Crypto Weekly Wrap: 12th January 2024

Gary Gensler's Cautionary Stance Despite SEC's Approval of Spot Bitcoin ETFs

Gary Gensler, the Chair of the Securities and Exchange Commission (SEC), remains cautious about the crypto market, despite the recent approval of spot Bitcoin exchange-traded funds (ETFs) by the SEC. In a statement on the SEC's website, Gensler clarified that the approval does not imply an endorsement of Bitcoin or a shift in the SEC's broader views on crypto assets.

Coinbase to Custody Newly Approved Spot Bitcoin ETFs

Coinbase has announced its role as the custodian for eight of the recently approved spot Bitcoin exchange-traded funds (ETFs) following the SEC's monumental decision. The SEC's approval of a total of 11 spot Bitcoin ETFs is seen as a "watershed moment" for the growth of the crypto market, according to a blog post by Coinbase. The move is expected to enhance crypto adoption and attract institutional investors.

Robinhood's Swift Listing of Spot Bitcoin ETFs

Robinhood CEO Vlad Tenev has announced the platform's swift listing of the newly approved spot Bitcoin exchange-traded funds (ETFs). As a pioneer in offering spot crypto trading, Robinhood views the SEC's decision as a significant development and plans to list the ETFs "as soon as possible." This move signifies the integration of cryptocurrencies into traditional finance and offers new opportunities for investors.

Goldman Sachs' Perspective on Bitcoin ETF Approval

Goldman Sachs acknowledges the potential benefits for institutional investors resulting from the approval of spot Bitcoin ETFs. The report highlights improved investor protection, increased liquidity, and lower tracking error compared to other investment options. While recognizing the positive aspects, Goldman also cautions about potential drawbacks, emphasising the importance of considering long-term sustainable demand and product suitability.

SEC's Approval and Market Impact on Bitcoin's Price

Bitcoin's price has surged above $46,000 following the SEC's approval of 11 spot Bitcoin exchange-traded funds. The approval is considered a major boost for the crypto industry, attracting both institutional and retail investors. The SEC's decision is also attributed to Grayscale's efforts and a favourable court ruling, reflecting the evolving regulatory landscape's impact on crypto prices.

Market Analysis

In the aftermath of the Securities and Exchange Commission's (SEC) approval of spot Bitcoin exchange-traded funds (ETFs), both Bitcoin (BTC) and Ethereum (ETH) have experienced notable developments in their market trends.

