Crypto Weekly Wrap: 8th March 2024

SEC Delays BlackRock and Fidelity Spot Ethereum ETF Proposals

The United States Securities and Exchange Commission (SEC) has once again delayed its decision on spot Ethereum ETF applications from BlackRock and Fidelity, adding another layer of uncertainty to the cryptocurrency market. This delay comes after the SEC approved several spot Bitcoin ETFs earlier, signalling ongoing regulatory scrutiny of cryptocurrency-related investment products.

The SEC's decision to postpone the approval or rejection of BlackRock's iShares Ethereum Trust and Fidelity's Ethereum Fund underscores the regulatory challenges facing the cryptocurrency industry. Analysts had speculated that May could be the month to watch for a decision on these ETFs, but the latest delay has pushed the timeline further out.

The market response to the SEC's delay has been relatively muted, with Ethereum's price remaining strong and posting gains of nearly 57% in the last month. This resilience suggests that investors remain optimistic about the long-term prospects of Ethereum and the broader cryptocurrency market, despite regulatory uncertainties.

While the delay may prolong the wait for a spot Ethereum ETF, it also provides an opportunity for market participants to assess the potential impact of such ETFs on Ethereum's price and adoption. Investors will be closely monitoring developments in the regulatory landscape and any updates from the SEC regarding the approval process for Ethereum ETFs.

Arkham Intelligence Identifies Tesla and SpaceX Bitcoin Holdings, Elon Musk Criticises OpenAI

