Bitcoin Halving Countdown: 195 Days…

The 4th halving of Bitcoin is only about 195 days away; here's why this is significant 👇

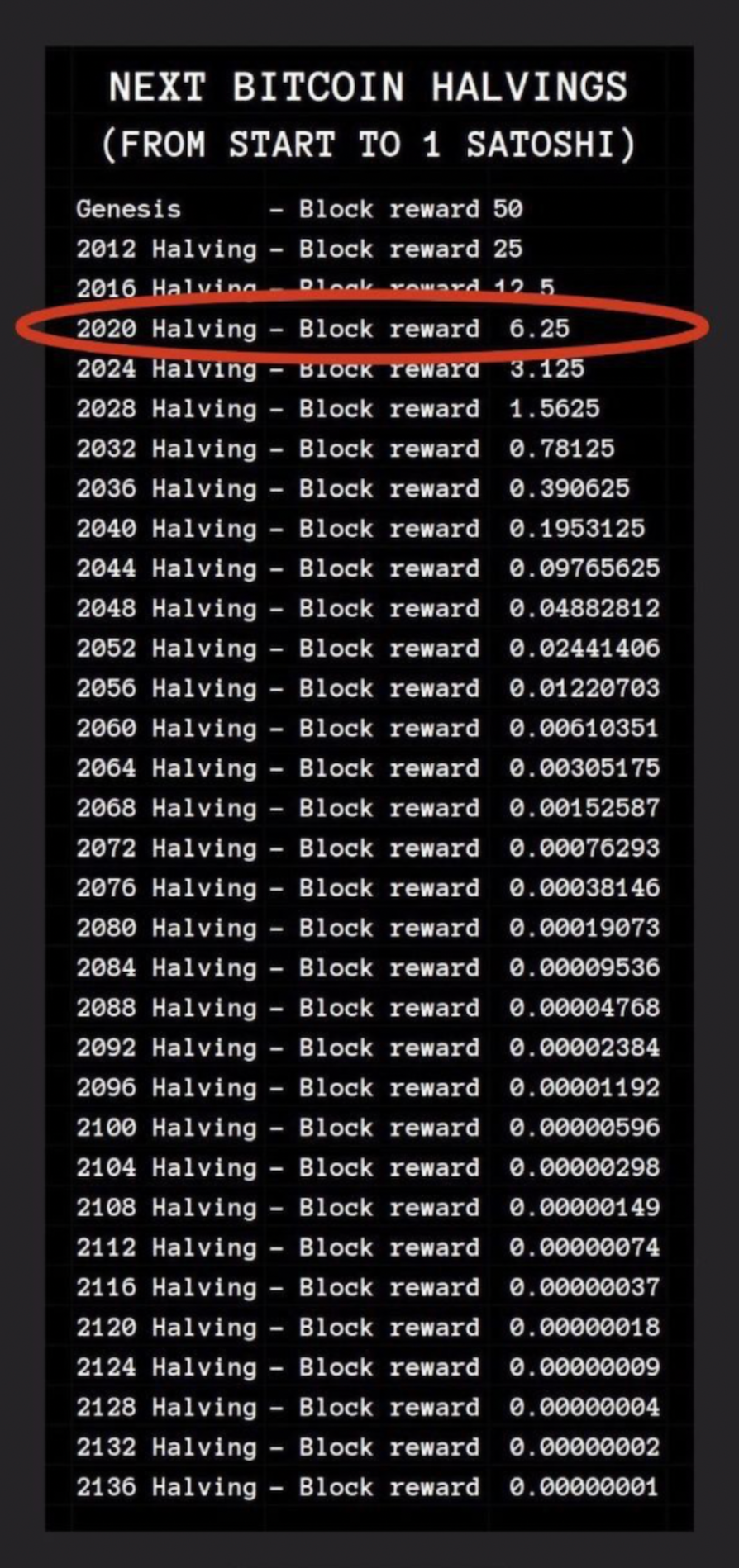

The rewards Bitcoin miners receive are generally cut in half every four years, resulting in a decline in the supply of new Bitcoin entering the market. This will be the fourth halving event for Bitcoin since its inception in January 2009. The very last halving event is expected to occur in the year 2136. The first chart puts the Bitcoin halving events into context and demonstrates how early in Bitcoin's long-term cycle we are. The last Bitcoin or Satoshi will not be mined until the year 2140.

The first Bitcoin halving event saw miners' incentives drop from 50 BTC per block to 25 BTC per block. The rewards per block will be reduced from 6.25 to 3.125 at the forthcoming halving event in May 2024.

🤯 By 2032, the rewards per block will be less than ONE Bitcoin. That means miners will compete for less than 1 BTC for every mined block.

If the "rewards" are so small, why are we seeing an influx of Bitcoin miners, pushing the overall network hash rate to new highs?

