Crypto Weekly Wrap: 22nd December 2023

Ethereum's Dencun Upgrade Targets January Testnet Deployment

Ethereum developers are gearing up for a significant milestone in the new year with the Dencun upgrade. Initially slated for the last quarter of 2023, the upgrade has been rescheduled for 2024 due to engineering complexities. The Dencun upgrade introduces "proto-danksharding," a process designed to enhance data storage capacity through layer 2 rollups, reducing fees and scaling the blockchain by accommodating more data "blobs." Developers aim to deploy the upgrade on the Goerli test network by January 17, followed by subsequent testnet deployments, with a soft target for the mainnet upgrade at the end of February.

SEC Expected to Approve Spot Bitcoin ETFs in Early January

Major money management firms anticipate the Securities and Exchange Commission (SEC) granting approval for the first "spot" Bitcoin exchange-traded fund (ETF) by January 10. Notably, companies like BlackRock and Fidelity are among approximately a dozen entities vying for approval. Recent guidance from SEC officials suggests a positive outcome, with a final deadline for approval or denial set for January 10, 2024. The approval of spot Bitcoin ETFs could provide retail investors with more accessible exposure to Bitcoin, bypassing unregulated exchanges and trading on established platforms like the New York Stock Exchange and Nasdaq.

BlackRock, the world's largest money manager, with over $9 trillion in assets under management, is prioritising SEC approval for its proposed Bitcoin ETF. CEO Larry Fink views Bitcoin as an international asset and a store of value, emphasising the potential to democratise the cryptocurrency market. BlackRock has engaged in multiple meetings with the SEC, with the latest occurring on Tuesday. The SEC's commitment to facilitating ETF approvals in the new year is evident, although the possibility of denial remains, as industry officials weigh in on potential outcomes.

While the potential approval of spot Bitcoin ETFs is awaited, the SEC has insisted on cash redemptions instead of the conventional "in-kind" transactions. This shift introduces complexities, as ETF issuers must exchange Bitcoin for cash in each transaction. Some, like Grayscale, are hesitant to abandon in-kind transactions, arguing that offering both options would be in the best interest of investors. Cash redemptions pose challenges to trading efficiency and may lead to tax implications for investors, as in-kind purchases are not subject to taxation.

