Weekly Crypto Wrap: 15th September 2023

Bitcoin Price Surges Amid Whale Activity

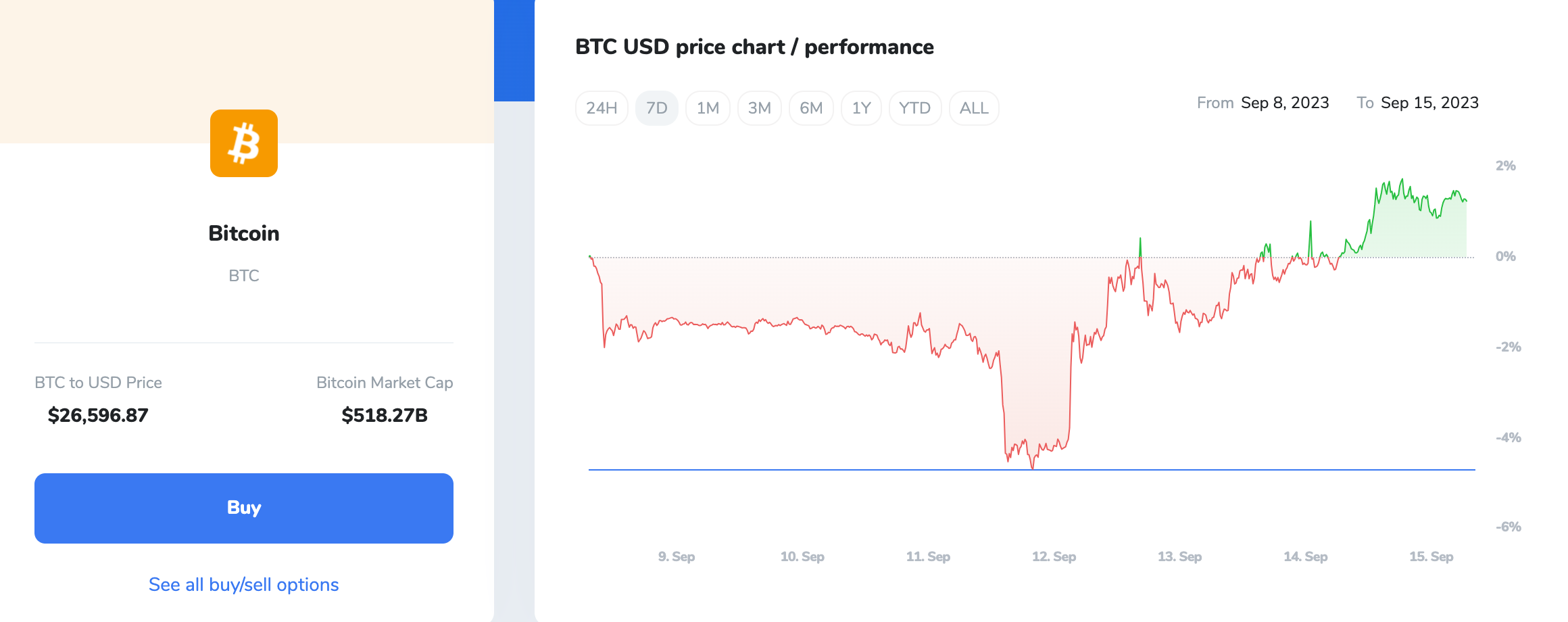

Bitcoin (BTC) has taken centre stage in the cryptocurrency market as it witnessed a remarkable resurgence. Over the past week, BTC experienced a nearly 1.28% increase in its trading price, reaching $26,587 on Friday morning. This surge in value has raised intriguing questions about the role of whales in the cryptocurrency market.

Bitcoin's recent price movements have led many to wonder whether large-scale investors, often referred to as whales, are once again entering the Bitcoin market. These major players have the potential to significantly impact the market, making their activity closely watched by both traders and analysts.

Coinbase Integrates Bitcoin Lightning Network

In a move welcomed by the cryptocurrency community, Coinbase, one of the leading cryptocurrency exchanges, officially confirmed its plan to integrate the Bitcoin Lightning Network (LN). The Lightning Network is a layer-2 payment protocol designed to address Bitcoin's scalability issues by enabling faster and more cost-effective Bitcoin transactions.

