Crypto Weekly Wrap: 24th November 2023

Binance Faces Landmark $4.3 Billion Settlement and Leadership Change

Binance is criminally charged with breaking sanctions and money-transmitting laws. The exchange agrees to a historic $4.3 billion settlement, marking one of the largest penalties obtained by the U.S. from a corporate defendant. Founder Changpeng Zhao (CZ) pleads guilty, agreeing to pay a $50 million fine and step down as CEO. Richard Teng, a former Abu Dhabi regulator, is set to replace CZ. The charges against Binance include failures in maintaining an anti-money laundering program, operating an unlicensed money-transmitting business, and violating sanctions laws. This landmark case signals increased regulatory scrutiny in the crypto industry, prompting a significant net outflow of over $950 million within 24 hours and raising questions about Binance's future operations in the U.S. market.

Ethereum Layer-2 Project Blast Sparks Controversy and Excitement

In the Ethereum ecosystem, the upcoming Layer-2 blockchain, Blast, scheduled for launch in March, has ignited both excitement and controversy. Despite scepticism from some corners of the crypto community, Blast has attracted over $225 million in staked ether and stablecoins within a few days. The protocol, led by the pseudonymous @PacmanBlur and backed by notable entities like Paradigm and "eGirl Capital," aims to incorporate native staking and generate yield through ether staking and real-world assets. However, questions arise about the invite mechanism, with some likening it to a pyramid scheme. As the Blast project unfolds, it adds another layer of intrigue to Ethereum's ongoing efforts to address scalability challenges.

Uniswap's UNI Token Surges Amid Governance Proposal

Uniswap's governance token, UNI, has taken the spotlight with a remarkable rally of over 13% within the last 24 hours, outpacing its peers. The surge in UNI's value lacks a clear catalyst, but market analysts suggest a potential connection to a proposal submitted by StableLab, a governance service provider. The proposal seeks to delegate a substantial 10 million UNI from the decentralised autonomous organisation's (DAO) treasury to underrepresented delegates. As the crypto community eagerly awaits the on-chain vote on this proposal, Uniswap's positive momentum underscores the influence of governance decisions on token dynamics within decentralised exchanges.

Bitcoin: Latest developments

Bitcoin has recently surged past the $38,000 mark, demonstrating resilience amidst a complex market environment. The upward trajectory, marked by a recent 5.76% increase to $38,420, unfolds against the backdrop of thin holiday trading and a strengthening dollar. Notably, Bitcoin's positive momentum persists despite the uncertainty surrounding Vivek Ramaswamy's proposal to deregulate digital currencies, a move that has sparked concerns within the crypto community.

Market dynamics, influenced by US and Japanese holidays and a fluctuating dollar, initially favoured the greenback due to unexpected drops in unemployment benefit claims. However, Bitcoin defied the odds, experiencing positive momentum as improved market sentiment overshadowed the dollar's comeback. This divergence highlights Bitcoin's growing influence in the broader financial system.

The crypto community closely monitors Ramaswamy's proposal, which aims to significantly diminish the Securities and Exchange Commission (SEC) and liberalise the cryptocurrency industry. Despite industry concerns about sweeping deregulation, the market sentiment has surprisingly improved, possibly influenced by financial backing from prominent figures in the crypto space.

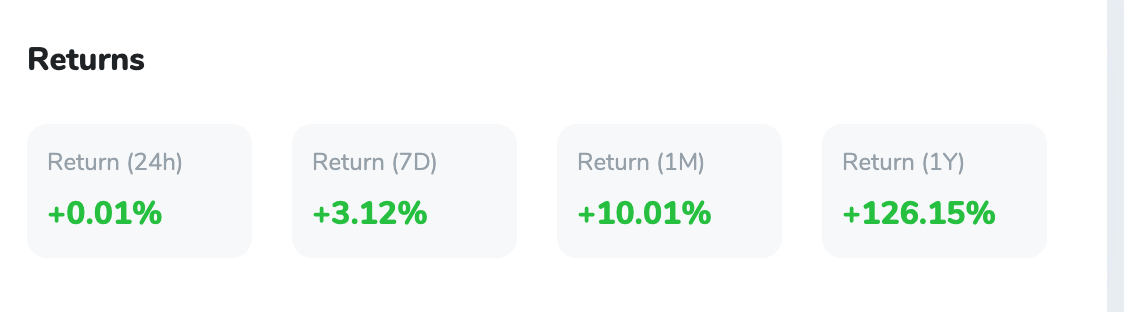

Bitcoin: Analysis

Bitcoin's recent surge to over $38,420, following Binance's settlement and amid regulatory debates, suggests a robust investor confidence. The settlement has positively impacted the broader CoinDesk Market Index (CMI), witnessing gains in other major cryptocurrencies like Ether (ETH), Solana (SOL), and Chainlink (LINK). Speculation arises that the Binance settlement might pave the way for the Securities and Exchange Commission (SEC) to approve a U.S. spot Bitcoin exchange-traded fund (ETF), contributing to the sustained positive sentiment.

