Crypto Market Wrap: 9th June 2023

There have been several high-impact news stories impacting both the cryptocurrency market and equity market over the past couple of weeks.

In this blog post, we will break down some of the key events:

- US Regulators At War with Crypto (Binance and Coinbase)

- Crypto Innovation Outside of the US

- The Next FED Interest Rate Decision

- Bitcoin Technical Analysis

- Top 5 Performing Cryptocurrency Strategies on ICONOMI over the past month.

US Regulators At War With Crypto

Just this week, the SEC made two announcements indicating legal action against both Coinbase and Binance. When a lawsuit was first announced against Binance, BTC quickly dropped into the 25,500k support level. However, as soon as Coinbase was the target of a second lawsuit, BTC instantly recovered those losses. It's interesting to note that the market seems to believe that these cases will ultimately result in market regulation.

However, Binance only just this morning warned its customers to remove their US dollars before June 13th, announcing the suspension of USD withdrawals and trading. Along with all USD withdrawals, all USD-paired trading will be stopped. However, they will function as a complete cryptocurrency exchange, enabling trading between cryptocurrencies as well as withdrawals. This may impact the cryptocurrency market due to decreased liquidity as Binance will soon be cutting ties with banking institutions in America.

The US cryptocurrency market continues to be choked, but Binance and Coinbase both seem prepared to take on the lawsuits, which are currently civil in nature.

What is equally important to recognise is that these two exchanges continue to enjoy investor confidence, which is demonstrated by the inflows and outflows of capital. Contrast this with the regional banking crisis, which caused every investor to rush for the door. Bank runs happen because, as a result of the fractional reserve banking system, banks frequently lack the liquidity needed to cover withdrawals. For instance, Binance has total frozen reserves of more than $59 billion, despite the fact that we have seen withdrawals of almost $2 billion this month.

Since the total locked value was trading at about $54.4 billion at the beginning of the year, Binance is still up year to date. Binance has stated they hold 1:1 reserves for all customer assets.

Investors have not yet abandoned the ship.

