The ICONOMI April Crypto Wrap

The ICONOMI April Crypto Wrap

Key Points To Cover:

- BITCOIN stalls at the 30k resistance

- BITCOIN dominance grows 6%

- The US Banking Crisis Continues

- Coinbase, SEC and Regulation

Bitcoin Update:

Bitcoin has stalled at the 30k USD resistance level after achieving a 100% return from the 15,500 lows back in November 2022.

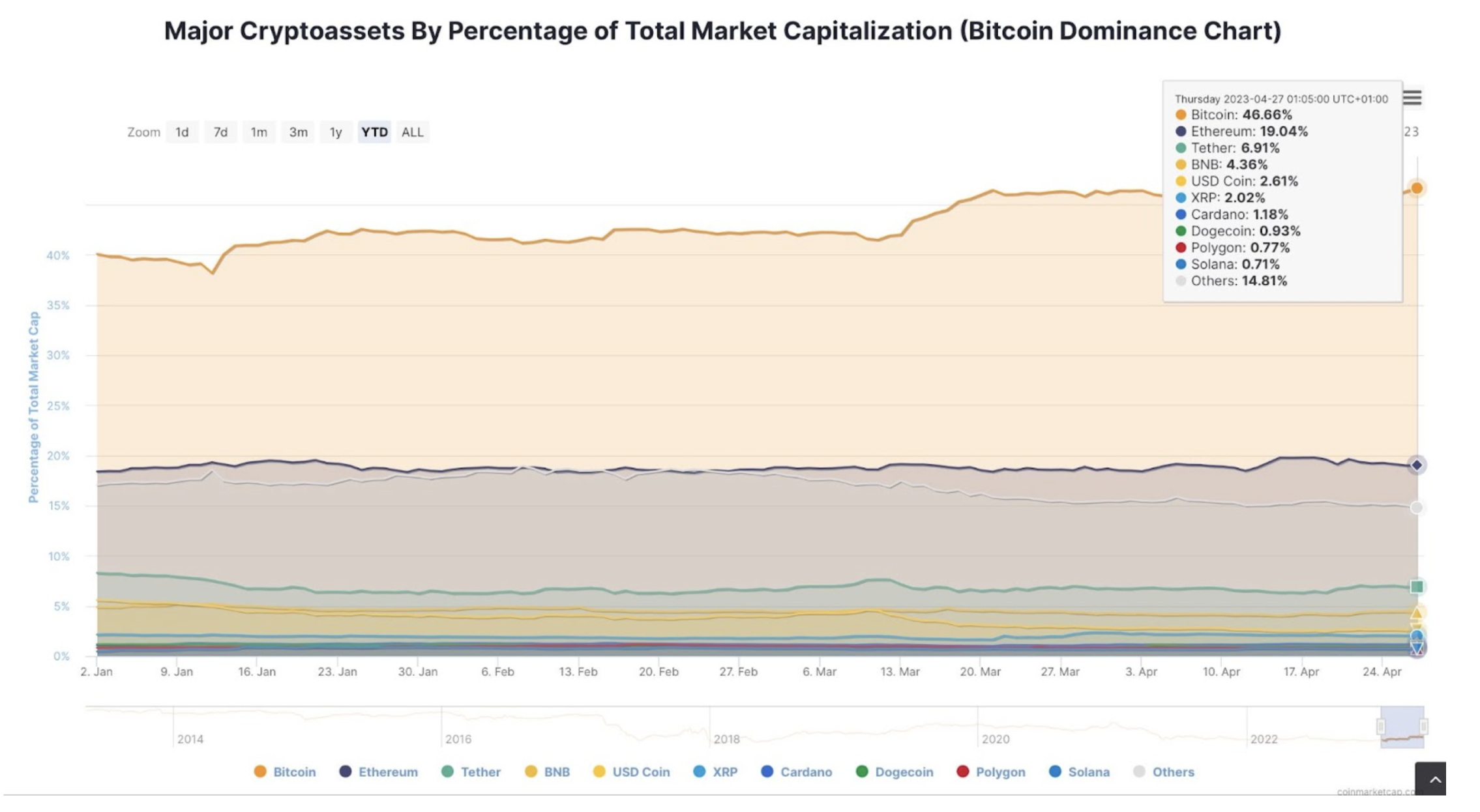

Bitcoin's dominance increased to 46% of the total cryptocurrency market share, up from roughly 40% at the start of the year. Bitcoin dominance indicates when investors rotate into and out of the largest cryptocurrency. During the early stages of a cryptocurrency bull market, Bitcoin becomes a front-runner as confidence in the overall market is still relatively low. Once the market sentiment has shifted from negative/ bearish, to a more positive sentiment, ALT coins will begin to thrive.

Currently, Bitcoin dominance is still rising whilst other coins remain relatively flat, indicating ALT coin season is yet to begin. Due to liquidity flowing into Bitcoin, the largest cryptocurrency should continue to lead the direction of the overall market. The sentiment is still on the bearish side due to regulatory concerns and the current banking crisis, however, investor inflows into the cryptocurrency market are positive.

Whilst the US banking crisis is supporting a higher Bitcoin price. It is raising alarm bells from an economic standpoint.

The Banking Crisis Continues:

4 major banks have fallen so far in 2023, and a 5th is on the chopping block.

- Silvergate Bank

- Silicon Valley Bank

- Signature Banks

- Credit Suisse

First Republic Bank (FRC) stock crashed by another 40% yesterday - trading on the stock has been halted. FRC shares are down over 95% from their record highs.

Is this bank the next domino to fall in the financial markets?

Long lines formed in front of one of First Republic's branches the day after Silicon Valley Bank failed in March, and the company has been under pressure from deposit withdrawals since. As investors fled the market in Q1, the FRC recorded $100 billion in banking deposit withdrawals.

According to individuals with firsthand knowledge of the situation, government officials are holding back to give time for a private sector solution to emerge, and the big banks are reluctant to face either short-term losses on asset purchases or the long-term pain of dealing with First Republic's problems.

