Crypto Weekly Wrap: 5th December 2025

The $92,000 Wall of Worry: Why High Prices Feel Like Fear

On the trading floor, they had a saying: "The market stops panicking when there's no one left to sell."

However, today we are witnessing a strange anomaly. Bitcoin is trading above $92,000, a price that would have seemed like euphoria a few years ago, yet the Fear & Greed Index is sitting at a brittle 28 (Fear). It’s a quiet tension. Investors are waiting for the other shoe to drop, but the floor underneath them is holding firm.

This divergence between high asset prices and low sentiment is a rare occurrence. It usually signals one of two things: an imminent correction fueled by exhaustion, or a "disbelief rally" where the market climbs simply because everyone is too scared to buy.

The Macro Lens

The broader financial machinery is undergoing its end-of-year portfolio rebalancing. Institutional treasurers are currently looking at their 2026 allocation models, and here is the reality they face:

Liquidity Constraints

As we close out 2025, global liquidity remains tight but stable. Central banks are pausing to assess inflation data before Q1, which leaves risk assets without a fresh injection of easy money.

The Dollar Strength

The DXY (Dollar Index) has shown resilience. In traditional banking logic, a strong dollar usually hammers crypto. The fact that Bitcoin is maintaining the $90k range despite dollar strength signals that it's graduating from a "risk-on tech play" to a legitimate counterparty asset.

The macro environment isn't offering a tailwind right now, but crypto isn't collapsing under the headwind. That demonstrates structural strength. Don't expect a macro-driven pump this week; this is about organic demand vs. supply.

The Stocks Lens

Equity markets are currently playing a game of "wait and see," which typically drains volatility from the system.

The Equity Correlation

The S&P 500 and Nasdaq 100 are consolidating gains. Historically, when equities go sideways after a run-up, impatient retail capital tends to drift toward higher-beta assets like crypto to find yield. We aren't seeing that rotation en masse just yet, which aligns with the low sentiment scores.

Tech Valuation

Big Tech valuations are stretched. Wealth managers looking to protect gains are trimming tech exposure. The question is, where does that capital go? If just 1% of those realised gains rotate into digital asset ETFs for tax efficiency or diversification, it creates a floor for Bitcoin's price.

Watch the Nasdaq close today. A sharp sell-off there could trigger margin calls that bleed into crypto (short-term pain), while a gentle drift lower might encourage the rotation we're looking for (long-term gain).

The Crypto Lens

The internal market dynamics this week suggest a flight to quality within the ecosystem.

