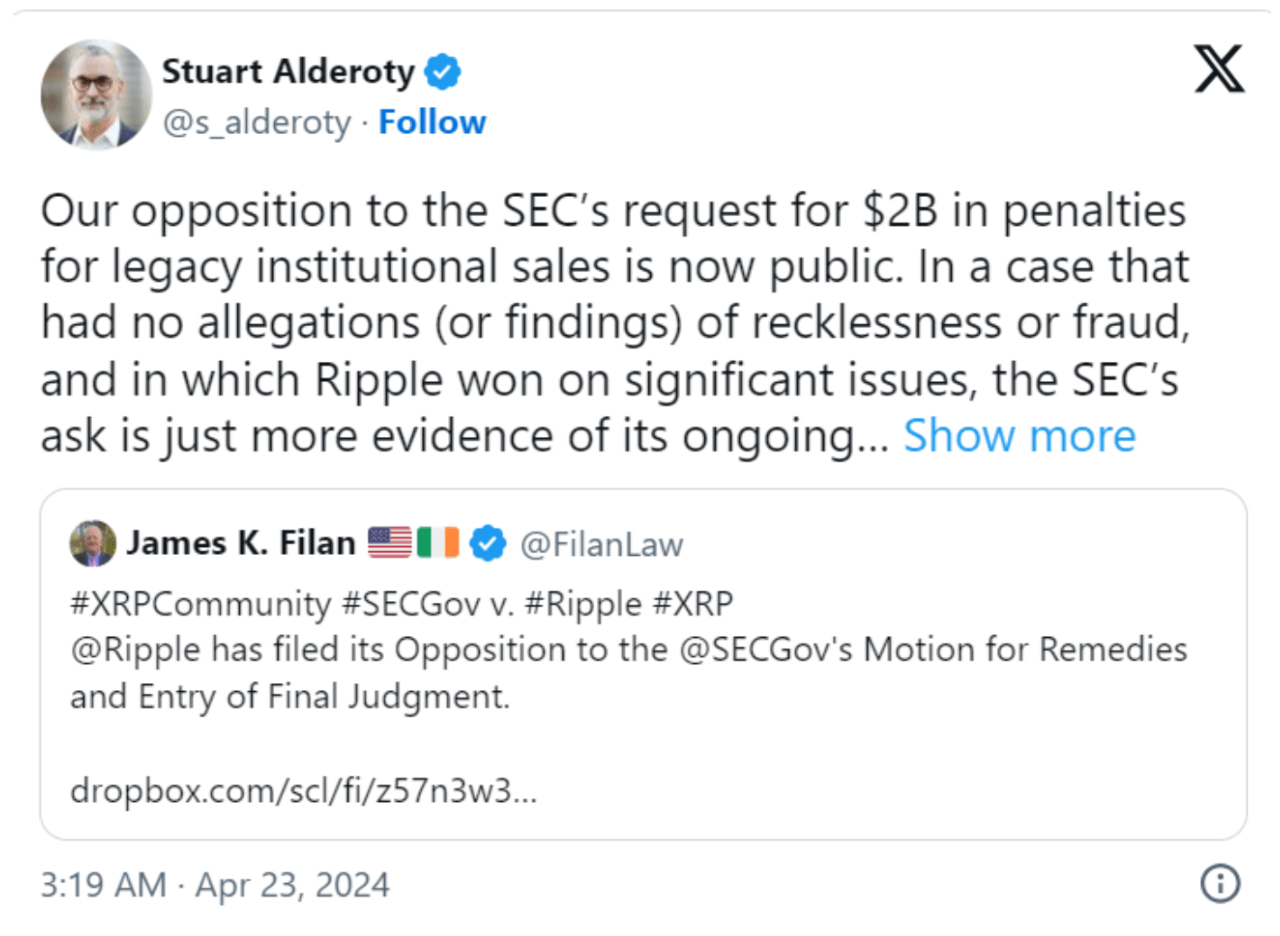

Latest News: Ripple Challenges SEC’s $2 Billion Penalty Demand

Ripple, the blockchain company behind XRP, has contested the Securities and Exchange Commission's (SEC) request for a hefty $2 billion penalty. In a recent filing, Ripple argued that the proposed fine is excessively punitive and disproportionate to the alleged violations. Instead, Ripple proposed a much lower penalty of $10 million, emphasising that this amount is more in line with the nature of the alleged violations and the company's actual conduct. The court is currently reviewing Ripple's opposition and the SEC's proposals, with the final decision on penalties to be made by Judge Analisa Torres. Despite the ongoing legal battle, Ripple remains confident in the fairness of the judicial process.

