Crypto Weekly Wrap: 5th April 2024

Spot ETH ETFs Under SEC Scrutiny

The Securities and Exchange Commission (SEC) has initiated a comment period for three ether spot exchange traded fund (ETF) proposals, signalling a potential shift in regulatory stance towards Ethereum (ETH). The applications from Grayscale Investments, Fidelity, and Bitwise are now subject to a three-week comment period, as announced by the SEC. Despite initial optimism following the approval of bitcoin spot ETFs in January, industry analysts remain cautious about the prospects for Ethereum-based products. The SEC's previous approval of bitcoin ETFs doesn't necessarily extend to other tokens, according to statements from SEC Chair Gary Gensler. The deadline for final decisions on some of the ETF applications is May 23, highlighting the significance of this period for the crypto market.

Sam Bankman-Fried's Remorse Amid Legal Troubles

Sam Bankman-Fried, the founder and former CEO of the defunct crypto exchange FTX, has expressed remorse for his actions after receiving a 25-year prison sentence for fraud. In an interview with ABC News from the Metropolitan Detention Center in Brooklyn, Bankman-Fried acknowledged the impact of his actions on customers and expressed regret for the insolvency of FTX. Despite defending his intentions, he took responsibility as the CEO and expressed frustration at his inability to repair the damage from prison. Bankman-Fried's case underscores the legal risks and accountability faced by prominent figures in the crypto industry.

Central Banks Embrace Tokenization to Enhance Financial Systems

Central banks worldwide are exploring tokenization as a means to improve financial systems, with the launch of Project Agorá by the Bank for International Settlements (BIS) leading the charge. The project aims to integrate tokenized commercial bank deposits with central bank money using smart contracts, offering potential enhancements to the monetary system's functionality. Seven central banks, along with private financial firms, are collaborating on Project Agorá to explore the possibilities of tokenization in a public-private partnership. By leveraging smart contracts and programmability, the project seeks to address operational, regulatory, and legal challenges while fostering innovation in payment infrastructure.

