The Ripple (XRP) Phenomenon: Latest News and Technical Analysis

Latest News: XRP Price Surge Amid Whale Activity and Capital Rotation

Ripple (XRP) has experienced a notable surge in price recently, attributed to several significant factors in the crypto market. One of the key drivers behind this surge is the activity of large-scale XRP holders, commonly referred to as "whales." These whales have been observed making substantial transfers of XRP tokens from exchanges to personal wallets, indicating a preference for holding rather than trading. Additionally, there has been a notable capital rotation from Bitcoin markets into altcoins like XRP, driven by traders seeking higher profit potential and diversification. These movements suggest growing confidence and interest in XRP among investors, contributing to its recent price rally.

Source: X

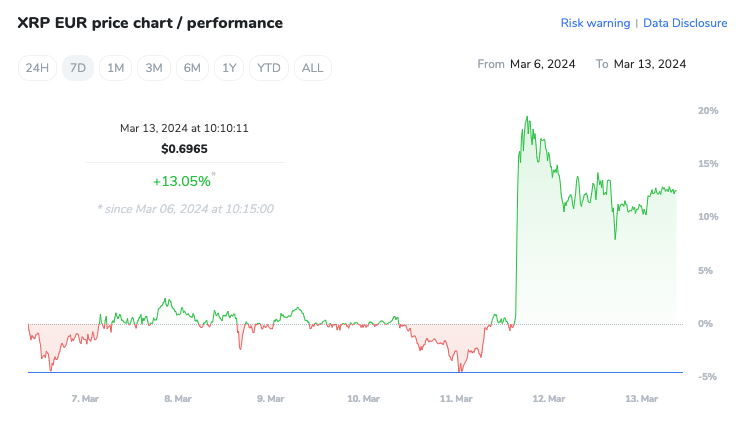

Price Analysis

From a technical analysis perspective, XRP's recent price gains have been supported by a confluence of key levels, including an ascending trendline, the 50-day exponential moving average (EMA), and Fibonacci retracement lines. These support levels have historically acted as strong foundations for price movements, with previous instances resulting in significant rallies.

Ripple (XRP) exhibits a promising technical outlook, with recent analysis pointing towards a bullish resumption of its uptrend. The breakout above the $0.68-$0.70 resistance zone signifies a significant milestone, suggesting a potential upside of around 30% towards the $0.92 level. This bullish momentum is further supported by the confirmation of an uptrend through the breakout from a Channel Down pattern and the breach of the 200-day moving average. The current trend indicates an uptrend in the short and medium term, while the long-term outlook remains neutral. Momentum indicators such as the MACD and RSI signal bullish sentiment, with the MACD Line above the MACD Signal Line and the RSI above 55. Key support levels are identified at $0.55 and $0.45, while resistance lies at the recently surpassed $0.68-$0.70 zone followed by $0.92. Traders are advised to set a price alert and consider a stop-loss level at $0.64 to manage risk effectively amidst this bullish setup.

Source: TradingView

Market Analysis: XRP's Position in the Crypto Landscape

While major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have been rallying consistently, XRP has lagged behind. However, recent developments indicate a potential reversal of this trend. Technical analysis reveals that XRP has consolidated its price above key support levels against both USDT and Bitcoin, signalling resilience and a possible transition into a new bullish phase. Notably, XRP has been retesting the 200-day moving average multiple times, with the market showing signs of rebounding from these levels. Furthermore, against Bitcoin, XRP has reached a critical support level, which could potentially lead to a bullish reversal in the coming months. These insights suggest that despite its previous underperformance, XRP may be poised for a resurgence in the cryptocurrency market.

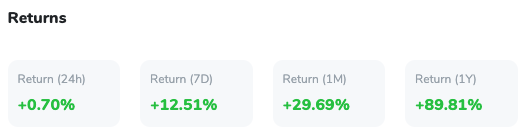

Evaluating XRP's Trajectory

Amidst a 17% rally in XRP's price over the past week, Ripple CEO Brad Garlinghouse emphasised the potential for creating value in XRP during an interview with Bloomberg Live. Despite a correction from its year-to-date peak of $0.7440, XRP maintained support above $0.6886, showcasing resilience ahead of the looming deadline in the SEC v. Ripple lawsuit. Garlinghouse's comments come as the crypto community speculates on XRP's future, with discussions revolving around its comparison to Bitcoin and the ongoing regulatory scrutiny faced by Ripple. Additionally, technical analysis indicates a positive outlook for XRP's price trajectory, supported by favourable indicators suggesting upward momentum. As XRP holders await developments in the lawsuit and regulatory landscape, market sentiment remains cautiously optimistic about XRP's ability to navigate challenges and sustain its recent gains.