Crypto Weekly Wrap: 29th March 2024

London Stock Exchange's Bitcoin ETN Market Launch

The London Stock Exchange is gearing up to launch a market for Bitcoin Exchange-Traded Notes (ETNs) in May. Issuers intending to introduce Bitcoin ETNs on the Main Market need to submit their applications by April 15. The exchange has set the date of April 8, 2024, to start accepting applications, following its earlier announcement on March 11 regarding the intention to permit trading of Crypto ETNs in the second quarter of the year. Pending approval from the Financial Conduct Authority (FCA) of the base prospectuses, trading of these ETNs is scheduled to commence on May 28, 2024. The decision aims to ensure maximum issuer participation on the first trading day and provide ample time for issuers to meet regulatory requirements and prepare documentation.

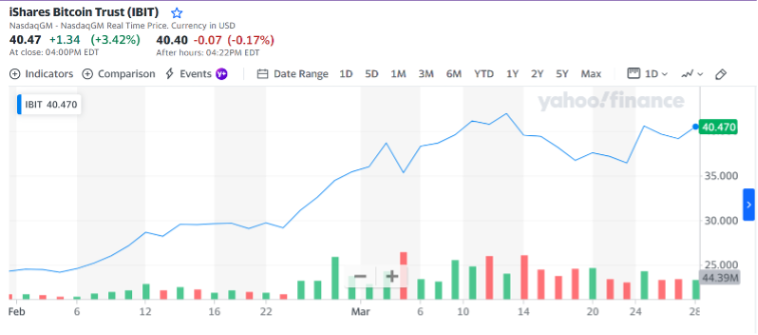

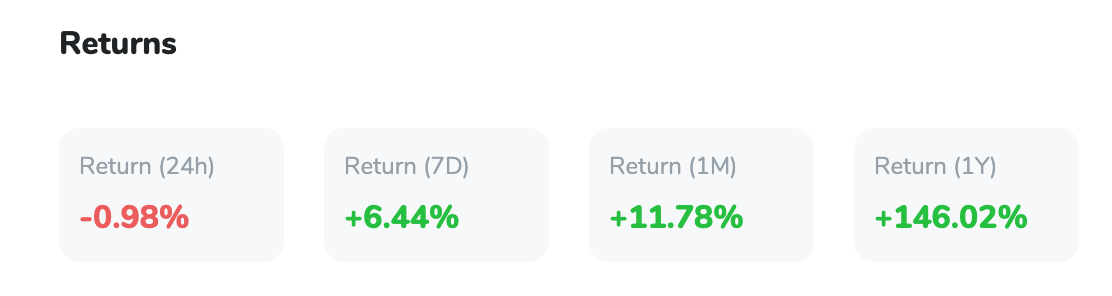

BlackRock's Bullish Stance and Bitcoin ETF Success

BlackRock, under the leadership of CEO Larry Fink, has expressed a notably bullish sentiment towards Bitcoin. This stance coincides with the success of the firm's Bitcoin ETF, the iShares Bitcoin Trust (IBIT), which has amassed over $17 billion in assets. IBIT's rapid success, gathering $13.5 billion within just 11 weeks, surpasses expectations and underscores significant retail interest. This growth not only contributes to a more liquid Bitcoin market but also solidifies IBIT’s position as a major player in Bitcoin ETF holdings. The recent approval of Hashdex’s spot Bitcoin ETF further energises the competitive landscape. Fink’s announcement reflects growing institutional engagement in Bitcoin, potentially influencing BTC prices as more investors turn to regulated avenues for cryptocurrency investment.

Source: Yahoo Finance

FTX Founder Sam Bankman-Fried Sentenced: 25 Years in Prison, $11 Billion Fine for Fraud

FTX founder Sam Bankman-Fried receives a 25-year prison sentence and an $11 billion fine for defrauding customers. Judge Lewis A. Kaplan compared Bankman-Fried's actions to a calculated game, where he prioritised personal gain over integrity. Convicted on seven fraud charges in November 2023, Bankman-Fried's trial culminated in a guilty verdict. The severity of his sentence reflects the gravity of his crimes, signalling a stern stance against fraudulent activities in the financial sector.

Bitcoin Price Analysis

Bitcoin (BTC/USD) currently exhibits a promising outlook, trading above the pivotal $68,560 mark, suggesting bullish momentum. Immediate resistance lies at $71,680, with subsequent thresholds at $73,380 potentially capping gains.

Support levels can be seen at $66,840, and $63,820. The Relative Strength Index (RSI) at 52 and a bullish engulfing candle on the 4-hour chart bolster the potential for upward movement, especially if Bitcoin sustains above the $68,500 benchmark. However, slipping below this critical level could trigger a significant sell-off, marking a crucial juncture for Bitcoin’s near-term trajectory.