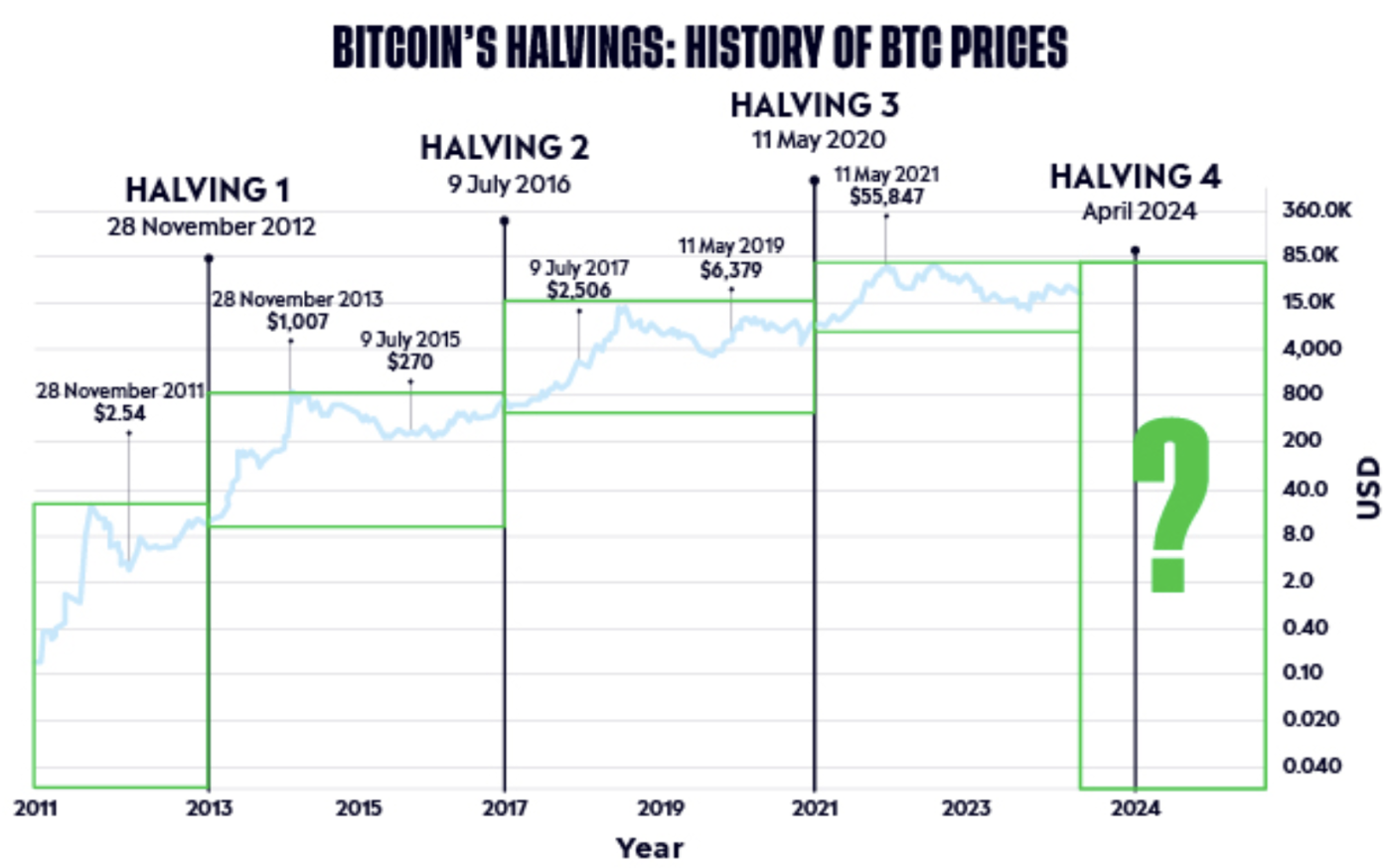

Bitcoin's Fourth Halving and Market Outlook

Bitcoin's upcoming fourth halving, scheduled for April 19, has sparked speculation about its impact on the market. Historically, halving events have led to significant price surges due to reduced supply and increased demand. However, this year's halving comes as bitcoin is already trading near all-time highs, presenting a unique scenario. While past performance suggests potential for post-halving rallies, analysts caution that not all halvings have yielded the same results.

