Crypto Weekly Wrap: 2nd February 2024

FTX Repayment Expectation and FTT Token Fluctuation

FTX is anticipated to repay its customers fully as per a court hearing. However, the full recovery of customer assets hinges on the date of FTX's bankruptcy, sparking debate among claimants due to market fluctuations. While the expectation of full repayment offers a glimmer of hope to affected users, the uncertainty surrounding the timing and method of reimbursement has contributed to market volatility. The native token of FTX, FTT, experienced significant fluctuations following the news, initially surging in response to the repayment expectation but subsequently plummeting by 15%. This price movement underscores the sensitivity of crypto markets to regulatory and legal developments, highlighting the challenges faced by investors in navigating uncertain terrain.

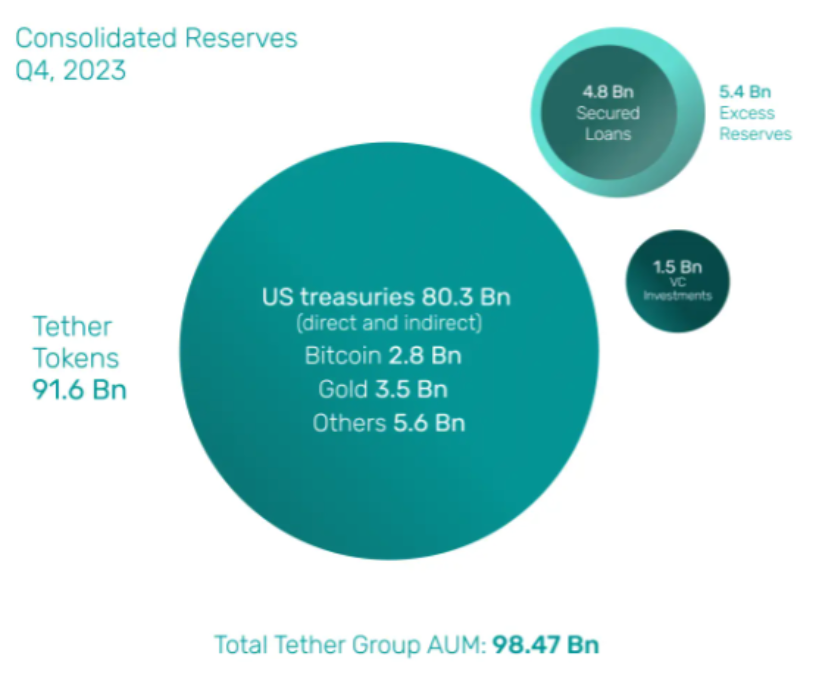

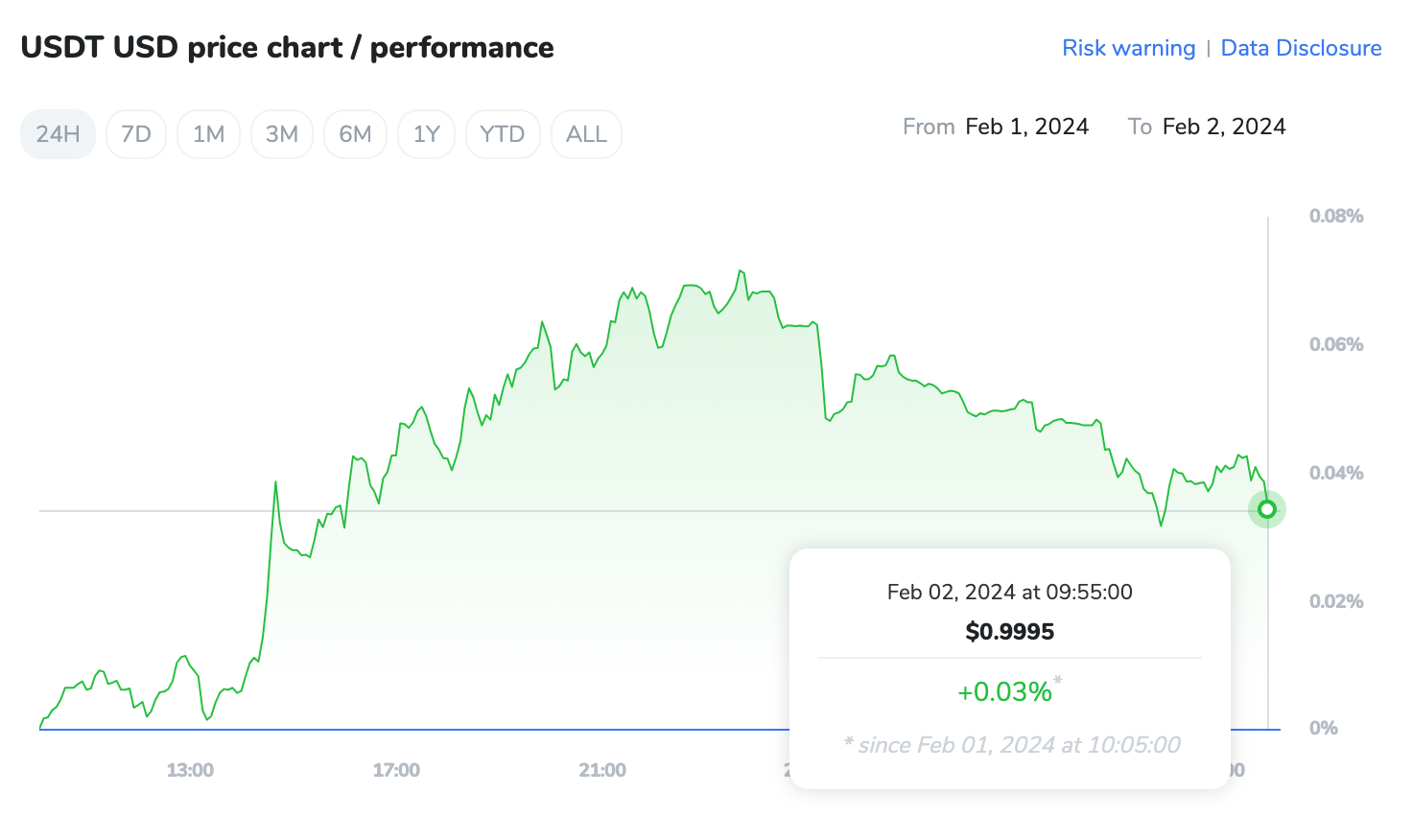

Stablecoin Profit Report by Tether

Tether reported record profits of $2.85 billion, primarily fuelled by interest earnings on its reserves, including U.S. Treasury holdings. This achievement underscores Tether's dominance in the stablecoin market and its strategic investment decisions, positioning it as a significant player in the crypto space. The substantial profits reported by Tether reflect the growing demand for stablecoins in the crypto ecosystem, driven by their role as a hedge against market volatility and as a preferred medium for trading and transferring value within the crypto economy. Tether's success highlights the importance of stablecoins in facilitating liquidity and stability in crypto markets, serving as a bridge between traditional finance and the digital asset space.