The evolution of Bitcoin

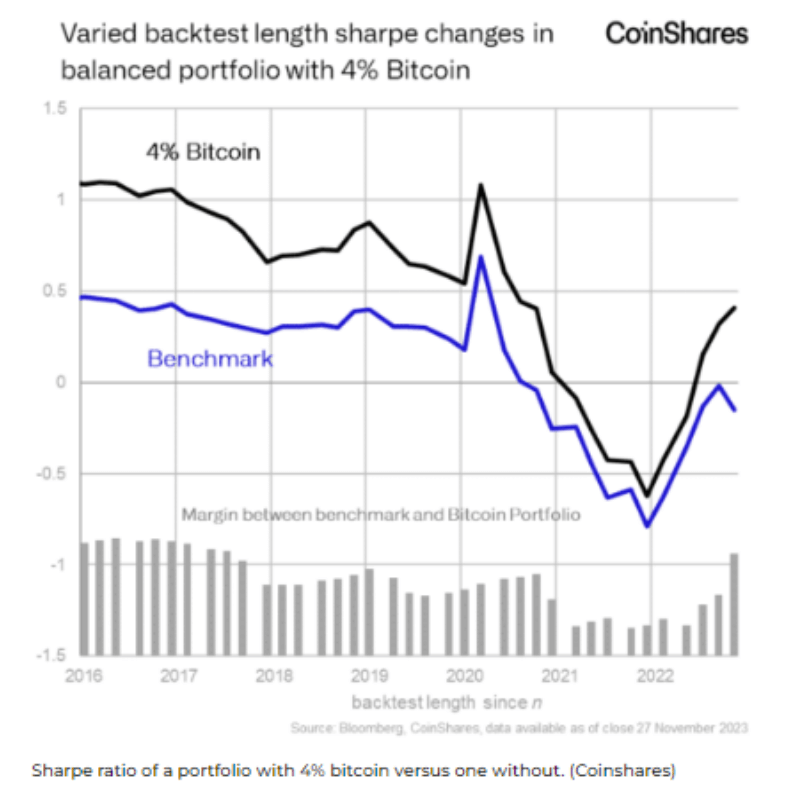

Coinshares, a digital asset investment firm, has observed a significant widening in the Sharpe ratio gap between portfolios containing 4% bitcoin and those without. This implies that portfolios incorporating bitcoin have exhibited superior risk-adjusted returns, solidifying the cryptocurrency's status as an alternative asset.

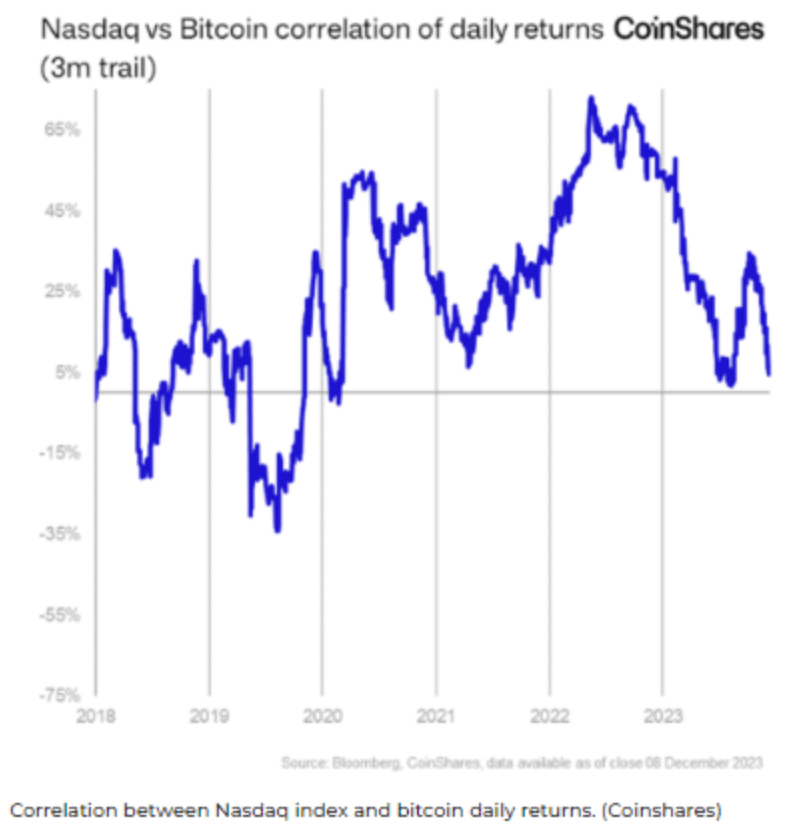

James Butterfill, head of research at Coinshares, attributes this trend to the growing correlation between bonds and equities, emphasising bitcoin's role in providing optimal diversification and risk-adjusted returns among alternative assets. Moreover, bitcoin has matured as an asset, evidenced by its decreased correlation with the Nasdaq index, dropping below 5%. This marks a departure from the previous bull cycle, highlighting bitcoin's resilience and potential for continued outperformance in the face of evolving market dynamics and the Federal Reserve's anticipated softer stance in 2024.