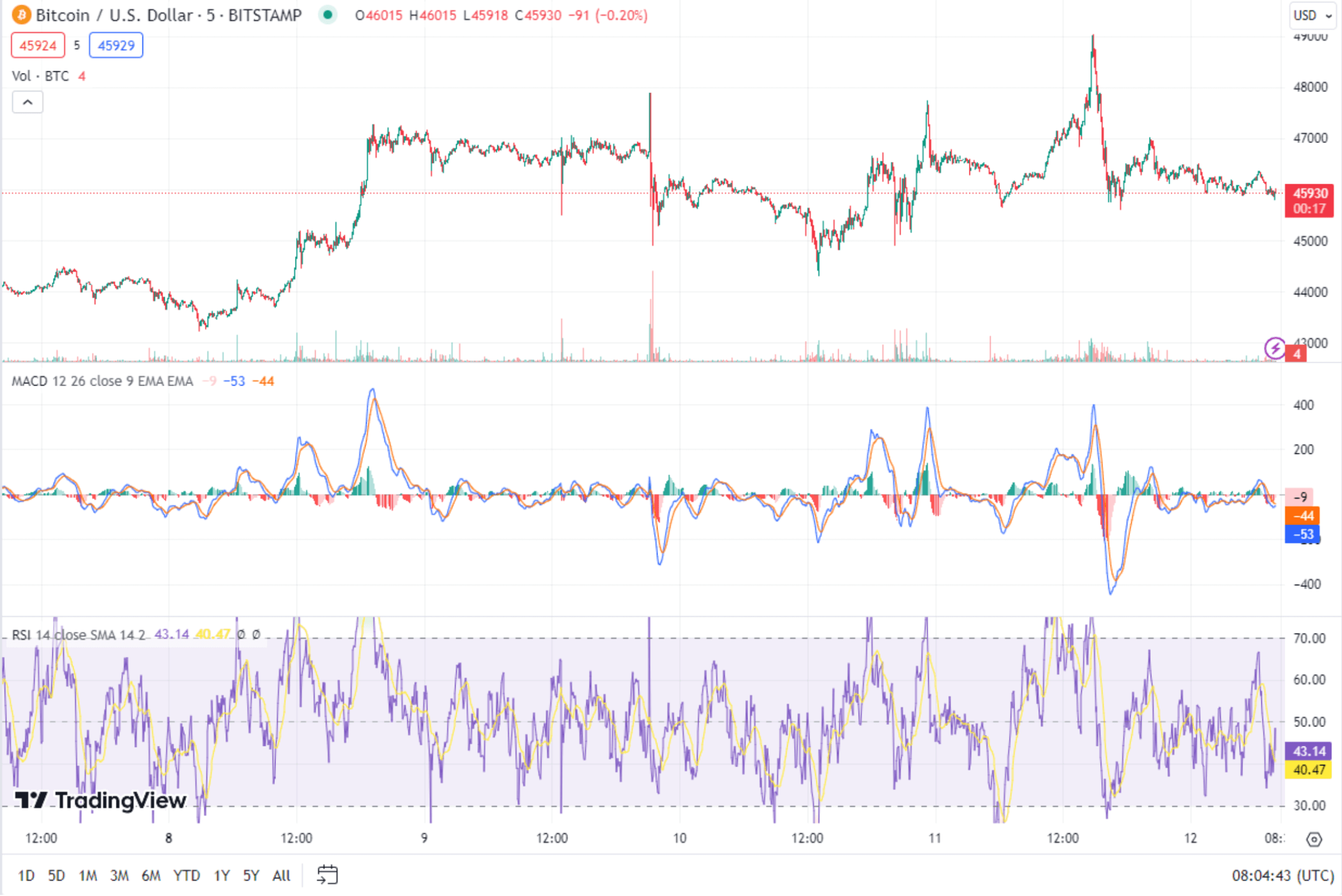

Bitcoin (BTC) Analysis:

Bitcoin's price surged above $49,000, reflecting the positive market sentiment following the SEC's approval of 11 spot Bitcoin ETFs, afterwards correcting to the current level of $45,764. The chart indicates a bullish trend, with BTC trading within an upward channel. The pivot point, acting as a support and resistance level, stands at $46,790. Immediate resistance levels are identified at $47,740 and $48,580, while support levels lie at $45,030 and $44,010.

The relative strength index (RSI) is at 43, indicating a balanced market. The RSI remains below 70, signalling no overbought conditions. The 50-day exponential moving average (EMA) supports the short-term bullish trend. A potential bearish reversal, indicated by a double top pattern at $47,750, is pending confirmation if BTC breaks below the neckline at $44,500.

The overall trend for Bitcoin remains bullish, trading above the pivot point and the 50 EMA within the upward channel. Short-term forecasts anticipate a test of resistance at $47,740, with a potential break above if market sentiment remains positive. However, a drop below support at $45,030 could trigger a bearish reversal, heading towards the neckline at $44,500.