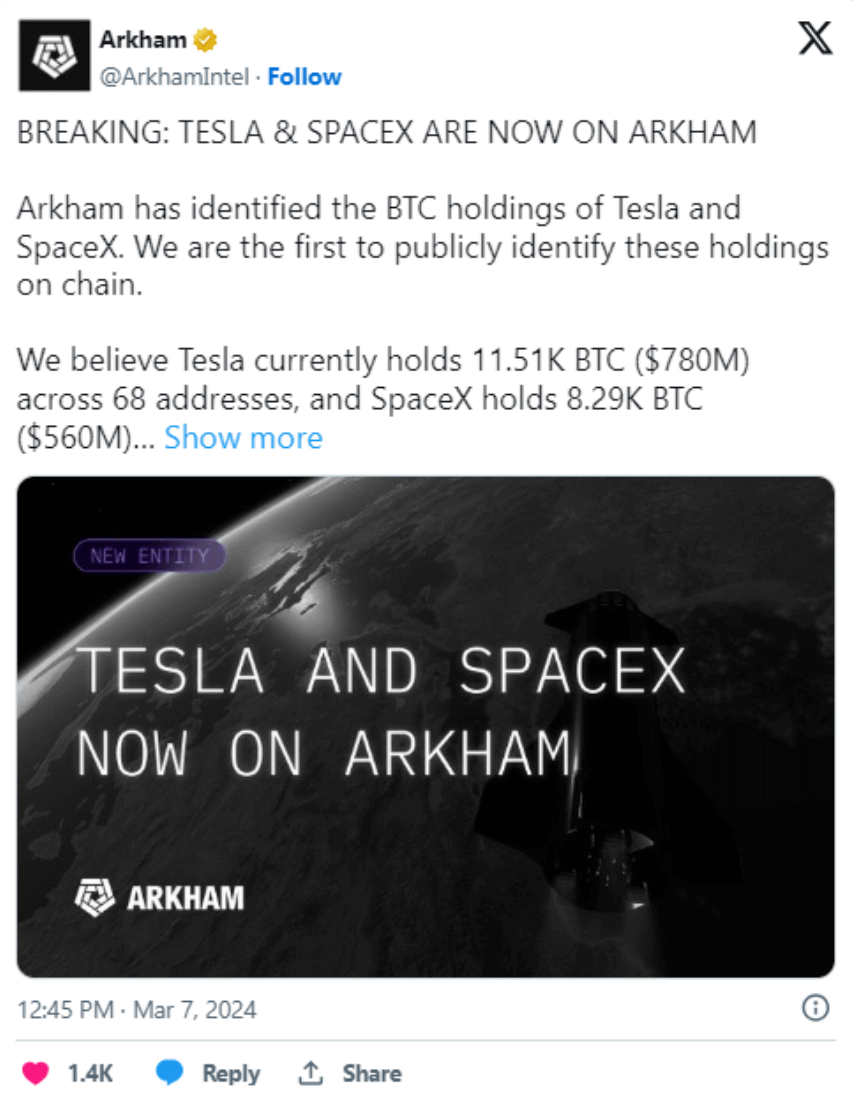

Arkham Intelligence claims to have identified Bitcoin addresses linked to Tesla and SpaceX, estimating their combined holdings to be over $1.3 billion. Tesla reportedly holds 11.51K BTC ($780M) across 68 addresses, while SpaceX holds 8.29K BTC ($560M) across 28 addresses. These findings align with Tesla's previous purchase of $1.5B worth of BTC in Jan 2021, followed by subsequent sales. Additionally, Tesla briefly allowed Bitcoin payments for its vehicles in 2021. In a separate development, Elon Musk criticised OpenAI, labelling it as "ClosedAI" and accusing CEO Sam