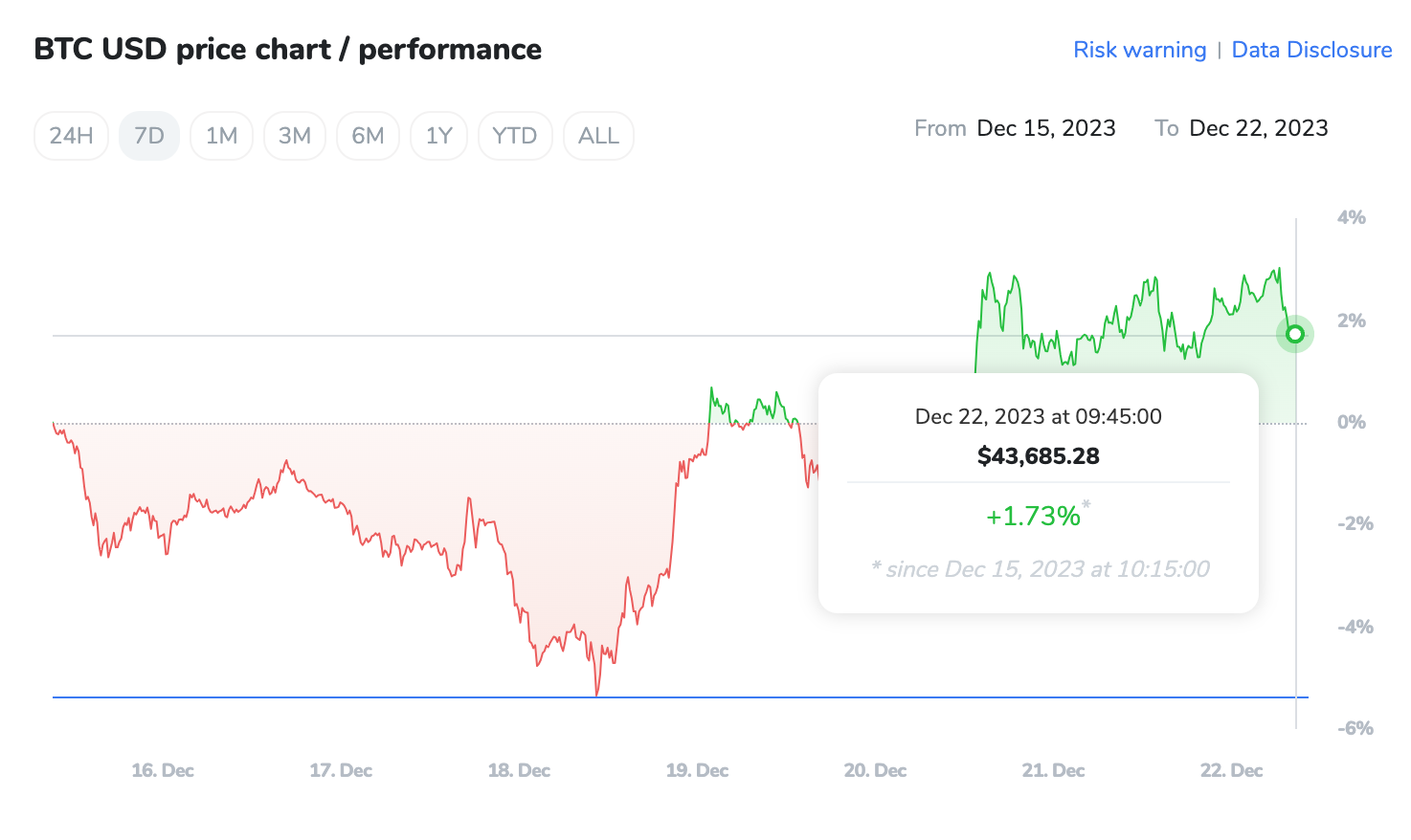

Bitcoin Price Surges Amidst Speculation of SEC Approval

The anticipation of the SEC's potential approval of spot Bitcoin ETFs has driven Bitcoin's price to $44,200, marking a 1.50% increase in the last 24 hours. This surge may be attributed to the persuasive impact of ETF filings, intensifying marketing campaigns within the crypto sector. Notably, market dynamics are influenced by institutional players intensifying their marketing strategies ahead of potential listings. The industry's focus on being the first to market is evident, drawing increased investor attention and impacting Bitcoin's price based on market sentiment and perceived institutional support.

