Crypto Weekly Wrap: 12th April 2024

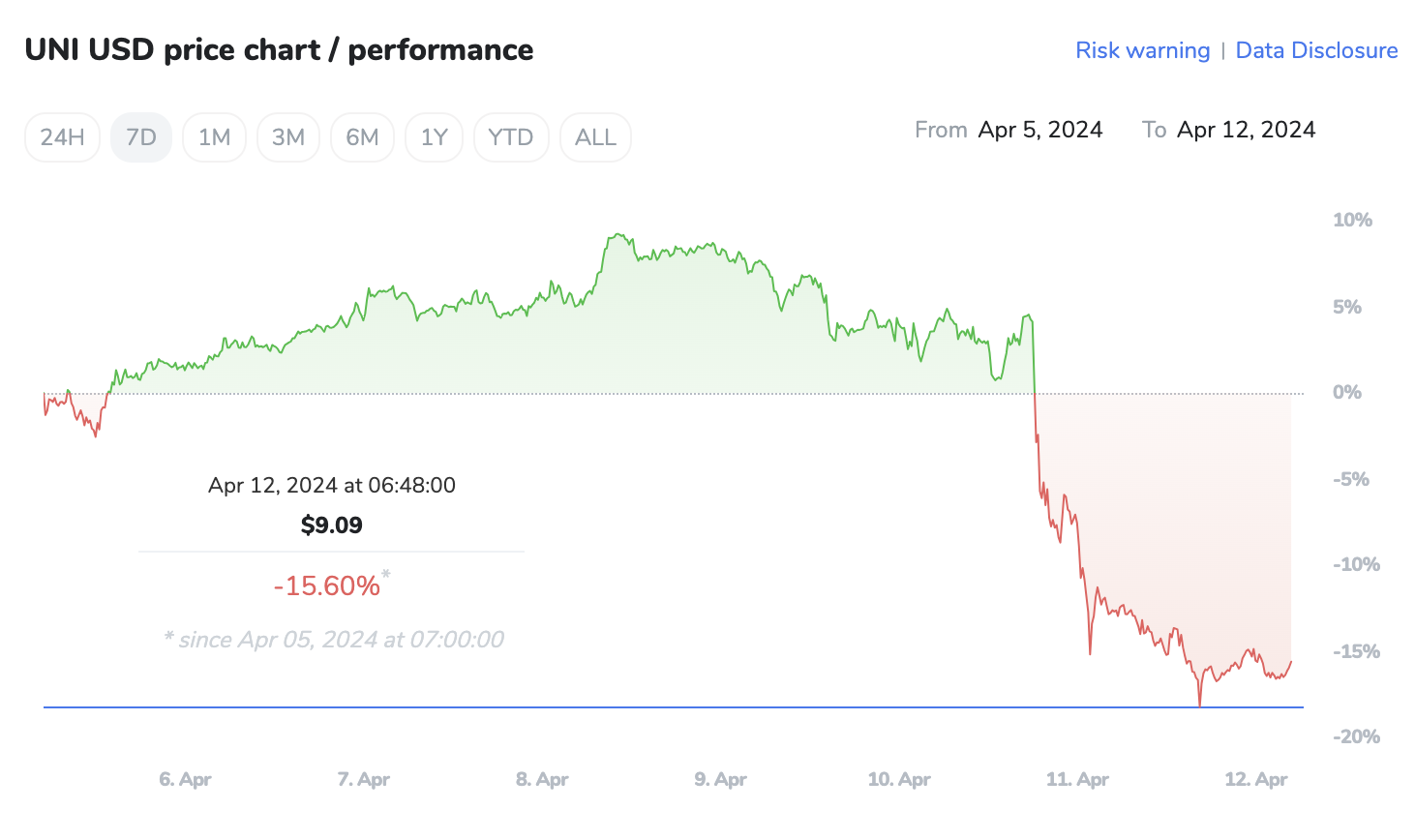

UNI Holder Crushed as Market Downturn and SEC Action Amplify Sell-Off

The recent crypto market downturn hit UNI holders hard. The United States SEC's impending action against Uniswap Labs exacerbated the situation, triggering panic selling by major UNI holders. Three whales collectively dumped over $20 million worth of UNI, amplifying the price slide. One whale pocketed over $1.6 million in profit, while two others transferred $11.7 million worth of UNI to Binance, signalling intent to sell for an estimated $3.5 million profit. Regulatory uncertainty and large-scale sell-offs highlight market vulnerability.

