Crypto Weekly Wrap: 5th January 2024

Battle for Dominance: Bitcoin ETFs and Management Fees

Trillion-dollar asset managers are on the brink of obtaining approval for their Bitcoin ETFs, sparking fierce competition for market share. A pivotal factor in this race is the management fees, representing the annual cost for handling the BTC backing clients' shares. Despite many revealing their fee structures, major players like BlackRock and Grayscale are keeping their rates undisclosed, intensifying the mystery surrounding the unfolding saga.

The competition among Bitcoin ETF sponsors intensifies, with a focus on sponsor fees as a crucial battleground. Fidelity stands out with the lowest sponsor fee at 0.39%, while others like Ark Invest and Valkyrie propose fees of 0.8% and 0.80%, respectively. Galaxy and Invesco present an even more enticing offer with a standard sponsor fee of 0.59% and a promise of zero fees for the first six months of activity and on the initial $5 billion in assets. This fierce competition underscores the significance of sponsor fees in attracting initial capital in the race to become the leading U.S. fund for gaining spot Bitcoin exposure. All eyes are on BlackRock, with predictions suggesting a fee target of 0.47%, emphasising the potential impact on the market depending on their pricing strategy.

Federal Reserve Signals Potential Interest Rate Cuts in 2024

The Federal Reserve's December meeting minutes reveal a consensus among officials that interest rates may have peaked, considering recent declines in inflation. While policymakers maintain optimism about inflation trends, they acknowledge the potential need for rate reductions in 2024. The decision to hold rates steady at 5.25% to 5.5% in December marked the highest level since 2001. Projections hint at at least three quarter-point rate cuts in 2024, with additional reductions planned for 2025 and 2026. The uncertainty surrounding the timing of these cuts highlights the challenges in navigating the economic landscape.

Arbitrum Token Surges: A Force in Crypto Ecosystem Plays

Arbitrum's ARB token has set a record high, nearing $2, while the total value locked (TVL) on the Arbitrum network surpasses $2.5 billion. This surge, coupled with increased on-chain volumes, indicates a growing interest in the Arbitrum ecosystem. Notably, decentralised exchanges like GMX and Gains Network have seen heightened activity due to token incentives, contributing to positive sentiment for ARB tokens. Data shows a substantial increase in TVL on Arbitrum-based applications since October, signalling a trend of net inflows.