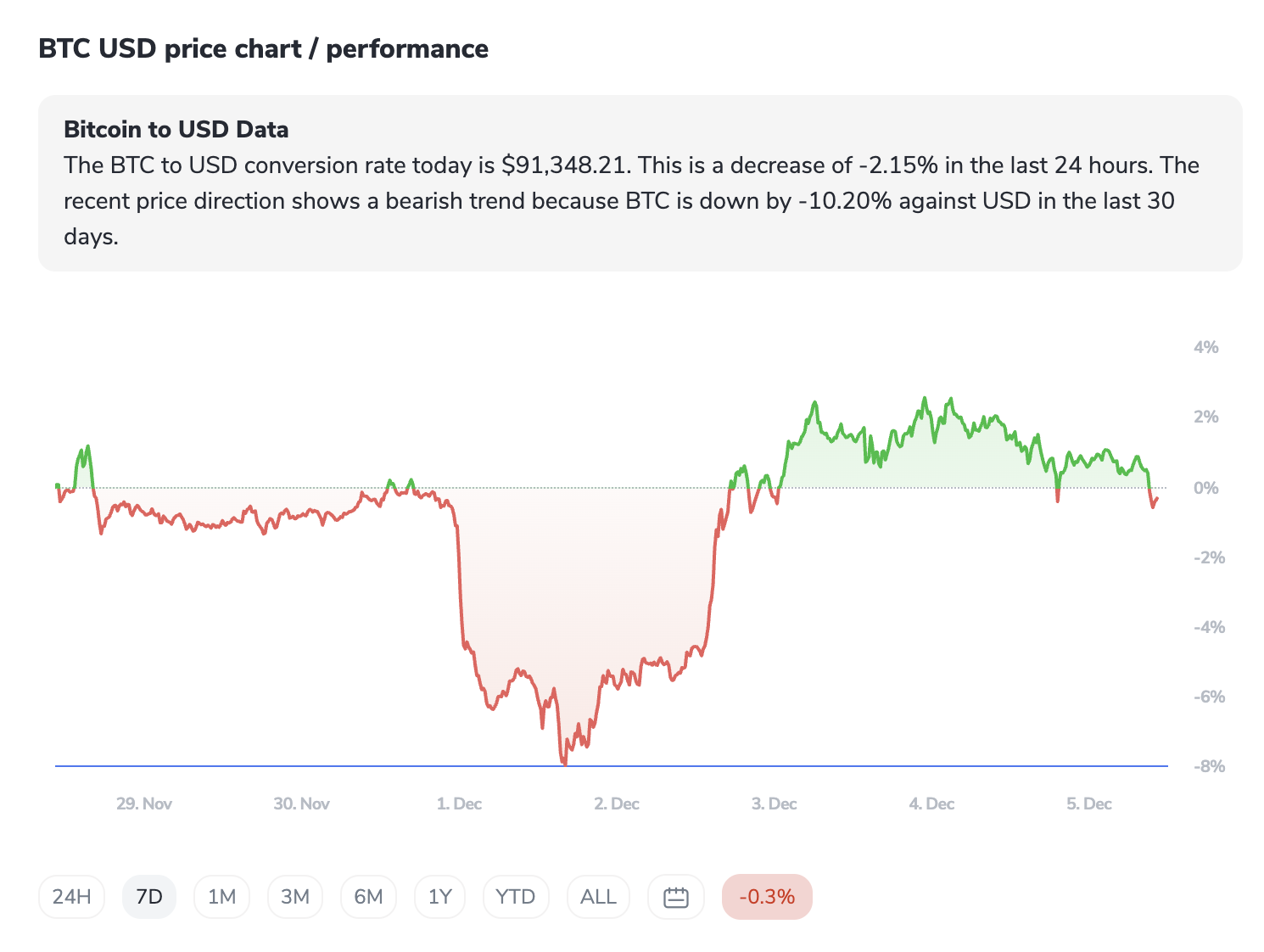

Bitcoin (BTC)

Trading at $91,108, BTC is down about 2.5% over 24 hours but effectively flat for the week. The chart shows resistance near $93.8k. The volume is respectable at $44B, indicating that this dip is being bought, albeit cautiously.

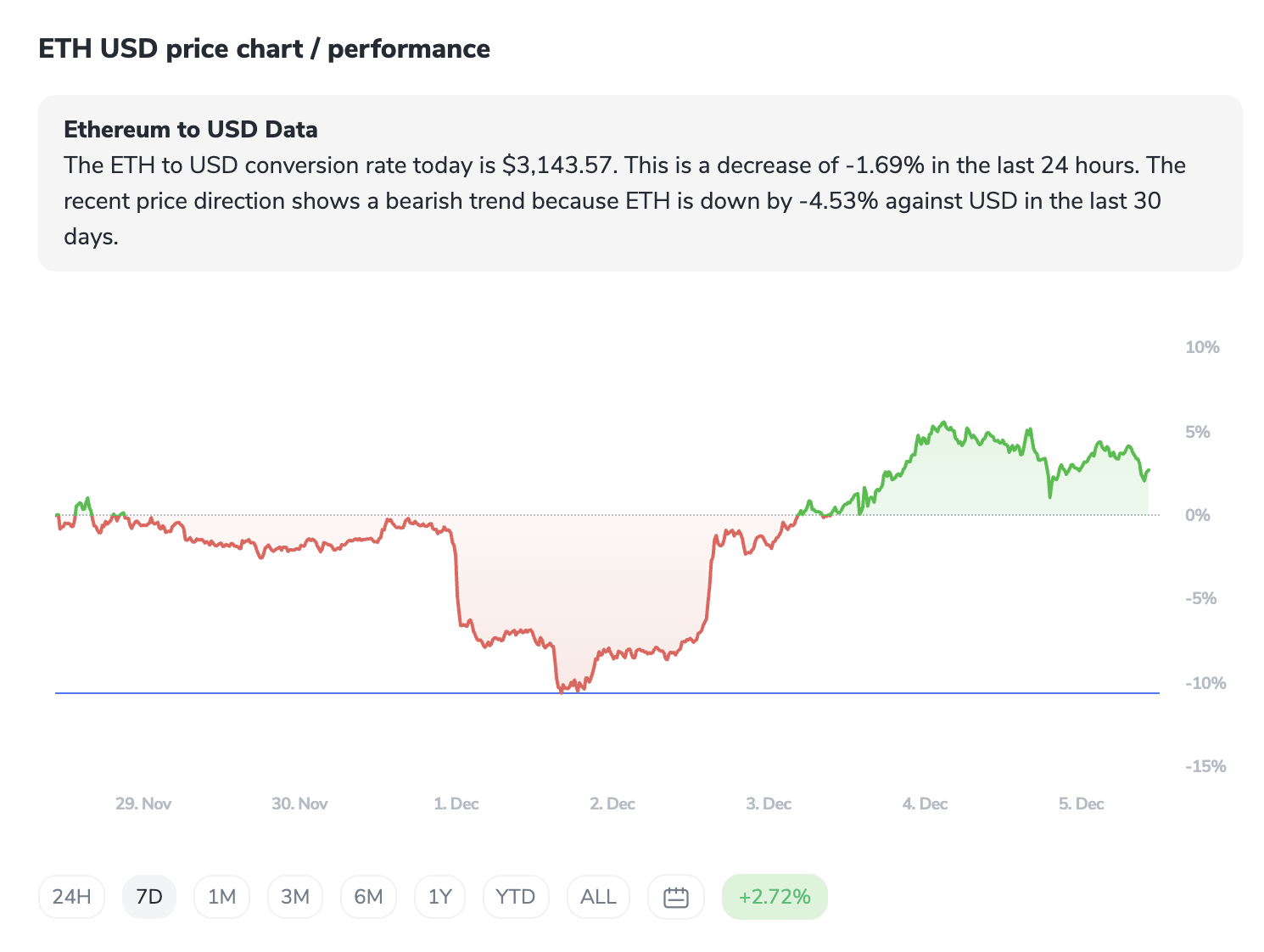

Ethereum (ETH)

ETH is the fascinating story this week. At $3,115, it’s down today but up 3.7% over the last 7 days. While Bitcoin catches its breath, Ethereum is quietly reclaiming dominance. This is often the first sign of capital rotating from the "Store of Value" leader into the "Utility" platform leader.