Altman of breaching foundational agreements. Musk's critique sparked discussions within the cryptocurrency community, with some supporting his actions and even suggesting he take over OpenAI.

Source: X

Bitcoin Price Surpasses All-Time High

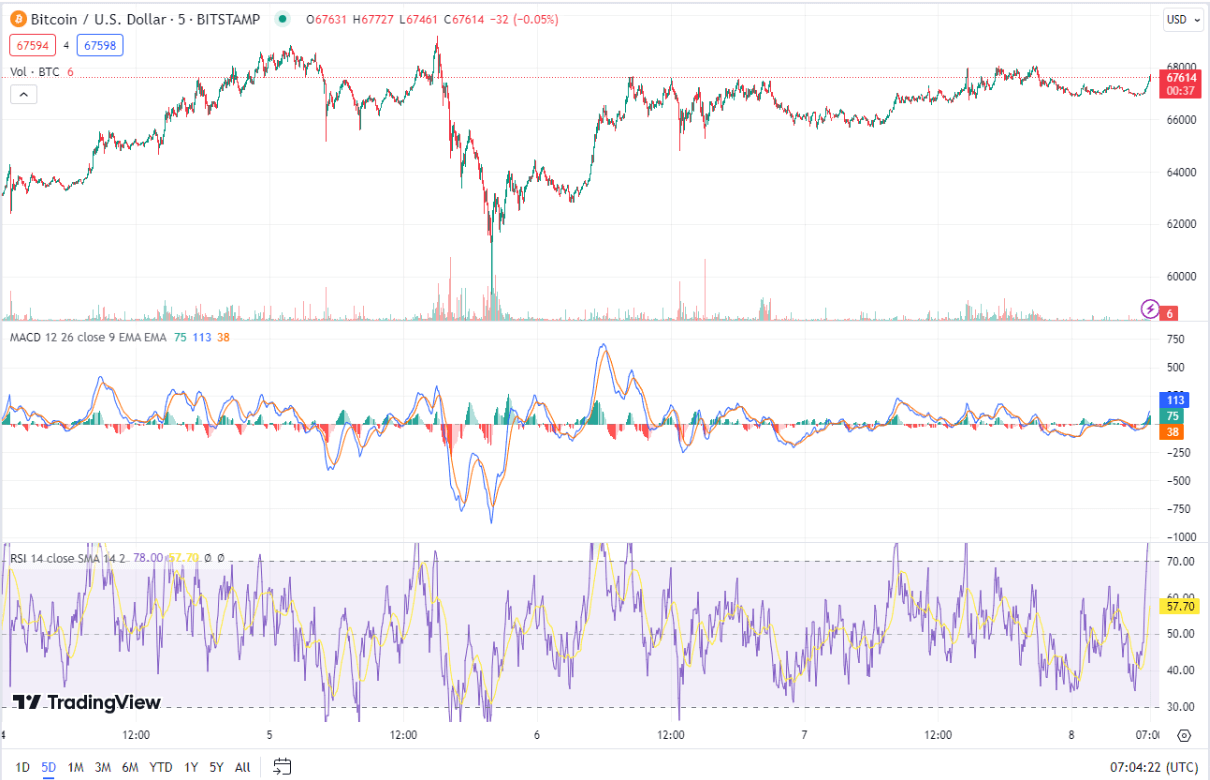

Bitcoin's recent price surge has captivated the cryptocurrency market, with the leading digital asset briefly surpassing its all-time high of around $69,000 set in November 2021. This milestone has reignited bullish sentiment among traders and investors, prompting speculation about the potential for further price appreciation.

