few projects stood out, painting a clearer picture of where current market interest might lie. Monero (XMR) saw a 24-hour gain of +0.897%, notably outperforming the broader market, even as its 7-day performance was down over 27%. This whipsaw action highlights the persistent, albeit volatile, interest in privacy-focused assets.

On the other side of the spectrum, Canton (CC) exhibited a 24-hour gain of +0.478% and a respectable +13.61% over the week, suggesting a quiet accumulation or specific project developments driving its independent trajectory. Conversely, fast-moving assets like Sui (SUI) and Hyperliquid (HYPE) experienced 7-day declines of -16.04% and -14.63% respectively, demonstrating that high-growth narratives can unwind quickly when market sentiment turns sour.

These outliers reveal a market navigating between deep-value plays, privacy coins responding to external narratives, and the inevitable correction in previously hot, speculative sectors.

Sector Spotlight

This week's data gently nudges us towards a spotlight on stable assets and their role in a contracting market.

Looking at ICONOMI's top performers, the leading strategy, Pecun.io Cryptocurrency (PCC), delivered a modest but positive 7-day return of +1.65 %.

The interesting piece? Its top holdings are 53.9% PAXG (a gold-backed stablecoin), 37.8% USDC, and only 8.3% BTC. Similarly, Ethereal (BIF) holds a full 100% in PAXG, albeit with a marginal negative return. Even FENERATOR Crypto Strategy (FENERATORCRYPTO), which holds BTC and ETH, has a significant 29.5% allocation to PAXG.

This tells a clear story: in times of "Extreme Fear" and broader market contraction, capital is actively seeking refuge in asset-backed stablecoins. Whether it's to weather the current downturn or to position for future opportunities, the demand for stability, even within the crypto ecosystem, is palpable.

This behaviour mirrors traditional finance's flight to quality, but reimagined in a digital context.

The Contrarian Take

Everyone's focused on the dip and the "Extreme Fear" indicator, and rightfully so. But what if this isn't merely a pause, but a necessary digestion period for the institutions that have recently entered the space?

The influx of traditional finance has been significant, yet these large players often operate with a longer horizon and stricter risk parameters. The current pullback could be them doing what they do best: re-evaluating positions, hedging, and reallocating capital to minimise downside. While retail narratives often get caught up in daily price action, the quiet movements of institutional capital are about building robust, long-term portfolios.

Many are calling for a further crash, but perhaps this is just the market recalibrating its foundations for the next leg up, shaking out the weak hands and setting more sustainable entry points for those with deeper pockets and longer timelines.

The ICONOMI Angle

The look at ICONOMI's top-performing strategies this week truly underscores the current market sentiment.

The leading strategy, Pecun.io Cryptocurrency (PCC), and the second, Ethereal (BIF), owe their relative resilience (or positive performance) to heavy allocations in PAXG and USDC.

With PCC showing a 7-day return of +1.65 % and Ethereal at -1.92% (largely stable given it's 100% PAXG), it’s evident that capital preservation strategies are winning right now.

Even FENERATOR Crypto Strategy, despite a -4.79% return, maintains a significant 29.5% in PAXG. This behaviour on the platform isn't just about market avoidance; it highlights a sophisticated user base actively mirroring traditional "flight to quality" tactics within the digital asset ecosystem. It's a pragmatic response to uncertainty, showing that even in crypto, diversification and a measured approach to risk can yield more favourable comparative outcomes. This tendency confirms our belief that smart capital, regardless of the 'asset class', always seeks to manage downside.

The Week Ahead

January 26th: Major Central Bank Speeches – Continued hawkish rhetoric could further dampen risk appetite across all markets.

February 1st: Key DeFi Protocol Upgrade – Announcements of significant technical upgrades can often spark short-term rallies or FUD, depending on community reception.

February 5th: Regulatory Panel Discussion on Digital Assets – Any shift in regulatory tone, particularly in major economies, could significantly impact market sentiment.

February 8th: Quarterly Earnings for a Major Crypto-Native Company – Bellwether for overall health and growth within the digital asset sector.

What to Watch Next

Institutional Flows vs. Retail Hysteria: Observe how much new capital enters or exits the space, particularly from traditional financial institutions, rather than short-term retail reactions.

The Continued Role of Stable Assets: Will PAXG and USDC maintain their appeal as safe havens, or will fresh capital gravitate toward more volatile but high-potential altcoins?

VIX and Gold's Trajectory: A sustained rise in the VIX or continued strength in gold could signal a deeper risk-off sentiment that crypto markets will invariably follow.

Yield Compression in DeFi: As capital becomes more cautious, how will this impact lending and borrowing rates within decentralised finance?

FAQs

Why are stablecoins and gold-backed tokens (PAXG) performing relatively well when the broader crypto market is down?

In periods of market uncertainty and "Extreme Fear," investors tend to move their capital into less volatile assets to preserve value. Stablecoins like USDC provide stability relative to the dollar, while PAXG offers exposure to the traditional safe-haven asset, gold, within the crypto ecosystem. This strategy is a "flight to quality", which is common in all financial markets.

What does the rising VIX in traditional markets mean for crypto?

The VIX, or "fear index," measures expected volatility in the stock market. A rising VIX indicates increased investor anxiety. Historically, when traditional markets become more volatile or fearful, investors often pull back from riskier assets, including cryptocurrencies. This can lead to decreased liquidity and downward price pressure in digital asset markets.

Both Bitcoin and Ethereum saw significant declines this week. Is this a healthy correction or a sign of a larger downturn?

While no one can predict the future, a pullback after a strong upward trend is often considered a healthy market correction, especially amidst broader market caution. The "Extreme Fear" sentiment suggests many might be overreacting, potentially setting the stage for future opportunities for those looking to accumulate at lower prices, though further downside is always a possibility.