Crypto Mining Energy Consumption Scrutiny

The US government, through the Energy Information Administration (EIA), is intensifying efforts to monitor energy consumption by crypto mining companies. This move aims to address concerns about the environmental impact of crypto mining amid Bitcoin's price surge. By collecting data on energy usage, the government seeks to regulate the crypto mining sector and assess its contribution to electricity demand. The scrutiny of crypto mining energy consumption reflects broader concerns about the sustainability of blockchain technologies and their environmental footprint. As the popularity of cryptocurrencies continues to grow, regulatory scrutiny of energy-intensive mining activities is expected to increase, necessitating greater transparency and accountability from industry participants.

Germany's DZ Bank Set to Pilot Cryptocurrency Trading Program

Germany's DZ Bank, the country's second-largest bank with assets totalling $627 billion, is set to launch a pilot program for cryptocurrency trading later this year, as reported by Bloomberg. This move follows the bank's release of a cryptocurrency custody platform in November, signalling a significant step towards embracing digital assets. According to board member Souad Benkredda, the trading offering will cater to customers who can invest "without advice," with plans to list a variety of cryptocurrencies. The initiative aligns with a growing trend among banks, with research indicating that half of all banks are considering offering similar solutions to their customers, reflecting a broader shift towards integrating cryptocurrencies into traditional banking services.

