Crypto Weekly Wrap: 26th April 2024

The cryptocurrency market is abuzz with activity as investors navigate through a series of ups and downs. Amidst the volatility, various developments have emerged, shaping the trajectory of digital assets.

FTX to Auction Remaining SOL Tokens

FTX, a bankrupt cryptocurrency exchange, has opted to auction off its remaining Solana (SOL) tokens rather than pursue direct sales. This move signifies a departure from its previous fixed-price sales strategy. Notably, major crypto firms like Pantera Capital and Galaxy Trading have shown interest in FTX's SOL holdings. The auction, scheduled for April 24, holds significant implications for both FTX and the broader crypto community.

Bitcoin's Post-Halving Price Trends

Bitcoin experienced its fourth halving recently, prompting speculation about its price trajectory. Historically, halvings have been associated with bullish trends, yet BTC's current post-halving performance remains mixed. Despite reaching an all-time high of over $73,000 prior to the event, BTC's price has since fluctuated around the $66,000 mark. The market awaits further clues on whether BTC will sustain its upward momentum or experience a downward correction.

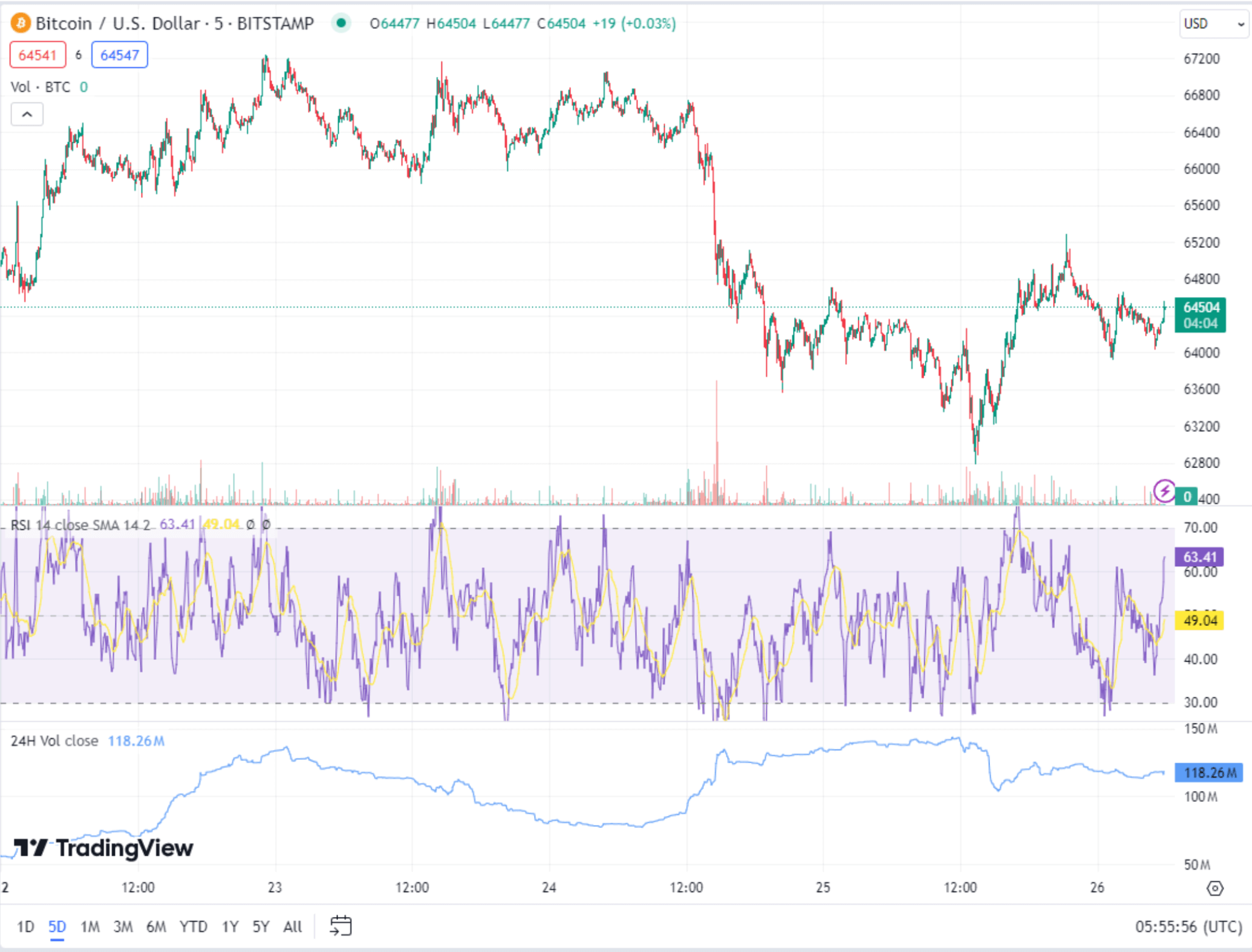

BTC Technical Analysis: Assessing Price Movements

Bitcoin's price performance post-halving has captivated the attention of investors and analysts alike, with technical analysis providing insights into its trajectory. Following its fourth halving event, BTC experienced notable fluctuations, shedding approximately 18% of its value from its peak of $73,000 to a low of $60,000. This correction marked a significant shift in market sentiment, prompting speculation about BTC's short-term outlook.

