Crypto Weekly Wrap: 23rd February 2024

The crypto market has been abuzz with a flurry of activities and significant developments in recent times. One of the notable developments is Reddit's disclosure of its investment in cryptocurrencies like bitcoin (BTC), ether (ETH), and Polygon (MATIC). This move not only demonstrates Reddit's forward-thinking approach in diversifying its investment portfolio but also signifies a broader acceptance of cryptocurrencies as legitimate assets by mainstream entities. As more companies explore investment opportunities in digital assets, it further validates the growing role of cryptocurrencies in the global financial landscape.

Moreover, the surge in AI-related tokens following Nvidia's impressive fourth-quarter earnings has captured the attention of market participants. Nvidia's stellar performance has not only boosted investor confidence in the AI sector but has also propelled the prices of AI tokens such as SingularityNet (AGIX), FetchAI (FET), and Render (RNDR) to new heights. This surge highlights the symbiotic relationship between advancements in artificial intelligence and blockchain technology, underscoring the transformative potential of these innovative technologies in reshaping various industries.

Vitalik Buterin Proposes AI-Based Code Audits

In a bid to enhance the security of blockchain projects, Ethereum co-founder Vitalik Buterin has proposed the use of artificial intelligence for code audits. Given the increasing complexity of blockchain systems and the rising threat of hacks and scams, Buterin's suggestion underscores the importance of innovative solutions to bolster security measures. By leveraging AI technology, developers can streamline the process of code audits, identify vulnerabilities more efficiently, and implement timely remedial measures. This proactive approach to cybersecurity aligns with the industry's ongoing efforts to fortify blockchain networks against potential threats, thereby fostering greater trust and reliability within the ecosystem.

