Crypto Weekly Wrap: 1st March 2024

Bitcoin Miner Sell-Off and Market Dynamics:

Bitcoin miners have been actively reducing their inventories amidst a bullish market sentiment. Data from Glassnode indicates a decline of 8,426 BTC (approximately $530 million) in the BTC holdings of miner wallets since the beginning of the year, bringing the total to 1,812,482 BTC. This trend commenced in the second half of October when miners possessed over 1.83 million BTC. Analysts attribute this sell-off to the anticipation of the impending halving of miners' rewards and the ongoing dry season in China, which affects mining operations. The reduction in miner-held BTC inventories reflects their strategy to capitalise on the current market momentum.

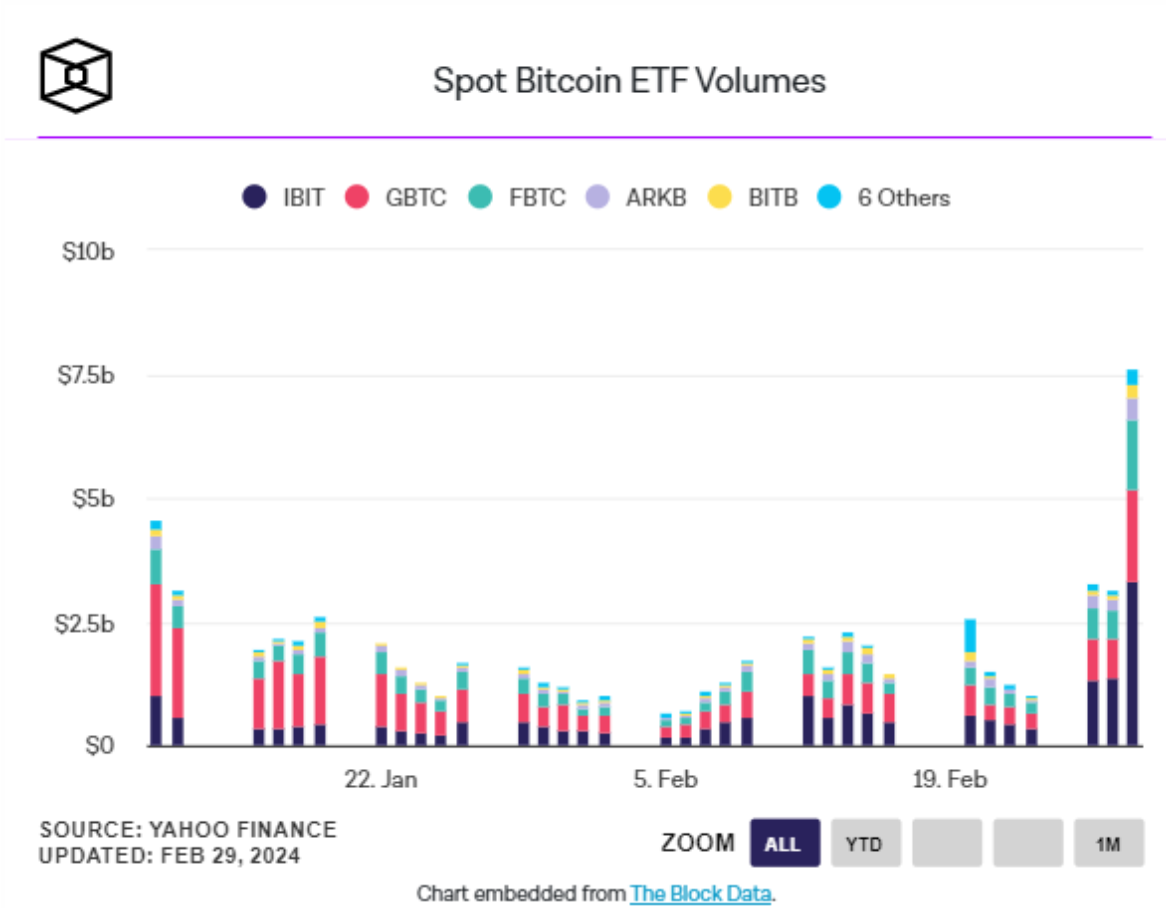

Morgan Stanley's Potential Entry into Spot Bitcoin ETFs:

Morgan Stanley, a prominent financial institution, is reportedly evaluating the possibility of offering spot Bitcoin ETFs to its clientele. Following the U.S. Securities and Exchange Commission's approval of 11 spot Bitcoin ETFs on January 10, significant capital inflows have been witnessed in these products. These ETFs provide investors with exposure to Bitcoin's price movements without requiring direct ownership of the cryptocurrency. The potential entry of major brokerage platforms like Merrill Lynch and Wells Fargo into the ETF market could amplify market liquidity and further legitimize Bitcoin as an investment asset class.

