Crypto Weekly Wrap: 28th November 2025

The November Blues: Bitcoin's Recovery Act, Starring Weak Demand and a Cast of Volatile Characters

Welcome back to the ICONOMI Weekly Market Wrap, where we sift through the digital tea leaves to tell you not just what happened, but why you should probably care.

This week, Bitcoin and Ethereum decided to put on a bit of a recovery performance, suggesting that perhaps, just perhaps, the market isn't entirely allergic to green candles. However, like a magician's misdirection, beneath the surface a less optimistic reality lurks. While charts whisper promises of upward mobility, the actual demand for these assets is, well, rather shy.

So, are we witnessing a genuine comeback, or merely a brief intermission before the next act of market drama? Your portfolio's immediate future likely hinges on spotting the difference.

The Macro Lens

Let's cast a glance at the old guard, because even in crypto, traditional finance often sets the stage for risk appetite.

The S&P 500 managed a respectable +0.91% bounce, which, for those keeping score, usually means traditional investors are feeling a tad more optimistic and might be more inclined to dip their toes into riskier assets – like, say, your crypto bags. However, the Nasdaq edged down -0.31%, signalling a more cautious sentiment towards growth stocks. This divergence suggests a selective risk-on environment, where broad-based speculative fervour might still be on thin ice.

Meanwhile, Gold, the eternal safe haven, crept up +0.76%. If the smart money is hedging with gold even as the S&P rises, it implies a lingering undercurrent of macro uncertainty, tempering any runaway enthusiasm for highly volatile assets.

In short: the macro picture is a shrug emoji, offering little clear direction for wholesale crypto risk-taking.