Source: TradingView

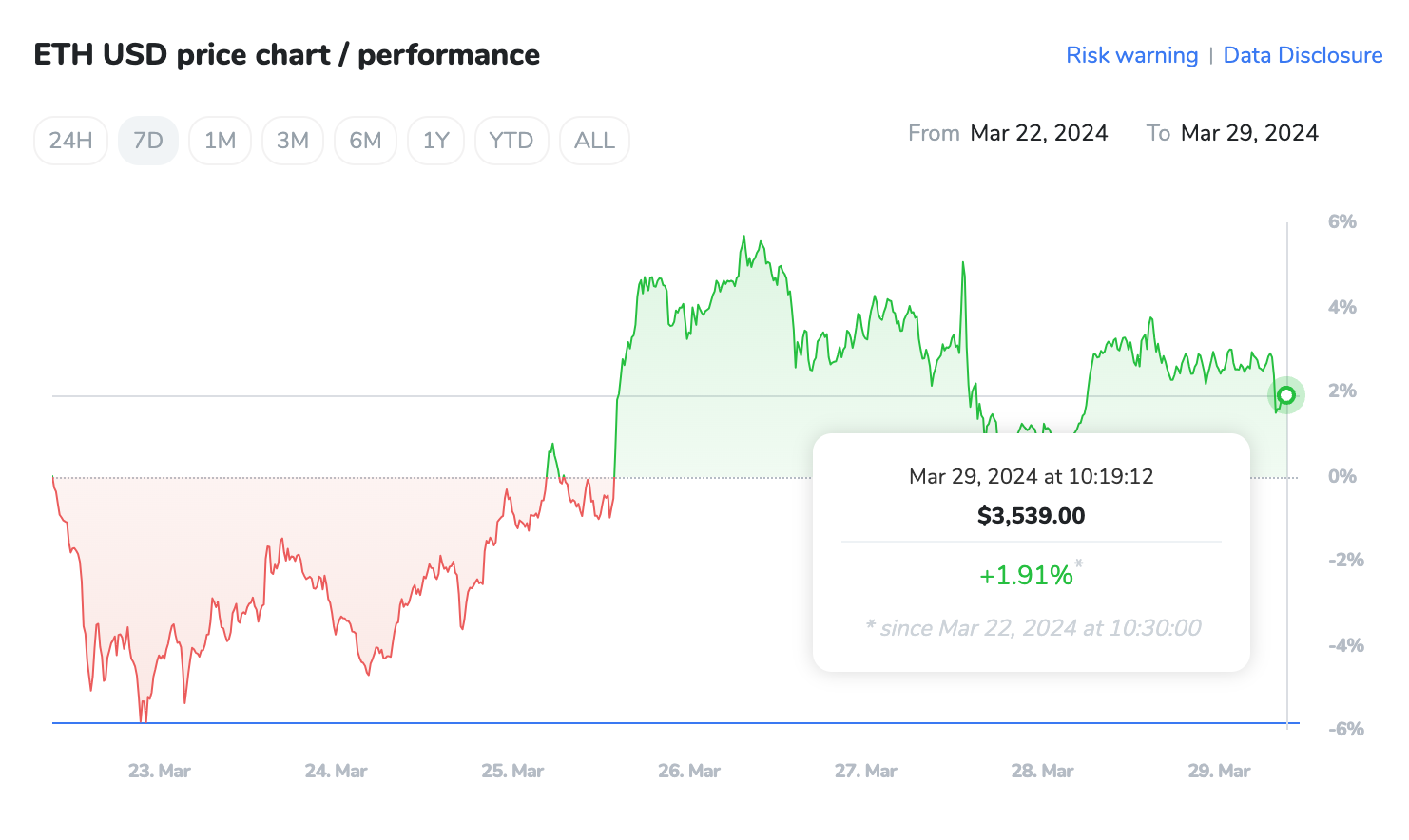

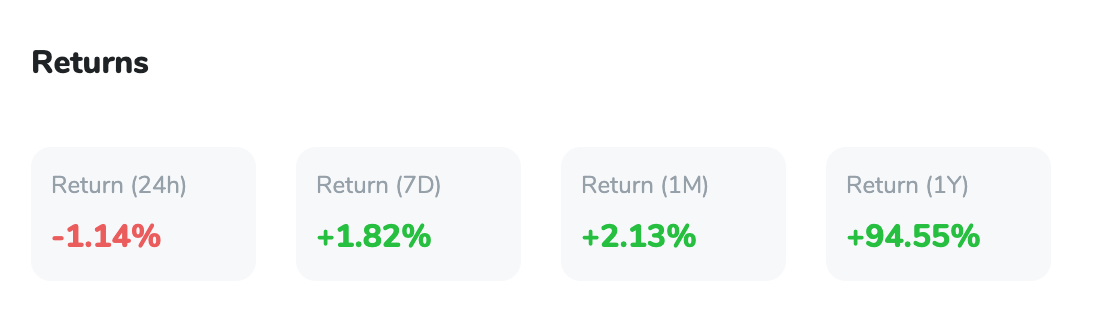

Ethereum's Milestone: 1 Million Validators & $114 Billion Staked, SEC Delays ETH ETF Verdict

The Ethereum network celebrates a significant milestone as it surpasses one million validators, with approximately 32 million Ether, valued at $114 billion, staked within the network. This achievement underscores the substantial commitment to Ethereum's proof-of-stake (PoS) consensus mechanism, with Lido accounting for about 30% of staked ETH, providing an accessible staking option for users with smaller amounts of Ether. While increased validator numbers enhance blockchain security, concerns arise within the Ethereum community regarding potential issues stemming from an excess of validators, such as an uptick in failed transactions. Ethereum co-founder Vitalik Buterin proposes a solution to address decentralisation concerns by suggesting penalties for validators based on their average failure rate. However, the Securities and Exchange Commission (SEC) has postponed decisions on Ether (ETH) ETF applications from major financial institutions like BlackRock and Fidelity to May 2024. Analysts predict a potential denial of approvals in May, with odds estimated at 35%. This delay follows the SEC's earlier extension in December 2023, indicating ongoing deliberations on whether to list Ethereum ETFs amidst growing interest in cryptocurrency investment products.#

Source: CoinMarketCap