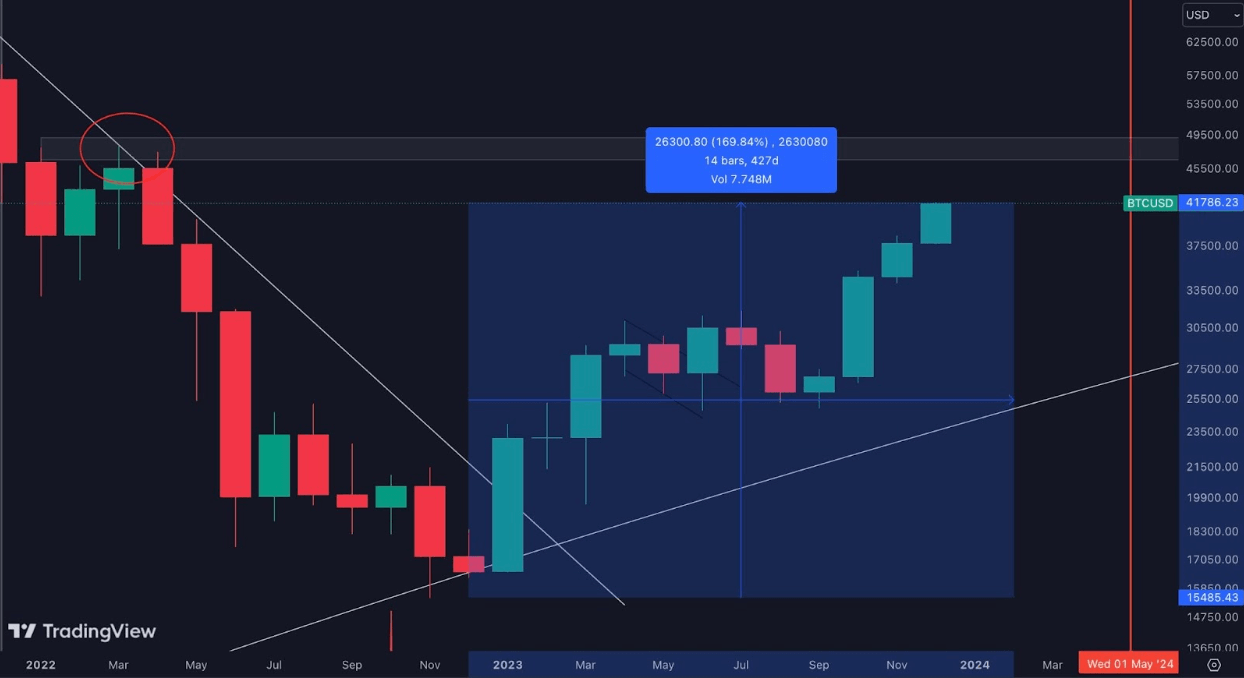

Bitcoin hits $41,600, up 169% from its bear market low.

