The SEC gives Bitcoin spot ETFs the green light. Will Ethereum be next?

Bitcoin Spot ETF Approval:

In an important step that cryptocurrency enthusiasts believe will bring more individual and institutional investors into the market, the US Securities and Exchange Commission has approved the first Bitcoin spot ETFs. Eleven proposals for Bitcoin spot ETFs, including those from BlackRock, Graysclae, Fidelity, and Ark, were authorised by the SEC, and trading could start this week.

In the upcoming months, billions of dollars are predicted to pour into the Bitcoin spot ETFs. Standard Chartered predicts inflows of $1 billion to occur in the first three months following the initial approval, and over $100 billion by the end of 2024. Another audacious prediction from Standard Chartered is that Bitcoin will reach $200,000 by the end of 2025.

However, upon the approval of the Bitcoin spot ETFs, Bitcoin's price remained relatively unchanged, with the initial response being "priced in". Interestingly, one of the top gainers out of the top 20 tokens by market cap during yesterday's approval process was Ethereum (ETH). ETH gained more than 11% from Wednesday's open, reaching highs of $2610, and is up more than 17% over the past 7 days.

Ethereum Picking Up Momentum:

Bitcoin's "rival" Ethereum, is picking up fresh momentum as investors bet that the SEC will approve an ETH spot ETF in the near future. Applications for Ether spot ETFs were submitted by several significant asset managers, including Invesco Galaxy, Fidelity, VanEck, ARK Invest & 21Shares, and BlackRock. Decisions on these applications must be made by the SEC by a number of deadlines, which vary from May 23rd to August 7th.

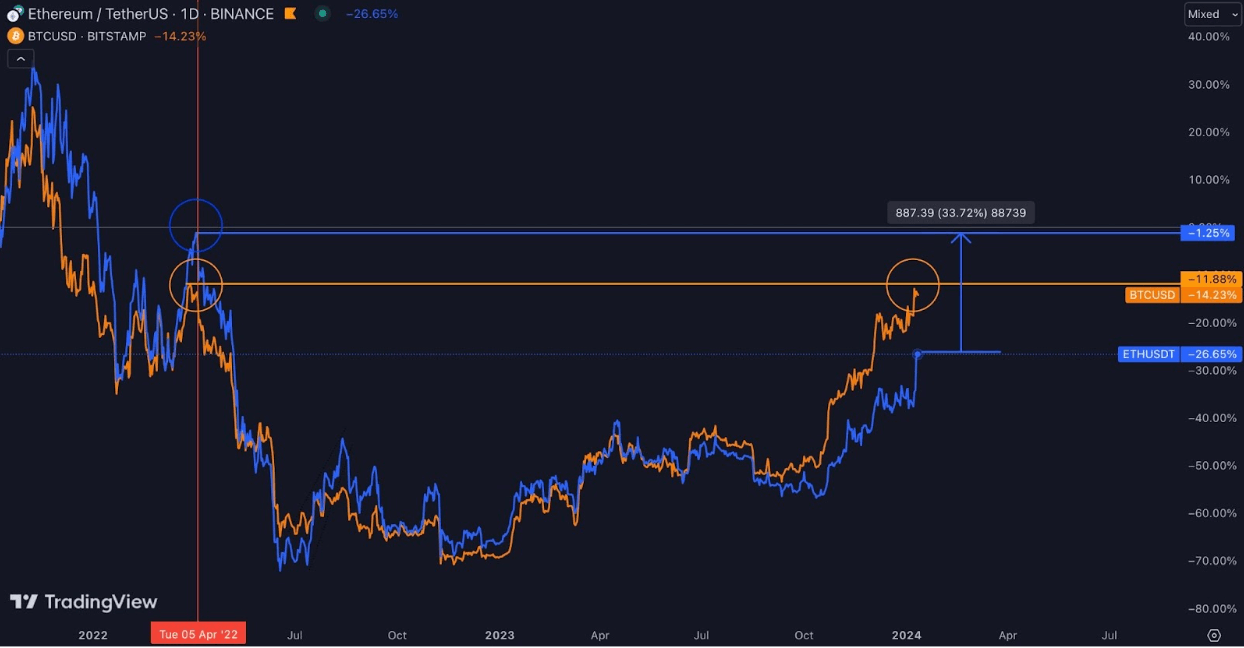

Ethereum has lagged behind Bitcoin in the early stage bull market, as investors piled into Bitcoin in an attempt to front-run the Bitcoin spot ETF approval. Bitcoin has now taken out its key resistance from April 2022, reaching highs of $47,700, up roughly 198%.

Bitcoin V Ethereum:

Ethereum, on the other hand, is trading at a 33% discount from the same major resistance zone. This comes as no surprise as institutional inflows into ETH have remained low throughout 2023.

However, with this week's encouraging Bitcoin spot ETF news behind us, the market may now shift its focus to Ethereum, which potentially has some catching up to do. As the anticipation/hype surrounding the ETH spot ETF deadlines builds, we may see a similar run into the peak seen in April 2022, at the $3550 resistance zone.

Do you want to learn more about the cryptocurrency market?

Book a consultation with a crypto specialist: