The Crypto Bull Run of 2024: What Does it Mean for Bitcoin and the Market?

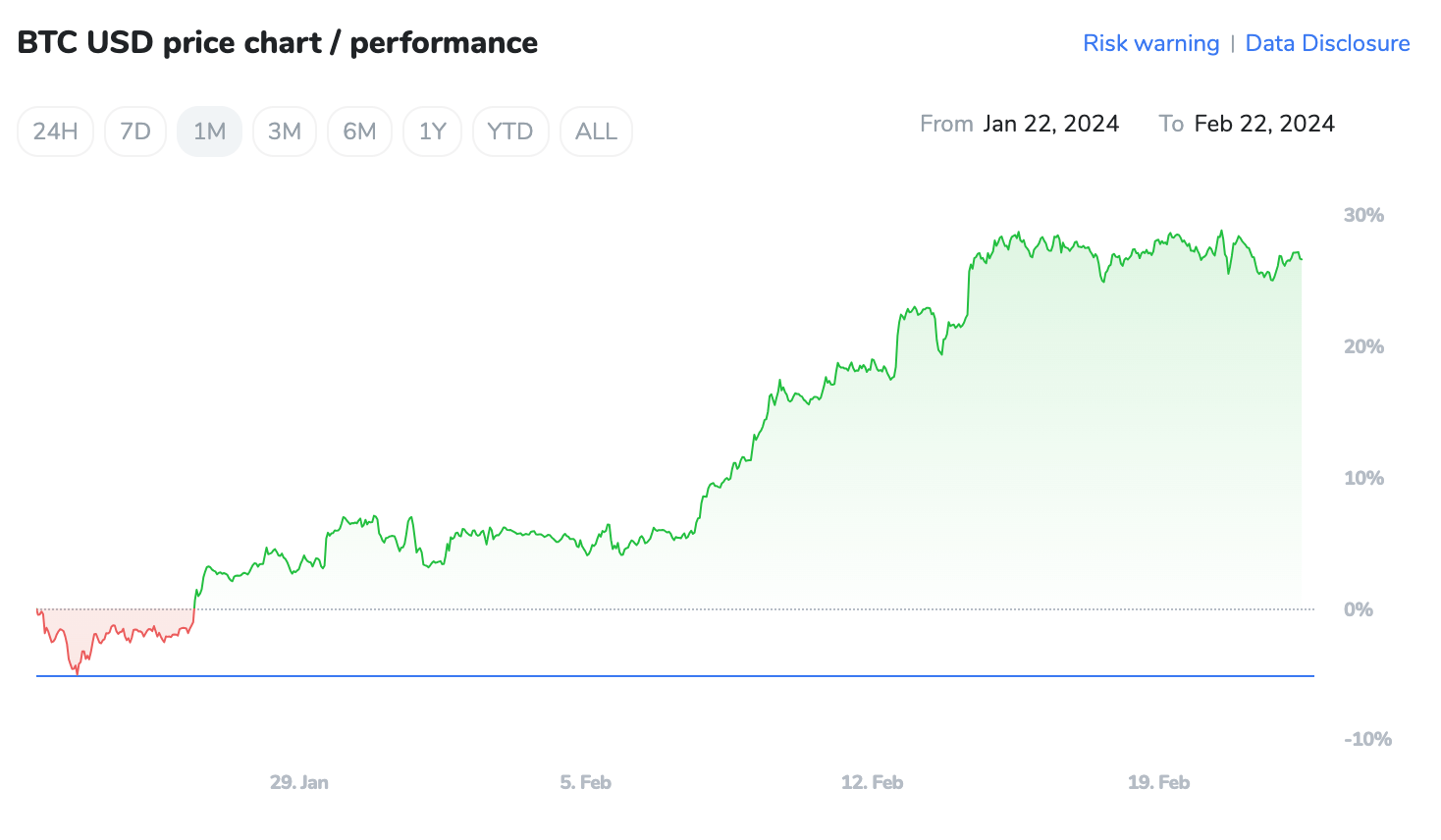

In February, Bitcoin (BTC) surged past the $50,000 mark, marking a significant milestone in the crypto market. This surge has sparked expectations for a bullish trend in 2024, with key factors contributing to the optimistic outlook. The recent approval of BTC exchange-traded funds (ETFs) has unleashed institutional demand for the cryptocurrency, setting the stage for further growth. Additionally, the upcoming Bitcoin halving event scheduled for April 2024 is expected to tighten supply-demand conditions, potentially fuelling a BTC bull run.