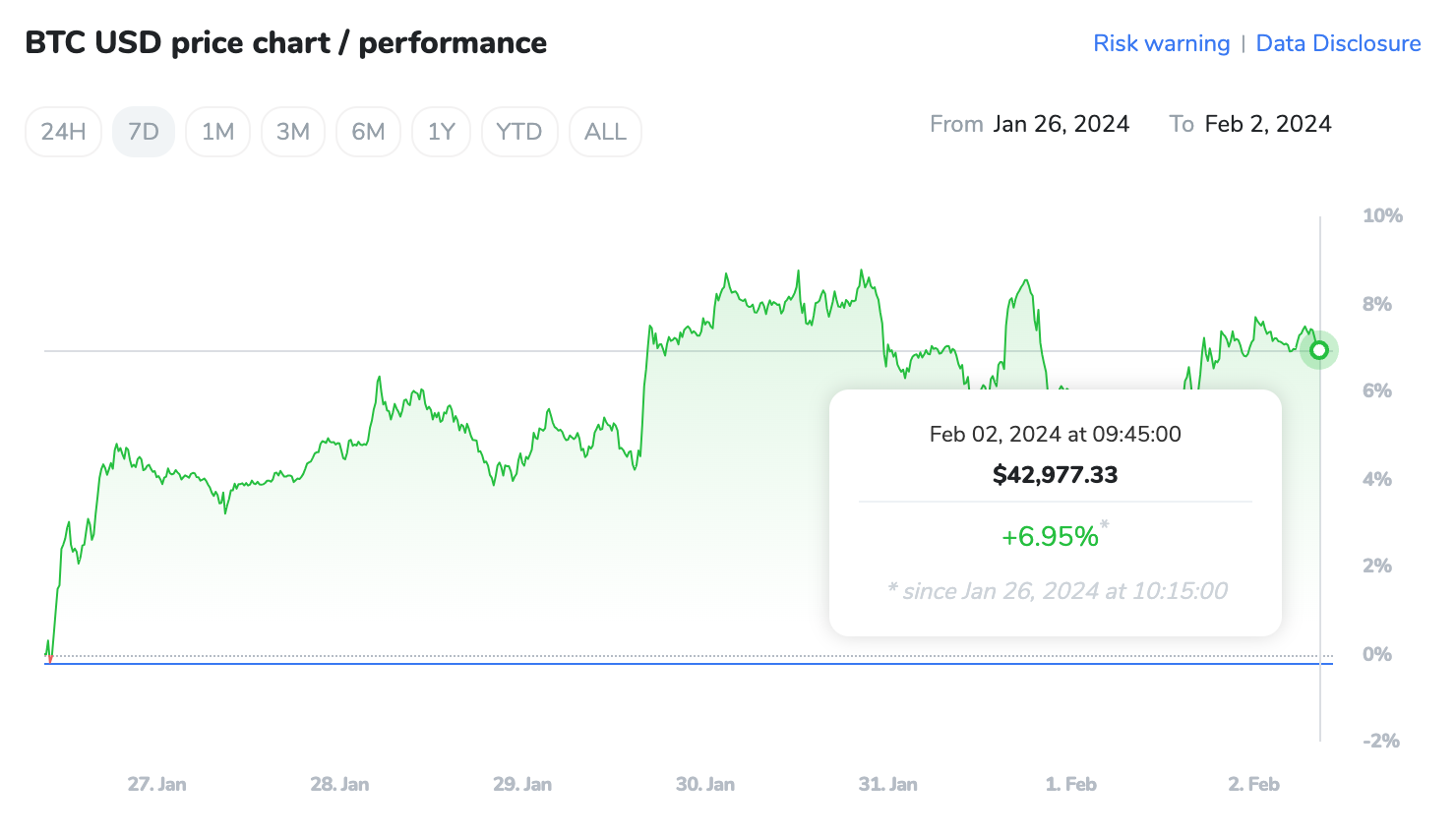

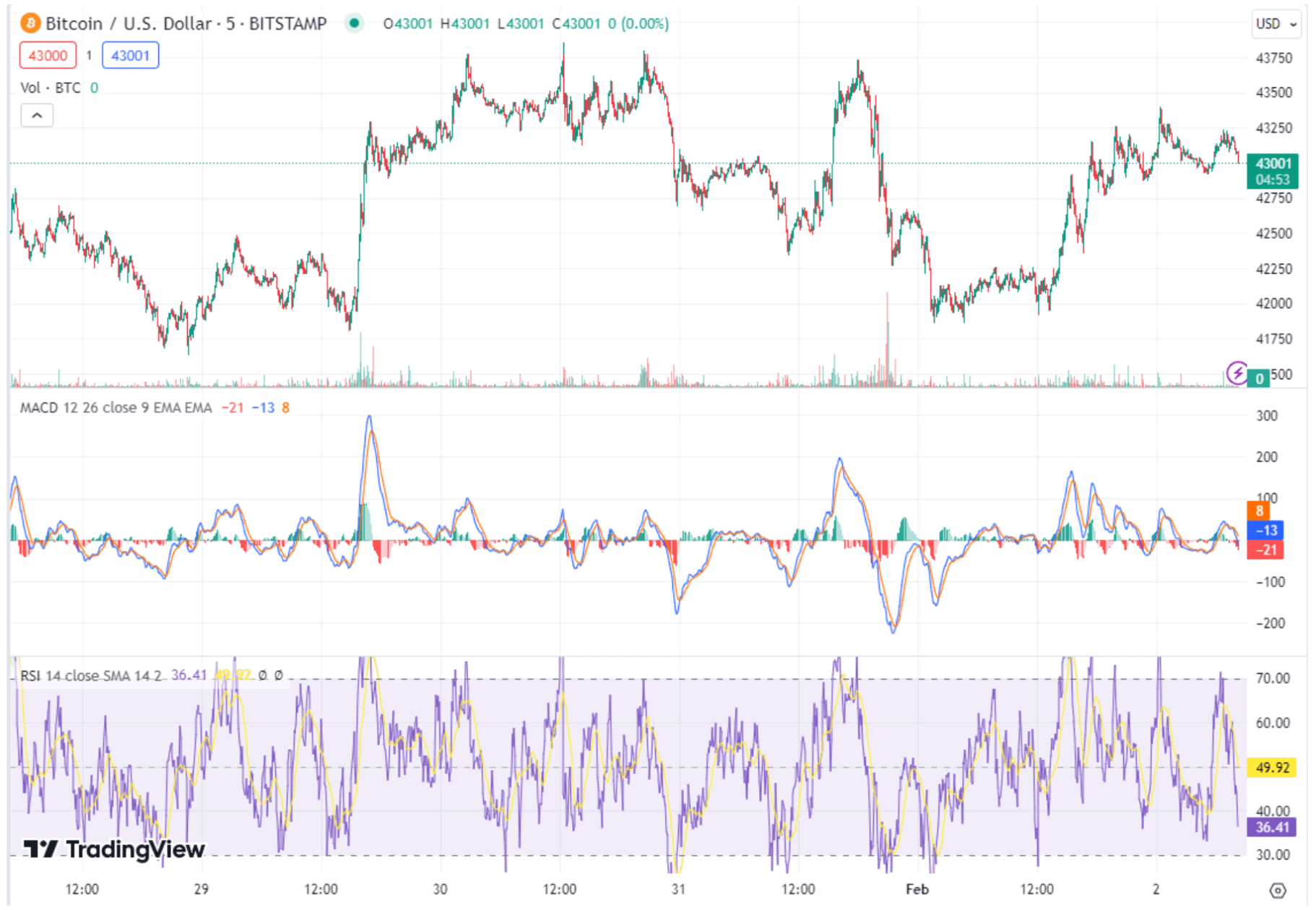

Bitcoin Price Analysis and Market Response

Bitcoin's price trajectory remains uncertain amidst significant global financial events, including the Federal Reserve's decision to maintain interest rates and China's policy shifts. Despite hovering around $42,500, BTC faces resistance levels at $43,920 and support at $40,790. Technical indicators suggest a bearish outlook, with the RSI signalling neutral momentum and the MACD indicating downward pressure. Market sentiment is influenced by regulatory actions and geopolitical factors, impacting Bitcoin's short-term direction. The recent market response to Jerome Powell's remarks underscores the sensitivity of crypto markets to macroeconomic news, highlighting the importance of monitoring key levels and indicators for informed trading decisions. As Bitcoin consolidates within a narrow range, traders remain cautious amid evolving market conditions and regulatory uncertainties, emphasising the need for a comprehensive understanding of market dynamics for effective risk management.

Notably, BTC's recent breakout above the upward trendline at $42,190 suggests temporary strength but is countered by a bearish engulfing pattern on the 4-hour timeframe. This conflicting price action indicates potential volatility and underscores the importance of monitoring key support and resistance levels for strategic trading decisions.

Key Takeaways

Bitcoin's price remains sensitive to macroeconomic factors, regulatory developments, and market sentiment. Technical indicators suggest a neutral-to-bearish outlook, with BTC facing resistance at $43,920 and support at $40,790. Regulatory scrutiny of crypto mining and geopolitical tensions contribute to market volatility, requiring traders to adopt a cautious approach. Despite short-term uncertainties, long-term prospects for Bitcoin remain optimistic, driven by growing institutional adoption and increasing recognition as a store of value. As market dynamics evolve, monitoring key support and resistance levels alongside macroeconomic trends will be essential for navigating Bitcoin's price movements effectively.