Simply put, it is because miners understand the impact of Bitcoin's halving event on the overall price action of Bitcoin. Bitcoin has controlled inflation, with deflationairy pressures. Using the common definition, Bitcoin is deflationary because Bitcoin's purchasing power increases over time. However, the traditional definition of inflation, according to the British Currency School, was an increase in the supply of money that was unbacked by gold. With the continuous decline of new Bitcoin entering the market and the hard cap of 21 million Bitcoin, paired with the growing adoption rate, naturally over time Bitcoin's price should increase.

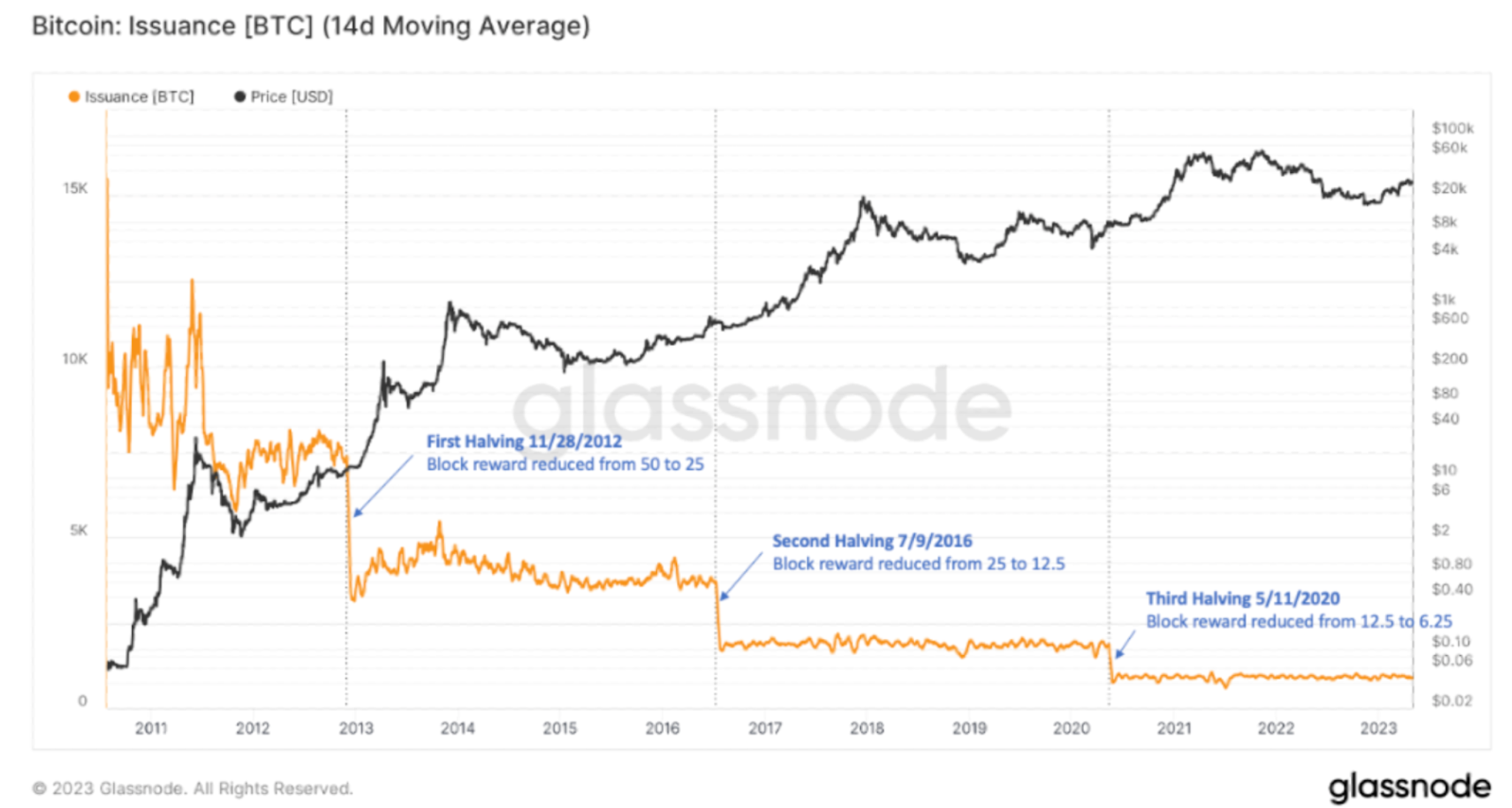

The second chart displays Bitcoin's price action over the issuance of Bitcoin miner rewards. Miner rewards are cut by 50% at each halving event. Mining Bitcoin through the use of computer power, is the only method to generate new Bitcoin. Historically speaking, Bitcoin's halving event has signalled the start of a new Bitcoin and crypto bull market. However, Bitcoin has historically bottomed on average 400 days prior to a halving event.

The fourth Bitcoin halving event is due in about 195 days, prepare for the next supply shock accordingly...

We are still early!

Do you want to learn how to build a digital asset portfolio?

Explore different ICONOMI Strategies: https://lnkd.in/eEj-5kBY

Book a crypto consultation: https://lnkd.in/gzJXuXMJ