From a technical perspective, Bitcoin's price movement indicates bullish momentum, with key support levels holding and the price consistently making higher highs and higher lows. The Relative Strength Index (RSI) suggests that Bitcoin is currently in overbought territory, indicating potential for a short-term pullback or consolidation.

However, the broader market sentiment remains overwhelmingly positive, fueled by strong demand for Bitcoin ETFs and a broader market rally. Traders are closely watching the $70,000 level as a potential psychological barrier, with a break above signalling further upside potential for Bitcoin's price.

Source: TradingView

While short-term price fluctuations are inevitable, the long-term outlook for Bitcoin remains bullish, supported by increasing institutional adoption, growing regulatory clarity, and broader market trends. As Bitcoin continues to solidify its position as a store of value and digital gold, investors are increasingly turning to the cryptocurrency as a hedge against inflation and economic uncertainty.

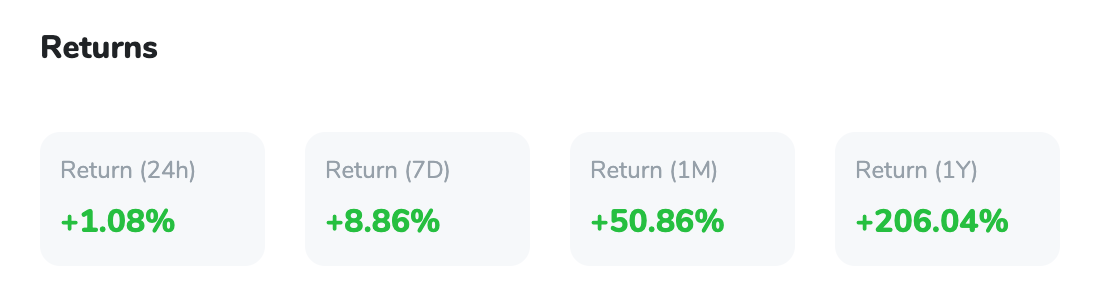

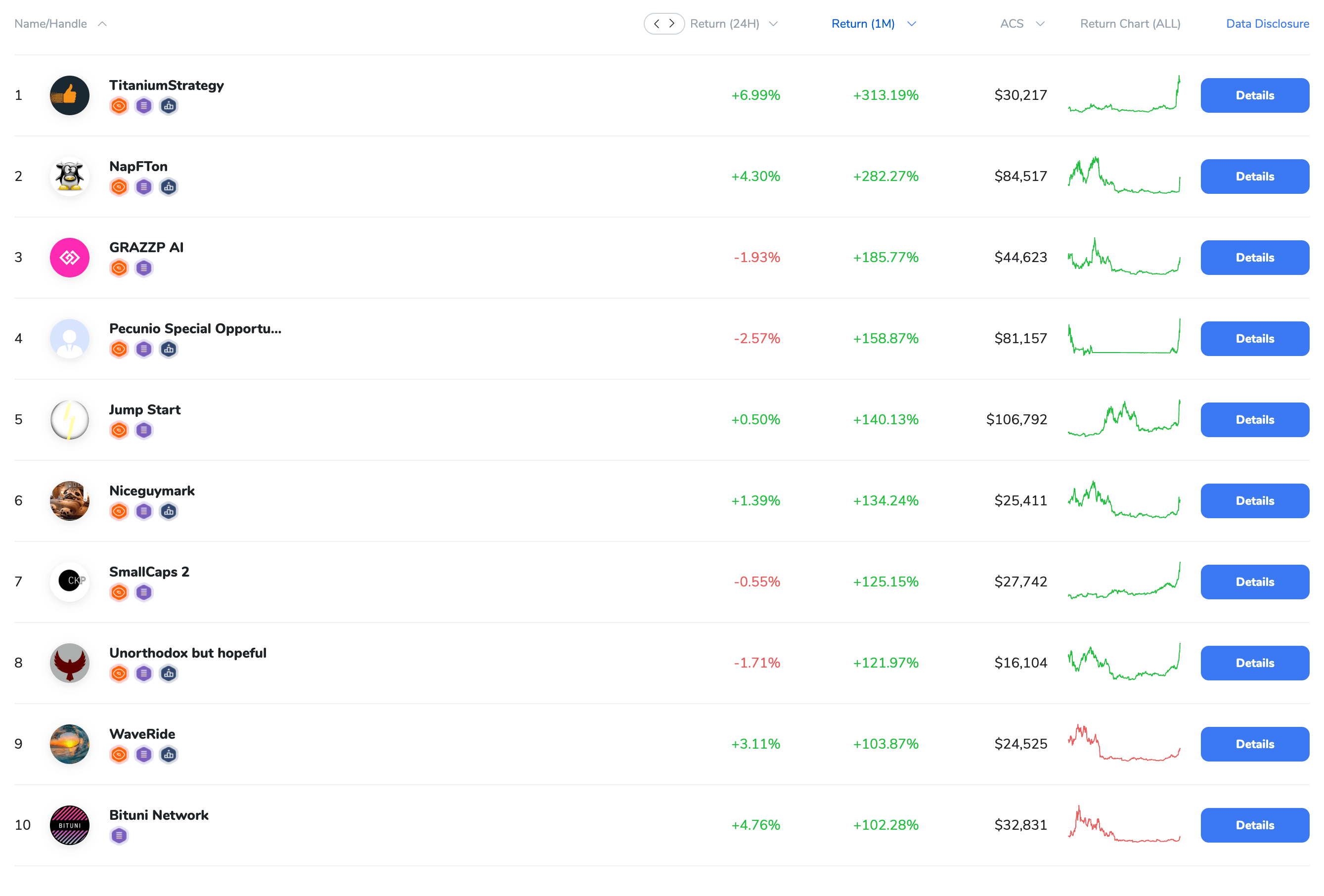

Best Strategies by 1M Return

Source: coinmarketcap.com

Pantera Capital Launches Fund to Purchase Discounted Solana Tokens

Pantera Capital has announced the launch of the Pantera Solana Fund, aimed at capitalising on the growing interest in Solana (SOL) tokens. The fund seeks to purchase discounted SOL tokens from the FTX estate, leveraging Pantera's expertise in cryptocurrency investments to unlock value for investors.

