Crypto Weekly Wrap: 30th October 2025

Fear and Flow Reversals: Is Crypto Catching a Chill, or Just Shifting?

This week in crypto felt less like a carefully choreographed ballet and more like a crowded concert where everyone’s suddenly looking for the exits, at least for the big acts.

The Crypto Fear and Greed Index dramatically dipped from 'Neutral' to 'Fear,' mainly due to notable outflows from the shiny new spot Bitcoin and Ethereum ETFs.

Yet, amidst the rush, smaller narratives bubbled up, with Solana managing a modest uptick and its new ETF quietly attracting capital. Is this a healthy market correction, a temporary panic, or the start of something genuinely new where the altcoins start to play by their own rules? Let’s unravel the threads.

The Macro Lens

The general air this week was distinctly risk-off. The Crypto Fear and Greed Index plummeted from 51 to 34, signalling a decisive shift from a 'Neutral' stance to outright 'Fear' among investors.

This isn't just about what's happening inside the crypto bubble; it reflects the broader macroeconomic climate. Looming US Federal Reserve policy decisions, particularly the perennial debate around interest rate cuts, continue to cast a long shadow. Add to that the simmering trade tensions between the US and China, and discussions around global liquidity tightening, and you have a cocktail of uncertainty.

Crypto, like many risk assets, tends to feel the chill when the larger financial ecosystem decides it’s time to bundle up.

The Crypto Lens

If you were just watching the headlines, you'd think institutional money was fleeing crypto like a house on fire this week. Bitcoin (BTC) and Ethereum (ETH) spot ETFs witnessed significant net outflows over the past 24-48 hours. Fidelity's FBTC and ARK Invest's ARKB, typically poster children for inflows, saw substantial redemptions. BlackRock's IBIT and even Grayscale's GBTC weren't immune. Ethereum ETFs also bled, with Fidelity's FETH and Grayscale's ETHE contributing to the gloom. This largely explains the market's sudden lurch into 'Fear.'

Bitcoin (BTC)

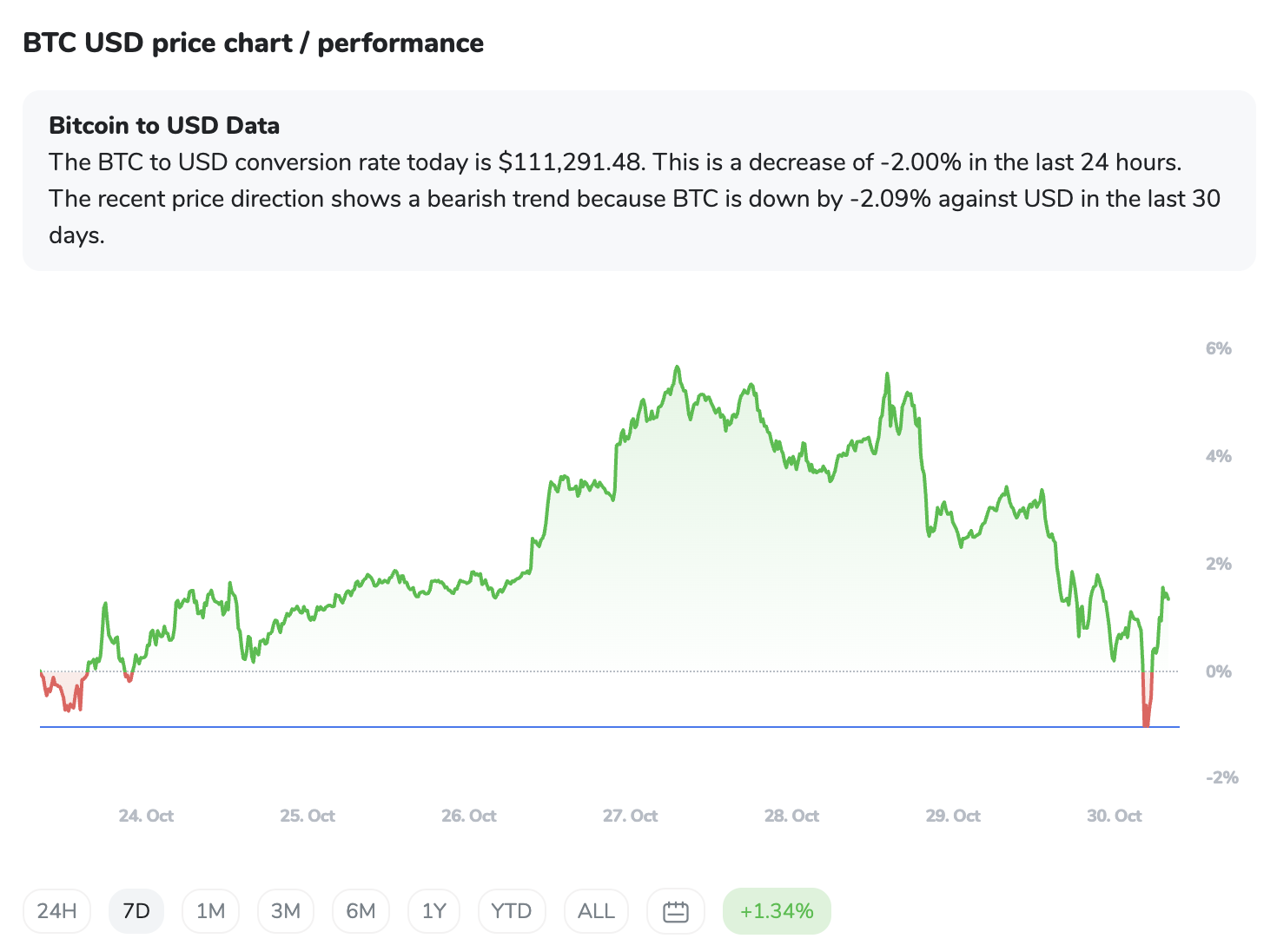

As for the assets themselves, Bitcoin has been caught in a somewhat indecisive, neutral-to-bearish consolidation phase. Imagine it as a giant, patiently waiting for instructions, hovering between a sturdy support floor of $108,000-$111,160 and a ceiling of $117,000-$120,000. Its current price sits at $111,312, down 1.8% in 24 hours. The Relative Strength Index (RSI) is below 50, which in plain English means there's no strong directional conviction. Bulls and bears are having a quiet staring contest.