The Crypto Lens

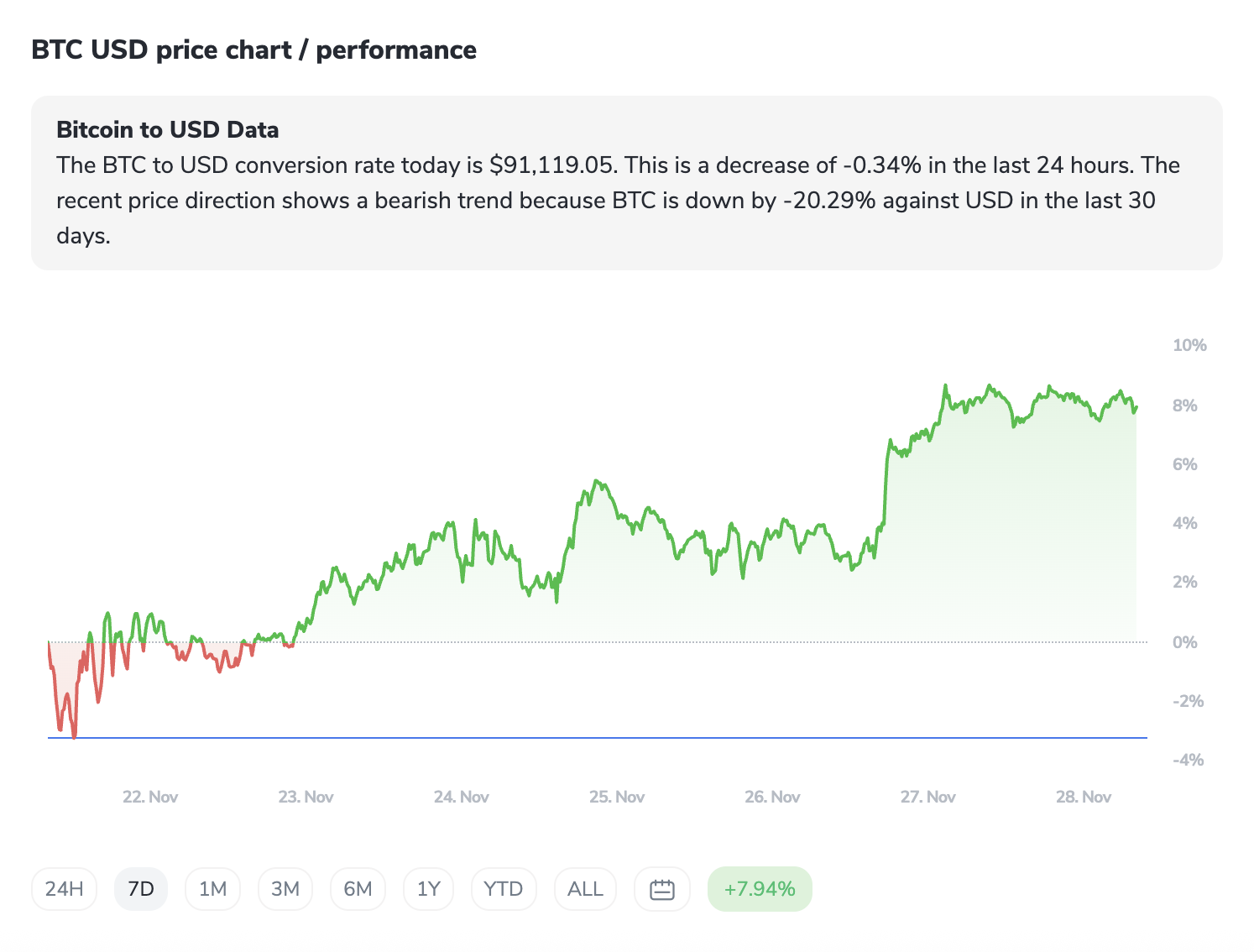

Bitcoin (BTC): A Recovery Attempt, Or Just Resting Its Eyes?

Bitcoin is currently trading above $85,000, having successfully defended the $80,500 support and even breaking a key bearish trend line at $86,800.

So what? Technically, these are encouraging signs that suggest the immediate downtrend has been interrupted. However, don't break out the champagne just yet: BTC remains stubbornly below its 100 and 200 Simple Moving Averages, which are often considered crucial indicators of long-term health.

Analysts are also pointing to increasing selling pressure and, more importantly, weak on-chain demand. This means that while price action might look like a recovery, the fundamental buying interest required for a sustained ascent isn't materialising. The market hasn't found a true bottom where buyers step in with conviction. Elliott Wave analysis is teasing a potential rally towards $100,000-$124,000 in a Wave (5) completion, but only if it successfully navigates significant hurdles and actual demand decides to show up.

For now, consider this a cautious rebound, not a confirmed breakout.

Ethereum (ETH): Tentative Steps on Shaky Ground

Ethereum is mirroring Bitcoin's indecision, attempting to stabilise around $2,900 after a notable dip from its November highs.

The good news? It's showing "emerging bullish momentum" and has cleared some resistance levels, establishing support near $2,623. This suggests some short-term trading opportunities might exist for nimble participants.

The bad news? ETH is still trading below its 9-EMA and is charting lower highs and lower lows, indicating that the overall momentum remains firmly to the downside. Elliott Wave chatter points to a corrective wave (B) possibly forming a triple zigzag, with a potential linking wave XX concluding near $3,431.04. Some brave souls even predict a revisit of $3,400 to $4,000 if a "vector candle recovery" materialises.

These are ambitious targets that rely on a significant, yet-to-be-seen, surge in buying interest. For now, Ethereum is in a tug-of-war between technical flickers of hope and broader market weakness.

The Outliers: Where Risk and Reward Play Hide-and-Seek

Zcash (ZEC): ZEC has had a truly wild ride, plunging nearly 20% over the last week. This follows an eye-watering 1,500% rally earlier in November, pushing it to $750, fueled by institutional backing, privacy narratives, tech improvements, and, critically, its recent halving event. It's now down 30% from that peak. This is a textbook "pump-and-dump" cautionary tale. While the halving provides a scarcity narrative, the extreme volatility means ZEC is currently a high-stakes gamble, heavily reactive to regulatory whispers. Proceed with extreme caution, or, perhaps, don't proceed at all unless you enjoy a good rollercoaster.

Canton (CC): Canton saw its price tumble over 30% after its initial exchange listings despite a hefty $540 million private investment – classic "bear market blues." However, it's recently shown flickers of life, with aggressive buying pushing it up 13.21% on daily charts, defending the $0.074 support, and touching $0.087. This came on the back of a 358% surge in volume, new exchange listings, and institutional integrations. Canton is a nascent project trying to find its footing. The early price drop indicated a mismatch between valuation and market reality, but recent news and buying activity suggest a potential turnaround. It's an interesting watch for those who like high-risk, high-reward plays, but remember that initial post-listing pumps and dumps are common.

