Crypto Weekly Wrap: 1st December 2023

BlackRock's Revised Bitcoin ETF Model: A Strategic Compromise with the SEC

BlackRock, a global asset manager, recently engaged in discussions with the Securities and Exchange Commission (SEC) regarding its application to launch a Bitcoin spot ETF in the United States. In response to SEC concerns, BlackRock has adjusted its ETF blueprint to find common ground on the Bitcoin redemption model.

The initial "in-kind" redemption model faced resistance due to the requirement for U.S. registered broker-dealers to directly interact with Bitcoin, posing balance sheet risks. The revised model retains in-kind redemptions but introduces an additional intermediary step, showcasing BlackRock's commitment to addressing regulatory concerns while preserving investor benefits.

Tokenized Funds Gain Approval in the UK: A Paradigm Shift in Asset Trading

The UK's Financial Conduct Authority has granted approval for investment managers to develop tokenized funds, a move poised to revolutionise the asset management industry. Tokenization, or fractionalisation, allows fund assets to be divided into smaller tokens backed by blockchain technology.

This development enables assets to trade more efficiently and transparently, providing investors with access to a broader range of assets. Michelle Scrimgeour, CEO of Legal & General Investment Management, emphasises the potential for greater efficiency, liquidity, risk management, and the creation of more bespoke portfolios in the industry.

SEC's Ongoing Investigation into Binance US: Seeking Proof of Potential Fraud

The Securities and Exchange Commission (SEC) is intensifying its search for evidence of potential fraud at Binance US following charges against Binance and its former CEO, Changpeng Zhao. The ongoing lawsuit, initiated in June, alleges fraudulent activity that jeopardises client funds.

With the Department of Justice (DOJ) bringing charges against Binance, the SEC is seeking to strengthen its case. Similar to the scrutiny faced by FTX, the SEC is particularly interested in any indications that Binance US granted its former CEO a backdoor to control assets on the platform. The SEC's investigation is crucial in determining the platform's adherence to legal standards in operating cryptocurrency exchanges.

Grayscale Bitcoin Trust (GBTC) Adapts for the Future: Anticipating a Shift to a Spot Bitcoin ETF

Grayscale Bitcoin Trust (GBTC) is preparing for the future by implementing strategic changes to its agreement, a significant update since 2018. The adjustments are geared towards optimising GBTC's structure in anticipation of a transition to a spot Bitcoin ETF. Among the proposed modifications is a shift in fee payment frequency, with fees becoming payable on a daily basis.

This structural change aligns with Grayscale's commitment to reducing fees. The proactive approach taken by Grayscale underscores the dynamic nature of the cryptocurrency market, with key players like Grayscale positioning themselves to adapt to both regulatory shifts and emerging market trends.

Bloomberg Foresees Potential BTC ETF Approvals

Bloomberg analysts are expressing optimism about the prospect of Bitcoin ETFs, foreseeing potential regulatory approvals as early as January 2024. The Securities and Exchange Commission (SEC) has expedited its decision-making process, advancing timelines by 34 days, leading to heightened expectations for approvals around January 10, 2024.

According to experts in Bloomberg's ETF team, there is a strong likelihood, estimated at 90%, of approval for spot Bitcoin ETFs by this specified date. This accelerated regulatory pace is instilling positive sentiment in the Bitcoin market, contributing to the ongoing uptrend in valuation, with approvals potentially occurring between January 5 and 8.

Bitcoin's Surge Past $38K: Federal Reserve Policy Shift as the Driving Force

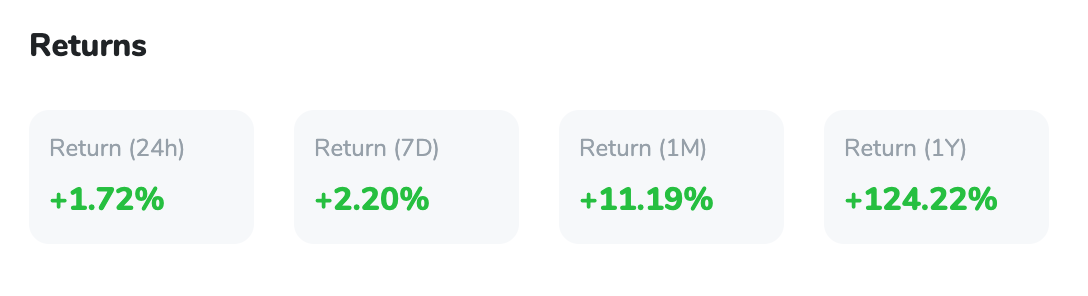

Bitcoin once again captures attention as its price surges to $38,248, marking a 2% increase over the last week. The rally is fueled by expectations of a Federal Reserve policy shift towards lowering interest rates amid subsiding inflation. Bitcoin's resurgence, with a remarkable 124% increase this year, reflects an upbeat market sentiment following challenging conditions in 2022. Fed Governor Christopher Waller's hints at potential rate cuts further contribute to the bullish outlook for Bitcoin, positioning it as a favoured asset in the current economic situation.

Bitcoin's technical landscape presents critical levels to watch, with the cryptocurrency trading around $38,000. Immediate resistance is observed at $38,680, with a potential target at $39,920 for bullish momentum. Support levels are firmly at $35,812, with an additional cushion at $34,420. Technical indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), suggest a tempered bullish sentiment, indicating a market leaning towards buying pressure. The short-term forecast anticipates a test of the $38,680 resistance, with market dynamics and sentiment likely driving the narrative in the coming days.