Ripple (XRP) Rides the Crypto Wave: Banking, Regulation, and Price Trends Unveiled

Ripple (XRP) has recently seized the spotlight, becoming a preferred digital asset among major global central banks. This surge in interest is highlighted in a comprehensive report from the Basel Committee on Banking Supervision (BCBS), shedding light on the growing engagement of 45 member central banks with digital assets. As the crypto market witnesses transformative shifts, let's delve deeper into the technical intricacies and recent developments shaping Ripple's journey.

Global Banks' Crypto Exposure:

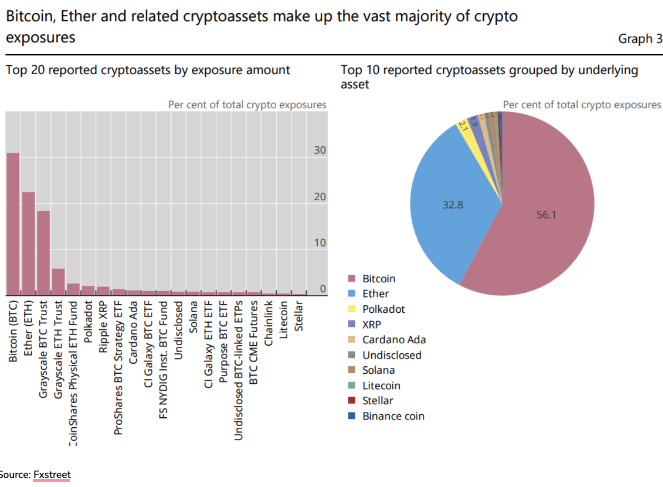

The BCBS report has cast a revealing spotlight on the global banking sector's engagement with cryptocurrencies, showcasing Ripple's XRP as the third-largest altcoin with a 2% share of the total exposure. This translates into a significant valuation of $205 million or €188 million, underscoring XRP's importance in the market. However, the report underscores the supremacy of Bitcoin (BTC) and Ethereum (ETH), which collectively constitute nearly 53% of the banks' crypto exposure. Bitcoin takes the lead with a commanding 31%, followed closely by Ethereum at 22%, solidifying their positions as pivotal players in the institutional crypto portfolios. Beyond the established leaders, the report highlights the inclusion of diverse digital assets like Solana (SOL), Polkadot (DOT), Litecoin (LTC), Cardano (ADA), Stellar (XLM), among others, in these portfolios, showcasing a strategic and exploratory approach to harnessing the potential of cryptocurrencies.

Source: Fxstreet

The BCBS report paints a comprehensive picture of global banks' crypto involvement, emphasising the significant presence of XRP alongside the dominance of Bitcoin and Ethereum. The combined weight of these three cryptocurrencies comprises a formidable 90% of the total crypto exposure, reflecting a nuanced and evolving strategy within the banking sector. This data signals a pivotal moment in the intersection of traditional finance and cryptocurrency, with major financial institutions actively diversifying their portfolios and adapting to the transformative possibilities presented by the crypto revolution.

SEC vs. Ripple:

The regulatory landscape continues to play a pivotal role in shaping XRP's trajectory. The SEC vs. Ripple legal showdown escalates with Kraken becoming the latest exchange in the crosshairs. The SEC's allegations against Kraken echo those against Coinbase, signalling a broader effort to regulate crypto exchanges. Kraken's CEO, Dave Ripley, vehemently opposes the SEC's claims, emphasising the need for regulatory clarity and congressional action in the U.S. crypto industry.

XRP Price and Market Trends:

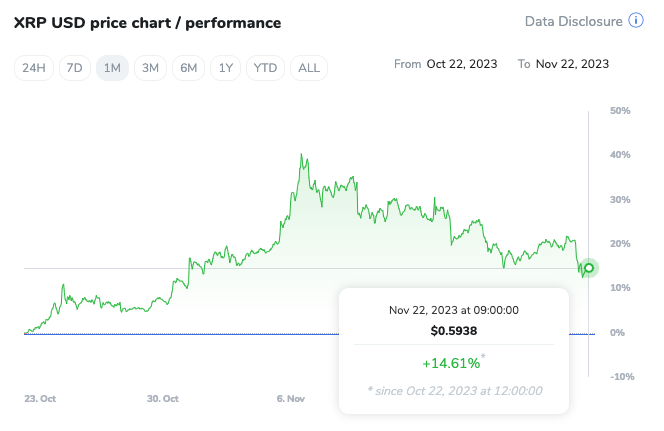

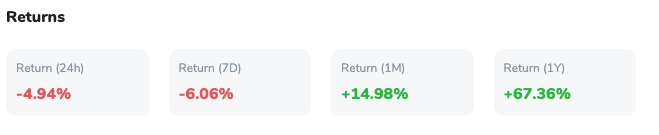

In the past 24 hours, XRP has experienced a modest 4.65% dip, settling at $0.5956, yet maintaining a 14% gain in the last 30 days and a substantial 55% increase in the past year. The recent dip is attributed to cautious market sentiment and technical indicators signalling a potential short-term decline.

Technical Analysis:

A closer look at XRP's technical indicators reveals a nuanced picture. The 30-day moving average, a key metric in assessing price trends, shows signs of tapering off, suggesting a possible consolidation phase. The 24-hour trading volume has risen slightly, but caution is warranted as it remains below the levels witnessed earlier in the month.

XRP's price resilience is evident on the daily chart, maintaining levels above both the 50-day and 200-day EMAs, signalling bullish momentum. Anticipation surrounds a potential return to $0.62, with a successful breach opening the door to the $0.6354 resistance. However, the ongoing SEC vs. Ripple legal battle remains a pivotal focus for XRP investors, with case-related news and SEC activities heavily influencing market sentiment. A bearish scenario could unfold if XRP drops below the trend line and the 50-day EMA, with $0.5835 as a potential support target, though buying pressure might intensify at $0.5920. The 1-month RSI at 43.58 suggests a possible dip below the trend line and 50-day EMA, entering oversold territory. On the 4-hourly chart, XRP sits below the 50-day EMA but above the 200-day EMA, presenting a mixed near-term bearish and longer-term bullish trend. Attention is keenly focused on XRP's ability to breach the 50-day EMA, influencing a breakout above the $0.6354 resistance, while a fall through the 200-day EMA could introduce challenges. The delicate balance between short-term bearish pressures and overarching bullish sentiment underscores the need for cautious navigation.

Recent Developments and Elon Musk's Influence:

Beyond the technical realm, recent developments include Elon Musk's tweet about SpaceX, which inadvertently added to XRP's positive narrative. XRP enthusiasts seized the opportunity, leveraging Musk's tweet for additional exposure. While this may be considered minor news, every positive contribution helps maintain a favourable narrative around XRP, especially considering the positive outcomes in Ripple's case with the SEC.Discover Ripple (XRP)'s rising significance in global banking, as the Basel Committee report highlights its role. Explore XRP's market trends, technical details, and the impact of regulatory challenges

Institutional Interest and Future Trends:

Despite regulatory challenges, institutional interest in XRP funds remains robust, with a net inflow of $500,000 in the past week. Retail investors are actively accumulating XRP, contributing to a bullish sentiment. On-chain metrics like Market Value to Realised Value (MVRV) suggest that recent XRP investors are unlikely to sell at the current price, leaving room for a potential continued rally.