Crypto Weekly Wrap: 12th December 2025

The $92,000 Fear Paradox

If you looked at the price boards today, you’d assume the champagne was flowing. Bitcoin is sitting comfortably above $92,000. Ethereum is holding the $3,200 line. Yet, if you look at the sentiment gauges, the market is terrified. The Fear & Greed Index is flashing a score of 29 - deep fear. We’ve rarely seen asset prices near all-time highs while sentiment is this bearish. Usually, fear lives at the bottom. When it shows up at the top, it signals a massive dislocation between price reality and investor psychology. Here is why that "Wall of Worry" might be the most bullish chart of the week.

The Macro Lens

The broader financial machinery is winding down for the year, and we are seeing classic "window dressing" behaviour in traditional markets.

Bond yields have stabilised, suggesting the frantic repricing of debt we saw earlier in Q4 2025 has calmed. For crypto, stable yields mean the "opportunity cost" of holding non-yielding assets like Bitcoin is neutral.

As corporate treasurers lock in their year-end balance sheets, liquidity tends to thin out. In the old days, this meant choppy stock trading. In digital assets, thin liquidity can amplify moves. The silence you hear isn't disinterest; it's the deep breath before financial books close for the fiscal year.

The macro environment isn't providing a tailwind right now, but it’s stopped being a headwind. For a risk asset class, "no news" is often good news.

The Stocks Lens

Equity markets are currently playing a waiting game, which directly impacts the risk appetite for digital assets.

We are seeing a slight rotation out of high-beta tech stocks into defensive staples this week. This defensive posture in equities explains why crypto sentiment is fearful despite high prices - traditional allocations are reducing risk, and crypto is essentially the furthest end of the risk curve.

The S&P 500 index is flat, digesting gains. When stocks stall, crypto often decouples. If the S&P 500 doesn't drag Bitcoin down this week, it proves that BTC is maturing as an uncorrelated asset class, a "flight to quality" within the digital realm.

Watch the Nasdaq closings. If tech stocks sell off and crypto holds steady (as it has done nicely this week), the correlation trade is breaking, and that is excellent for portfolio diversification.

The Crypto Lens

The data this week tells a story of accumulation masked by boredom.

Bitcoin (BTC)

Bitcoin is at $92,385. We are up 2.3% in 24 hours. The chart reflects a tightening coil. We have spent days chopping between $89k and $92k. In technical analysis, consolidation near highs is usually a precursor to a continuation upwards. The market is absorbing sellers without dropping prices.

Ethereum (ETH)