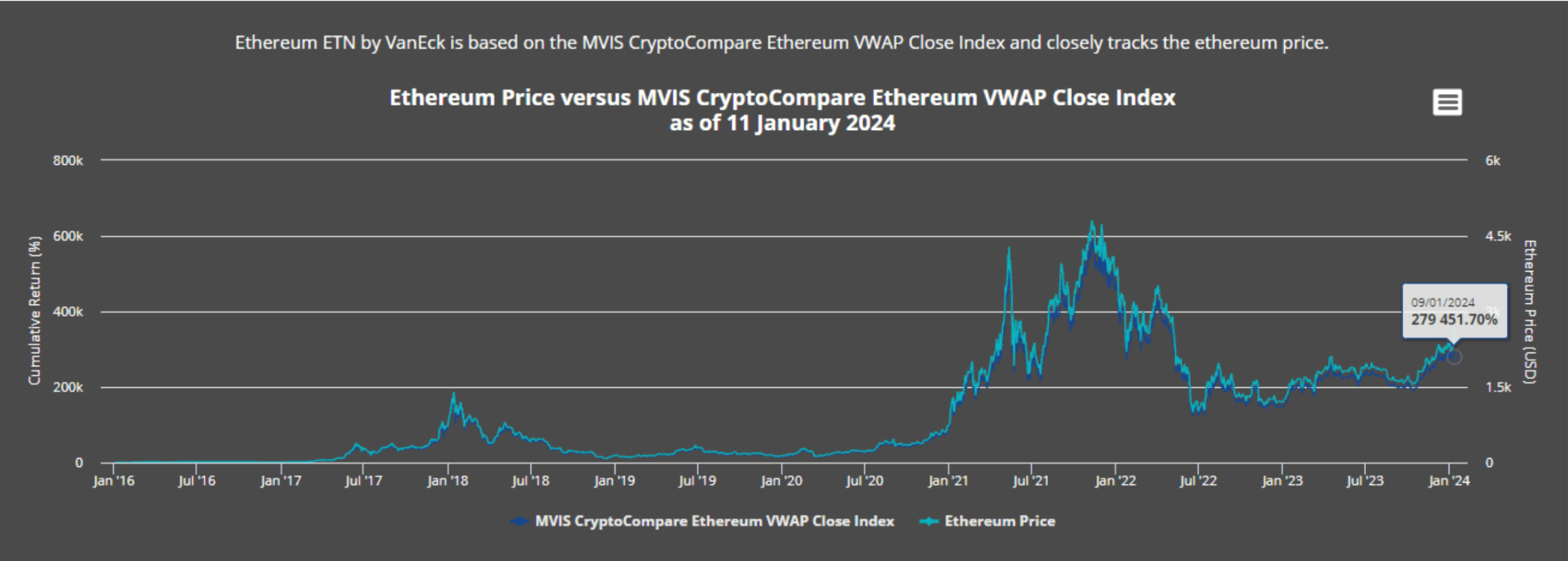

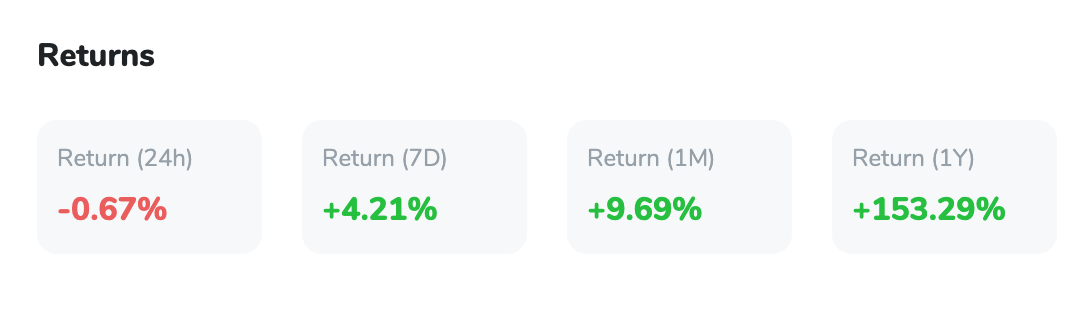

Ethereum's Bullish Momentum

Following the Securities and Exchange Commission's (SEC) approval of spot-based Bitcoin ETFs, Ethereum (ETH) has experienced a remarkable 15% surge in the last 7 days, reaching $2,609. The altcoin's performance surpasses the market average.

ETH's upward trajectory is evident in its 16% gain over the past week and an impressive 85% increase in the last year. Analysts are now speculating that Ethereum could be the next cryptocurrency to have spot-based ETFs approved in the United States, adding to the positive outlook for the coin in 2024.