Sam Bankman-Fried's Legal Battle and Its Implications:

Sam Bankman-Fried, convicted on seven fraud and conspiracy charges, has petitioned the court for a "just" sentence ranging from 63 to 78 months, opposing the recommended 100-year prison term. Bankman-Fried's defence emphasises his status as a first-time, non-violent offender and highlights his charitable contributions. The outcome of this legal battle could have broader implications for regulatory scrutiny within the cryptocurrency industry, particularly regarding the accountability of industry participants and the potential repercussions for illicit activities.

Coinbase's Account Balance Issues and Ethereum Staking Program Expansion:

Coinbase, a leading cryptocurrency exchange, is investigating reports of users experiencing zero balances in their accounts during Bitcoin's recent rally. Assuring users of the safety of their funds, Coinbase is actively addressing these issues to ensure a seamless trading experience. Additionally, Coinbase has expanded its Ethereum staking program to include Nethermind and Erigon, diversifying the execution layer beyond the Geth Ethereum client software. This expansion aims to enhance the efficiency and reliability of Ethereum staking, following a recent bug that affected a significant portion of Ethereum validators.

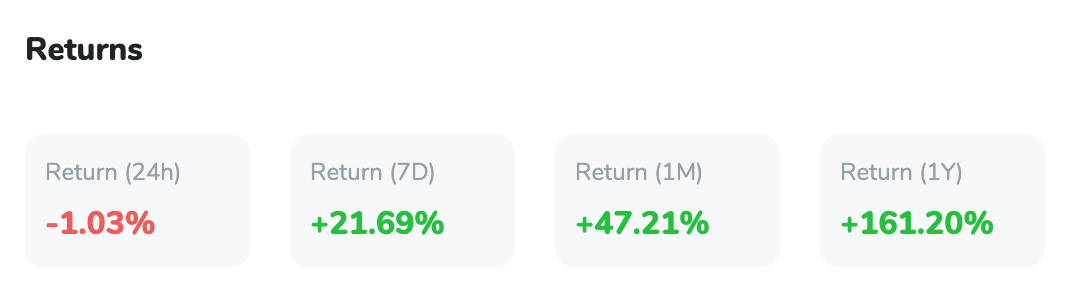

Bitcoin Price Volatility Returns Amidst Bullish Momentum:

Bitcoin's price has experienced notable volatility in tandem with its upward trajectory. Currently trading at $61,576, Bitcoin saw a 20.05% surge in the last week, reaching highs near $64,000. However, this surge in price has coincided with a spike in realised volatility, reaching an annualised rate of 46%, up from 30% in just a week. The derivatives market has witnessed heightened activity, with $374 billion worth of contracts traded in the past 24 hours, marking the highest single-day tally since November 2021. The demand for leveraged products suggests an increase in risk appetite among traders, potentially leading to sudden price turbulence driven by liquidations.