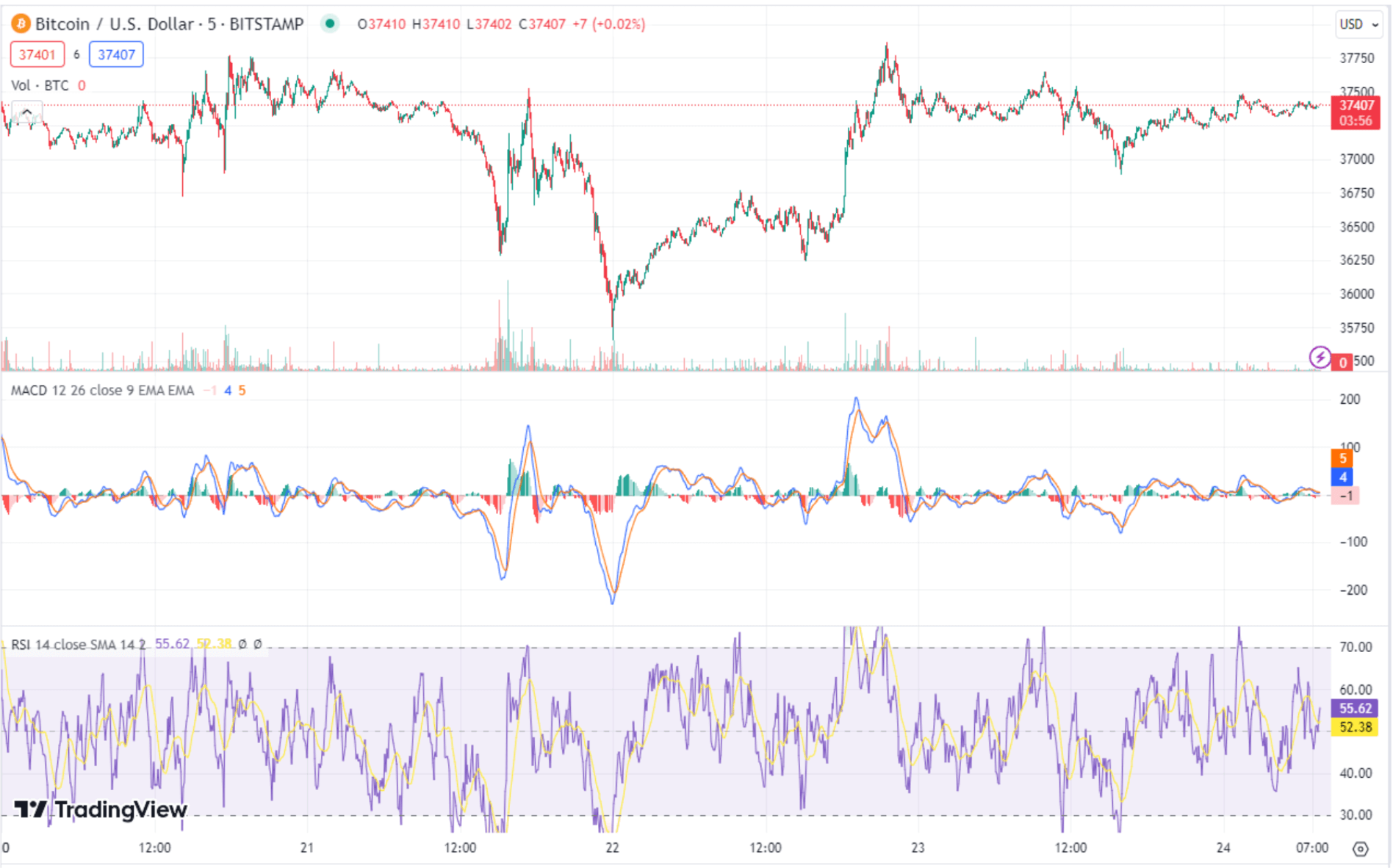

In terms of technical analysis, Bitcoin's current price of $37,388 positions it just above the key pivot point of $37,175. The immediate resistance levels at $38,040, and $38,700 indicate potential hurdles, while strong support levels at $36,035, and $35,215 provide a safety net. Technical indicators, including the Relative Strength Index (RSI) and the 50-Day Exponential Moving Average (EMA), suggest a cautiously bullish sentiment.

In conclusion, Bitcoin's resilience, positive market sentiment, and technical indicators point towards a cautiously bullish trend. Traders may consider a buying strategy if Bitcoin maintains its position above the pivot point, with a watchful eye on resistance levels for potential profit-taking opportunities. Conversely, a dip below the pivot point could signal a selling strategy. In the short term, Bitcoin is anticipated to test the resistance at $37,630, with the potential for further upward movement if it successfully navigates these levels.

Weekly Winner: SKALE (SKL) Emerges on Bitget

In response to heightened demand, SKALE (SKL) has landed on Bitget, a global cryptocurrency exchange. SKALE is a network specifically designed to enhance the scalability and efficiency of Ethereum-compatible applications, addressing the industry's ongoing challenges.

Unique Features Fueling SKALE's Rise:

Renowned for its capacity to support multiple high-speed blockchains without burdening users with transaction fees, SKALE alleviates the volatility in gas fees experienced during peak activity on the Ethereum network. This has proven particularly advantageous for developers, users, and NFT creators. SKALE's architecture empowers developers to deploy interoperable Ethereum Virtual Machine (EVM) blockchains, creating a potent blend of speed, security, and decentralisation.

The SKALE ecosystem is thriving, with projects like Gamifly, motoDEX, CryptoBlades, Untitled Platformer, 5TARS, and Strayshot contributing to its popularity, especially within the emerging GameFi sector. Notably, SKALE's modular design enables the creation of new SKALE Chains without limitations, offering the potential for infinite scalability.

Impressive November Metrics:

Recent on-chain data showcases SKALE's robust performance in November, handling over 18 million transactions, bringing its cumulative total to over 200 million. The user base has experienced significant growth, reaching over 1.3 million total users in November, up from 1 million in October.

SKALE's recent developments position it as a promising force in the blockchain space, catering to the increasing demand for scalable and efficient solutions for decentralised applications.

This is not investment advice. Previous gains do not mean future returns. Always do your own research or consult an investment advisor. Cryptocurrency investment is risky, no investment is secured.