A closer examination of BTC's price action reveals key support and resistance levels that are instrumental in assessing its future movements. At present, BTC appears to be consolidating within a range of $60,000 to $70,000, with these levels serving as crucial pivot points for traders. The $60,000 support level represents a psychological barrier for investors, as breaches below this threshold could signal further downside potential.

On the upside, BTC faces resistance around the $70,000 mark, a level that has historically posed challenges for bulls. A breakout above this resistance could pave the way for a renewed bullish momentum, potentially leading to a retest of previous highs. However, failure to breach this level could result in prolonged consolidation or even further downside pressure.

Technical indicators offer additional insights into BTC's price dynamics. The Relative Strength Index (RSI), a momentum oscillator, currently hovers around neutral levels, indicating a balanced market sentiment. Meanwhile, moving averages such as the 50-day and 200-day moving averages provide clues about BTC's trend direction and potential areas of support or resistance.

SEC's Impact on Ethereum ETFs

The U.S. Securities and Exchange Commission (SEC) continues to cast a shadow over the cryptocurrency market, particularly concerning Ethereum ETFs. Regulatory uncertainties surrounding ETH's classification as a security and the approval of ETFs pose challenges for market participants. While the prospect of Ethereum ETFs offers new avenues for investment, delays in SEC approvals could dampen sentiment and hinder the growth of these assets.