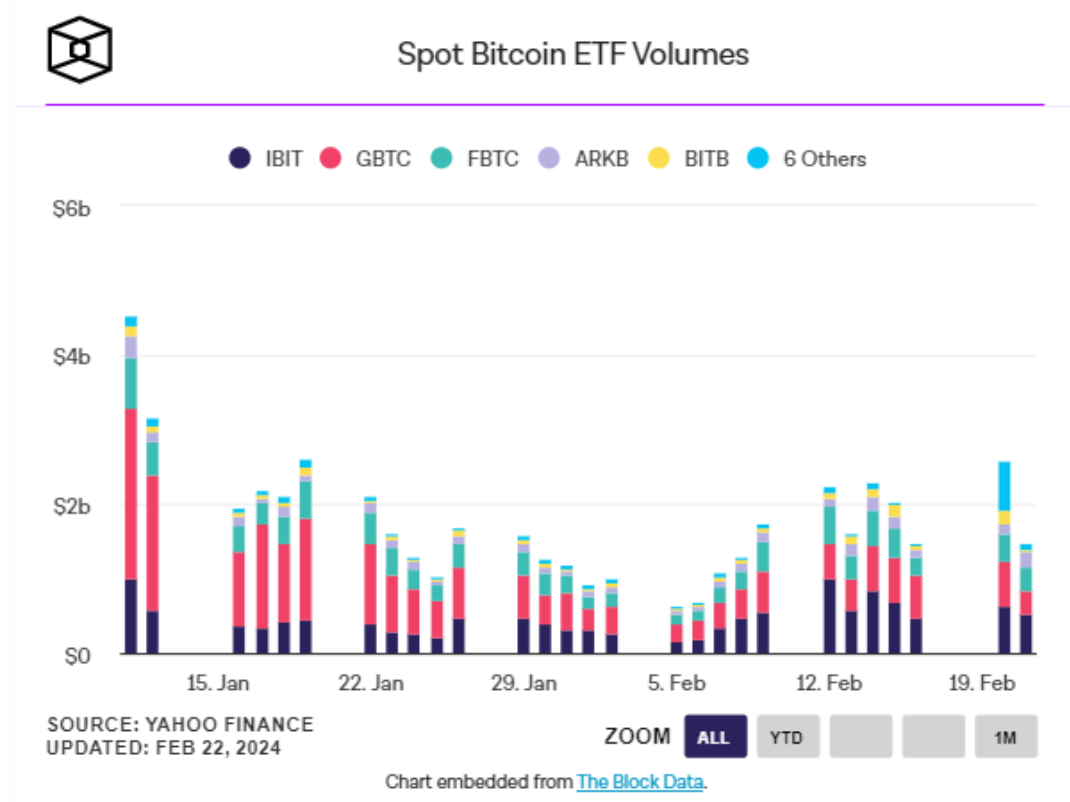

VanEck's Bitcoin ETF Records Surge in Volume

In a surprising turn of events, VanEck's HODL product experienced a remarkable surge in trading volume, driven primarily by individual traders. The sudden spike in volume, coupled with the impending fee reduction by VanEck, indicates a growing interest in bitcoin ETFs among retail investors. This trend signifies a democratisation of access to bitcoin investment opportunities, as retail investors increasingly seek exposure to digital assets through regulated investment vehicles like ETFs. The surge in trading volume also reflects the broader trend of retail participation in the cryptocurrency market, underscoring the growing mainstream adoption of bitcoin and other digital assets.

Bitcoin Analysis

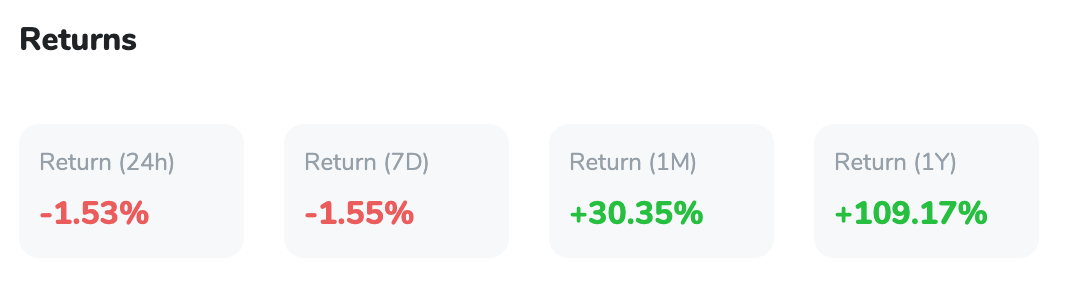

Turning our attention to the technical aspects, bitcoin's price action has been characterised by resilience amidst recent market fluctuations. Analysis of bitcoin's price chart reveals the formation of an "ascending triangle" pattern, which typically indicates a bullish trend. This pattern, characterised by higher lows and a breakout above a horizontal resistance level, suggests a potential upward movement in bitcoin's price. Moreover, the recent crossing of bitcoin's price above the 200-week moving average signals a significant milestone, with the moving average serving as a key support level.

In the wake of NVIDIA's remarkable fourth-quarter earnings report, speculation regarding Bitcoin's future trajectory has intensified within the financial sphere. NVIDIA's unprecedented revenue surge to $60.9 billion for fiscal year 2024, coupled with a substantial increase in earnings per share, underscores the profound impact of technological innovation on both traditional and the cryptocurrency markets.

The surge in NVIDIA's revenue, driven by accelerating demand for AI and computing technologies, has sparked discussions among investors about the potential implications for Bitcoin's market value. While Bitcoin's current pivot point hovers around $51,300, resistance levels at $52,880 and $56,480 pose challenges for upward price movement. Conversely, support levels at $50,820 and $47,710 offer potential buffers against downward trends.

Chart created using TradingView

Despite the cautious bearish sentiment reflected in Bitcoin's price trend, the 50-day Exponential Moving Average (EMA) provides a dynamic support level. Additionally, the Relative Strength Index (RSI) indicates a moderate lack of momentum, neither overbought nor oversold.

Overall, NVIDIA's financial success has ignited speculation about a potential correlation between technological advancements and Bitcoin's market performance, setting the stage for a captivating chapter in the cryptocurrency market. As investors monitor Bitcoin's price movements amidst evolving market dynamics, the intersection of technological innovation and financial forecasting continues to shape discussions surrounding Bitcoin's future trajectory.