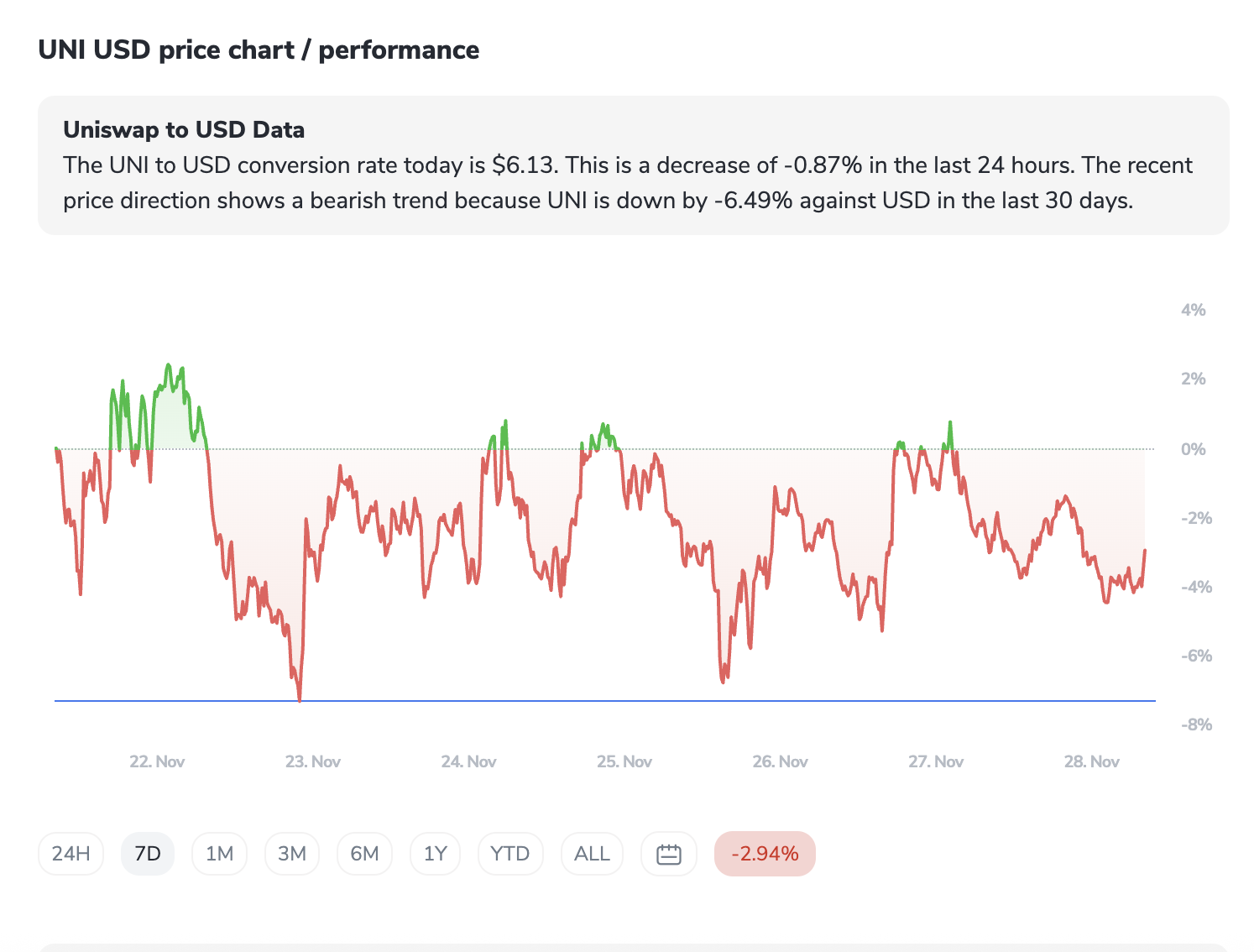

Uniswap (UNI): UNI dropped over 17% this past week, wiping out much of the enthusiasm from its 26.2% surge on November 11 after a fee switch proposal. The sentiment took a hit when a crypto whale liquidated a 5-year UNI position for an $11.7 million loss. While the fee switch is a significant narrative for Uniswap's long-term value, short-term price action is being dominated by profit-taking and weak demand. Declining open interest and an RSI around 43 scream "bearish momentum." Though it briefly reclaimed $7.20, it faces stiff resistance at its 50-day moving average. For UNI, the potential is long-term, but the present is rather grim.

Sector Spotlight

This week's outliers paint a picture of Narrative-Driven Volatility rather than a single booming sector. We're seeing privacy coins (ZEC) catch a speculative wind from halving events, followed by a sharp correction.

Then there are new enterprise-focused L1S (Canton) trying to establish legitimacy through institutional integrations and exchange listings, struggling initially but showing signs of life. And finally, established DeFi blue-chips (UNI) are wrestling with significant protocol upgrades and the fickle nature of whale money.

