Stellar’s (XLM) Excitement Over Upcoming Announcement

Stellar’s (XLM) Excitement Over Upcoming Announcement

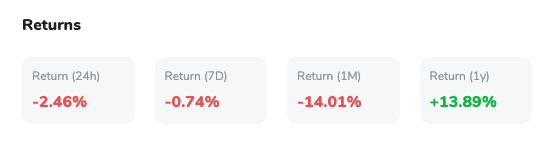

Stellar has been making headlines recently with a remarkable surge in its price. Even in the midst of a broader market downturn, XLM defied gravity, skyrocketing by 7,6% during that period. This impressive performance has left many investors and market analysts intrigued, wondering what's behind this remarkable rally. Despite that, it fell by about 4% in the last 24 hours.

The surge in XLM's price coincides with Stellar's tantalizing hint about an impending "shift or innovation" in a cryptic social media post. While the specifics of this announcement remain shrouded in mystery, it has ignited a wave of enthusiasm within the Stellar community and the wider crypto space.

Market analytics Santiment has added fuel to the fire, suggesting the possibility of a "larger breakout" for XLM. This projection has only further intensified interest in the cryptocurrency and the upcoming announcement scheduled for September 12.

From a technical perspective, XLM's recent price action presents an intriguing picture. After breaking out from a Falling Wedge pattern, XLM experienced a rapid surge to $0.19. However, this surge led to an overbought condition, with the RSI exceeding 75, prompting profit-taking and selling pressure.

Currently, XLM has retraced to the support level of $0.12, which could potentially serve as a swing entry point for traders. It's worth noting that key Fibonacci retracement levels to watch are $0.12 (78.6%) and $0.13 (61.80%). Traders are advised to set price alerts for these levels to closely monitor potential entry or exit points.

Stellar (XLM) is currently generating excitement in the cryptocurrency space, thanks to its impressive price surge and the anticipation surrounding an upcoming announcement. However, traders should exercise caution and consider technical analysis when making trading decisions. The $0.12 support level holds key importance, and attention to Fibonacci retracement levels is advisable. As we eagerly await Stellar's revelation on September 12, the path forward for XLM remains uncertain, but we are undoubtedly keeping a close eye on its next moves.

Current happenings in the crypto market

The cryptocurrency market is experiencing a downturn in September 2023 due to many factors. While the beginning of the year brought hopes of recovery for cryptocurrencies, several challenges persist.

Firstly, market sentiment has shifted from "greed" to "neutral," reflecting the highly volatile nature of cryptocurrencies. Uncertainty regarding interest rate hikes by the U.S. Federal Reserve has left investors nervous, impacting liquidity and trading.

Moreover, cryptocurrencies like Bitcoin and Ethereum, while showing signs of recovery, remain significantly below their all-time highs from the 2021 bull run. Bitcoin, for instance, is still over 50% down from its peak in November 2021.

Additionally, the fallout of major exchange FTX in 2022, has triggered a loss of trust and liquidity. The regulatory system and the recent hawkish stance of the U.S. Federal Reserve have also contributed to market uncertainty.