Latest News: Chainlink (LINK) Surges Amidst Market Volatility

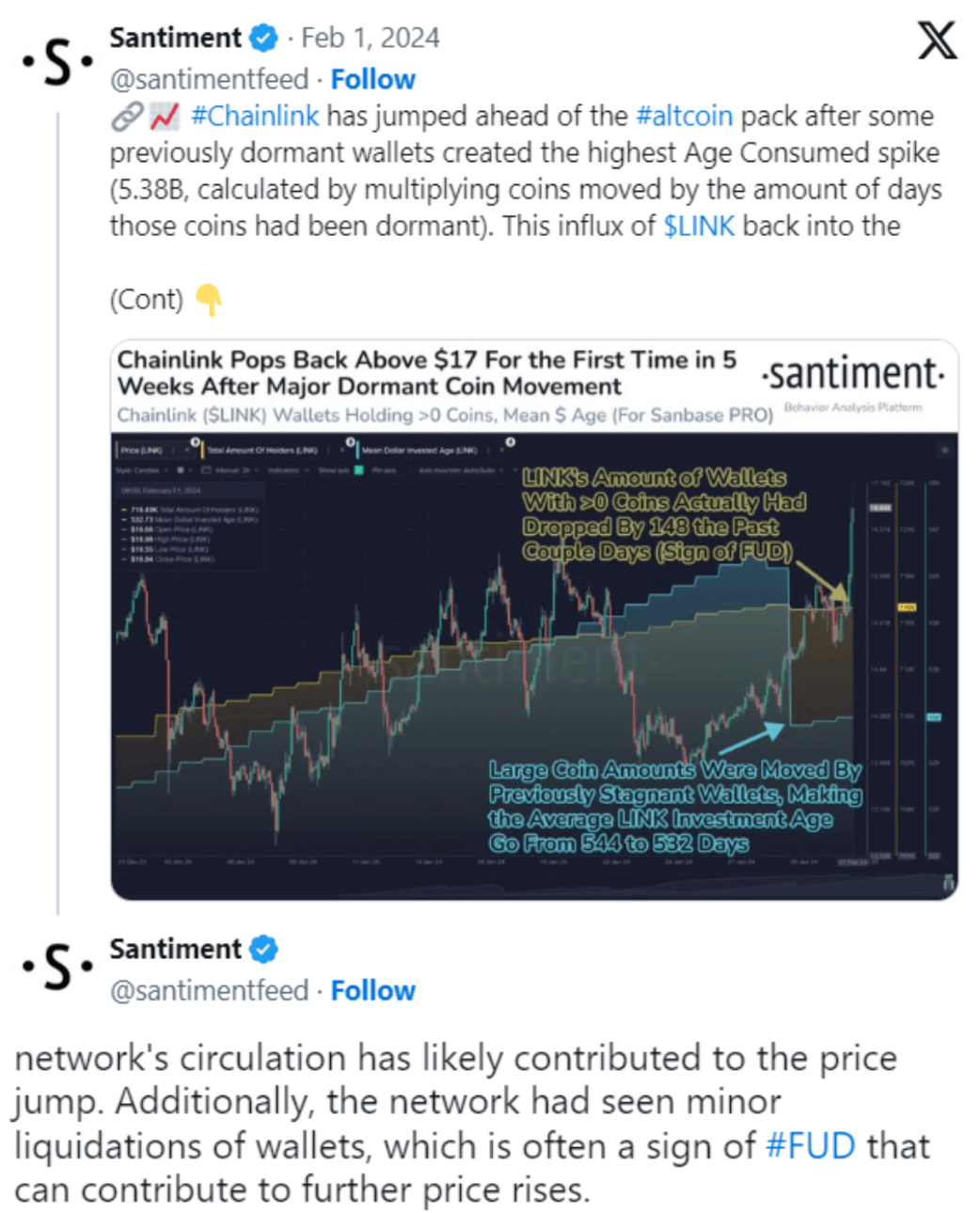

Chainlink's native token, LINK, experienced a notable surge of 16 % over the past 7 days, reaching a 22-month high. This surge comes amidst a relatively stable Bitcoin (BTC) trading around $43,000, while altcoins, including LINK, showed gains. The surge in LINK marks an end to a three-month period of consolidation, positioning it as one of the leading decentralised oracle networks in the cryptocurrency market. The surge in LINK's price reflects the growing demand for platforms that provide data, compute, and cross-chain capabilities, essential for traditional financial institutions to adopt blockchain technology and tokenized Real World Assets (RWAs) at scale.

