Crypto Weekly Wrap: 15th March 2024

Latest News and Developments in the Crypto Market

In a recent report by blockchain intelligence firm Chainalysis, it was revealed that global crypto gains surged to $37.6 billion in 2023, marking a significant recovery from the losses experienced in 2022. The United States led in total crypto gains, with $9.36 billion, followed by the United Kingdom, Vietnam, and China. Despite the positive trend, the gains in 2023 fell short of 2021's total, attributed to investors holding onto their assets with the expectation of further price increases. The report also highlighted the growing adoption of cryptocurrencies in lower-income and middle-income countries, with several nations achieving outsized gains, signalling the potential for broader adoption globally.

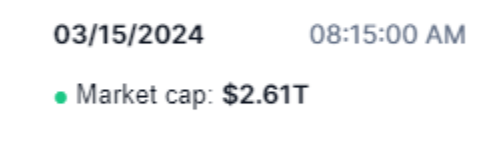

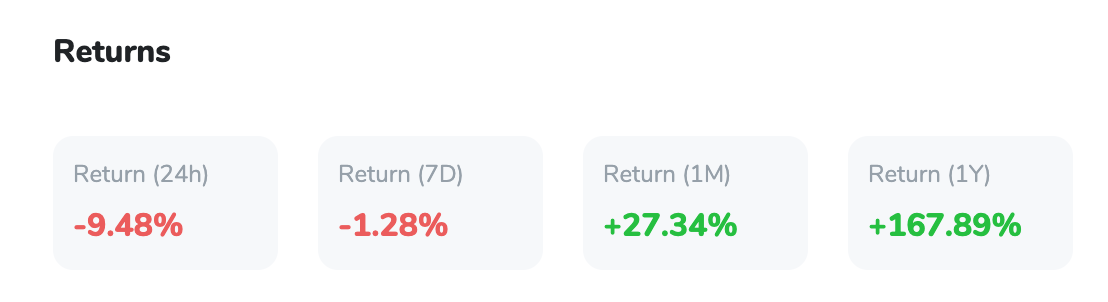

Crypto Market Cap in the Last Month

Source: Coinmarketcap

Source: Coinmarketcap

Institutional Interest and Regulatory Challenges for Bitcoin

Institutional interest in Bitcoin has been steadily increasing, particularly with the recent approval of several US spot Bitcoin exchange-traded funds (ETFs). However, regulatory challenges continue to pose obstacles to future adoption. Concerns over security, compliance, and regulatory clarity are paramount for institutional investors. Recent proposals, such as the implementation of wash sale rules for digital assets in the US, could impact trading strategies and increase compliance burdens. Despite these challenges, endorsements from prominent figures like Blackrock CEO Larry Fink and increasing regulatory clarity in regions outside the US are driving continued institutional interest in Bitcoin.

SEC Orders First Trust-SkyBridge to Declare Bitcoin ETF Application Abandoned

The Securities and Exchange Commission (SEC) has ordered First Trust Advisors and SkyBridge Capital to mark their Bitcoin ETF application as abandoned. Despite initially filing for a Bitcoin ETF in March 2021, the application was unsuccessful, and the firms did not reapply following the approval of other Bitcoin ETFs. This development underscores the regulatory challenges facing Bitcoin ETFs in the US and highlights the importance of compliance and regulatory clarity for institutional adoption.