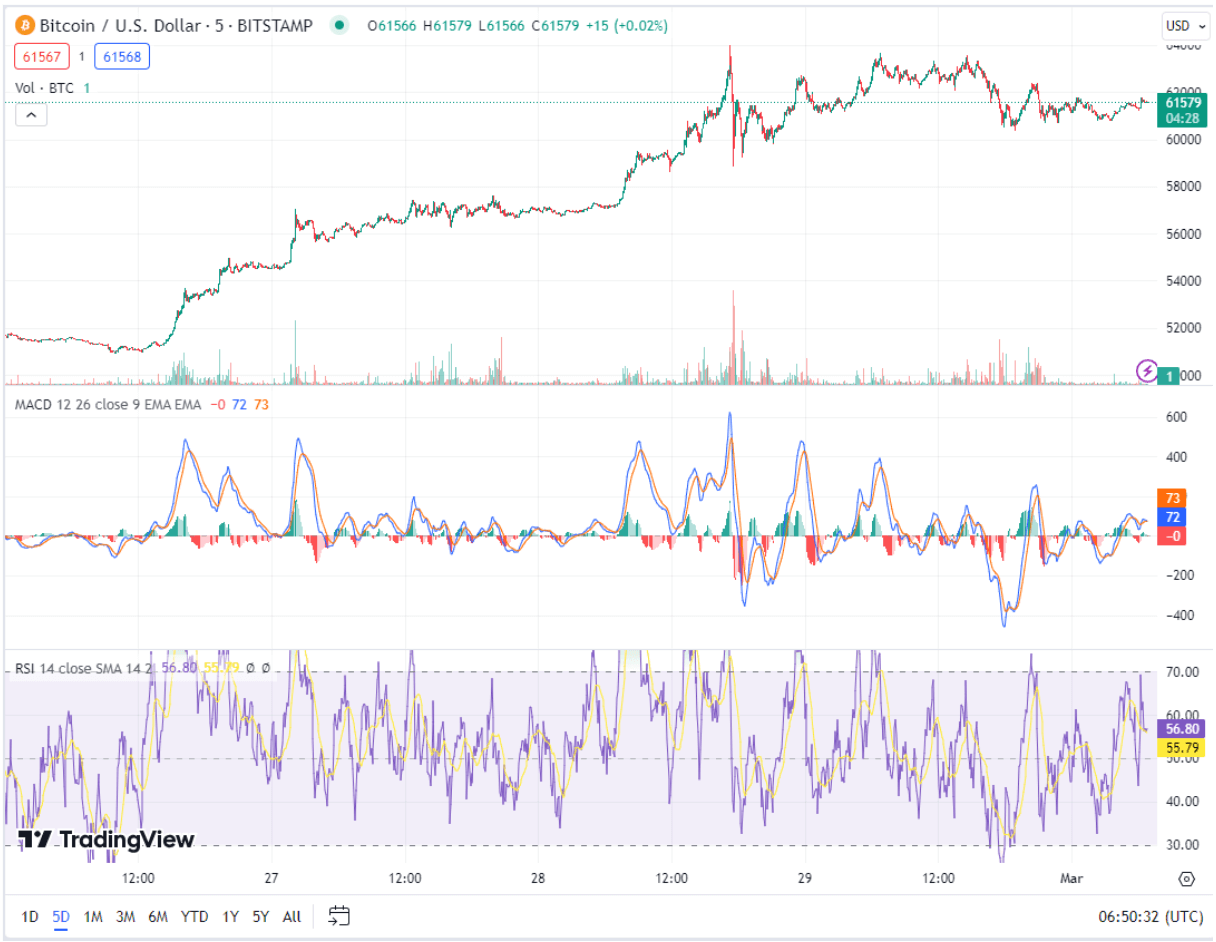

Bitcoin Technical Analysis:

On February 29, Bitcoin (BTC/USD) underwent a slight bearish correction, trading with a 2.86% decrease over the last 24 hours. Bitcoin faces its first major resistance at $63,930, followed by a barrier at $66,520. Conversely, support levels are established at $58,980 and $56,100, providing potential fallback positions in case of a downturn.

Source: TradingView

A noteworthy observation is Bitcoin's struggle near the $62,500 resistance level, accompanied by the formation of a Doji candlestick pattern, signalling potential selling pressure. Additionally, the Relative Strength Index (RSI) dropped to the value of 57 after a large increase, indicating a neutral condition. Furthermore, the 50-day Exponential Moving Average (EMA) at $55,130 serves as a historical support baseline.

Given these technical indicators, Bitcoin's current trajectory appears precarious. Its immediate future depends on whether it can breach the $61,500 threshold with conviction or succumb to selling pressures. While exhibiting a bullish front above $61,500, the prevailing sentiment could swiftly shift to bearish below this critical juncture, suggesting potential volatility in the near term. Traders should closely monitor these key levels and indicators to navigate Bitcoin's price action effectively.