Chainlink Price Analysis

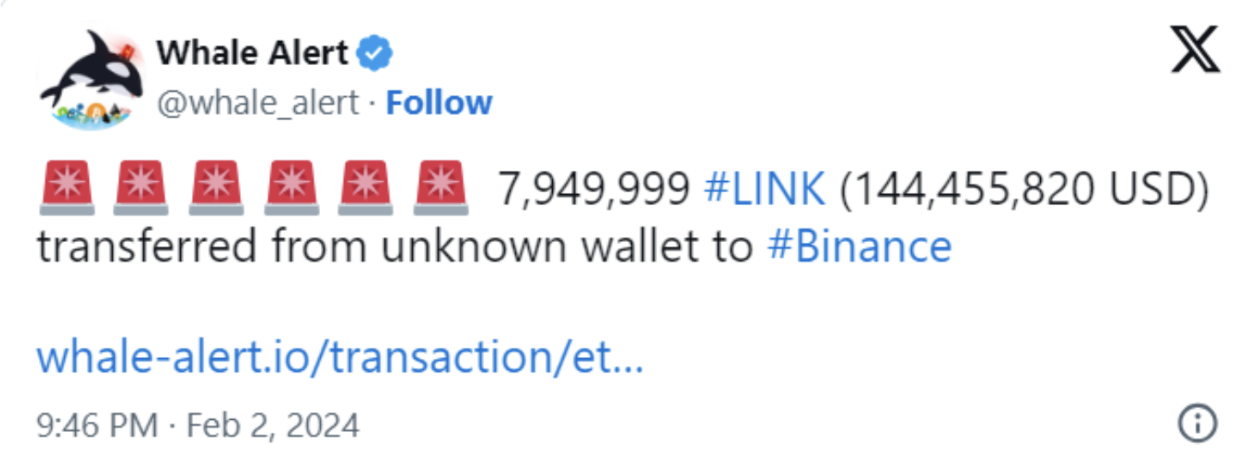

Despite a minor 3.11% drop in the past 24 hours, Chainlink's price remains bullish, sitting at $18.27. LINK has experienced significant gains recently, with a 15.76% increase in a week and a 34.01% gain in a month. Analysts foresee a potential bull market later this year, which could drive LINK's price even higher. With trading volume consistently above $1 billion, investors remain interested in LINK despite some profit-taking by whales.

Fundamentals and Partnerships: Driving Chainlink's Growth

Chainlink's recent success is attributed to its fundamental strength and strategic partnerships. As a decentralised data network, Chainlink serves multiple blockchains and facilitates various blockchain applications. Recent partnerships with Circle and Vodafone highlight Chainlink's role in facilitating cross-chain USDC transfers and applications in international trade. These developments underscore Chainlink's position as one of the fundamentally strongest platforms in the crypto market, supporting its potential to reach $30.