Investors aren't looking for broad sector plays right now; they're chasing specific catalysts (halvings, new listings, major protocol changes) but with an extremely short leash. This means that while some niche plays might offer explosive gains, they come with equally explosive downside risk.

The takeaway: do your homework on the story behind the coin, but be prepared for the story to change rapidly.

The Contrarian Take

The market's current narrative of "recovery" feels distinctly like an optimistic gloss over persistent weakness. While Bitcoin and Ethereum charts show tentative bullish signals, the underlying on-chain demand for BTC is notably absent.

This disconnect suggests that the current price action could be more akin to a 'dead cat bounce' or a 'bull trap' rather than the beginning of a sustained rally. The market might be missing the forest for the trees, focusing on short-term technicals while ignoring the crucial lack of fresh capital inflows.

True bottoms are often characterised by capitulation and then robust accumulation, neither of which is clearly evident when demand remains weak. The contrarian view here is simple: don't confuse a reprieve with a full recovery, and certainly don't mistake technical bounces for confirmed trend reversals when the fundamentals of demand aren't there.

The ICONOMI Angle

Amidst the market's daily gyrations and the dramatic swings of outliers, ICONOMI strategies have shown remarkable resilience and strong performance this week.

All five highlighted strategies delivered weekly returns exceeding 7%, handily outperforming Bitcoin's 6.44% and Ethereum's 7.73% on their own.

The WMX Crypto (+8.13%), Diversitas (+8.07%), sLOVEnia Crypto Strategy (+7.58%), Wisdom World (+7.40%), and Bitcoin Ether Risk Adjusted (+7.33%) all demonstrated that a thoughtful, diversified, or even focused approach can yield superior results.

The "so what?" for ICONOMI users is clear: smart curation, whether it's a concentrated BTC/ETH play or a broad altcoin mix, is paying dividends.

In a market where even positive news can lead to sharp corrections (looking at you, Zcash), having a professionally managed or well-researched strategy isn't just about reducing volatility – it's about consistently capturing upside and navigating complex market dynamics with a bit more grace.

The Week Ahead

Late November/Early December: Expect a flurry of macroeconomic data releases, including inflation updates (CPI, PPI) and employment figures, which will heavily influence central bank sentiment. Any unexpected shifts could send ripples through both traditional and crypto markets.

Ongoing: Keep an eye on any major regulatory announcements, especially concerning privacy coins like ZEC, or new frameworks for DeFi platforms like Uniswap. Regulatory clarity (or lack thereof) continues to be a major market mover.

End of Year Narratives: As 2025 wraps up, expect market participants to start positioning for 2026. Narratives around Ethereum upgrades, or the emergence of new Layer 1 contenders, will likely gain traction.

What to Watch Next

1. Bitcoin's Demand Revival: Is on-chain demand going to pick up, or will the selling pressure continue to cap any rallies? Watch the daily volume closely.

2. Key Resistance Levels: For BTC, keep an eye on the $88,000 (200-hour SMA) and $90,800 levels. For ETH, the psychological $3,000 and critical $3,060-$3,150 resistance zones. A clear breach with conviction would be a significant signal.

3. Outlier Sustenance: Can Canton maintain its recent gains and attract sustained interest, or will it fall back? Can UNI overcome its 50-day moving average and shake off the whale liquidation blues? These will indicate if their "stories" have legs.

4. Macro Cues: Any surprise Federal Reserve statements or unexpected inflation prints could swiftly dictate risk-on/risk-off sentiment across all markets.

FAQs

Is Bitcoin's current recovery sustainable given weak demand?

Bitcoin's recovery is currently driven by technical bounces, but weak on-chain demand suggests it lacks the fundamental buying pressure for a truly sustained, strong rally. It's more of a fragile rebound than a confirmed trend reversal right now.

Why are some altcoins, like Zcash, so volatile?

Extreme volatility in altcoins like Zcash is often due to narrative-driven speculation (e.g., privacy, halving events), lower liquidity, and susceptibility to "pump-and-dump" dynamics. They can offer high returns but carry commensurately high risks.

What does "Elliott Wave analysis" mean for my investment?

Elliott Wave analysis is a technical forecasting tool suggesting potential price movements (like BTC to $100k-$124k or ETH to $3,400-$4,000). While it provides potential targets, it's not a guarantee and should be used as one data point among many, especially when the underlying demand is weak.

With mixed market signals, what's a good strategy?

In highly uncertain and volatile markets, a disciplined approach focusing on diversification and Dollar-Cost Averaging (DCA) into a well-researched portfolio can help mitigate risk and capture long-term growth without needing to perfectly time the market.