Ethereum (ETH)

Ethereum, priced at $3,934.99 (down 2.04%), found itself in a similar boat, trading around the $3,900-$4,000 range. While there's underlying chatter about institutional interest potentially pushing it towards $5,500, the recent ETF outflows are a more tangible, immediate reality. It's holding key support, but also bumping against resistance from its moving averages, making forward momentum a bit of a grind.

Solana (SOL)

Then there's Solana (SOL), the contrarian of the week, chalking up a modest 0.2% gain to trade around $195. While BTC and ETH ETF managers were busy counting outflows, a newly launched spot Solana ETF (Bitwise BSOL) saw a notable $46.5 million in inflows.

This is a subtle but significant divergence: institutional appetite appears to be broadening beyond just the crypto titans, perhaps signalling a rotation or a belief in Solana's underlying tech and ecosystem. SOL is currently above its $180 support, but will need to clear resistance zones around $205-$209 to truly break free.

In essence, while Bitcoin and Ethereum took a small hit from profit-taking and broader market apprehension, the quieter story of Solana's resilience and ETF inflows suggests that institutional interest in the wider crypto landscape isn't evaporating; it might just be diversifying.

The ICONOMI Angle

Amidst a week where the broader market sentiment dipped into 'Fear,' the ICONOMI platform showcased some impressive resilience and strategic diversification.

The Metastrategy stole the show with a stellar +14.82% weekly return. Its composition, heavily weighted in Zcash (ZEC), Ethereum (ETH), Solana (SOL), and Bitcoin (BTC), demonstrates the power of a well-balanced, actively managed approach, especially when some of those smaller-cap assets find their footing.

Other top performers included the FENERATOR Crypto Strategy (+4.82%) and the Blockchain Growth Index (+4.34%), both illustrating that intelligent asset allocation can thrive even when the market's big players are navigating headwinds.

The FENERATOR strategy, with a significant allocation to Bitcoin and Ethereum alongside ZEC and SOL, managed to capture upside.

Meanwhile, the Blockchain Growth Index, focused on altcoins like SOL, Avalanche (AVAX), and Ripple (XRP), proved the potential of diversified exposure to emerging layers of the crypto ecosystem.

Perhaps most interestingly, the HODLers strategy, comprised entirely of USD Coin (USDC), delivered a solid +4.6% return. This isn't just about holding stablecoins; it suggests savvy users are leveraging ICONOMI's capabilities to generate yield on their stable assets, providing a safe harbour that still delivers returns when volatility strikes the broader market.

Despite the general 'Fear' sentiment and ETF outflows, the consistent performance of these strategies underscores the value of structured investment approaches and diversification beyond just the market leaders.

What to Watch Next

Regulatory Roadmaps: Keep an eye on the US for potential new legislation (e.g., GENIUS Act, BITCOIN Act) and clearer regulatory stances. Clarity often precedes significant capital inflows.

ETF Expansion: Beyond the immediate drama, watch for further spot ETF approvals in the U.S., particularly for Solana (SOL) and XRP (XRP), before year-end 2025. These could be major catalysts.

Institutional Adoption & Nuance: While recent ETF outflows were notable, continued institutional adoption remains key. Monitor large firms' Bitcoin allocations and how the lines between traditional finance and crypto continue to blur.

Ethereum's Evolution: The upcoming Pectra upgrade and the potential for existing spot Ethereum ETFs to gain staking functionality could significantly boost ETH's appeal and utility.

Global Monetary Policy: The Federal Reserve's anticipated interest rate cuts in 2025 are a macro heavyweight. Lower rates typically make risk assets like crypto more attractive.

Liquidity Landscape: Track global liquidity flows. Quantitative tightening continues to drain capital, creating headwinds, but any shift could reverse this trend.

Leverage Levels: Be wary of overleveraged crypto firms and ETF products. These can amplify volatility and trigger liquidation cascades during sharp downturns.

Whale & Miner Activity: Keep an eye on large-scale Bitcoin holders ("whales") and miner selling patterns, as these can signal significant price movements.

FAQs

Why did the market sentiment suddenly shift to 'Fear' this week?

The primary driver was significant net outflows from established spot Bitcoin and Ethereum ETFs over the past 24-48 hours. This, combined with broader macroeconomic anxieties like looming Fed policy decisions and global trade tensions, contributed to a risk-off sentiment.

Bitcoin and Ethereum ETFs saw outflows, but Solana's price held up. Why the divergence?

While Bitcoin and Ethereum ETFs experienced profit-taking or repositioning, a new spot Solana ETF (Bitwise BSOL) actually attracted notable inflows. This suggests that institutional interest is diversifying beyond just BTC and ETH, potentially viewing Solana as an attractive alternative or a next-generation growth play.

Does this mean institutional interest in crypto is waning?

Not necessarily. While there were significant outflows from existing Bitcoin and Ethereum ETFs, these could be attributed to short-term profit-taking or reallocation. The positive inflows into a new Solana ETF indicate that institutional capital is still actively exploring the crypto space, just perhaps with a broader and more nuanced approach.