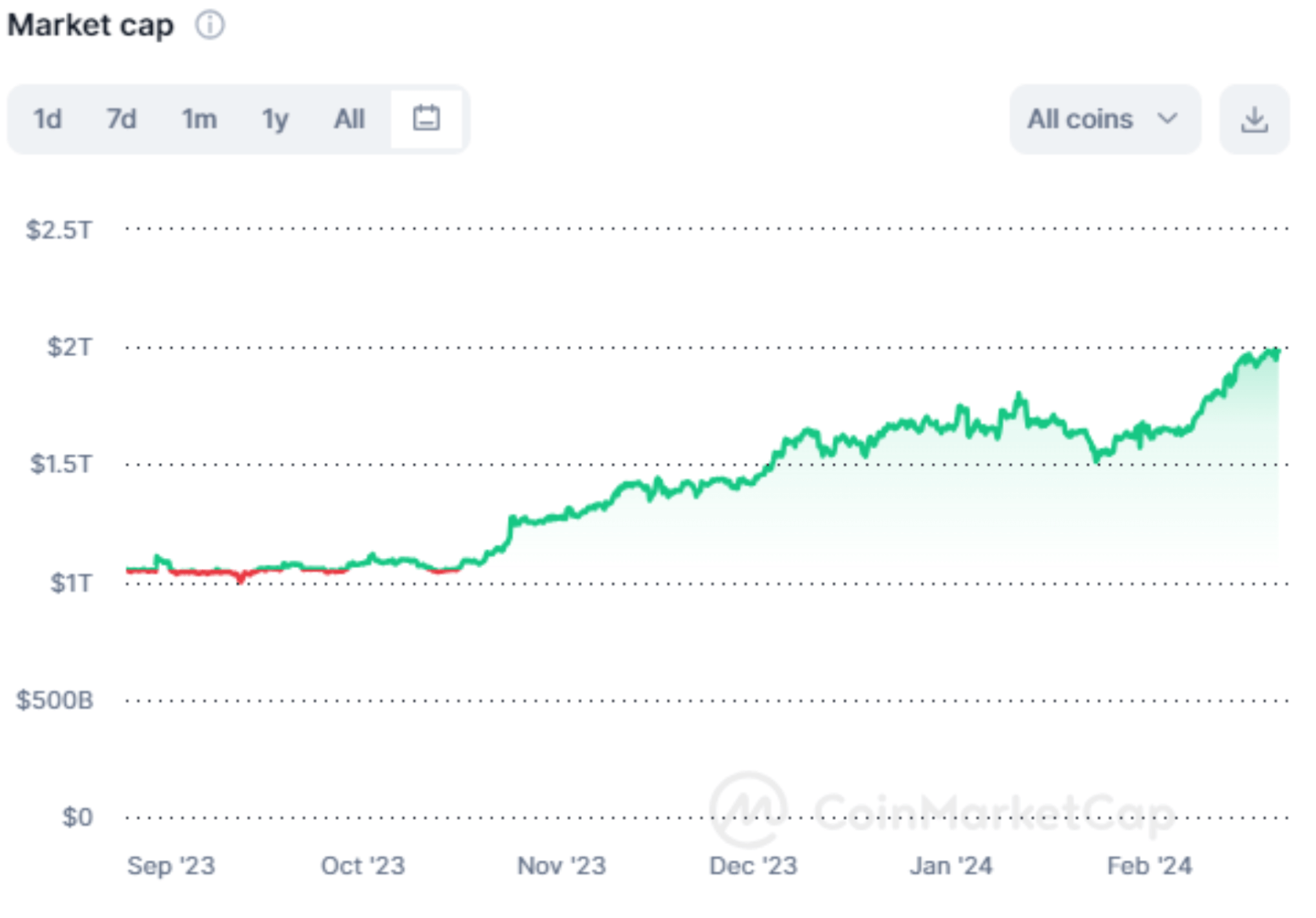

Source: CoinMarketCap

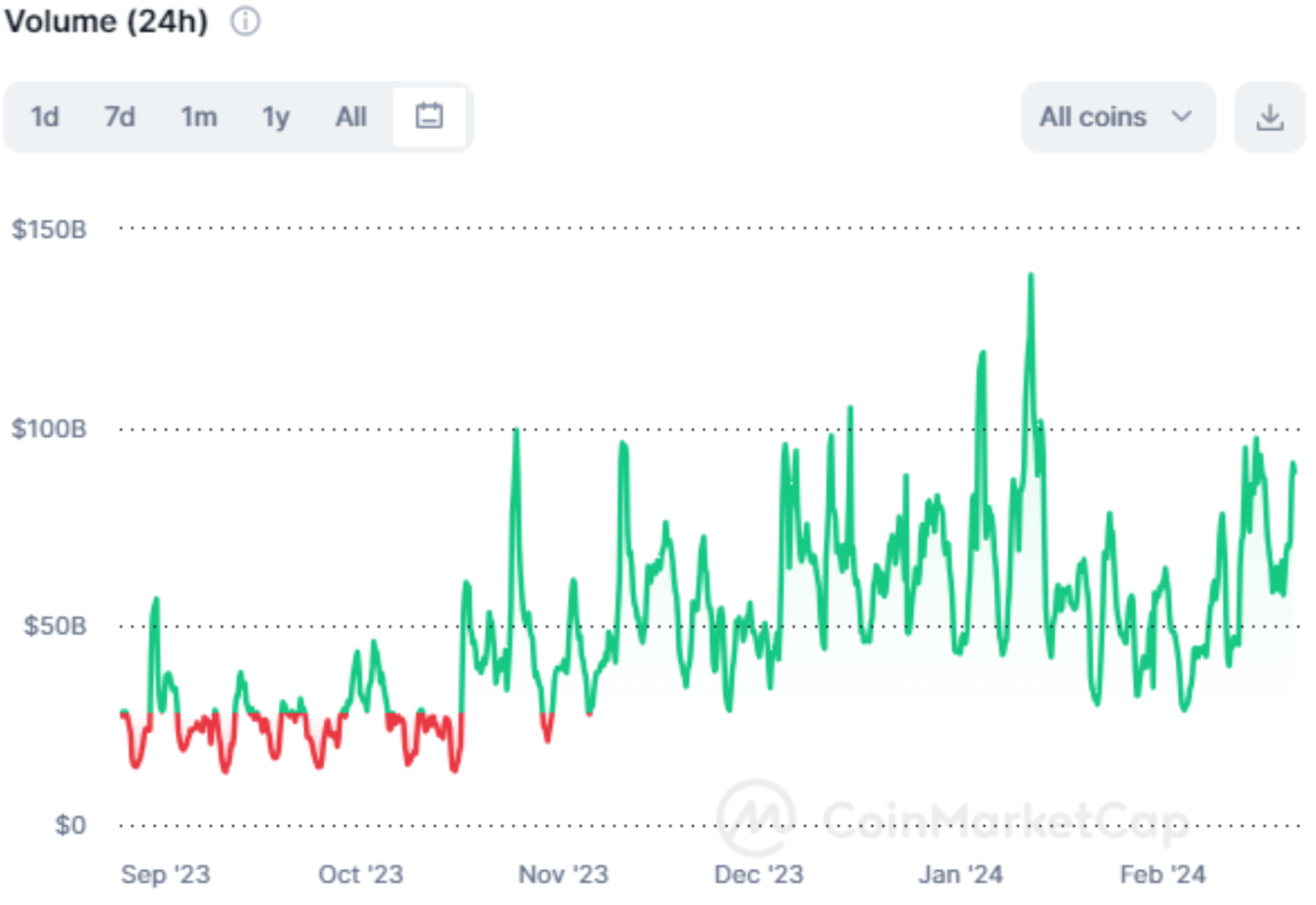

Source: CoinMarketCap

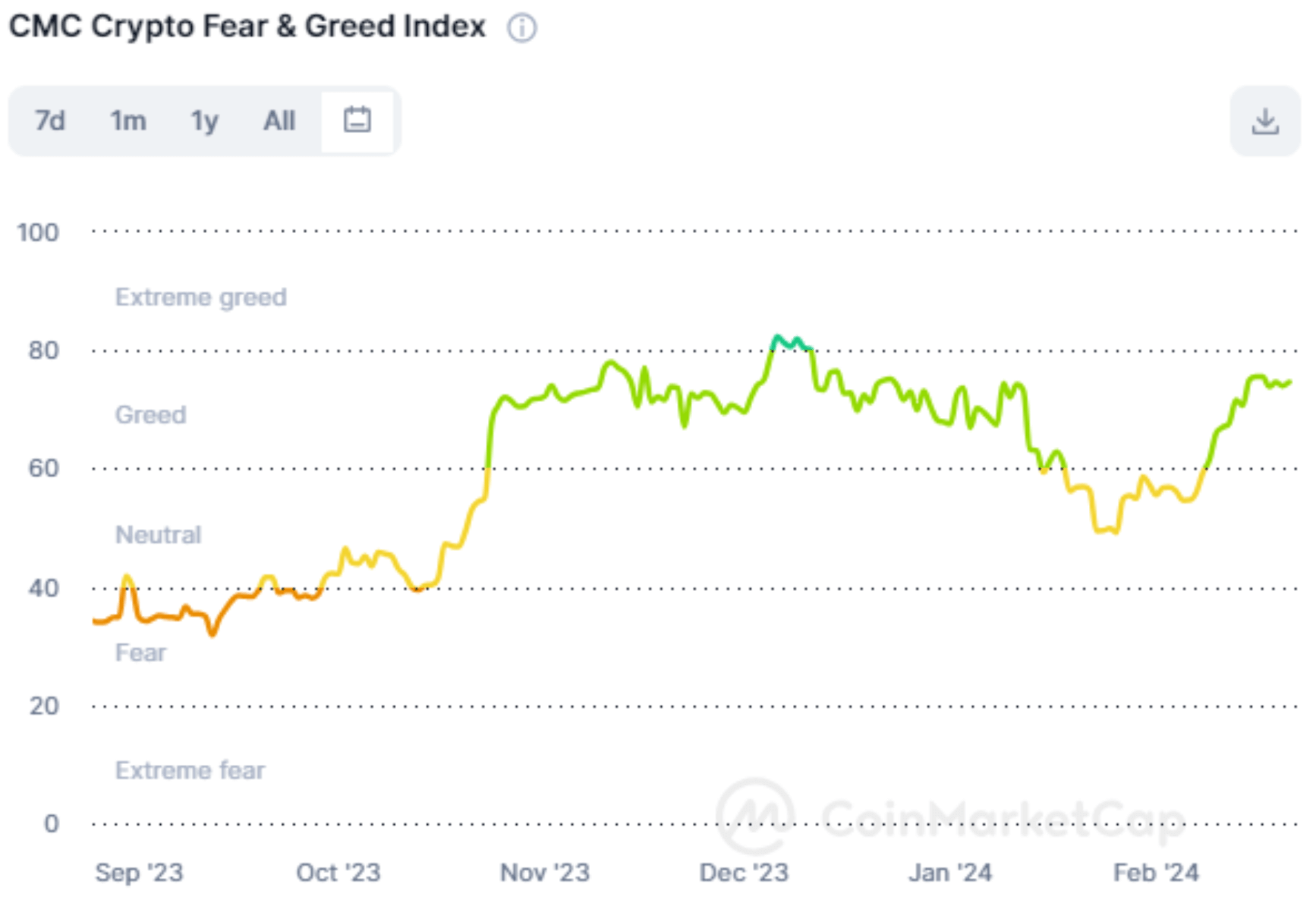

Source: CoinMarketCap

Bitcoin Halving and Supply-Demand Dynamics

The Bitcoin halving, anticipated in April 2024, will reduce the number of Bitcoins minted with each block by 50%, from 6.25 BTC to 3.125 BTC. While the immediate impact on supply may not be immediate due to Bitcoin mining operations, historical charts indicate that Bitcoin typically traded range bound for a period following previous halving events before entering a bull run. This brewing phase is characterised by adjustments in the mining community to the reduced mint supply and periodic price spikes, leading to investor FOMO.