SEC Lawsuit Impact on XRP Market

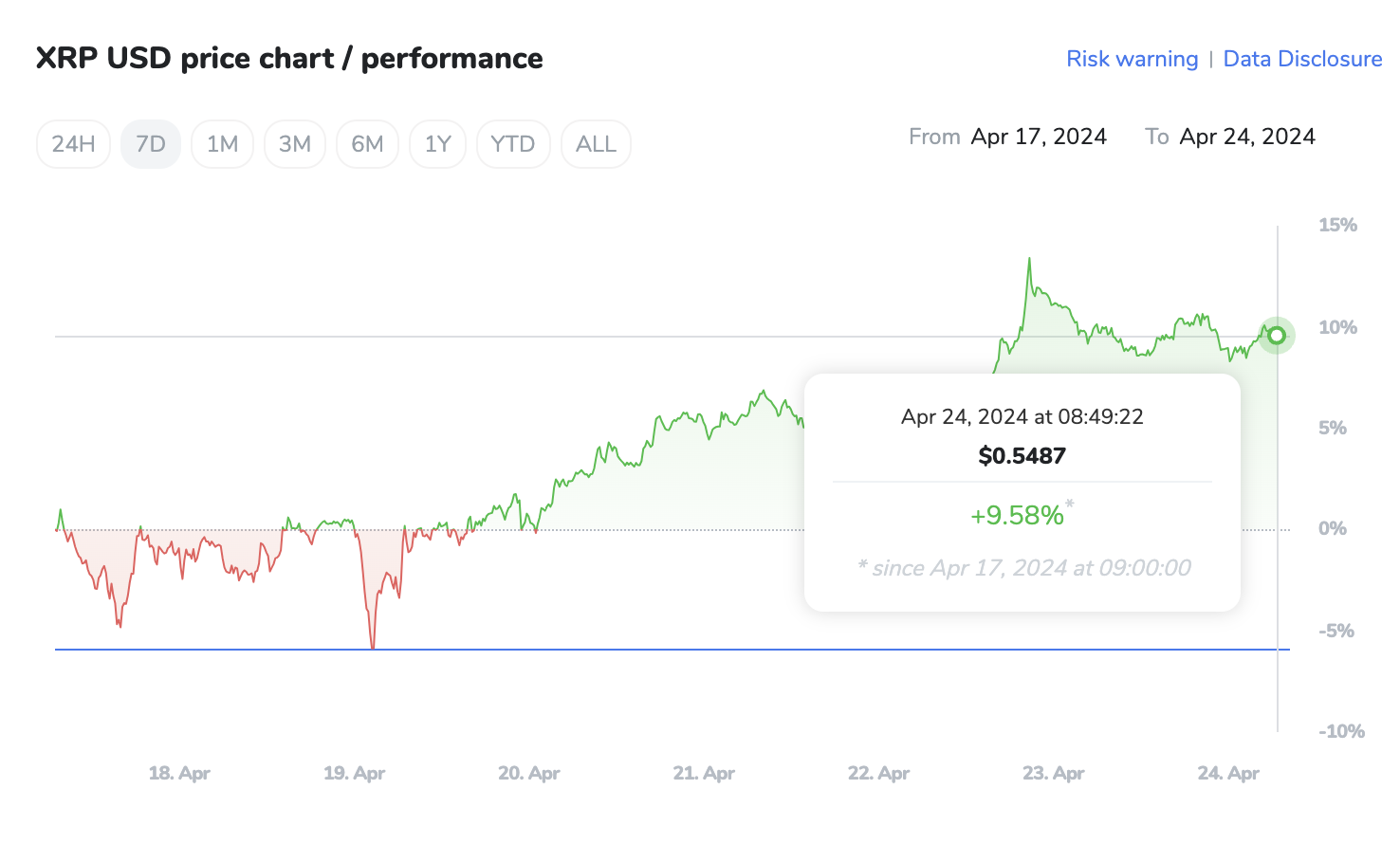

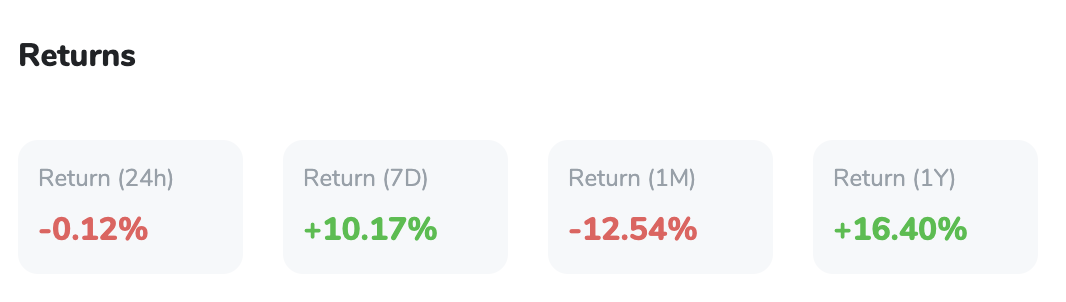

The ongoing lawsuit between Ripple and the SEC has significant implications for the XRP market. Speculations surrounding the outcome of the legal battle have led to increased volatility in XRP's price and heightened market activity. The SEC's request for substantial penalties has intensified scrutiny of Ripple's legal strategy and potential outcomes. Investors and observers closely monitor legal developments as they directly influence market sentiment and XRP's price trajectory.

Price History: XRP's Price Amid Legal Proceedings

Amid the legal proceedings, XRP's price has experienced fluctuations. Market sentiment fluctuates in response to key events, such as court filings and hearings. Despite uncertainties surrounding the lawsuit, XRP has demonstrated resilience, with its price exhibiting both upward and downward movements. Investors closely track price changes, seeking insights into market dynamics and potential future trends.