US SEC Delays Decision on Grayscale, Bitwise Bitcoin ETF Options

The U.S. Securities and Exchange Commission (SEC) has announced a postponement in its decision regarding options trading for Bitcoin exchange-traded funds (ETFs) offered by Grayscale and Bitwise. The SEC cites the need for additional time to review the proposed rule changes, setting May 29, 2024, as the new deadline for a decision. This delay underscores the cautious approach of regulatory authorities towards crypto-related products and derivatives, despite the growing demand for ETFs and other investment vehicles in the crypto market.

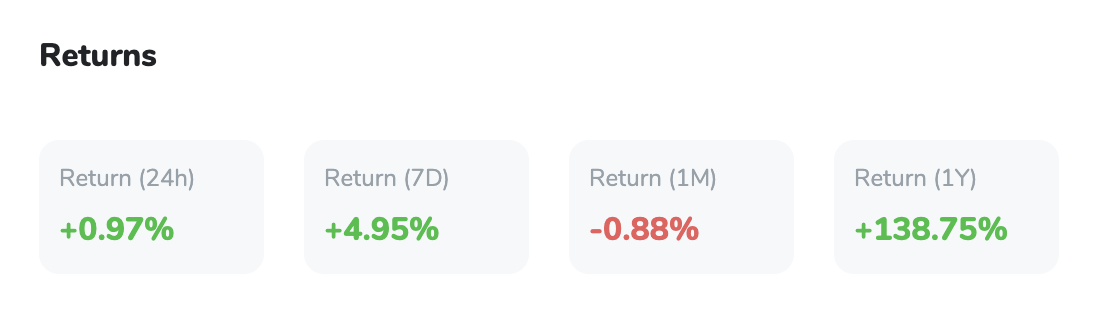

Spot Bitcoin ETFs Experience Fluctuating Investor Sentiment

Spot Bitcoin exchange-traded funds (ETFs) in the United States have witnessed a shift in investor sentiment, with net outflows recorded following several days of inflows. Notably, Grayscale's GBTC spot ETF experienced a significant single-day net outflow, while other Bitcoin ETFs saw varying levels of inflows. Despite the outflows, the overall trend indicates continued interest and investment in Bitcoin ETFs, with substantial inflows recorded over the past week. This fluctuation in investor sentiment reflects the dynamic nature of the crypto market and the diverse preferences of market participants.

