Crypto Update 17 August

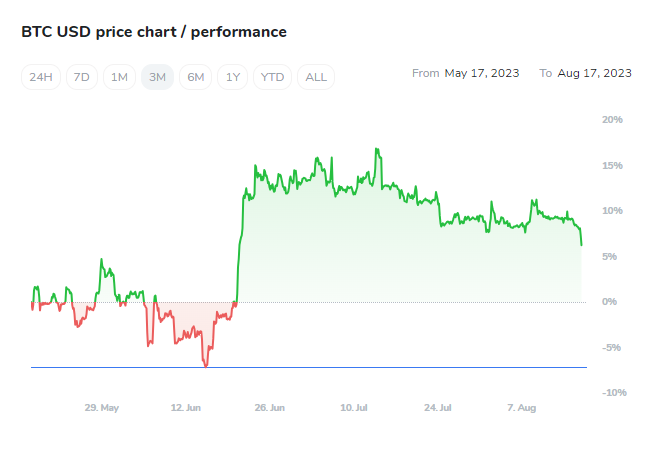

The past week in the cryptocurrency market has been marked by relatively stable prices. This sustained period of price consolidation could indicate an accumulation phase, potentially setting the stage for a significant price movement in the near future. While Bitcoin remains in a balance between bullish and bearish forces, there have been several noteworthy events and developments within the crypto market.

Bitcoin's price has exhibited limited volatility over the past three weeks, suggesting a period of accumulation. This could hint at a forthcoming decisive price shift as the market awaits clearer signals from both buyers and sellers.

PayPal's introduction of PYUSD, an Ethereum-based stablecoin, has ignited discussions within the crypto community. The stablecoin's potential to drive Ethereum's mainstream adoption and expand its user base has been met with both optimism and scepticism. While some view it as a positive step toward broader crypto acceptance, concerns have been raised regarding centralisation and the potential impact on decentralisation and asset control.Discover the signs hinting at future market movements, as Bitcoin consolidates, PayPal ventures into Ethereum, and the U.S. Federal Reserve eyes crypto innovations

The U.S. Securities and Exchange Commission (SEC) has announced its intent to appeal a recent court ruling in the ongoing legal battle with Ripple Labs. The ruling declared that XRP is not inherently a security, although it could be classified as one under certain circumstances. The appeal adds another layer of complexity to the crypto regulatory system.

Curve Finance, a decentralised finance (DeFi) protocol, has offered a substantial bug bounty of $1.85 million to identify the perpetrator responsible for a $61 million attack on its stable pools. The exploit targeted vulnerabilities in the Vyper programming language, impacting multiple DeFi projects. The incident highlights the ongoing challenges of security and risk management within the DeFi protocol.

The U.S. Federal Reserve has introduced the Novel Activities Supervision Program to enhance oversight of novel activities in the cryptomarket. The program aims to address the unique challenges posed by these activities while prioritising customer protection and maintaining financial stability. This move underscores the growing recognition of the importance of regulatory measures in the crypto market.

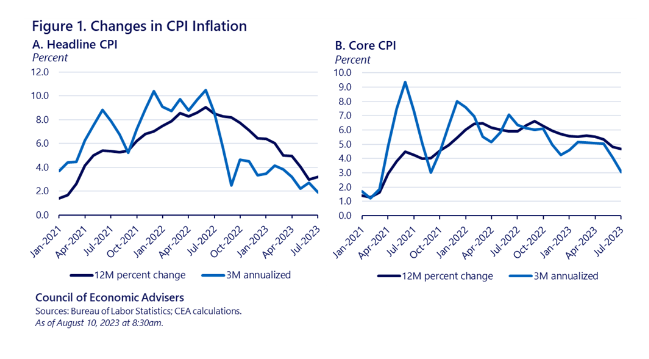

In the economic sphere, U.S. consumer prices experienced a 0.2% increase in July. The year-on-year increase of 3.2% in the Consumer Price Index (CPI) and 4.7% in Core CPI (excluding food and energy) could influence the Federal Reserve's decisions on interest rates, with potential implications for the broader financial market. The following charts shows headline and core inflation, presenting data for both 12-month and 3-month annualised growth rates.

While the crypto market has seen a period of price stability, the underlying developments and events continue to shape its direction. From the introduction of new stablecoins to regulatory actions and economic indicators, the market remains dynamic and subject to a range of influences that could have significant implications for investors and other participants.