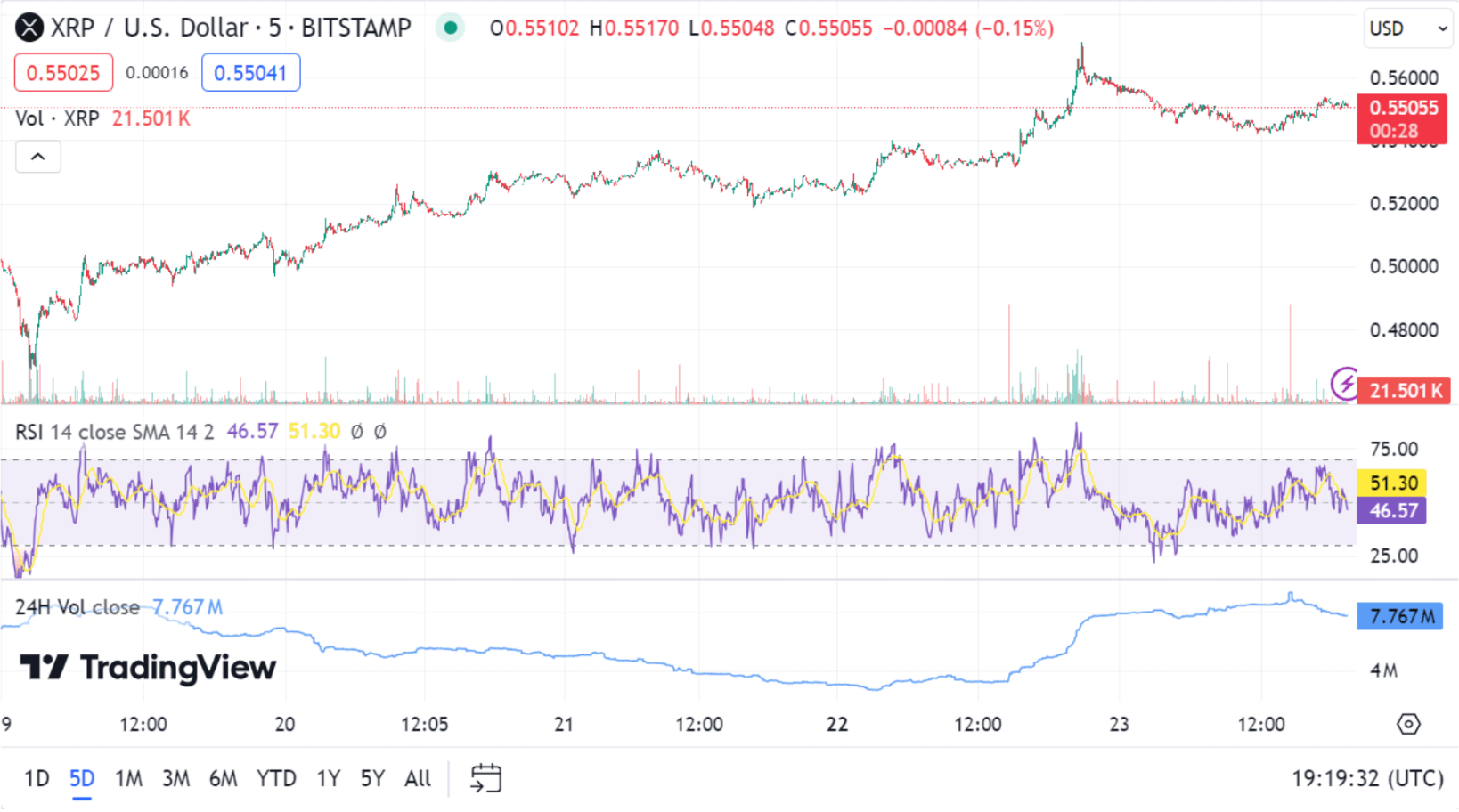

Technical Analysis: Evaluating XRP's Price Surge and Trading Volume Dynamics

XRP's recent price surge of 30% to reclaim the $0.55 territory has sparked interest among traders, but accompanying trends in trading volume warrant a closer examination. Despite the significant price recovery, XRP's trading volume has declined by $930 million over the past 10 days, indicating a potential lack of conviction among market participants.

Traditionally, falling trading volume during a period of rising prices suggests a hesitancy among traders to commit to large volume positions. This divergence between price action and trading volume raises concerns about the sustainability of the upward trend. If this trend persists, it could signal a potential bearish reversal as bullish momentum may not be strong enough to sustain the current price levels.

Moreover, the Bollinger Band indicator further reinforces this cautious stance. While XRP managed to reclaim the $0.55 territory, the presence of a looming sell-wall at the $0.56 level suggests potential resistance ahead. Additionally, the lower trading volume compared to previous instances of XRP falling below $0.55 indicates potential challenges for maintaining upward momentum and reclaiming this territory.

However, in the event of a major downtrend, the lower-limit Bollinger band points to a key support level at $0.45. This level is significant as it represents a substantial buy-wall, indicating strong potential support against further downside movement.

XRP Potential

Despite regulatory uncertainties, analysts remain optimistic about XRP's future price performance. The resolution of the legal dispute with the SEC could serve as a catalyst for renewed investor confidence and propel XRP's price higher. However, market participants should remain vigilant and closely monitor legal developments, as they will likely continue to influence XRP's price trajectory in the coming days and weeks.