Crypto Weekly Wrap: 26th January 2024

Bitcoin Price Surges Amid ETF Approvals and Regulatory Trends:

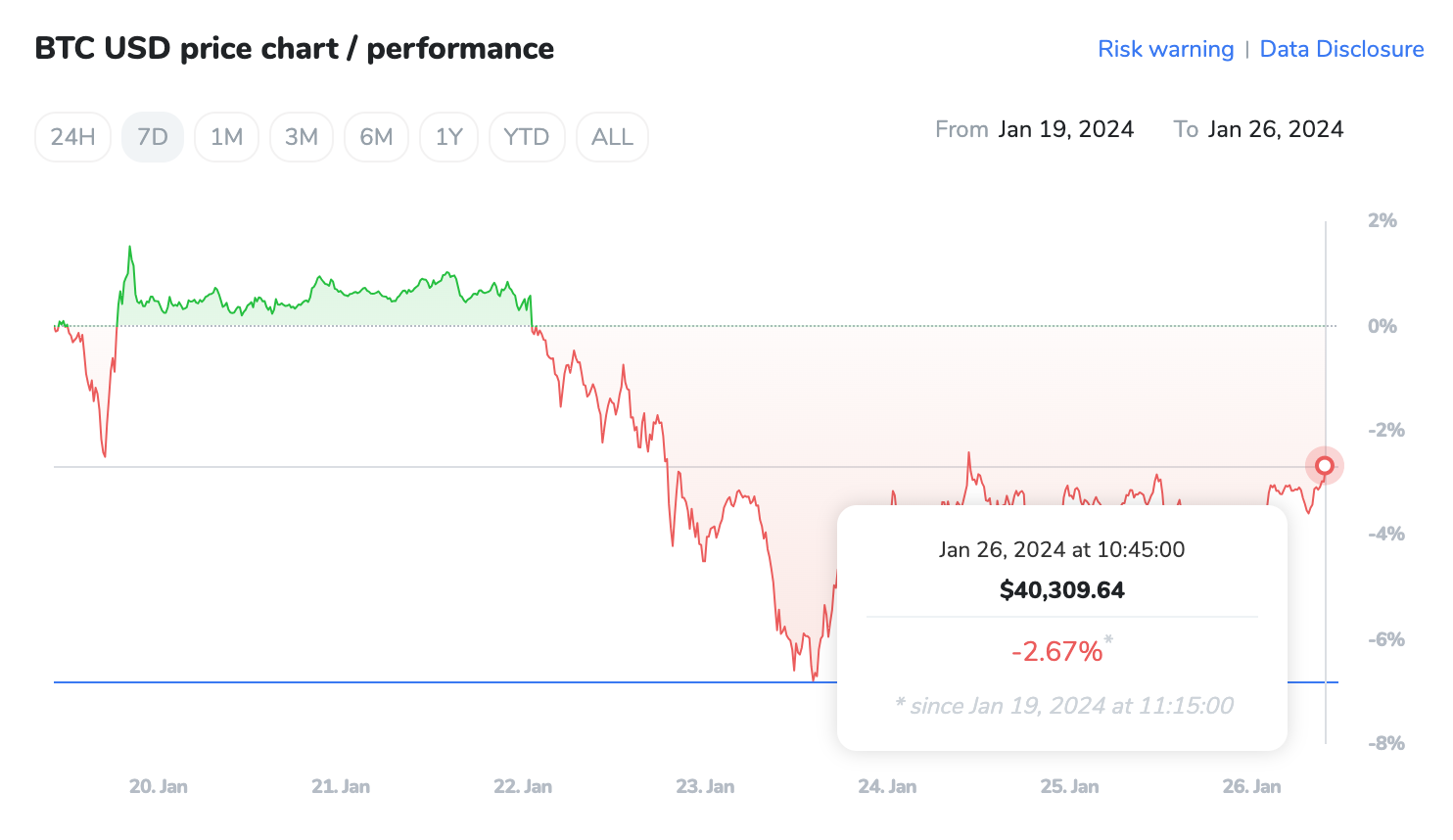

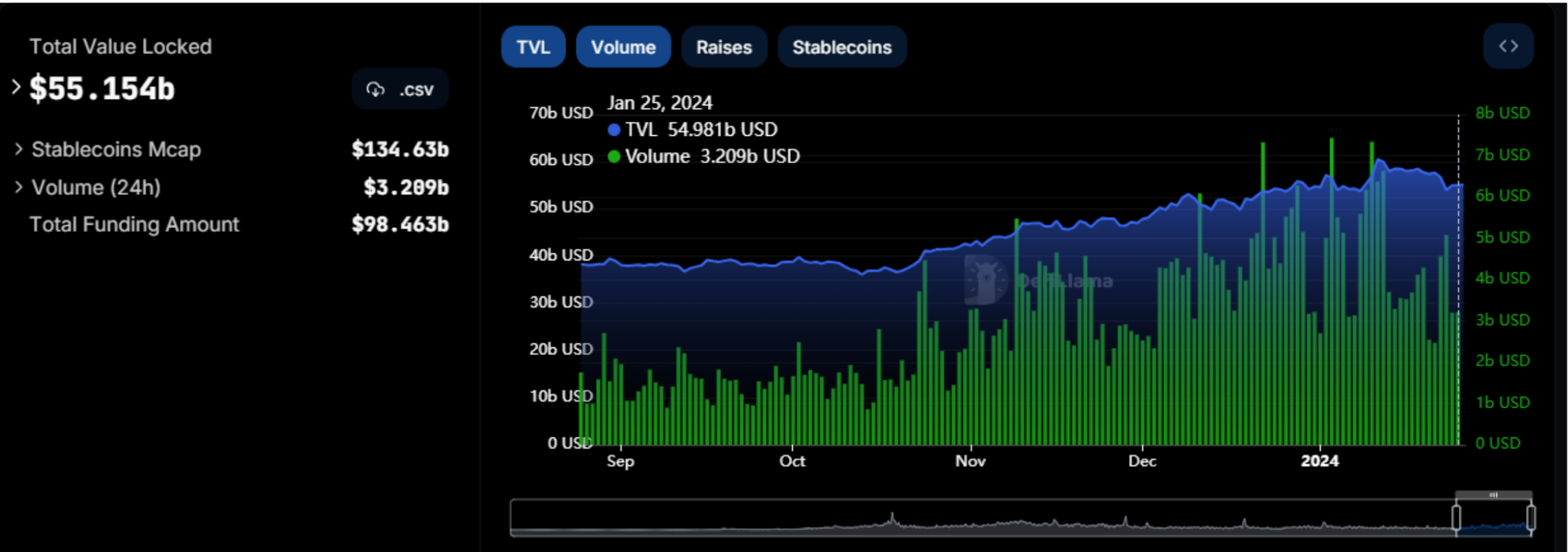

Bitcoin's price settling at the $40,000 mark has been a focal point in the cryptocurrency market, particularly in light of the approval of several Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). This development has been widely regarded as a significant milestone for Bitcoin, as it opens up easier access to investment in the cryptocurrency for a broader range of investors, including institutional players. However, the surge in Bitcoin's price has also been accompanied by a backdrop of evolving regulatory trends and ongoing market dynamics.

Regulatory authorities, led by the SEC, have been actively tightening compliance measures within the crypto space. The SEC's enforcement actions in 2023, totalling a record $2.8 billion in fines against digital asset market participants, underscore the imperative of investor protection. These enforcement actions have primarily targeted infractions related to fraud and unregistered securities offerings, reflecting the SEC's commitment to maintaining market integrity. The regulatory stance, spearheaded by SEC Chair Gary Gensler, has sparked debates within the crypto community, with some applauding the efforts to enhance investor protection while others expressing concerns about potential stifling of innovation.

Regulatory Landscape in 2023 and Enforcement Actions:

The regulatory landscape continues to evolve rapidly, with regulatory bodies worldwide grappling with how to effectively oversee and regulate this burgeoning industry. The SEC's enforcement actions in 2023, which resulted in fines totalling $2.8 billion against digital asset market participants, highlight the agency's commitment to maintaining market integrity and protecting investors.

These enforcement actions have sent a clear message to market participants that non-compliance with regulatory requirements will not be tolerated. However, the SEC's regulatory approach has also faced criticism from some quarters, with concerns raised about potential overreach and its impact on innovation within the crypto industry. Despite these challenges, regulatory clarity and compliance remain essential for the long-term sustainability and legitimacy of the crypto market.

Technical Analysis of Bitcoin's Price Movement:

A technical analysis of Bitcoin's recent price movements reveals intriguing insights into the factors influencing its fluctuations. As Bitcoin surged to the $40,000 mark, traders closely monitored key support and resistance levels for potential entry and exit points. Notably, Bitcoin encountered resistance around $39,950, forming a double top pattern indicative of a potential selling trend if it fails to breach this critical threshold. This resistance level is particularly significant as it aligns with historical price patterns and trader sentiment.

Indicators such as the Relative Strength Index (RSI) and the 50-Day Exponential Moving Average (EMA) offer additional layers of analysis. The RSI, jumped to 65, suggests a balanced field with slight signs of oversold conditions, leaving room for potential shifts in either direction. On the other hand, the 50-Day EMA, situated at $40,490, hovers just above the pivotal $40,000 mark, indicating an ongoing struggle between buyers and sellers.