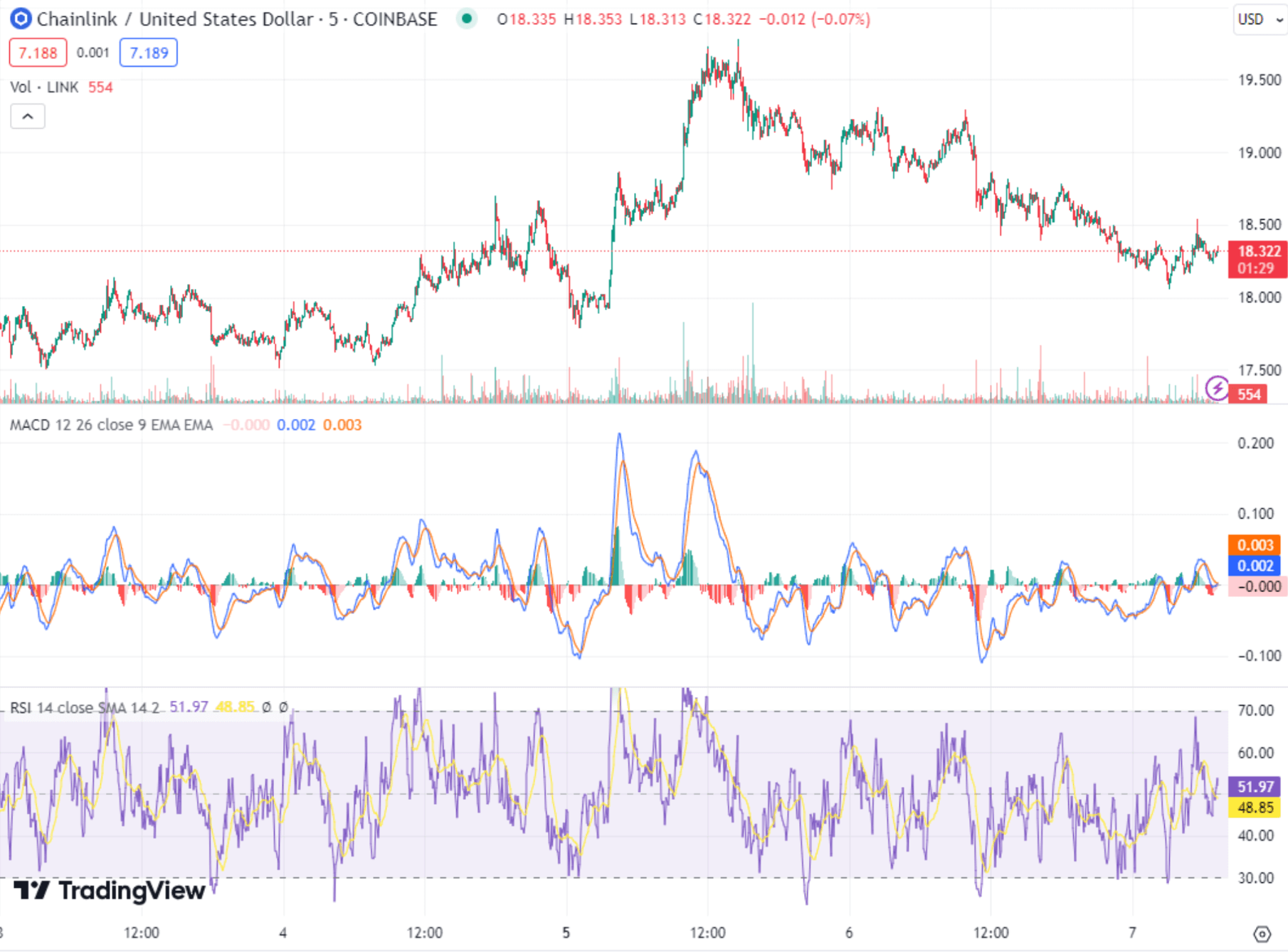

Technical Analysis of Chainlink (LINK):

Chainlink's technical analysis reveals a potential divergence between rising prices and declining momentum, suggesting a cautious approach for investors. While LINK's price surged by approximately 16% over the past week, indicators such as the relative strength index (RSI) and open interest (OI) in derivatives markets demonstrate market stability. LINK's RSI nearing 52 indicates a neutral state. Furthermore, the increase in open interest combined with positive funding rates suggests increased leverage among traders, amplifying both profits and risks of liquidation in case of market downturns. Key support and resistance levels, particularly around $18.50, will be crucial in determining LINK's future price movements. Failure to break this level decisively could lead to a downward trend towards the next support level at $14.50, while a breakthrough above $18.50 could push LINK towards its next Fibonacci resistance at $21.50.

In conclusion, Chainlink (LINK) continues to exhibit strong performance amidst market volatility, driven by its fundamental strength, strategic partnerships, and growing adoption in the crypto ecosystem. However, technical indicators suggest a cautious approach for investors, highlighting the importance of diligent risk management strategies in navigating the cryptocurrency market.