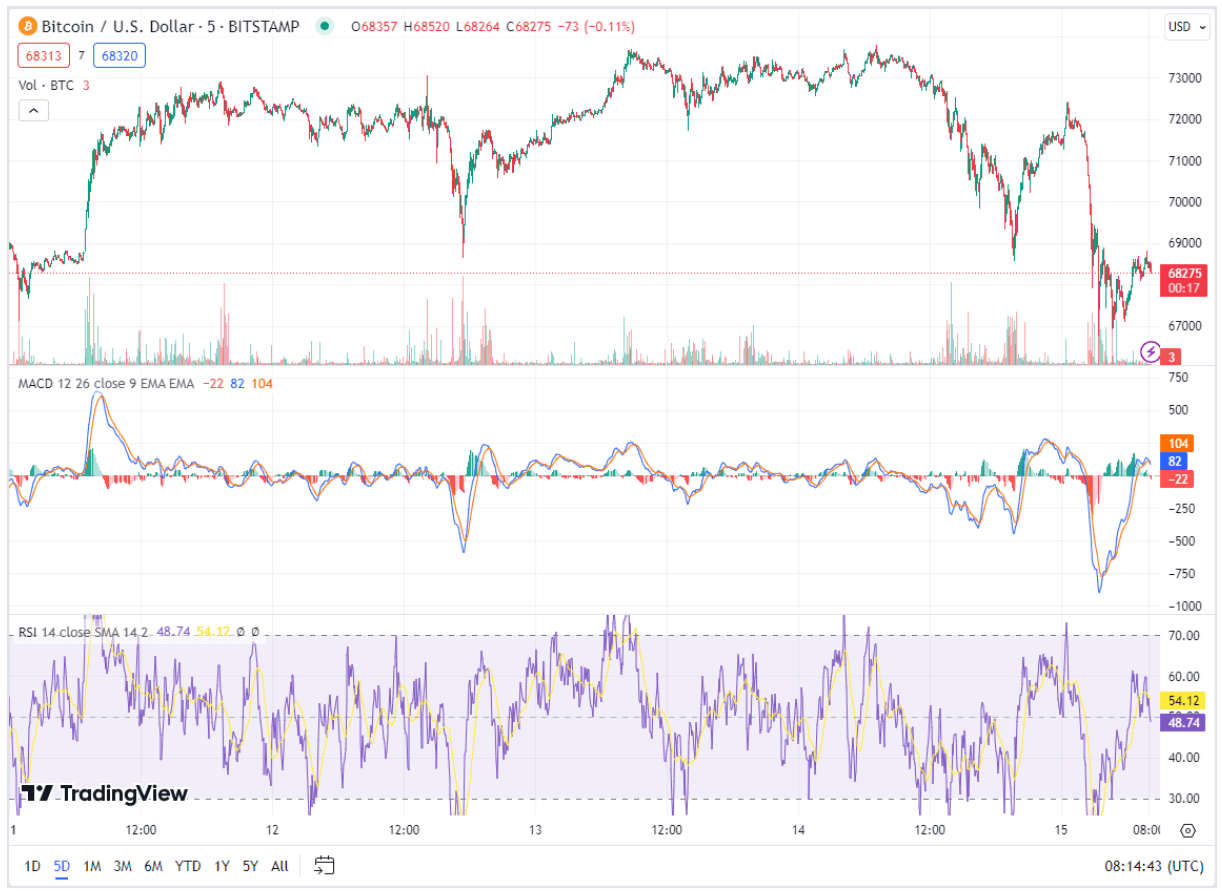

Bitcoin's Price Prediction and Technical Analysis

Bitcoin's recent uptick to $73,400 has ignited discussions about its future trajectory, despite the sharp drop in the last 24 hours. The surge in price has instilled a sense of bullish sentiment among traders and investors, who are closely monitoring key technical indicators for potential signals.

Technical analysis suggests that Bitcoin is currently experiencing consolidation within an uptrend, indicating a period of price stability following the recent rally. The pivot point, marked at $70,587, serves as a crucial reference for assessing short-term price movements.

Source: TradingView

Immediate resistance levels are identified at $74,842, with subsequent barrier at $77,450. These levels represent critical thresholds that bulls must overcome to sustain the upward momentum. On the flip side, immediate support is observed just below at $68,540, with additional safety net at $67,630, where buyers may intervene to prevent further downside.

The Relative Strength Index (RSI) hovering around 54, indicating a slightly overbought market condition. However, the presence of the 50-day Exponential Moving Average (EMA) at $69,540 suggests a continued bullish trend, reinforcing the positive outlook for Bitcoin's price trajectory.

Overall, the technical stance for Bitcoin remains cautiously optimistic, with traders closely monitoring key support and resistance levels for potential breakout opportunities. While the recent surge in price has fuelled bullish sentiment, maintaining momentum above key resistance levels will be essential for sustaining upward momentum in the near term.

Layer 2 Blockchains and Ethereum's Dencun Upgrade

Ethereum's recent Dencun upgrade aims to reduce transaction costs on layer 2 solutions, such as Optimism and Arbitrum, by introducing "blobs" for data storage. This upgrade has led to a significant decrease in transaction fees on layer 2 networks, making transactions more affordable for users. However, concerns about security, fragmentation of the Ethereum ecosystem, and reliance on third-party networks remain. While the upgrade represents a step towards scalability, developers warn of potential risks and challenges associated with increased adoption of layer 2 solutions.