Crypto Happenings in early September

Crypto Happenings in early September

MetaMask Scams Targeting Government Websites:

One of the most concerning developments was the discovery of MetaMask scams infiltrating government-owned websites across multiple countries, including India, Nigeria, Egypt, Colombia, Brazil, and Vietnam. Scammers took advantage of these official platforms to deceive unsuspecting visitors. By redirecting users to fake MetaMask websites closely resembling the legitimate one, they aimed to trick individuals into connecting their MetaMask wallets, thereby gaining access to their crypto holdings. This alarming trend highlights the growing sophistication of crypto scammers and serves as a stark reminder of the need for heightened security measures when engaging in the crypto space.

Genesis Global Capital's Lawsuits Against DCG:

Genesis Global Capital, a subsidiary of Digital Currency Group (DCG), initiated two lawsuits against DCG and DCG International (DCGI). These lawsuits sought the repayment of loans totalling a substantial $600 million. Genesis had earlier declared bankruptcy following a significant reduction in its workforce. The legal action underscores the complexities and challenges faced by crypto-related companies, especially when dealing with substantial financial obligations. Traders and investors should closely monitor the outcomes of these lawsuits, as they could have implications for the broader crypto industry.

Ether ETF Filings by ARK 21Share and VanEck:

In the United States, ARK 21Share and VanEck filed for the first-ever Ethereum (ETH) spot Exchange-Traded Funds (ETFs). These ETFs are designed to track the performance of Ethereum by holding the cryptocurrency directly, potentially opening up new investment avenues for traders. The SEC's decision on these ETF applications will be eagerly awaited, as it could have a significant impact on the broader adoption of cryptocurrencies, particularly Ethereum. Traders should keep an eye on these developments, as they may lead to increased market activity and potential price movements in the world's second-largest cryptocurrency.

IMF and FSB Joint Policy Paper on Cryptocurrencies:

The International Monetary Fund (IMF) and the Financial Stability Board (FSB) published a joint policy paper addressing cryptocurrencies. This paper cautioned against implementing blanket bans on cryptocurrencies, instead advocating for targeted restrictions and sound monetary policies. The document highlighted concerns about the potential volatility of global stablecoins and emphasised the importance of comprehensive regulatory oversight. For traders and investors, this paper signifies growing international interest in regulating cryptocurrencies, which can have profound implications for the market's stability and future growth.

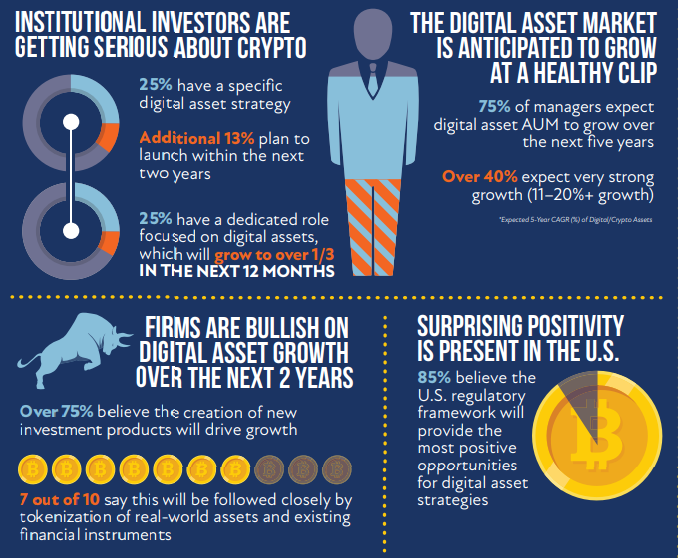

Digital Assets Under Management (AUM) Research Summary:

The research report conducted by Amberdata in partnership with Coalition Greenwich, offers valuable insights into the institutional adoption of digital assets. Notably, it revealed that nearly half (48%) of surveyed asset managers and hedge funds are actively managing digital assets. Moreover, 25% of these firms have a specific digital asset strategy, with an additional 13% planning to launch one in the near future. This data highlights a growing institutional commitment to the digital asset class, underlining its potential for continued growth. As these institutions increasingly enter the crypto market, traders and investors can expect greater liquidity and potentially more stable market conditions.