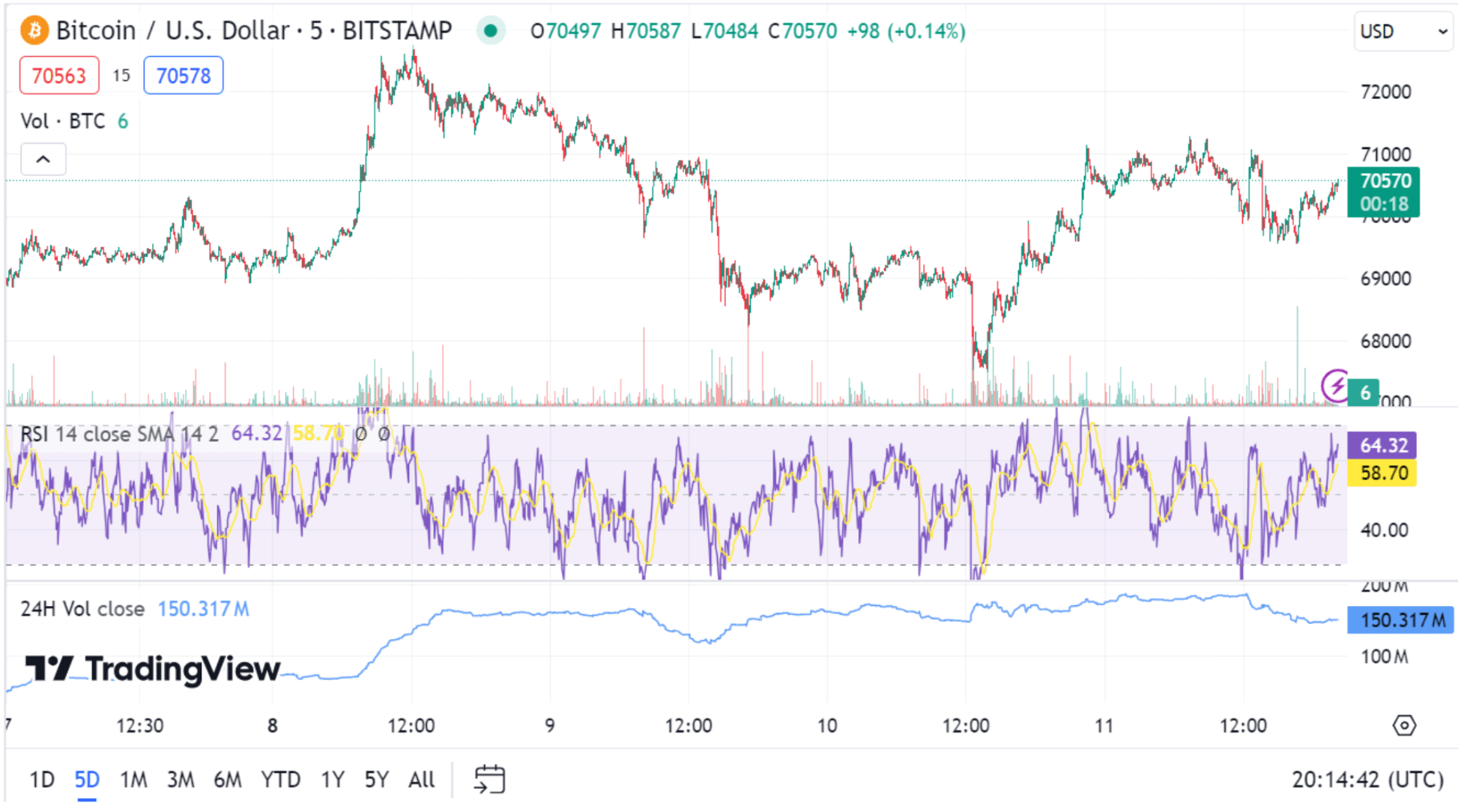

Technical Analysis for Bitcoin (BTC)

Price Movement and Resistance Levels

Bitcoin (BTC) has demonstrated resilience in recent trading sessions, bouncing by 4% and surpassing the $70,250 resistance level. The cryptocurrency currently trades at $70,498, supported by a 1.5% gain in the overall crypto market. Despite a 4% increase over the past week, BTC remains down by 2% in the monthly time frame. However, bullish sentiment prevails, fueled by expectations of rising inflation prompting potential Fed rate cuts and anticipation of the upcoming halving event. BTC's price chart exhibits encouraging signs, with the 30-day average and relative strength index indicating increased momentum and potential for further rallies in the near term.

Support and Convergence Analysis

BTC's price chart reveals a convergence of resistance and support levels, suggesting the potential for a significant price movement. This convergence often precedes a major market shift, highlighting the importance of monitoring BTC's price action closely. With the halving event approaching and trading volume remaining high, BTC is poised for a potentially positive trajectory. Analysts caution against short-term selling pressure associated with the halving event, but anticipate long-term price appreciation due to the reduction in BTC's supply. The coin's proximity to its all-time high and continued institutional investment signal a bullish outlook for BTC's price trajectory.