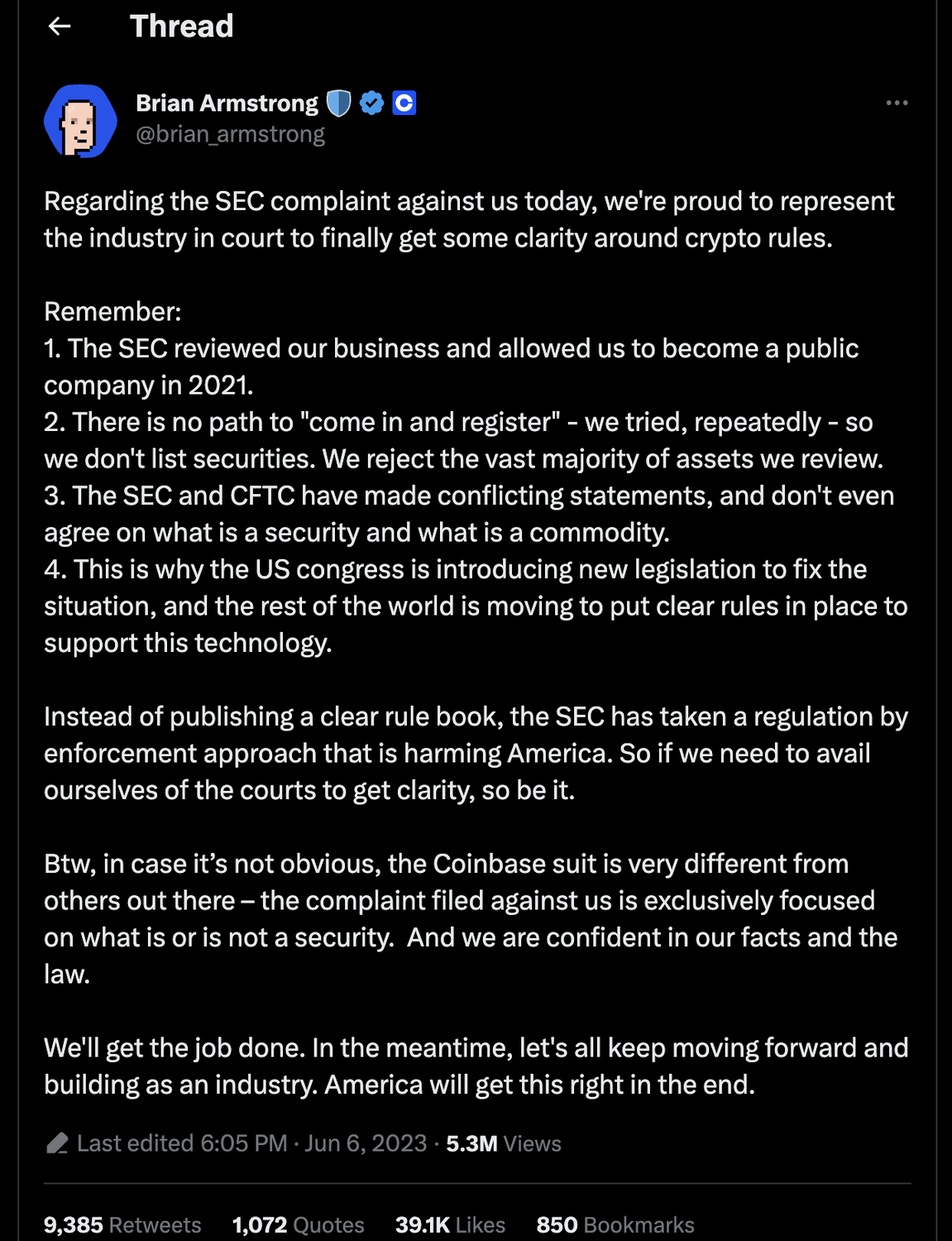

Brian Armstrong, the CEO of Coinbase, likewise exudes confidence in their capacity to defeat the lawsuit, which he claims is unlike the others out there, implying that the allegations in the two lawsuits are different.

Whilst this continuous back and forth between US regulators and US-based cryptocurrency exchanges escalates, the noise creates FUD and negative market sentiment. When this occurs, it's important to not make any immediate investing decisions. It's time to zoom out on the charts and take a look at on-chain data.

Crypto Innovation Outside of the US

We must also understand that the Cryptocurrency market is not just the US. The US has been a major player in the Cryptocurrency market, but other countries and locations are beginning to thrive.

- The largest financial institution in Japan, MUFG, has announced plans to launch stablecoins on various blockchains as a result of the regulatory environment around stablecoins in Japan.

- With the debut of First Digital Group's USD stablecoin, FDUSD, in Hong Kong, the market for regulated stablecoins is expanding throughout Asia. This token complies with the new legal framework for crypto assets in the area.

- A white paper on "Internet 3.0" by China has been released, outlining the country's desire to be a global leader in web3 and blockchain development.

- Deutsche Telekom, the largest telcom in Europe by sales, has joined Polygon as a validator, demonstrating the company's confidence in blockchain as a complement to current telecom services.

Although we use the US market as an indicator of how the global financial markets will perform, the cryptocurrency market is bigger than the US and will rotate into areas of innovation. A similar scenario occurred when China banned cryptocurrency mining in 2021.

FED Interest Rates & Liquidity

Although the US debt ceiling has been raised, eliminating the short-term threat of a US default, there are question marks around the direction of the Federal Reserve. FED policy directly impacts risk assets, and although the cryptocurrency market is thought of as being decentralized, BTC acts as a risk-on asset. The cryptocurrency market is also at the mercy of FED policy. This month, tech stocks from Meta, Tesla, Google, Apple and Nvidia, have all surged higher due to expectations of lower interest rates as we move into the later stages of 2023 and into 2024. There has been a clear rotation into high-growth tech stocks, which have a similar correlation to BTC.

Interest Rates in the United States are expected to be 5.25 per cent by the end of this quarter, according to Trading Economics global macro models and analysts' expectations. In the long term, the United States Fed Funds Rate is projected to trend around 3.75 per cent in 2024 and 3.25 per cent in 2025. The market is clearly expecting the FED to begin cutting interest rates by year-end. Economists polled by Reuters expect the FED to hold interest rates next week but suggest there is a possibility of another rate hike later in the year.