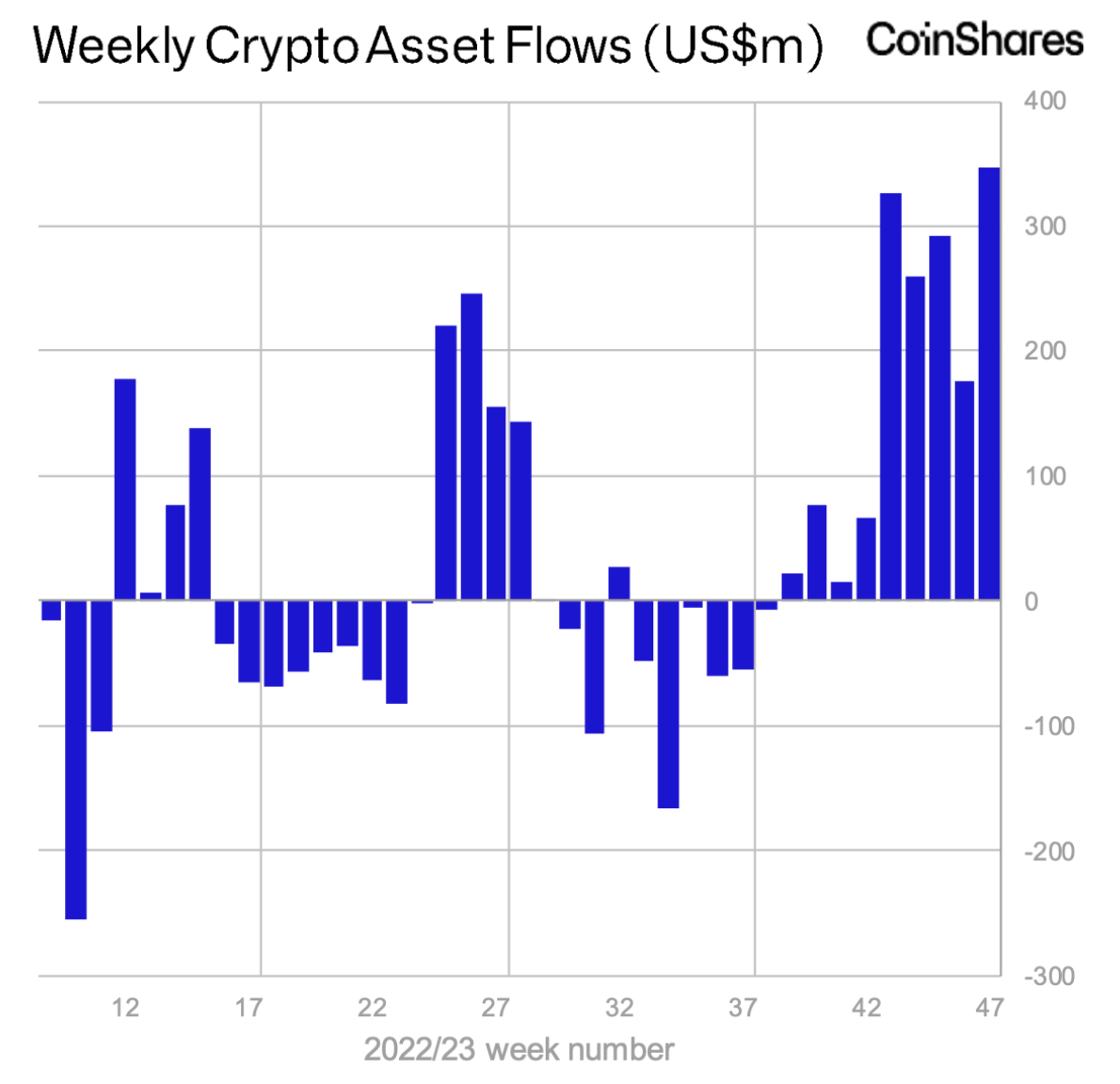

We have now seen 9 consecutive weeks of positive institutional inflows into digital asset-related investment products, indicating a strong demand for digital assets at the institutional level.

This year, more than $1.5 billion of institutional liquidity has flowed directly into Bitcoin-related investment products. As a result of the positive inflows, Bitcoin is now up roughly 169% from its bear market low in November 2022, reaching $41,600 earlier this morning.

Due to price rises and positive institutional inflows, total assets under management at the institutional level have reached $45.3 billion, the highest level in over 1.5 years.

What is driving the institutional inflows?

Investors at the institutional level are expecting positive news around the Bitcoin spot ETF applications in the new year. They are positioning in an attempt to gain an early mover advantage.

There is more than $17 trillion of combined assets under management between the institutions pending approval of a Bitcoin Spot ETF - including asset managers like BlackRock, Vanguard and Ark. An approval of a Bitcoin Spot ETF opens the doors for billions of institutional liquidity to flow into the market.