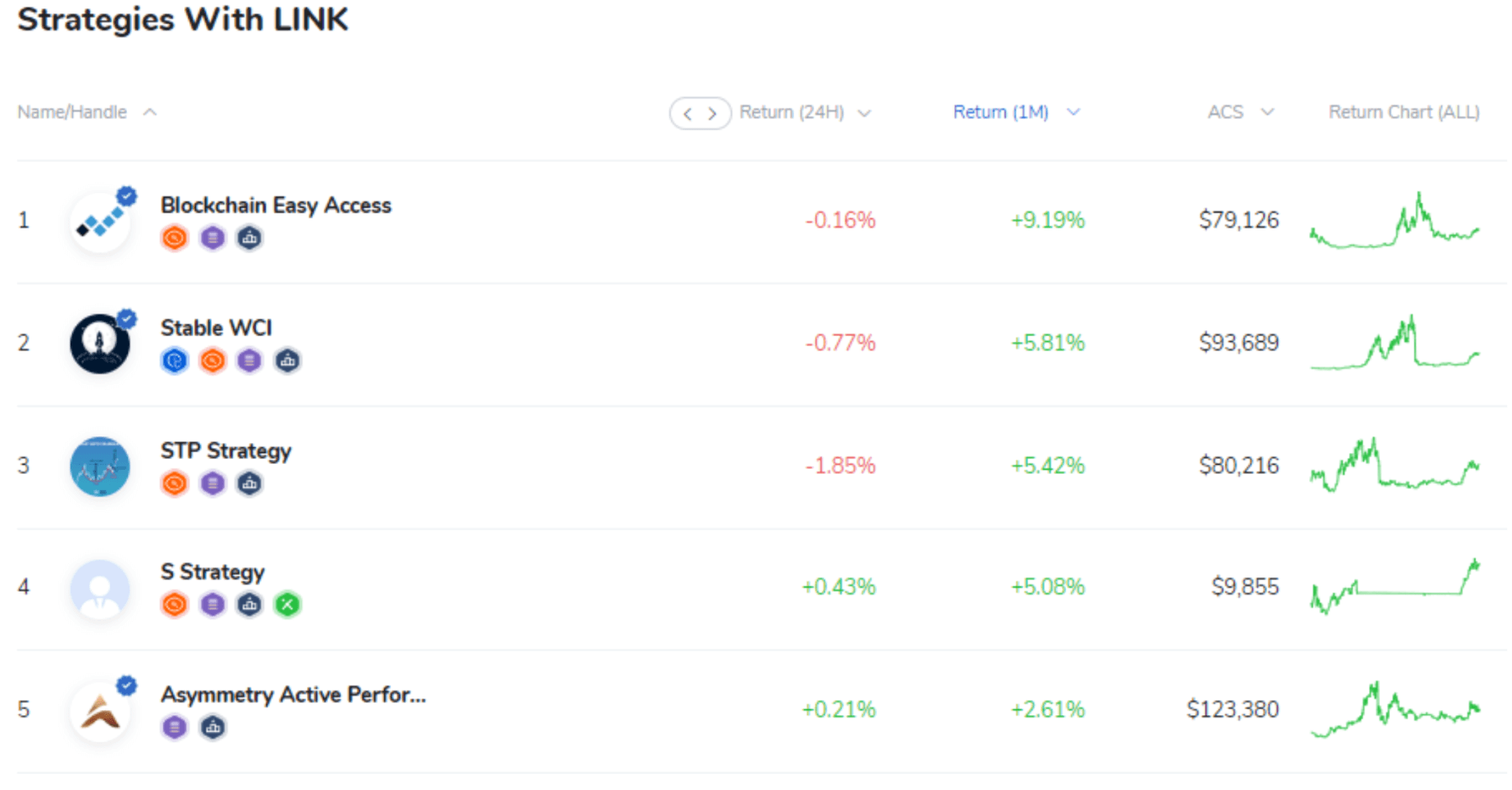

Top 5 Strategies with Chainlink (by Return 1M)