The Fear Index

A score of 28 (Fear) while BTC is near ATHs implies that traders are over-hedged or sitting in stablecoins.

This is not the time to chase obscure altcoins. The market is signalling that safety lies in the "Big Two." Until BTC decisively breaks $95k, expect choppy trading. The smart money is likely accumulating ETH on the ratio trade at the moment.

Notable Outliers

The volatility is concentrated at the edges of the market this week.

The Winners:

Zcash (ZEC): Up 6.7% in 24 hours. Privacy coins often catch a bid when regulatory fears spike or when the broader market gets bearish. It's a defensive rotation.

TRON (TRX): Up 1.5%. Weak market days often see liquidity flow to "old reliable" networks that capture steady transaction fees.

The Losers:

Bittensor (TAO): Down 10%. High-flying AI narratives are cooling off. When the market gets fearful, high-valuation speculative tech is the first to be sold.

Canton (CC): Down 8.1%.

Hyperliquid (HYPE): Down 7.6%. After a strong run, profit-taking is hitting the DeFi derivatives sector.

Sector Spotlight

Take a look at the trending list: Zcash (ZEC), Firo (FIRO), Terra Luna Classic (LUNC), and Bitcoin Cash (BCH).

It sounds like 2017 again. Why is this happening in late 2025? In moments of high "Fear," algorithms and older retail investors often cycle back to names they recognise, assets with long histories and unfair distribution phases behind them.

It’s also a sector rotation into Privacy. With ZEC and FIRO active, the market might be pricing in upcoming regulatory news or simply hedging against increased surveillance.

Don't ignore the "legacy" coins. In a choppy market, liquidity often flows to where the liquidity histories are deepest.

The Contrarian Take

The "Santa Rally" might be a trap. Every newsletter is predicting a massive push to $100k by December 31st. The consensus trade is almost always crowded and wrong.

With the Fear Index at 28, the contrarian view isn't that we crash, it's that we don't rise. We might be entering a period of "maximum boredom" where BTC ranges between $88k and $93k for the next four weeks, bleeding out leverage traders who are paying high funding rates to stay long. The real pain trade right now isn't a crash; it's a sideways chop that eats up your patience. Cash is a position. Don't feel forced to deploy it just because the calendar says December.

The ICONOMI Angle

This week’s ICONOMI performance data is the ultimate validator of the "Risk-Off" thesis. Look at who is winning:

Pecun.io, the top performer, is half allocated to synthetic Gold. This is classic wealth preservation. In a week where crypto is down, Gold and Cash held the line. This is how you hedge volatility.

The market is favouring diversified, defensive structures. If you are fully allocated to high-risk alts, your portfolio is volatile. Taking a page from the Pecun.io playbook, dampening volatility with stable assets or Gold, is proving to be the smart move for December.

If you are managing your own structure, check your "Ex-Top 10" exposure. In a "Fear 28" market, those assets bleed twice as fast as Bitcoin. Review your allocations to mirror what the winning Strategists are doing: staying close to the core.

The Week Ahead

December 6 (Tomorrow): US Non-Farm Payrolls. If the labour market looks too hot, expected rate cuts for 2026 might be priced out, hurting risk assets.

December 10: Monthly CPI Data. The inflation print will decide the Fed's tone for the new year.

December 12: European Central Bank (ECB) Rate Decision. Watch for divergence from the Fed; liquidity often flows from the looser currency to the scarcer asset (Bitcoin).

What to Watch Next

The $90k Defence: If Bitcoin closes two consecutive daily candles below $90,000, expect a rapid flush to the $86k support level.

ETH/BTC Ratio: Ethereum has outperformed BTC this week (+3.7% vs flat). Watch if this trend holds. If ETH breaks higher relative to BTC, it signals "risk-on" is returning despite the low sentiment index.

Stablecoin Inflows: Watch the market cap of USDT/USDC. If it stays flat, the rally lacks fuel. We need to see new dollars entering the system to break $95k.

FAQs

Why is the index showing "Fear" (28) if Bitcoin is over $91k?

Fear isn't just about price lows; it's about uncertainty. Investors are terrified of a "double top" or a significant correction after a massive run-up. Many are sitting on cash, afraid to buy the top, which ironically creates a floor under the price because there are fewer sellers left.

Why is Ethereum rising while Bitcoin falls/stagnates this week?

This is a classic rotation. Profits generated from Bitcoin's massive run are being reinvested in Ethereum, which has lagged for months. Investors see ETH as "undervalued" relative to BTC at these levels, chasing the catch-up trade.