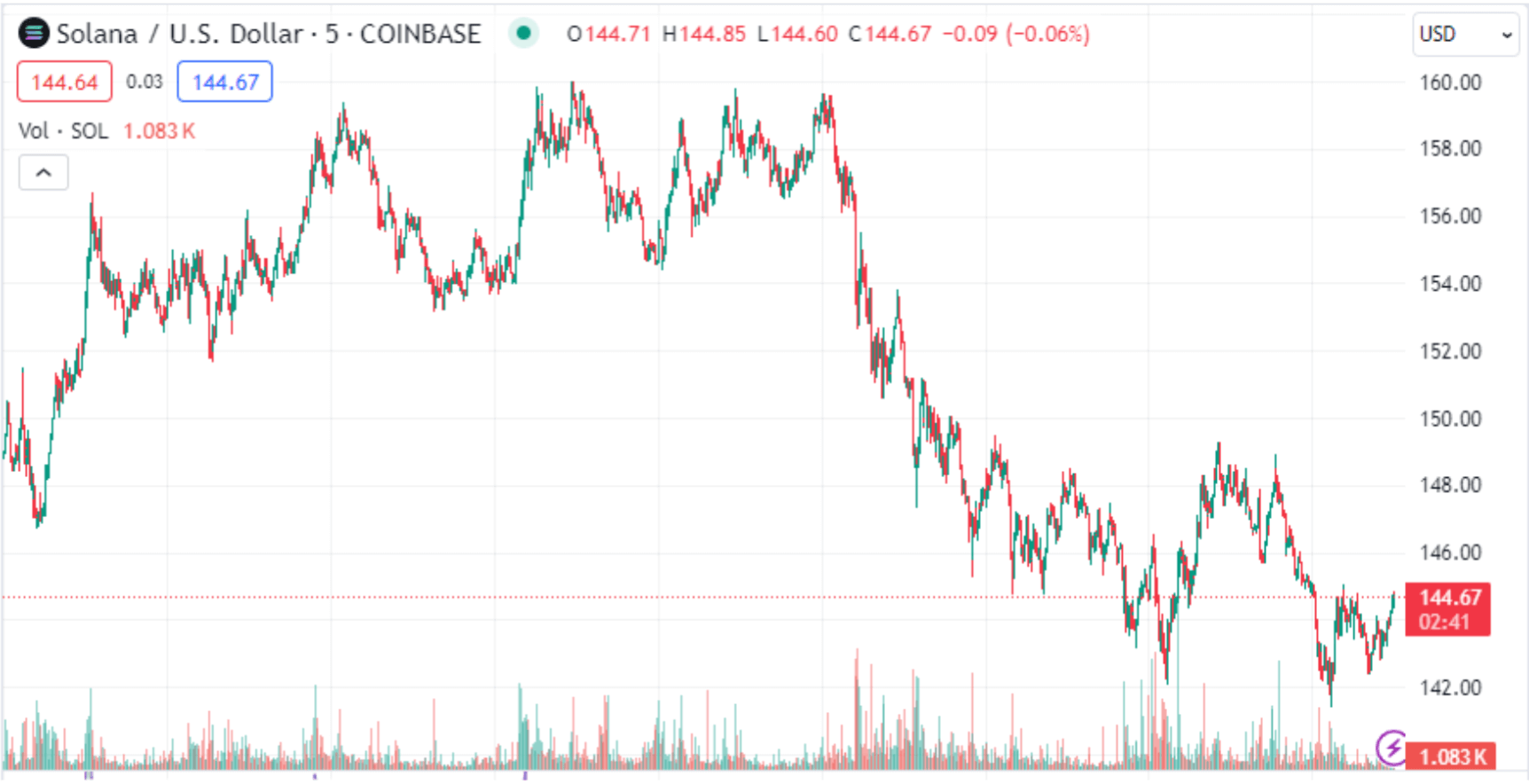

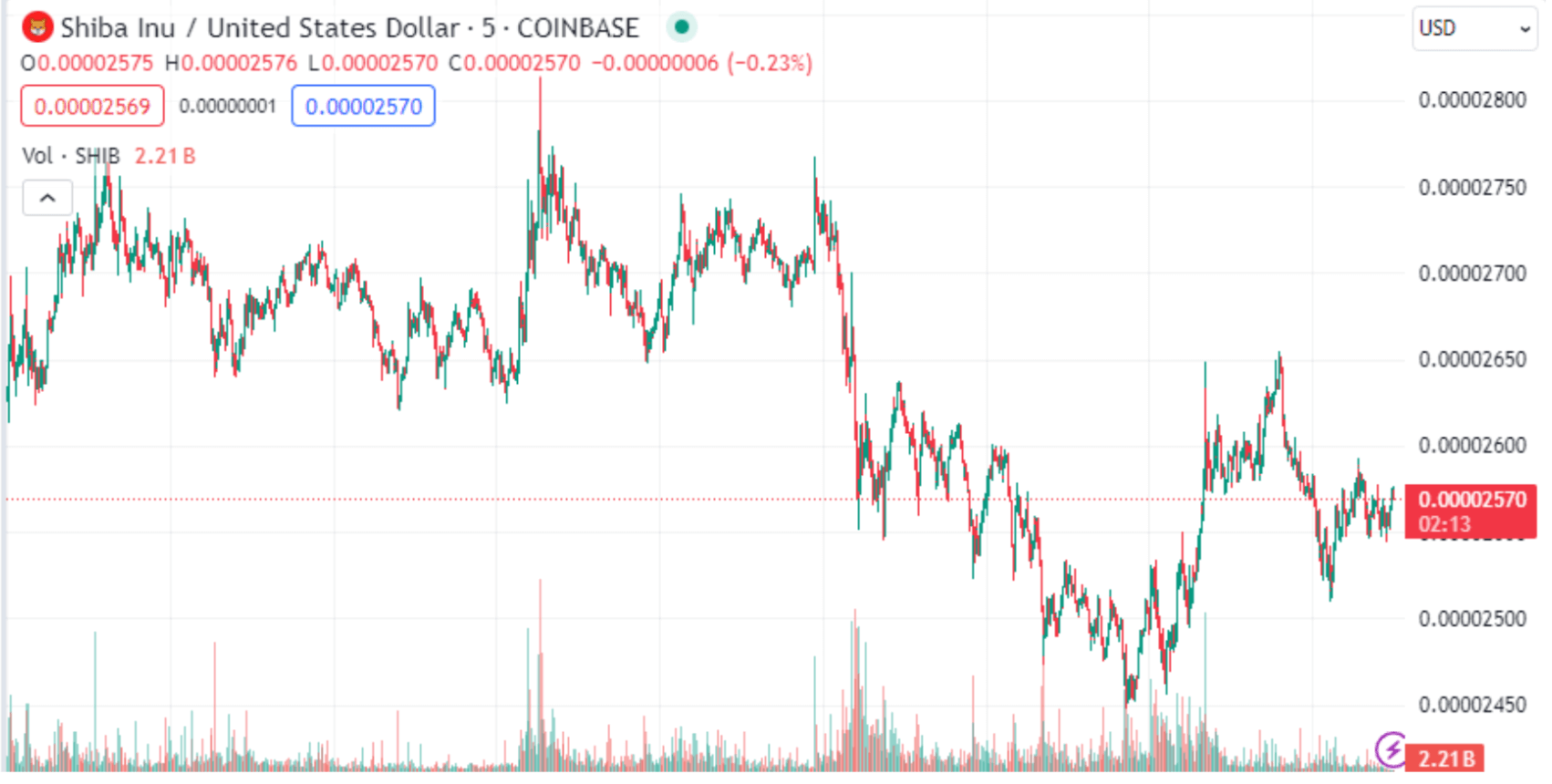

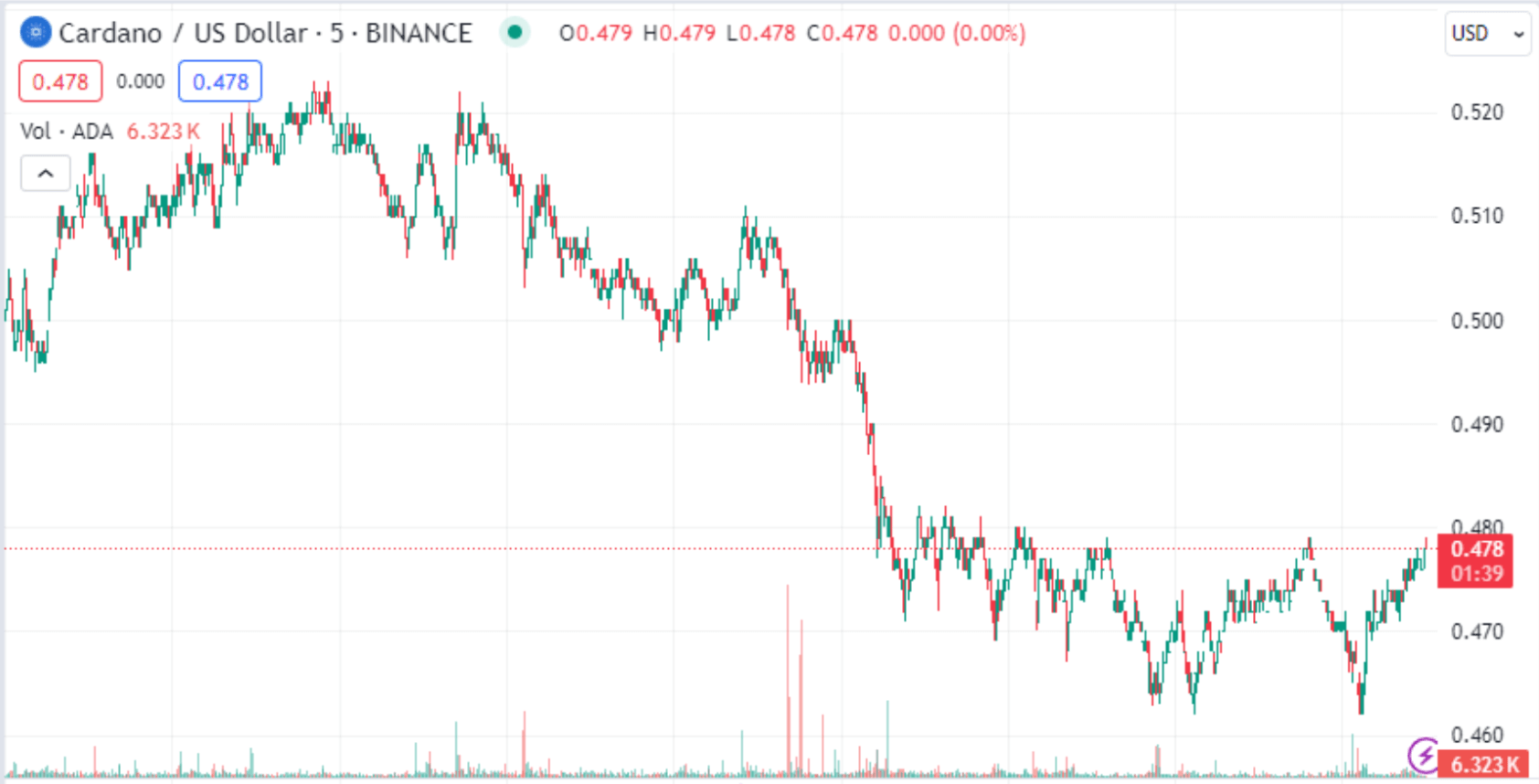

Altcoin Volatility Amidst Market Fluctuations

Altcoins have been subject to heightened volatility amidst the broader fluctuations in the cryptocurrency market. Several prominent altcoins, including Solana (SOL), Shiba Inu (SHIB), and Cardano (ADA), have experienced significant price swings, reflecting the turbulence in the crypto landscape.

Solana witnessed a sharp decline of approximately 7% in recent days. Despite its robust fundamentals and growing ecosystem, SOL's price has been impacted by broader market sentiment and external factors.