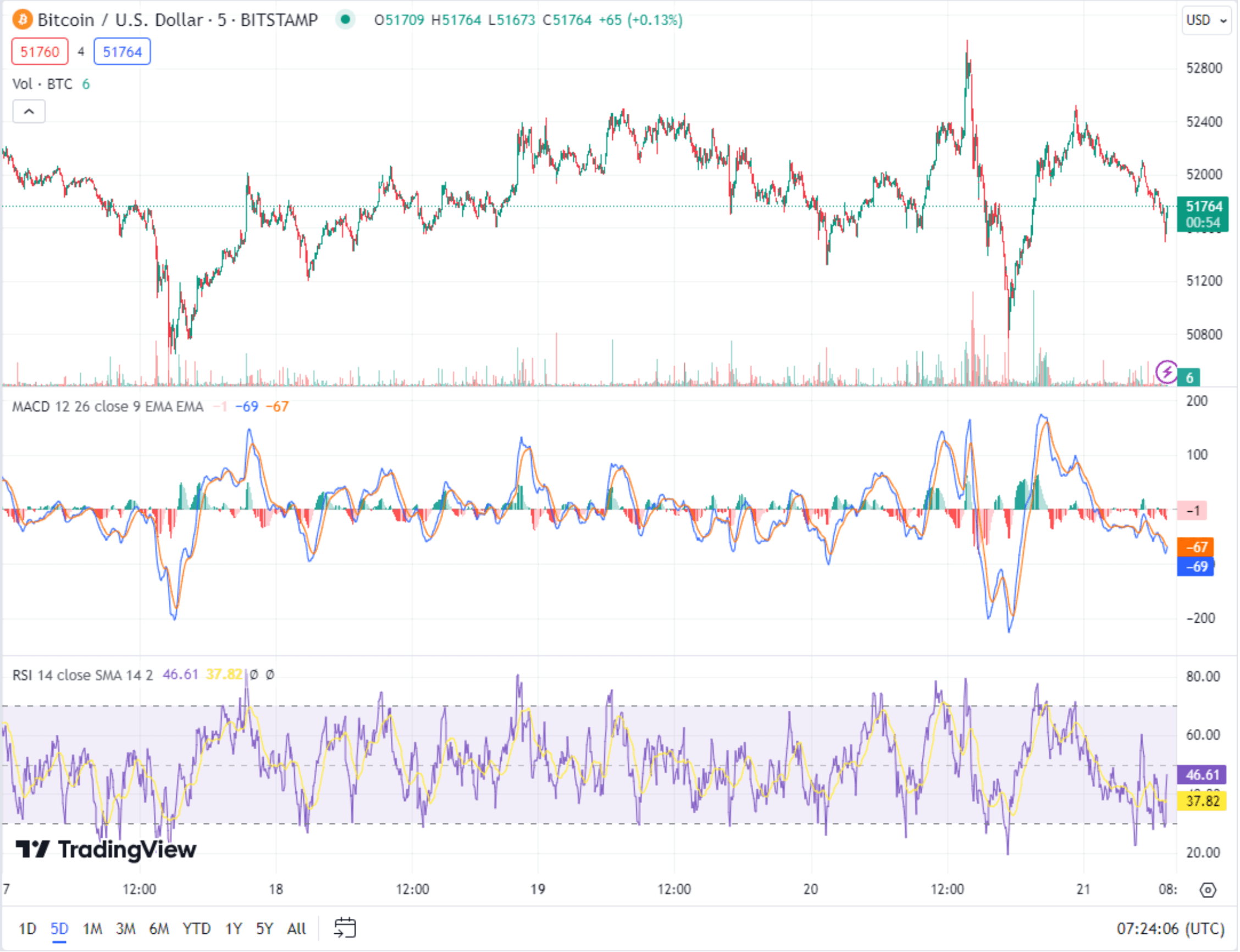

Chart created by TradingView

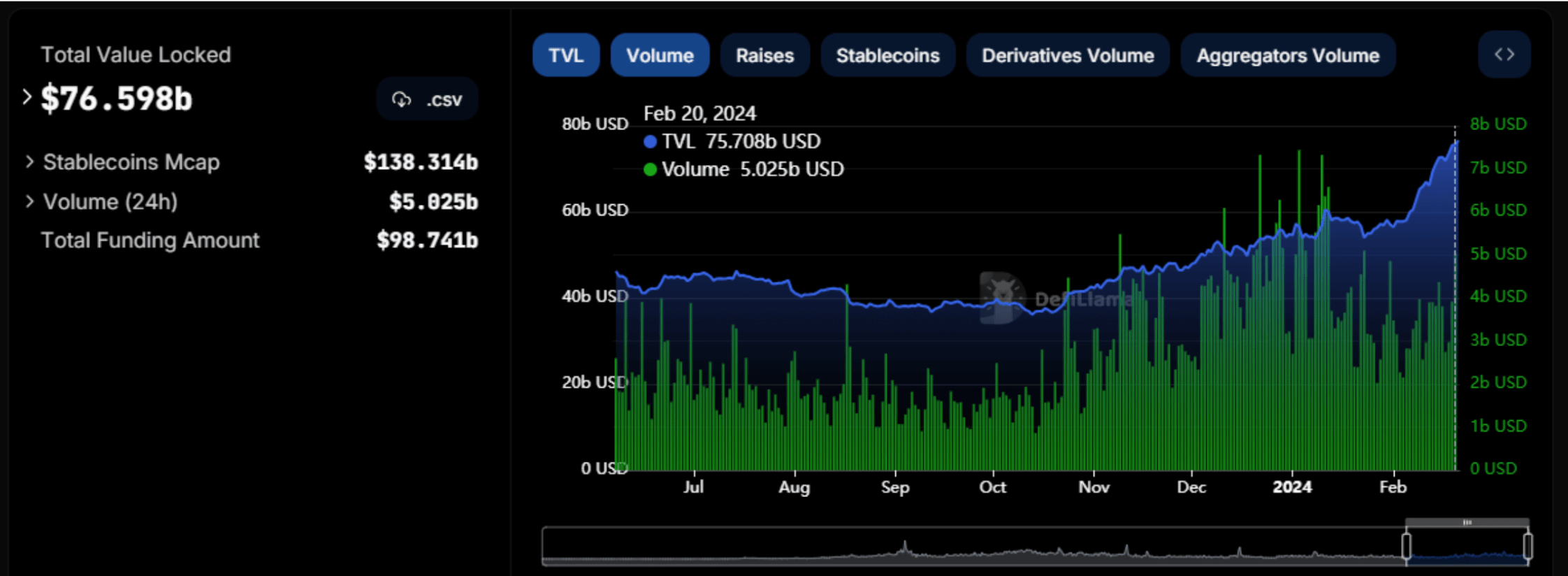

Accumulation by Investors and Institutional Inflows

Bitcoin investors are accumulating coins in anticipation of the 2024 halving event, with notable entities like Microstrategy leading the way. The firm has acquired a significant amount of BTC, indicating confidence in Bitcoin's future growth. Blockchain data suggests that wallets of all sizes are increasing their holdings, with long-term holders nearing all-time highs. Additionally, the approval of spot BTC ETFs has attracted significant institutional capital, with net inflows exceeding $2.8 billion within a month of launch. Institutional participation is expected to play a crucial role in driving Bitcoin's price higher.

Opportunities and Caution

Experts have varying perspectives on the potential outcomes of the 2024 bull run. While some anticipate a decrease in Bitcoin's annual inflation rate to less than 1%, others caution that a price increase post-halving is not guaranteed. The current crypto bull run presents unprecedented opportunities for investors, driven by factors such as the Bitcoin halving, institutional inflows, and regulatory developments like spot BTC ETF approvals. While historical patterns and market dynamics provide valuable insights, it's crucial to conduct thorough research and exercise diligence when navigating the crypto landscape. Staying informed and adapting to changing market conditions will be key to maximising investment opportunities in 2024 and beyond.