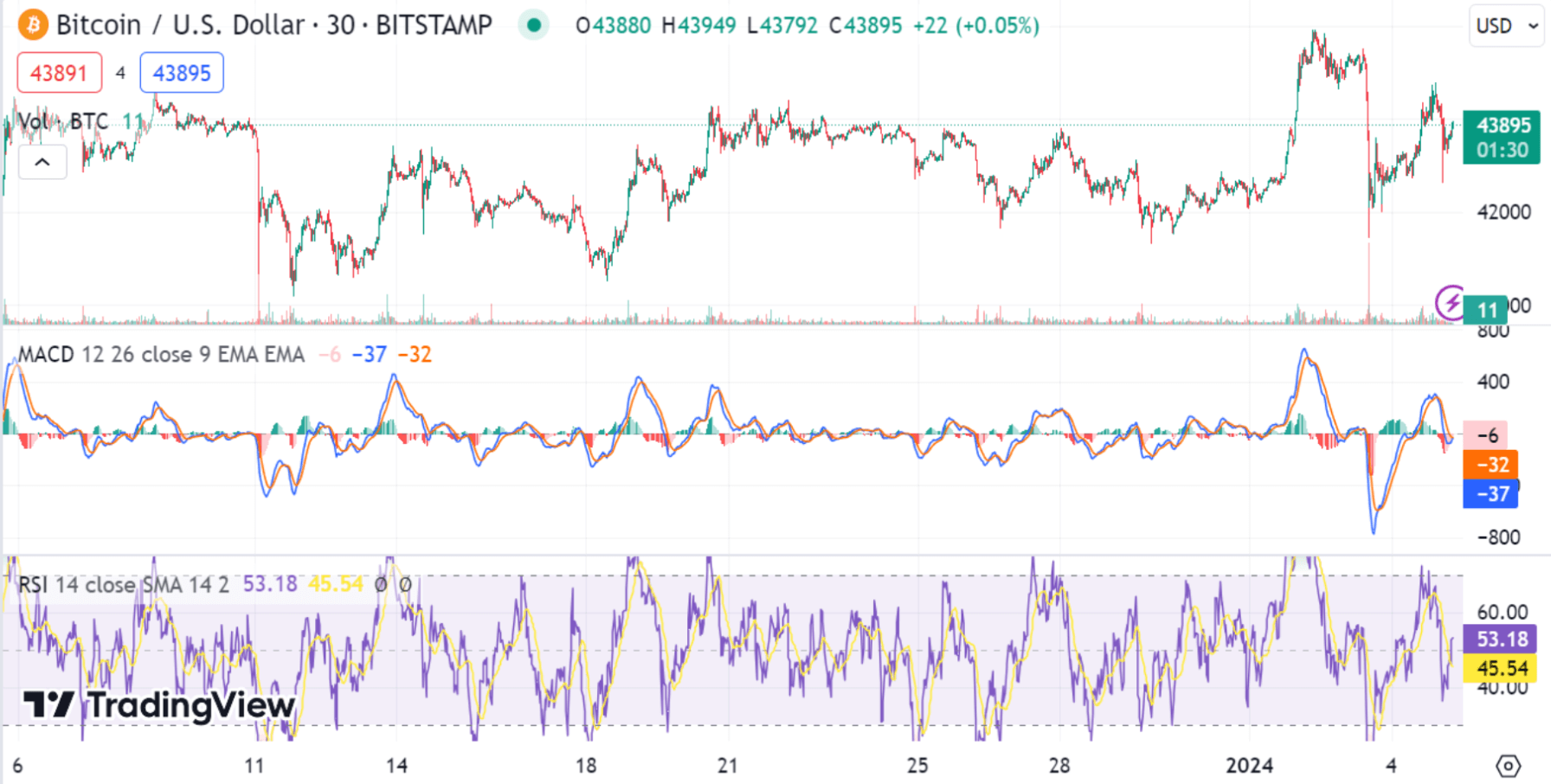

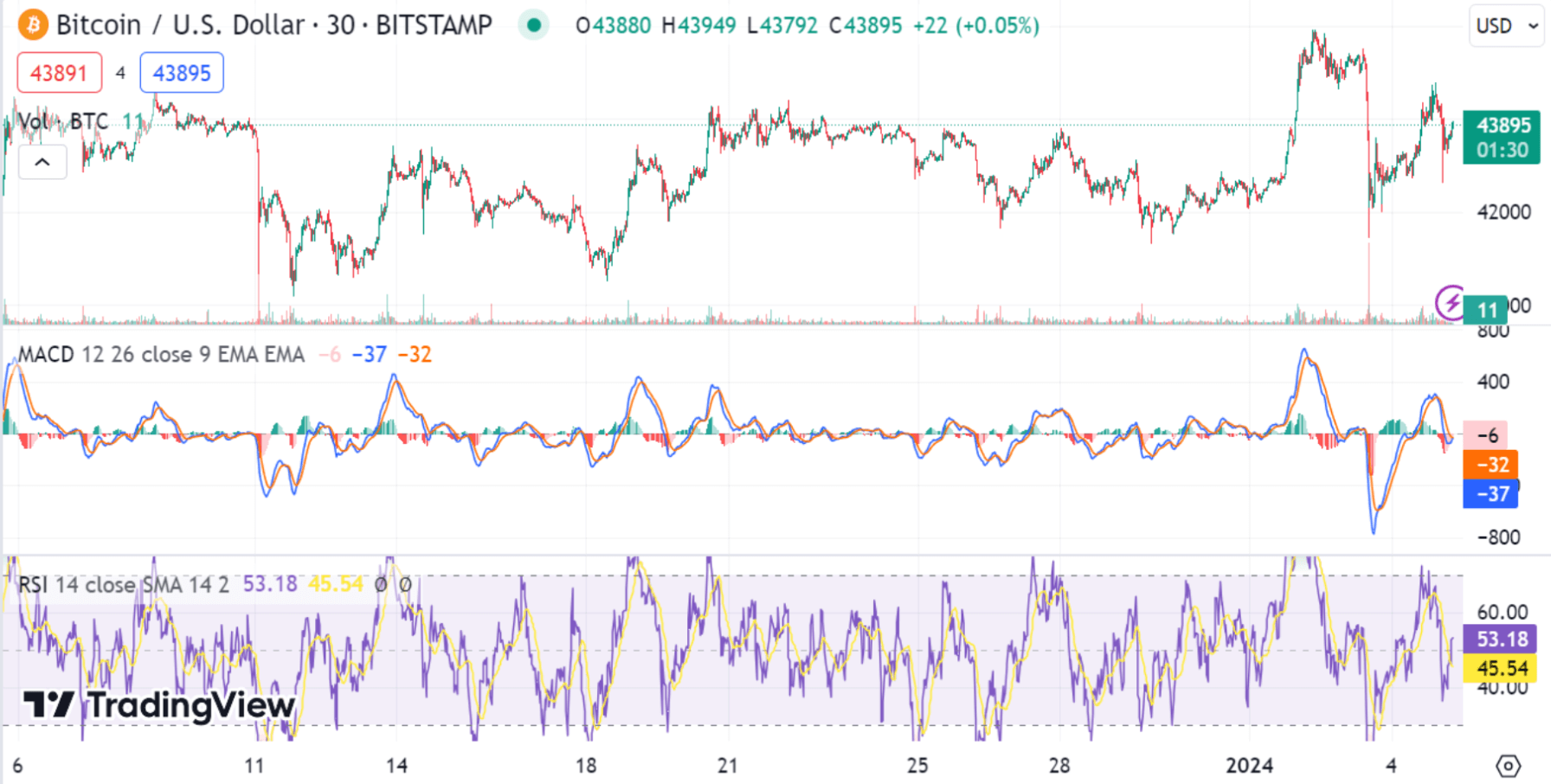

Bitcoin Analysis: Navigating Market Turbulence

As Bitcoin commemorates its 15th anniversary, the cryptocurrency faces a complex and challenging market terrain, marked by a notable 6,7% price fluctuation. The recent fluctuations in the price range, oscillating between $41,636 and $45,822, have raised concerns among investors and traders. With a market capitalization of $832 billion and a trading volume of approximately $35.96 billion in the past days, Bitcoin is undergoing a critical phase that demands a meticulous technical analysis.

The recent market movements reveal a tug-of-war between bullish and bearish forces. The cryptocurrency's price has experienced significant volatility, creating a broad range for traders to navigate. The daily chart unfolds a dramatic narrative, showcasing a substantial uptrend followed by a sudden and precipitous decline, but signs of recovery are already showing up. This decline is signalling robust selling pressure in the market.

Various technical indicators provide a nuanced view of Bitcoin's current status. While the momentum and moving average convergence/divergence (MACD) level indicate a bearish sentiment, suggesting ongoing negative market action, there's a contrasting bullish signal from the exponential and simple moving averages, especially over longer periods (50, 100, and 200 days).

A detailed examination of oscillators, including the relative strength index (RSI), Stochastic, commodity channel index (CCI), average directional index, and awesome oscillator, reveals a somewhat neutral stance. Despite the bearish signals from certain indicators, others suggest a neutral market sentiment. The RSI, for instance, does not lean decisively towards either oversold or overbought conditions.

Zooming into the daily chart, we witness a consolidation phase preceding the recent sell-off. This consolidation phase can be interpreted as an accumulation period before a significant market move. The transition from a robust bullish trend to prominent bearish flags raises concerns and indicates a potential reversal. Traders are on the lookout for exit points, particularly as the bearish signals gain prominence.

Despite the recent downturns and market volatility, the longer-term moving averages and certain oscillators still suggest an underlying bullish sentiment. If the market can leverage the current consolidation phase as a springboard, coupled with significant historical support levels holding firm, there remains potential for an upward trajectory. As Bitcoin celebrates its 15th anniversary, the innovative spirit and growing adoption could catalyse a resurgence, especially if external factors like ETF approvals turn favourable.

Market Dynamics

In conclusion, the cryptocurrency market is witnessing a convergence of significant developments, from the heated competition among Bitcoin ETF sponsors to potential interest rate cuts signalled by the Federal Reserve. The soaring value of Arbitrum tokens reflects a growing interest in decentralised finance, while Bitcoin's technical analysis underscores the complexities of navigating market turbulence. As market dynamics evolve, investors and traders must stay vigilant, considering both fundamental factors and technical indicators to make informed decisions in this dynamic and rapidly changing landscape.