Will the FED come to the rescue and backstop another bank?

While everyone waits to see if the FED will start printing money once again, BITCOIN and the cryptocurrency market stand to gain significantly. Bitcoin is being used as a hedge against the FIAT system and against inflation, which has been caused in part by central banks around the world printing endless amounts of FIAT currency.

Another central bank intervention will only highlight the importance of Bitcoin and cryptocurrency in the financial markets.

Coinbase, SEC and Regulation:

The SEC sent a Wells notice to Coinbase in March, formally warning that the exchange might face enforcement action. On Monday, Coinbase filed a lawsuit against the SEC, requesting that a federal judge order the regulator to provide a response to Coinbase's July 2022 petition regarding whether current securities rule-making procedures might be applied to the cryptocurrency business. Coinbase's petition received no specific public response from the SEC, although it has recently aggressively increased enforcement proceedings and warnings against cryptocurrency exchanges, including Coinbase.

At the same time, US-based cryptocurrency companies appear to be planning for a continued crackdown from US regulators. Coinbase has secured an offshore license, furthermore, Gemini is in plans to set up a new cryptocurrency derivative trading platform outside of the US. Due to the lack of clarity around US regulation, companies are being pushed offshore which will be detrimental to the security of US citizens.

The EU has taken a step in the right direction with the announcement of MiCA, setting a clear framework for cryptocurrency companies to follow. Hong Kong’s Securities Futures Commission (SFC) announced that it is releasing crypto license guidelines in May to better clarify its digital currency sphere. However, the UK and the US are severely lagging behind and the market is growing impatient.

LEARN MORE

Do you or your business want to learn how to diversify into the cryptocurrency market?

- Book a crypto consultation: https://lnkd.in/gzJXuXMJ

- Learn more about ICONOMI Business Solutions: https://lnkd.in/ggfXuEVM