Traders and investors are also paying close attention to trading volumes and price patterns to gauge market sentiment and potential price movements. High trading volumes accompanied by bearish price patterns could signal a shift towards a downtrend, while low volumes coupled with bullish patterns may indicate a potential uptrend.

Market Trends and Shifting Investor Sentiment:

Current market trends provide valuable insights into shifting investor sentiment and preferences within the crypto sphere. Chinese investors, for instance, are increasingly turning to digital assets like Bitcoin amidst economic uncertainties and regulatory restrictions in their home country. This trend underscores Bitcoin's perceived status as a safe-haven asset during times of economic turbulence.

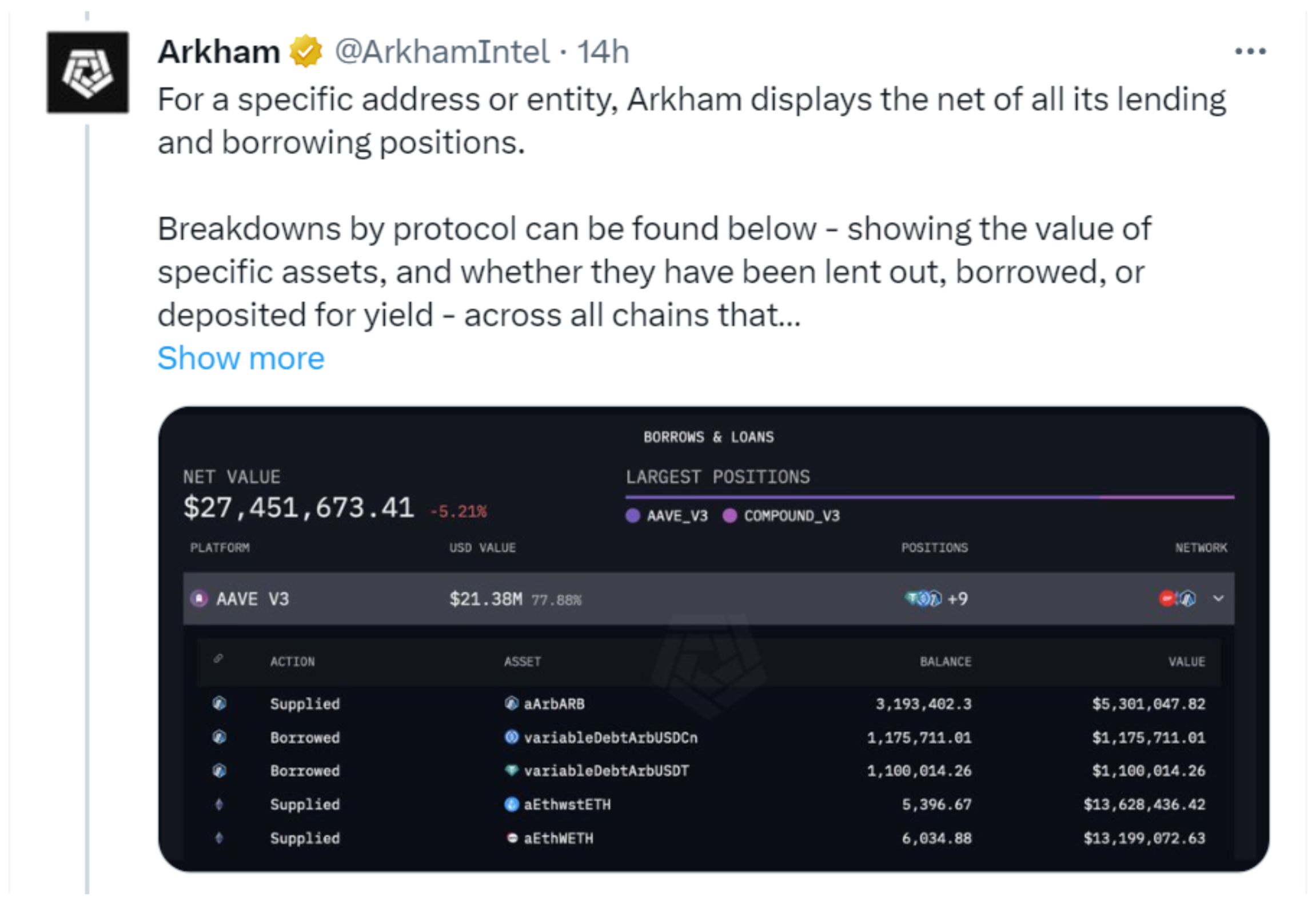

Moreover, initiatives aimed at enhancing market transparency, such as Arkham's disclosure of on-chain data for Bitcoin ETFs, contribute significantly to fostering investor confidence and facilitating informed decision-making. As the crypto market continues to evolve, investors and traders must stay attuned to market trends and sentiment shifts to capitalise on emerging opportunities and mitigate risks effectively.

