Ethereum (ETH) News and Price Analysis

Ethereum (ETH) Price Surges Amid Market Momentum

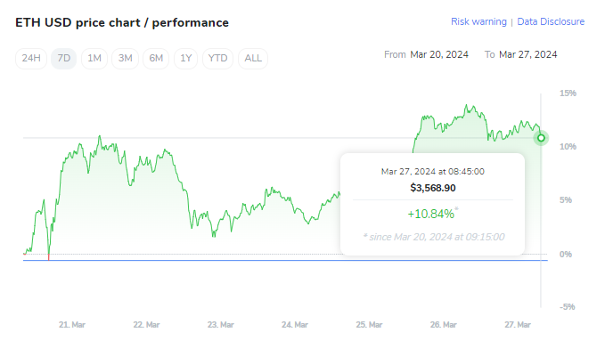

Ethereum (ETH) has experienced a significant surge, rising by 11% in the last week to reach $3,569 demonstrating its resilience and attractiveness to investors. This jump comes as the broader cryptocurrency market gains momentum, with a 5.5% increase over the same period. Furthermore, its performance over the last year showcases a remarkable 103% increase. This surge in price is buoyed by positive developments in the cryptocurrency market, particularly the transition of Bitcoin ETF inflows into positive territory, potentially signalling the onset of another bullish rally.

Analysing Ethereum's Technical Indicators

From a technical standpoint, Ethereum's chart exhibits promising signals. The Relative Strength Index (RSI), a momentum oscillator, has touched 70, and dropped to 30 during the last 24 hours, which may indicate that the asset is oversold, and could be due for a price rebound. Additionally, the 30-day moving average has crossed over its 200-day counterpart, indicating a potential breakout. Moreover, the increase in 24-hour trading volume, from $13 billion to nearly $23 billion, underscores growing interest and participation in Ethereum. These technical indicators collectively point towards a bullish sentiment in the market, with the potential for further price appreciation.

Source: TradingView

Source: X

Regulatory Outlook and Ethereum's Classification

Despite Ethereum's positive trajectory, regulatory uncertainties loom over its classification. Currently, Ethereum is considered a decentralised cryptocurrency, not a security, by the U.S. Securities and Exchange Commission (SEC). However, there are ongoing speculations regarding the SEC's stance, with some concerns raised about potential reclassification as a security. While industry experts deem it highly unlikely for the SEC to classify Ethereum as a security, recent actions such as the initiation of a probe into the Ethereum Foundation have sparked apprehensions. Any reclassification could impact Ethereum ETF applications and lead to delisting from exchanges.

Implications and Future Outlook for Ethereum

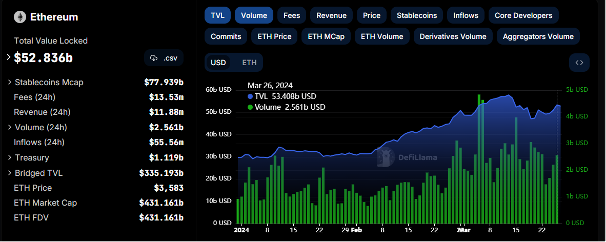

Looking ahead, the fate of Ethereum ETF applications remains uncertain, contingent upon regulatory decisions and market dynamics. The SEC's deadline to approve or reject VanEck's ETF application for an Ethereum ETF is May 23. However, there are speculations that the SEC might use the review of Ethereum's security status to delay its decision on ETF approvals. Despite regulatory challenges, Ethereum's fundamentals remain robust, with its blockchain commanding a significant share of the total value locked in the sector. Ultimately, Ethereum's long-term trajectory hinges on regulatory clarity, market sentiment, and its ability to maintain technological innovation and decentralised principles.

Source: DefiLlama