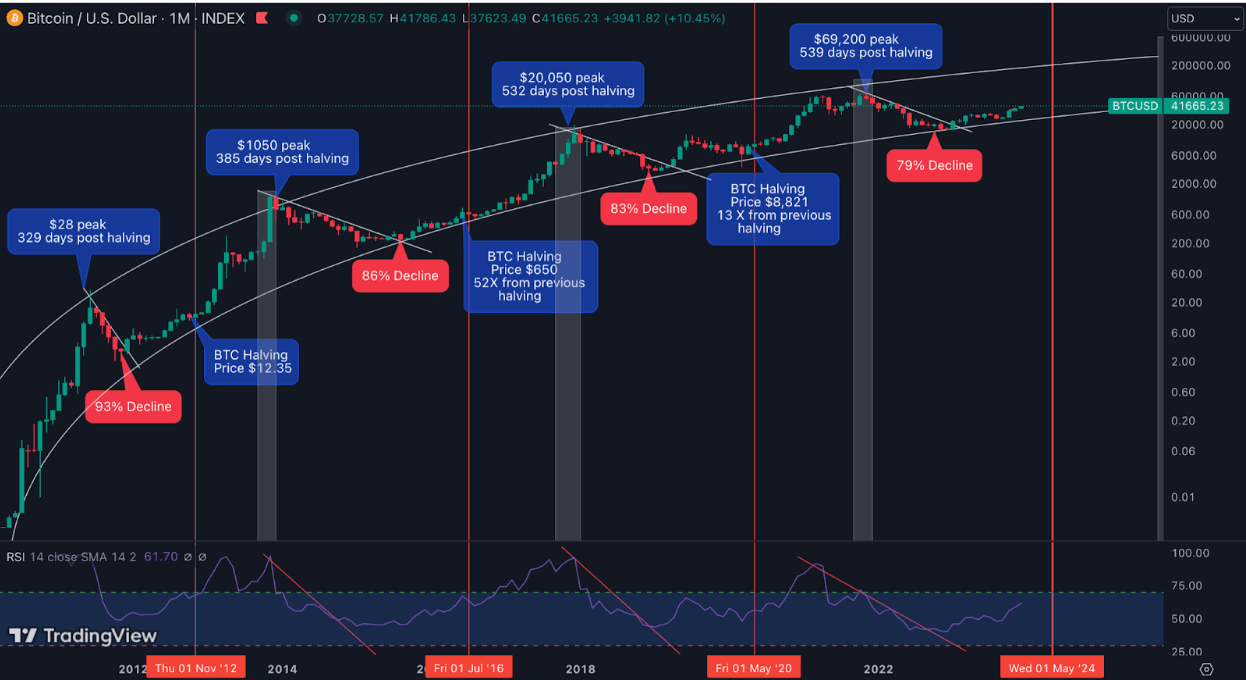

There are two major supply shocks taking place next year. First, the approval of a Bitcoin Spot ETF will result in an increased demand to purchase Bitcoin at the institutional level, decreasing the available Bitcoin in circulation. There are potentially billions of dollars waiting to flow into the digital asset market. Secondly, we are facing the next Bitcoin halving event which will cut the supply of new Bitcoin entering the market in half. At today's rate, there are 900 new Bitcoin entering circulation per day through mining. After April 2024, the number of newly created Bitcoin will decrease to 450 per day.

Both events are bullish for the price of Bitcoin, and will consequently provide a bullish outlook for the overall cryptocurrency market.

The previous Bitcoin halving events are displayed above in the red vertical lines. The Bitcoin halving events have historically marked the start of a new bull market for retail investors.

The bottom line… Bitcoin is becoming increasingly scarce, and due to its tokenomics, it's providing a hedge against fiat currency devaluation, which is taking place globally, and economic uncertainty.

Just last week, Michael Saylor’s Microstrategy stock price reached a two-year high, with the stock price boosted by its Bitcoin holdings. MicroStrategy's outlook of storing Bitcoin for the long term has produced positive returns for the business. Under the direction of its founder and chairman, Michael Saylor, the company began accumulating cryptocurrencies, specifically Bitcoin, as a hedge against inflation in August 2020.

Bitcoin currently has an annualised return of 145% per year, beating inflation and currency devaluation. Bitcoin's purchasing power traditionally increases over time, whereas fiat currencies purchasing power historically declines due to money printing.

This raises the question, should your company have a digital asset solution in place to hedge against the rising costs of goods and services, fiat currency devaluation, and economic uncertainty...

If you are yet to build your digital asset strategy, personally or for your business, understand we are still in the infancy stages of the next bull market cycle.