The Bitcoin ETF Race Is On! - Crypto Weekly Wrap: 30th June

After strong gains across the cryptocurrency market the week previous, Bitcoin is currently consolidating around the 31,000 level of resistance. However, over the past week, roughly US$200 million of institutional liquidity flowed into digital asset investment products, the largest weekly inflow since July 2022. The inflows offset more than half of the institutional outflows over the past 9 weeks. Following the announcement of the BlackRock ETF application, institutional investors have continued to pour capital into the market. $187m or 94% of that liquidity flowed into BTC-denominated products.

Bitcoin is currently dominating the market as the race to create the very first spot Bitcoin ETF is on!

Fidelity, like BlackRock, re-entered the race to establish the first Bitcoin ETF in the United States on Thursday. The financial services firm registered for the Wise Origin Bitcoin Trust a second time. The prior filing of the investment manager was rejected by the SEC, early last year. Both BlackRock and Fidelity's recent registrations for spot bitcoin ETFs include surveillance-sharing agreements. ARK also revised their spot bitcoin ETF registration yesterday, according to CoinDesk, to add a reference to a surveillance-sharing agreement. The US Securities and Exchange Commission (SEC) has received an amended spot Bitcoin exchange-traded fund (ETF) application from ARK Investment Management.

The SEC has often voiced concern that Bitcoin markets may be manipulated. Potential spot Bitcoin ETF issuers are likely to consider surveillance-sharing agreements as a method to alleviate such concerns. The new feature would improve transparency surrounding their suggested items.

The next SEC decision date for ARK's request for a Bitcoin ETF is August 13, 2023, although no date has been set for the other 19b-4 applications, such as the one from BlackRock. The first company to obtain SEC approval for its proposed spot Bitcoin ETF will enjoy an undeniable first-mover advantage.

It appears as though the period of extreme FEAR in the Bitcoin market is over. Investor confidence is returning as institutions increase their exposure to the space. As a contrarian investor, the period of extreme fear was the optimal time to accumulate BTC.

Other Key Headlines:

▶ On June 29, Coinbase filed a motion to dismiss the recent lawsuit filed by the US Securities and Exchange Commission (SEC), claiming that the regulator went outside its regulatory jurisdiction.

▶The Financial Services and Markets Act 2023, a U.K. reform bill that recognizes cryptocurrency trading as a regulated financial activity, received so-called Royal Assent on Thursday to make the bill law.

▶Another setback for Binance is Germany's BaFin rejects the company's licence application.

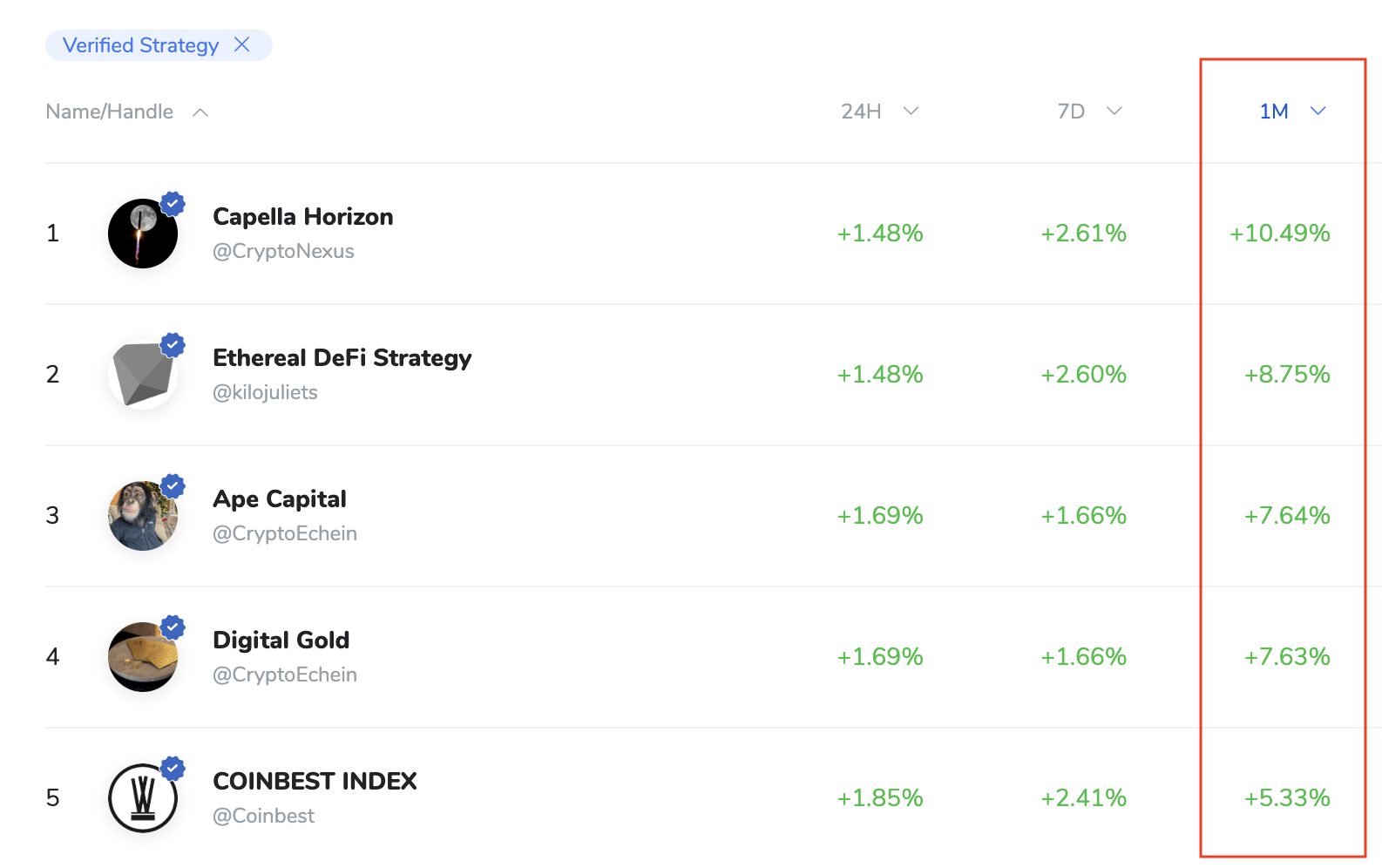

This Months Top Performing Strategies

The past month has seen very choppy price action due to the initial negative market sentiment. However, the price action during the later stages of the month has put our Strategy Managers in a great position. The stand-out performer over the past 30 days has been Capella Horizon with a +10.49% monthly gain for its investors. Ethereal DeFi Strategy is second in line with a +8.75% gain for its investors.

📞 Book a crypto consultation: https://calendar.app.google/vFWh9fhSjWaa96KN7

👉 ICONOMI Business Cryptocurrency Solutions: https://www.iconomi.com/for-business