Shiba Inu also faced notable volatility, with its price dropping by around 8% in a single day. SHIB's price movements are often influenced by speculative trading activity and social media trends, contributing to its erratic price behaviour.

Similarly, Cardano experienced a price decline of approximately 6%. ADA's performance is closely tied to market sentiment and developments within the Cardano ecosystem, with investor confidence fluctuating based on news and announcements.

Evaluating Bitcoin ETF Outflows and Market Sentiment

Bitcoin ETF outflows have emerged as a key metric influencing market sentiment. Recent data indicates a significant withdrawal of funds from spot Bitcoin ETFs, coinciding with a decline in BTC's price. While fluctuations in ETF flows are common, they serve as indicators of investor confidence and can impact short-term market dynamics. Analysts emphasise the importance of monitoring ETF trends to gain insights into investor sentiment and market direction.

Key Takeaways and Future Outlook

The crypto market's landscape remains dynamic, characterised by a blend of optimism and caution. Developments such as FTX's SOL auction, Bitcoin's post-halving performance, regulatory challenges, and altcoin volatility underscore the market's complexity. As investors navigate through these dynamics, strategic analysis and risk management become paramount. Looking ahead, market participants await further clarity on regulatory fronts and monitor key indicators to inform their investment decisions in the ever-evolving crypto ecosystem.