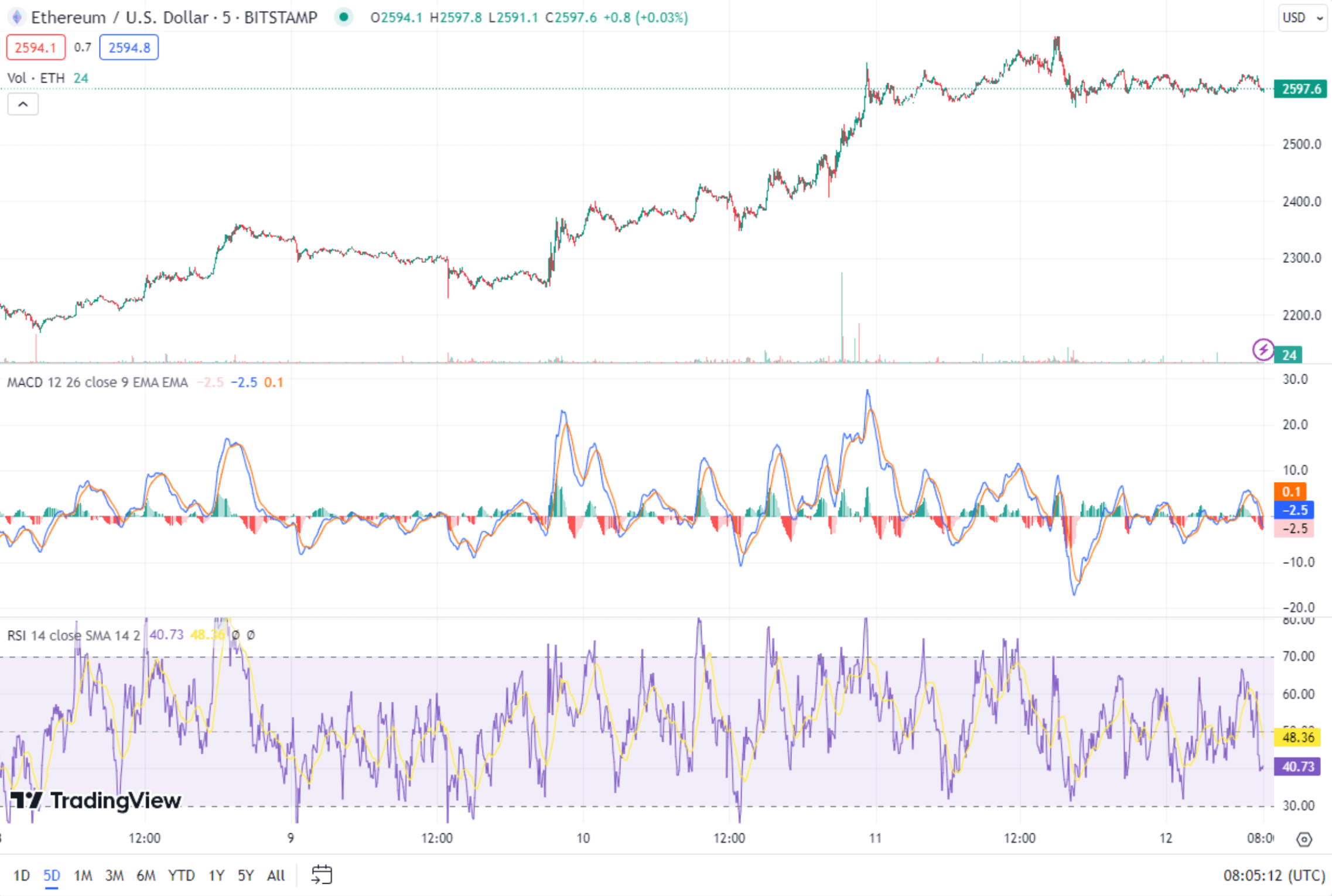

Technical Analysis:

Ethereum is currently in the midst of a breakout, with its price surpassing the 30-day average and showing signs of breaking the current resistance level. The relative strength index (RSI) has crossed 70, and settled down at 40, indicating a balanced market.

The 30-day moving average is rising steeply beyond the 200-day average, a clear signal of significant buying pressure. Ethereum's trading volume, standing at approximately $53 billion, further reinforces the notion that the coin has entered a bullish phase.

Whale Accumulation:

Data suggests that after recent Bitcoin (BTC) acquisitions, whales have shifted their focus to Ethereum, engaging in aggressive accumulation. Analysts highlight May 23 as the final deadline for the proposed VanEck Ethereum-based ETF, indicating a potential catalyst for ETH's continued upward trajectory.