The direction of FED policy will be dictated by a combination of inflationary data, unemployment data, economic conditions (more bank failures) and pressure leading into the 2024 presidential campaign. If the economic conditions of the US economy deteriorate over the coming months, it will put pressure on the FED to hold and potentially pivot.

Technical Analysis Deep Dive:

BTC Weekly Chart:

If we eliminate all of the noise and FUD in the market, and take a look at the price action, we can see a very similar structure to the previous accumulation phases in 2015 and 2020. BTC has tagged its first major resistance level at 30,000. Profit-taking and selling pressure at this level is expected from a technical perspective. Therefore, it is no surprise that negative market sentiment is coming into the market. BTC has reclaimed the 200-day moving average and is being compressed beneath the negative trend line resistance. Despite the largest cryptocurrency exchange under attack, BTC and the overall market is holding up well so far.

BTC Halving Cycle:

A quick recap on the BTC halving cycles. The rising channel formation or structure is still being used for Bitcoin trading. BTC reached its first significant milestone at 30,000 USD, up roughly 100% from its December 2022 lows, after marking the channel's lower barrier of roughly 15,500 USD. And given that the next BTC price halving will occur in only a year, history suggests a fresh bull cycle has already started. BTC halvings are detailed by the vertical red lines. BTC typically reaches its bottom 400 days before a price halving, therefore the bottom should have occurred in Q1 2023. In a very loud market, zooming out and grasping market cycles will bring clarity.

Is the bottom in for BITCOIN?

The technical trends indicate a bottom is in for BTC, however, as an investor we must be aware of the major risks the market is currently facing. Next week's FED interest rate decision and policy statement will cause short-term volatility, as well as the ongoing chokehold on the US cryptocurrency market.

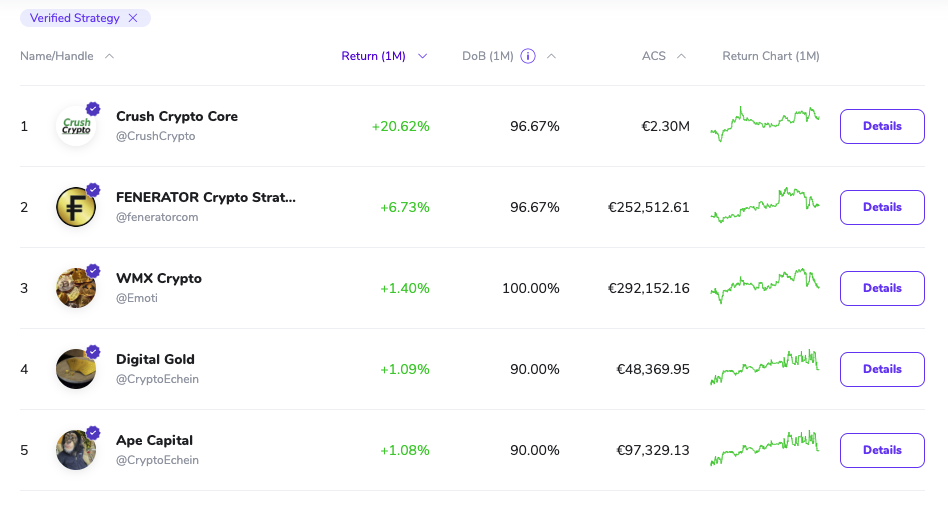

Top 5 Performing Cryptocurrency Strategies on ICONOMI over the past month.

Crush Crypto Core has excelled over the past month generating its investors with over a 20% gain. Assets copying this strategy have increased north of 2 million Euros.

The top 5 performing monthly Strategists have all returned their investors with positive gains in a very difficult and choppy market.

Want to learn more about the cryptocurrency market?

📞 Book a crypto consultation: https://lnkd.in/gzJXuXMJ

💻 Learn more about ICONOMI cryptocurrency solutions: https://lnkd.in/ggfXuEVM