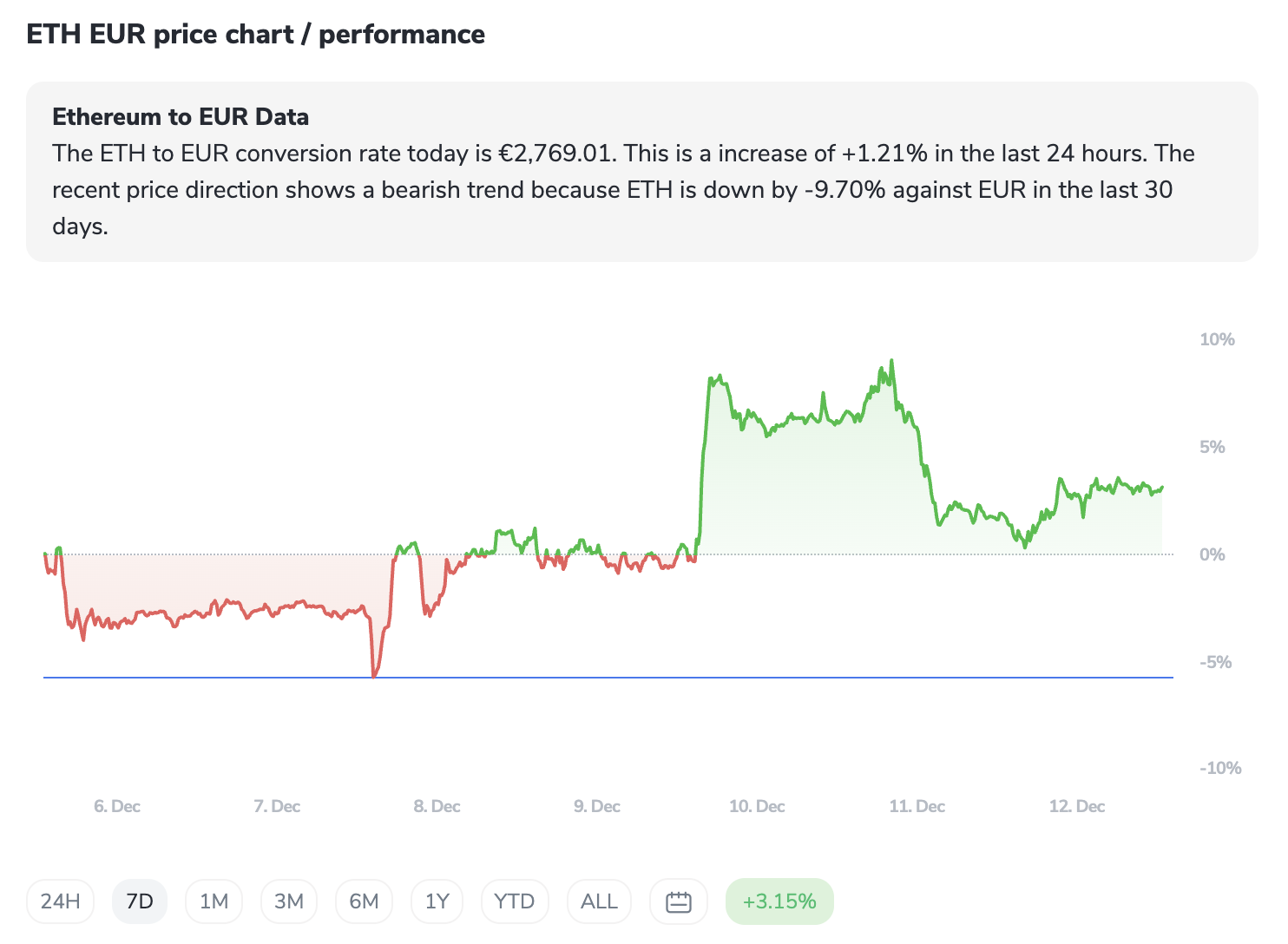

Ethereum sits at $3,239 and continues to play second fiddle, but is showing resilience with a 1.3% gain. The key here is the volumes, $24B in 24 hours. It’s healthy, but not explosive. ETH is waiting for a narrative shift to catch up to BTC.

Why the fear (Index: 29) at these prices? It's likely "height vertigo." Investors are conditioned to expect a crash after a run-up. But markets climb a wall of worry. When everyone is scared to buy but the price doesn't drop, it means the holders aren't selling.

Historically, when the crowd is fearful near price highs, it indicates that the weak hands have already folded. The remaining capital is sticky.

Notable Outliers

While the majors consolidate, capital is rotating aggressively into infrastructure and legacy privacy protocols.

Zcash (ZEC): +19.7% & +4.6% (24h)

The Why: The privacy coin sector has been dormant for ages. A near 20% move suggests a rotation of profits into "forgotten" value plays, or perhaps anticipation of regulatory clarity regarding privacy focused assets in 2026.

Mantle (MNT): +19.5%

The Why: Layer 2 wars are heating up. Mantle's double-digit gain indicates speculation on liquidity incentives or ecosystem growth. It's an infrastructure bet.

Hyperliquid (HYPE): +8.3% (24h) / -8.4% (7d)

The Why: High volatility here. After a sell-off earlier in the week, buyers stepped in. This volatility is typical for newer DEX tokens finding their fair market value.

Sector Spotlight

In moments of uncertainty (remember that fear index?), capital retreats to what it knows. Aave has a functioning revenue model. Zcash has a clear use case (privacy). When investors are scared of vaporware, they park money in protocols that have survived multiple bear markets. This isn't necessarily a new bull run for these specific coins, but a defensive rotation within crypto.

The Contrarian Take

The Fear Index is Right, but for the Wrong Reason.

Most analysts think the Fear Index (29) is a buy signal. I’m not so sure. The contrarian view here is that the market is "tired." We are hovering at high valuations with thinning liquidity as the holidays approach. The lack of a blowout "Santa Rally" yet could indicate exhaustion.

If BTC fails to break $94,000 decisively in the next 48 hours, we could see a harsh "liquidity flush" down to the mid-$80ks simply because there are no buyers left to push it higher until January. The contrarian move right now isn't to leverage up—it's to keep dry powder for a potential end-of-year markdown.

The ICONOMI Angle

The top-performing strategies on ICONOMI this week reinforce the theme of Focused Diversification.

Metastrategy (+2.83%) and FENERATOR Crypto (+1.72%) took the top spots.

The Common Thread: Look at their holdings. They aren't chasing the outlier flavour of the month. They are heavy on BTC (anchoring the portfolio). They have strategic allocations to Zcash (ZEC) (catching the 19% breakout).

The winners this week didn't win by day-trading the 15-minute charts. They won by having a position in ZEC before it moved, while using BTC to dampen volatility. This validates a core portfolio theory: You buy the majors to preserve wealth, and you sprinkle in high-conviction alts to grow it. Chasing the pump usually means you're being used as exit liquidity.

The Week Ahead

Dec 15 (Monday): US Tax Harvesting Deadline (Soft): Many traders begin selling losers to offset gains mid-month. Expect downward pressure on underperforming altcoins.

Dec 17 (Wednesday): FOMC Minutes Release: The market will scan this for hints on 2026 interest rate policy.

Dec 19 (Friday): Monthly Options Expiry: Large open interest on BTC/ETH options could pin prices or cause volatility as contracts settle.

What to Watch Next

The $93,500 Level: If BTC cracks this, the path to $100k is open. If it rejects, we retest $88k.

Volume vs. Price: If prices rise but volume drops, it's a "fakeout." We need volume to confirm conviction.

ETH/BTC Ratio: Ethereum is waking up. If this ratio starts climbing, we are entering an "Altcoin Season" rotation.

FAQs

Why is the Fear & Greed Index at "Fear" (29) if Bitcoin is over $92k?

Sentiment often lags price or reflects uncertainty rather than loss. Investors are likely nervous that the rally has gone "too far, too fast" and are fearful of a correction, even though the price is holding up. This is often called "disbelief."

Zcash is up almost 20%. Is privacy making a comeback?

Privacy never left, but regulatory pressure suppressed the price. The current move looks like a "mean reversion"—it was oversold for too long. However, be careful chasing it; meaningful regulatory changes haven't happened yet.

Is it safe to enter the market right now?

"Safe" is relative. Entering at All-Time Highs always carries risk. However, buying during a period of consolidation (sideways movement) is generally safer than buying during a vertical pump. Dollar-Cost Averaging (DCA) remains the smartest play for long-term entry.