Analysis and Market Outlook

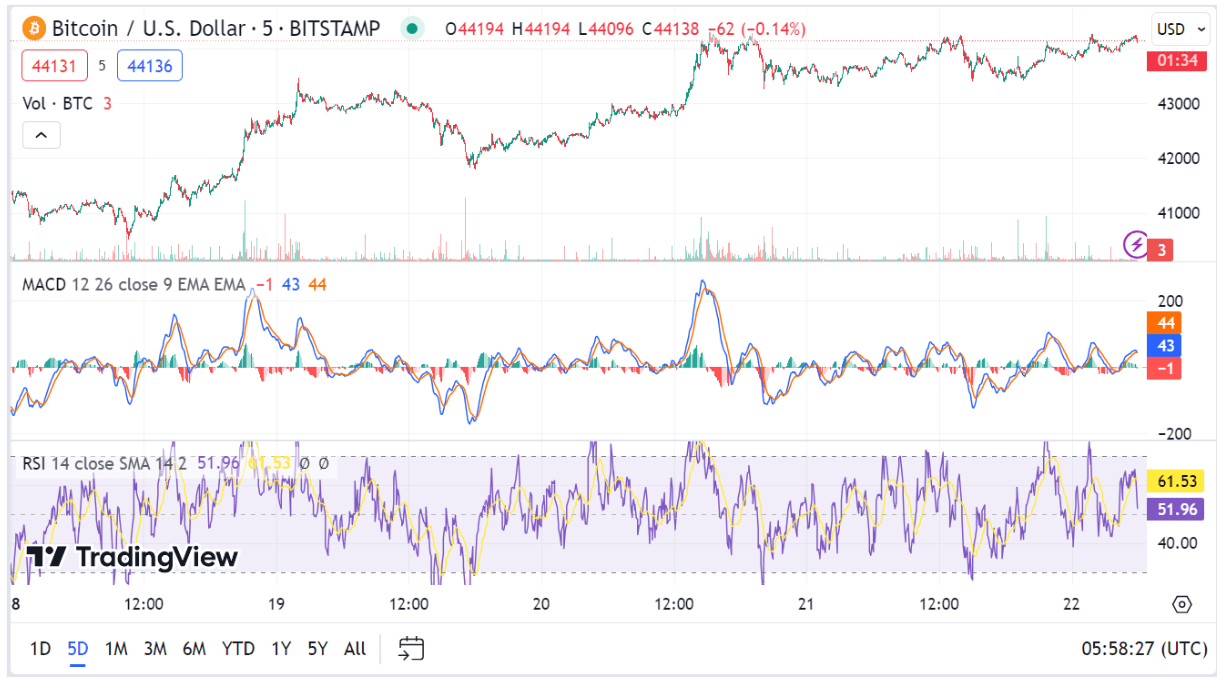

The Relative Strength Index (RSI) stands at 61.5, indicating slightly bullish momentum without entering overbought territory. Bitcoin's price is consistently trending above the 50-Day Exponential Moving Average, reinforcing a short-term bullish outlook. The chart showcases an ascending trendline, signalling continued bullish momentum. Resistance levels at $43,510, and $46,020 are identified, with support levels at $42,160, and $40,520 in the event of a pullback.

Santa Claus Rally

During the Christmas season, the crypto market often experiences unique trends, with historical data suggesting the presence of a 'Santa Claus rally.' This phenomenon, observed in traditional markets, involves a surge in asset prices during late December through early January. While Bitcoin has showcased both bullish and bearish movements during this period in different years, the 2023 transition from a bear market to positive sentiments has set the stage for a potentially bullish outlook in 2024. Factors such as Bitcoin's recovery, lowered volatility, regulatory developments, and the anticipated Bitcoin halving in April 2024 contribute to the positive trend. However, challenges like regulatory scrutiny and economic factors persist, making predictions for the crypto market uncertain.