Source: TradingView

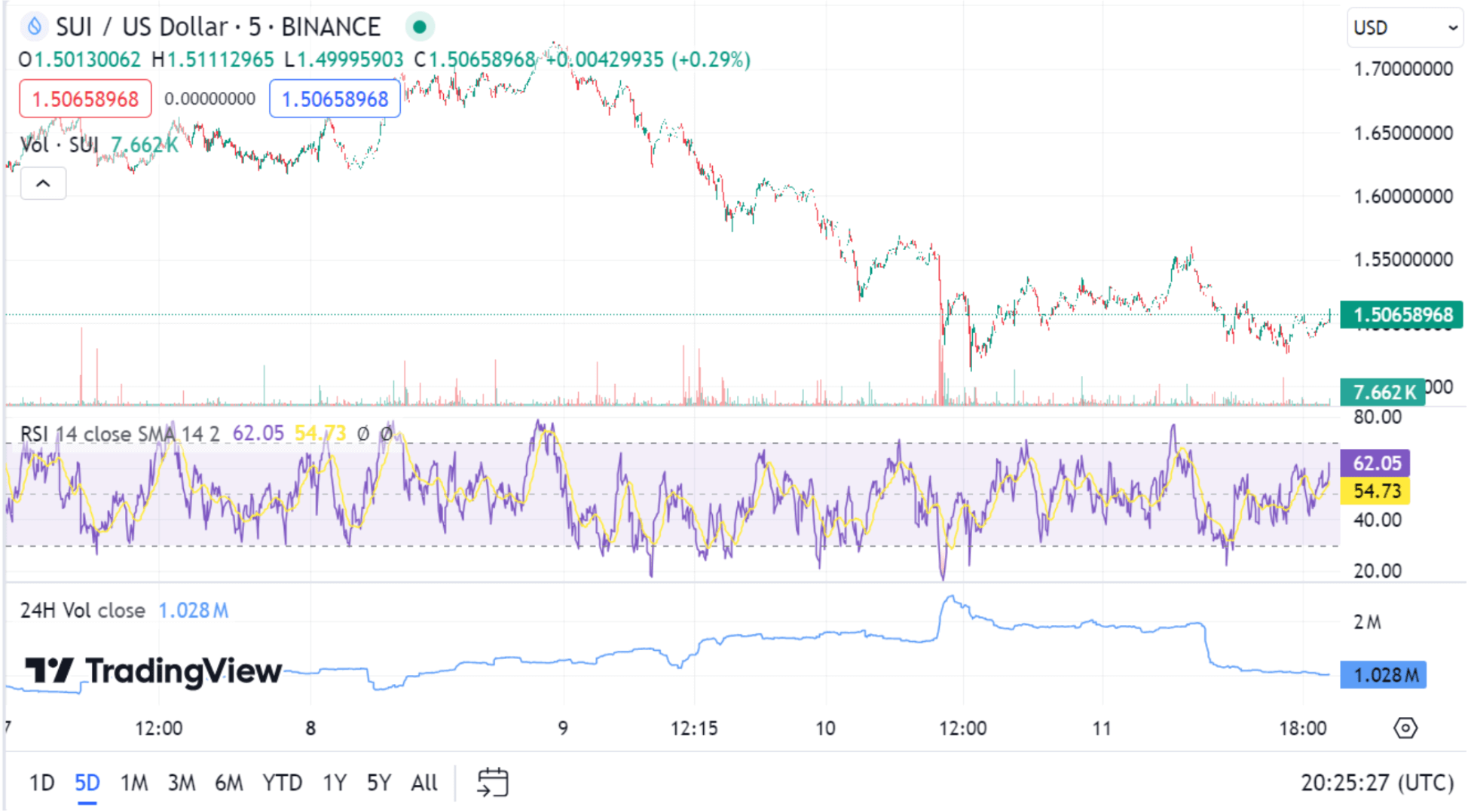

First Digital Labs Partners with Sui Network for FDUSD Integration

First Digital Labs announced its collaboration with the Sui network to introduce FDUSD, its dollar-pegged stablecoin, enhancing liquidity and transaction efficiency. Currently the fourth-largest stablecoin by market capitalization at $3.28 billion, FDUSD's integration marks a significant milestone. Utilising Sui's delegated proof-of-stake (DPoS) system, FDUSD becomes the first 1:1 backed dollar native stablecoin on the network. This strategic alliance aims to bridge traditional finance with the expanding digital economy. Notably, FDUSD is unavailable to U.S. individuals, adhering to regulatory guidelines. This move underscores the growing role of stablecoins in crypto ecosystems and blockchain networks' integration for seamless financial operations.

Source: TradingView