Navigating the Dynamic Crypto Landscape:

In conclusion, navigating the dynamic landscape of the crypto market requires a comprehensive understanding of regulatory trends, market dynamics, and technical analysis. Regulatory clarity and compliance are essential for fostering investor confidence and ensuring the long-term sustainability of the crypto market. By staying informed and proactive, participants can effectively navigate the nuances of the crypto landscape and position themselves for success in this dynamic ecosystem.

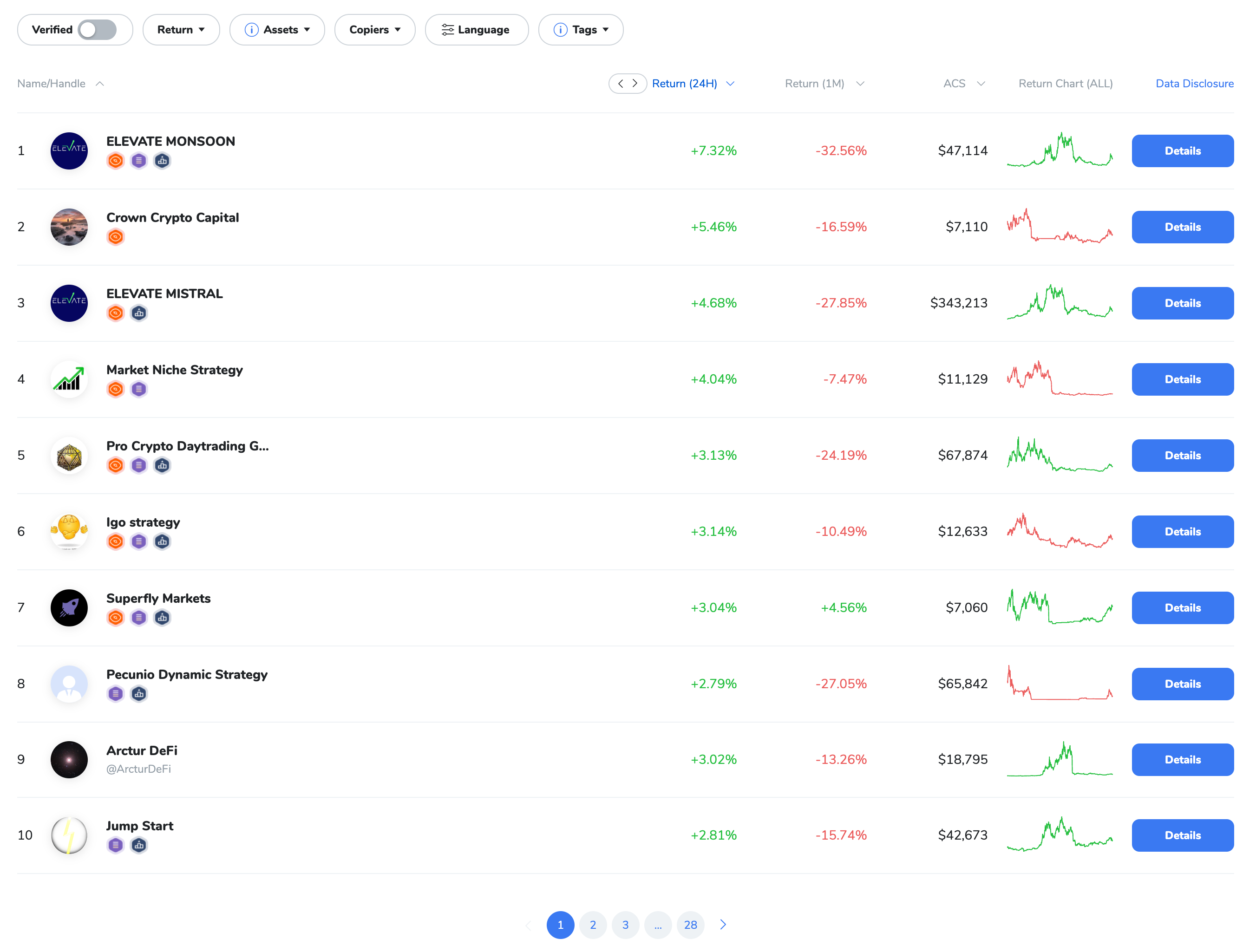

Top 10 Crypto Strategies by 24-hour Return