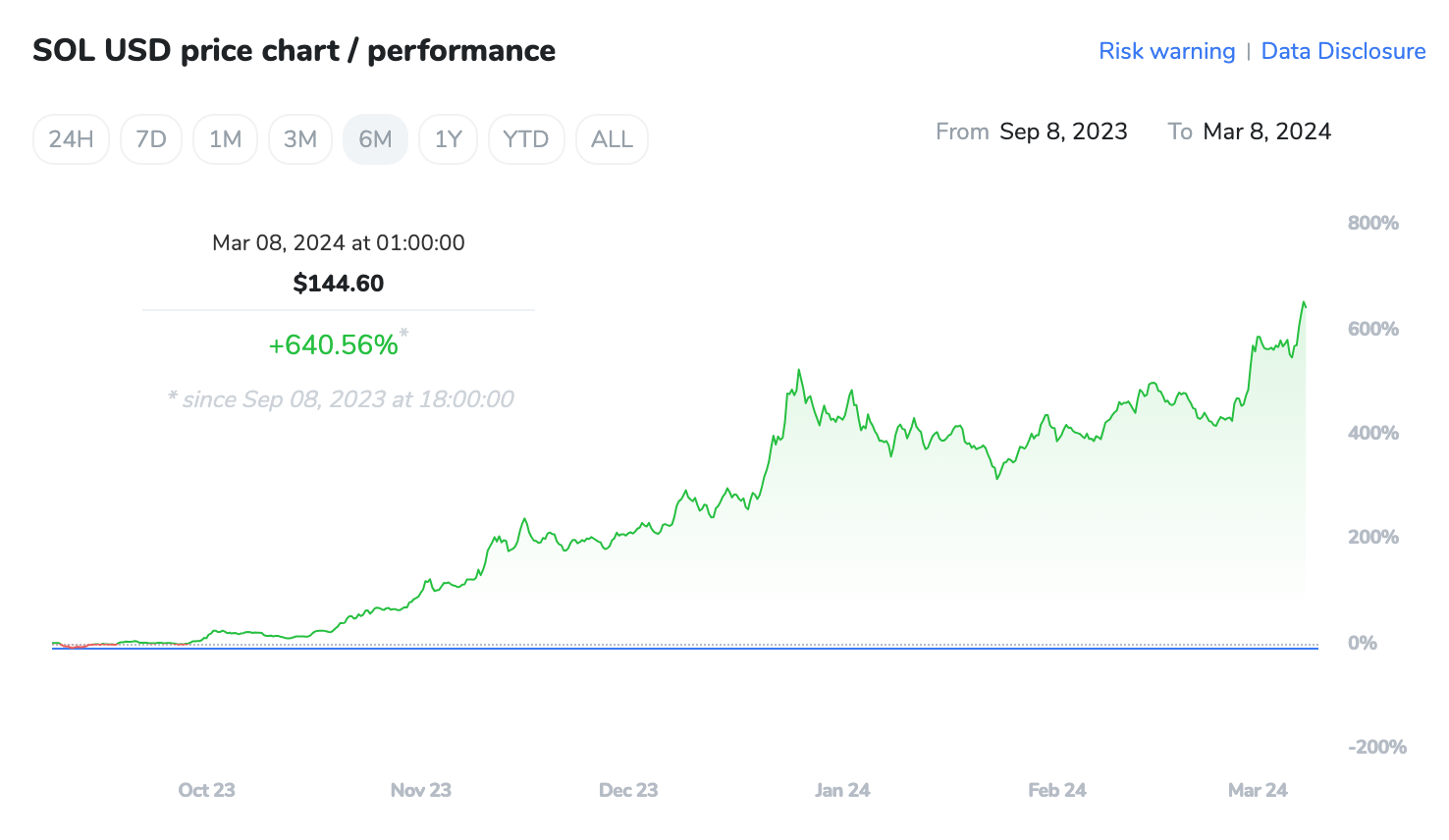

SOL tokens have experienced significant gains in recent months, rising nearly 600% over the past year. This surge in SOL's price underscores the growing demand for Solana's blockchain platform and its native cryptocurrency, as developers and users flock to the network for its scalability and low transaction fees.

The launch of the Pantera Solana Fund represents a strategic move by Pantera Capital to capitalise on the potential upside of SOL tokens while offering investors exposure to one of the fastest-growing blockchain ecosystems in the cryptocurrency market. By acquiring discounted SOL tokens from the FTX estate, Pantera aims to generate attractive returns for its investors while contributing to the liquidity and stability of the Solana ecosystem.

DeFi Yields Surge to Highest Levels in Two Years

Decentralised finance (DeFi) yields have surged to their highest levels in two years, driven by record-setting volume in the decentralised derivatives sector. GMX, a decentralised perpetual trading exchange, has hit $1 billion in trading volume, offering liquidity providers yields ranging from 11.8% to 105.3% APY across its versions.

This surge in DeFi yields underscores the growing interest and participation in decentralised finance protocols, as investors seek higher returns amidst a bullish market environment. With an overall resurgence in decentralised finance, as seen in the total value of crypto assets deposited in protocols and total volume generated by decentralised exchanges hitting their highest levels in years, the yield could continue to increase. As decentralised finance continues to evolve and mature, investors are increasingly turning to DeFi protocols for higher yields and innovative financial products.

Source: DefiLlama