Brian Armstrong, the CEO of Coinbase, expressed his commitment to facilitating faster and more affordable Bitcoin transactions, recognizing Bitcoin's pivotal role in the cryptocurrency ecosystem. However, Armstrong cautioned that the integration process would take time and encouraged users to be patient.

This integration follows in the footsteps of other cryptocurrency exchanges, such as Binance, which have already integrated the Lightning Network for BTC withdrawals and deposits. The move is expected to significantly enhance the efficiency and affordability of microtransactions for Bitcoin users, further solidifying Bitcoin's utility as a digital currency.

FTX Receives Approval for Controlled Asset Liquidation

In a significant legal development, a Delaware District Judge, John Dorsey, granted permission to FTX, a cryptocurrency exchange currently undergoing bankruptcy proceedings, to liquidate up to an astounding $100 million worth of digital assets on a weekly basis.

This decision aims to address FTX's complex financial situation while ensuring the return of funds to creditors. To maintain a controlled and stable liquidation process, the approved plan includes specific restrictions, such as oversight by a financial advisor and a weekly sales limit of $100 million for most tokens, with the possibility of individual token-based adjustments of up to $200 million.

FTX plans to hedge its Bitcoin and Ethereum holdings to mitigate market volatility during the sales process. Additionally, FTX offers an option for users to stake certain tokens, potentially increasing returns.

DWF Labs, a tech firm, has expressed interest in acquiring FTX's assets, aiming to ensure optimal execution prices and prevent significant market fluctuations. This move is seen as a measure to safeguard the stability of the broader cryptocurrency market, instilling confidence among market participants.

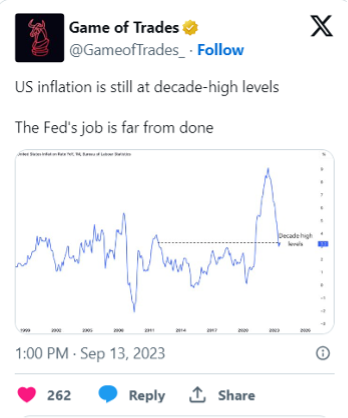

Positive Regulatory Developments and US Inflation

In a notable development for the cryptocurrency industry, Deutsche Bank announced its collaboration with Taurus, a Swiss startup specialising in cryptocurrency custody and tokenization technology. The partnership signifies traditional finance institutions' growing interest in the digital asset space. Deutsche Bank, having applied for a crypto custody licence in Germany, intends to offer custody services for selected cryptocurrencies and stablecoins, with future plans to expand into tokenized financial assets.

Meanwhile, in the traditional financial sphere, the US Department of Labor reported a 0.6% increase in the consumer price index (CPI) for August. This marked the largest monthly rise in US inflation so far in 2023, with prices rising by 3.7% compared to the same month last year. These inflationary concerns continue to drive interest in alternative stores of value, such as Bitcoin and cryptocurrencies, further highlighting their role in a rapidly evolving economic landscape.

Bitcoin Price Prediction and Analysis

Bitcoin's stability continues for now. Early this week, BTC’s price briefly fell below the significant $25,500 resistance level, falling even below $25,000. Over the week it then steadily rose to a current price of $26,587. These price dynamics have generated optimism and fuelled discussions about Bitcoin's price outlook.

Key technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), have entered the buying zone. Furthermore, the 50-day exponential moving average suggests strong bullish momentum as long as Bitcoin maintains support above $25,600.

In the event of a dip below this crucial support level, potential support zones could be identified at $25,400 and $24,950. On the flip side, Bitcoin managed to break the $26,500 resistance, so it could target higher levels.

Summary

The past week in the cryptocurrency market has been characterised by Bitcoin's resurgence, integration of the Lightning Network by Coinbase, regulatory decisions affecting FTX, Deutsche Bank's collaboration with Taurus, and concerns about US inflation. As concerns regarding traditional fiat currencies persist, Bitcoin and other cryptocurrencies continue to gain traction as alternative stores of value. This heightened interest could potentially lead to further price surges, making Bitcoin's price movements a subject of keen anticipation and analysis within the cryptocurrency community.