Source: eToro

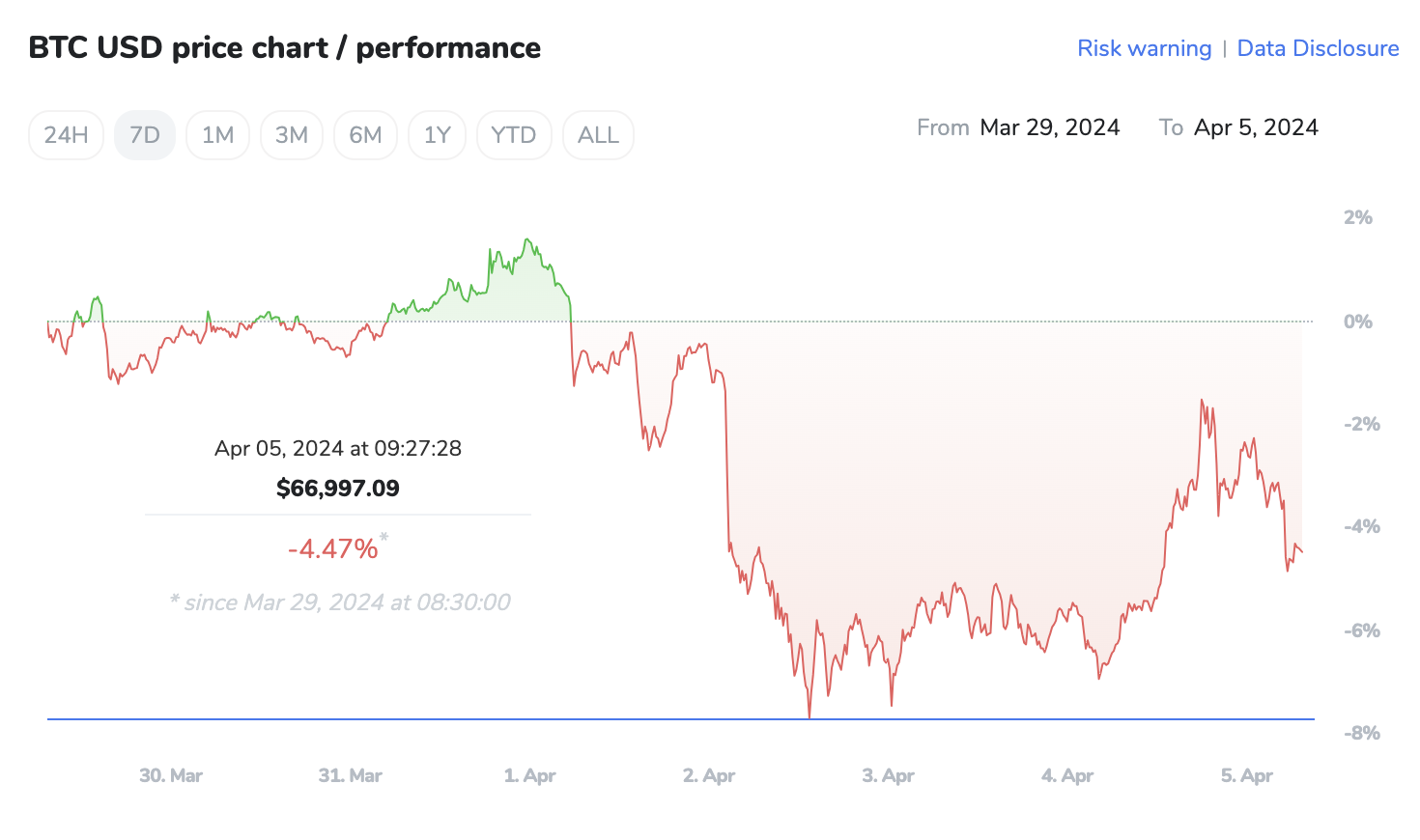

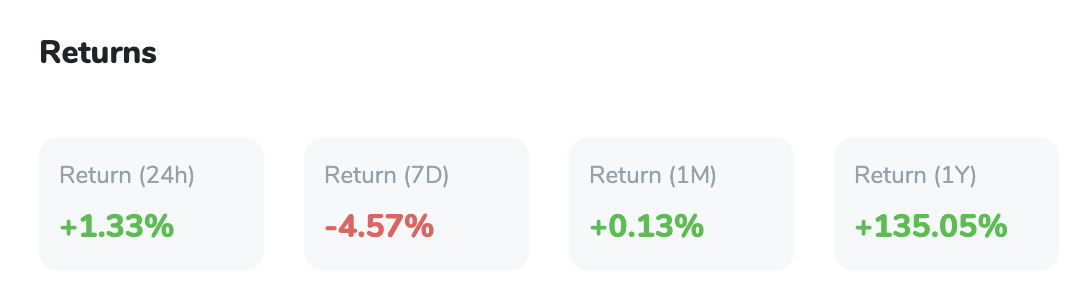

Bitcoin Technical and Price Analysis:

Technical analysis reveals a mix of bullish and bearish signals for bitcoin, indicating uncertainty in the market. On the daily chart, bitcoin presents a complex picture of alternating bullish and bearish patterns, hinting at a broader phase of consolidation. Significant volatility, as marked by extensive price swings, underscores the uncertainty prevailing in the market. Yet, the appearance of the last significant drop suggests a bearish undertone. Support at $59,310 and resistance at $73,790 mark the boundaries of this longer-term phase, offering a glimpse into the critical levels that could define bitcoin’s path forward.

The aggregate view from oscillators and moving averages paints a narrative of caution. While the relative strength index (RSI), Stochastic, and other oscillators largely signal neutrality, the preponderance of bearish indications among moving averages—especially in the short to mid-term ranges—hints at underlying negative pressure. Notably, longer-term moving averages suggest a potential for reversal, with positive signals emerging in the 50, 100, and 200-day metrics, reflecting a contrast to the more immediate bearish indicators.

Source: TradingView

Despite short-term fluctuations, long-term investors remain optimistic about bitcoin's potential, emphasising its role as a store of value and hedge against inflation in a rapidly evolving financial landscape. In summary, the crypto market is witnessing significant developments, from regulatory scrutiny of ETFs to legal repercussions for industry figures like Sam Bankman-Fried. Meanwhile, central banks are embracing tokenization to enhance financial systems, while the upcoming bitcoin halving prompts speculation about market dynamics. Amidst these developments, technical analysis provides insights into bitcoin's current trajectory, reflecting both bullish and bearish sentiments among investors.