Crypto Weekly Wrap: 27th June 2025

Global Watchdog Issues Crypto Enforcement Warning Amid Stablecoin Surge

The Financial Action Task Force (FATF) has issued a strong call for enhanced global oversight in the crypto space, raising concerns over the increasing use of stablecoins by illicit actors, particularly those linked to North Korea. In its latest report, the FATF highlighted that while many jurisdictions have made progress implementing anti-money laundering (AML) and counter-terrorism financing (CTF) measures since 2024, significant enforcement gaps remain. These include issues in licensing, cross-border regulatory oversight, and identification of virtual asset service providers.

The watchdog spotlighted the growing use of stablecoins in illicit finance, referencing the $1.46 billion crypto heist carried out by North Korean hackers targeting ByBit – the largest theft on record. Alarmingly, only 3.8% of the stolen assets have been recovered, underscoring the lack of global coordination in asset tracing and seizure. While 99 jurisdictions are moving toward compliance with the Travel Rule, the FATF warns that stronger cross-border supervision is vital to reduce crypto's exposure to criminal misuse.

MiCA’s Stablecoin Rules Face Early Challenges in the EU

In Europe, stablecoin regulation under the Markets in Crypto-Assets (MiCA) framework is encountering early resistance. The European Commission is preparing fresh guidance on whether stablecoins issued across jurisdictions by the same firm can be treated as interchangeable. This clarification follows market confusion after Ethena’s EU exit due to a failed licensing attempt in Germany.

Under MiCA, only licensed firms can issue stablecoins backed by reserves held in EU-based banks, with no interest allowed on tokens. The Commission is expected to allow fungibility across regions if the issuer holds a MiCA licence within the EU. However, the European Central Bank (ECB) has raised alarms, warning that this could strain EU financial reserves during redemptions by non-EU users. Despite these concerns, the Commission remains confident that proper re-balancing mechanisms and clearly separated redemption channels will mitigate risk.

Ethereum Shows Signs of Strain as RSI Nears Overbought Levels

Ethereum’s recent price movement reflects a period of consolidation, with the asset trading around $2,446 after a brief climb. The 5-day chart reveals a lack of strong directional momentum, as price fluctuations remain within a narrow band. The RSI currently reads 66.25, approaching the overbought threshold of 70, suggesting that buying pressure may soon taper off. Volume data adds to the cautious sentiment, as 24-hour trading volume has gradually declined to 237.47 million, pointing to reduced participation. While Ethereum has held above $2,400, the absence of a clear breakout or high-volume surge indicates limited upside in the immediate term. Traders should watch for potential short-term corrections or sideways movement unless stronger catalysts emerge.

Bitcoin Confronts Market Crossroads Amid Macro Uncertainty

Bitcoin is holding above $107,000 after rebounding from recent geopolitical shocks, but market signals now suggest the asset is approaching a key turning point. Adding to concerns, stablecoin outflows from derivative exchanges have reached $1.25 billion. This sharp exodus highlights weakening structural support for long positions and reflects a growing aversion to risk in the current climate. The macro backdrop remains fragile, with Federal Reserve Chair Jerome Powell recently signalling that future conditions may warrant rate cuts, prompting speculation about a pivot to looser monetary policy.

According to fresh market indicators, investor sentiment is now in neutral territory, with the Fear and Greed Index sitting at 49. Bitcoin dominance continues, as shown by the Altcoin Season Index score of just 21—well within “Bitcoin Season” territory. Meanwhile, overall market capitalisation has stabilised around $3.28 trillion, with 24-hour trading volume near $96.65 billion. Bitcoin’s relative strength, despite wider market softness, reflects its perceived safety but also suggests that without renewed risk appetite, its current levels may be difficult to sustain.

Internal Market Metrics Signal Rising Volatility for BTC

Recent technical indicators on the 5-day BTC chart suggest heightened volatility may lie ahead. The Relative Strength Index (RSI) is trending upward, with the latest RSI reading at 67.45—approaching overbought territory. This signals potential exhaustion in buying momentum, often a precursor to short-term corrections or sideways movement. At the same time, volume has remained relatively subdued, and the 24-hour volume trend has gradually declined to 78.63 million, reflecting waning trading enthusiasm despite recent price gains. Price action shows a volatile but overall upward trajectory, yet this growth has lacked strong volume confirmation, implying fragility in the rally. As such, while there is no clear indication of immediate reversal, these internal signals suggest Bitcoin could enter a consolidation phase or experience profit-taking pressure if buying power weakens further.

Ripple’s Legal Hurdles Persist as Court Rejects $50M Settlement

In a key legal development, Judge Analisa Torres has rejected a $50 million settlement between Ripple and the SEC, leaving in place the permanent injunction on XRP’s institutional sales. The ruling underscores the long-standing legal uncertainty surrounding XRP’s classification and highlights Ripple’s ongoing regulatory hurdles. While other crypto firms have benefited from a more lenient SEC stance under new leadership in 2025, Ripple remains bound by a prior court judgment that found institutional XRP sales in violation of securities laws. As retail trading of XRP continues unaffected, Ripple’s ability to engage institutional partners remains severely restricted—setting it apart from peers enjoying regulatory reprieve.

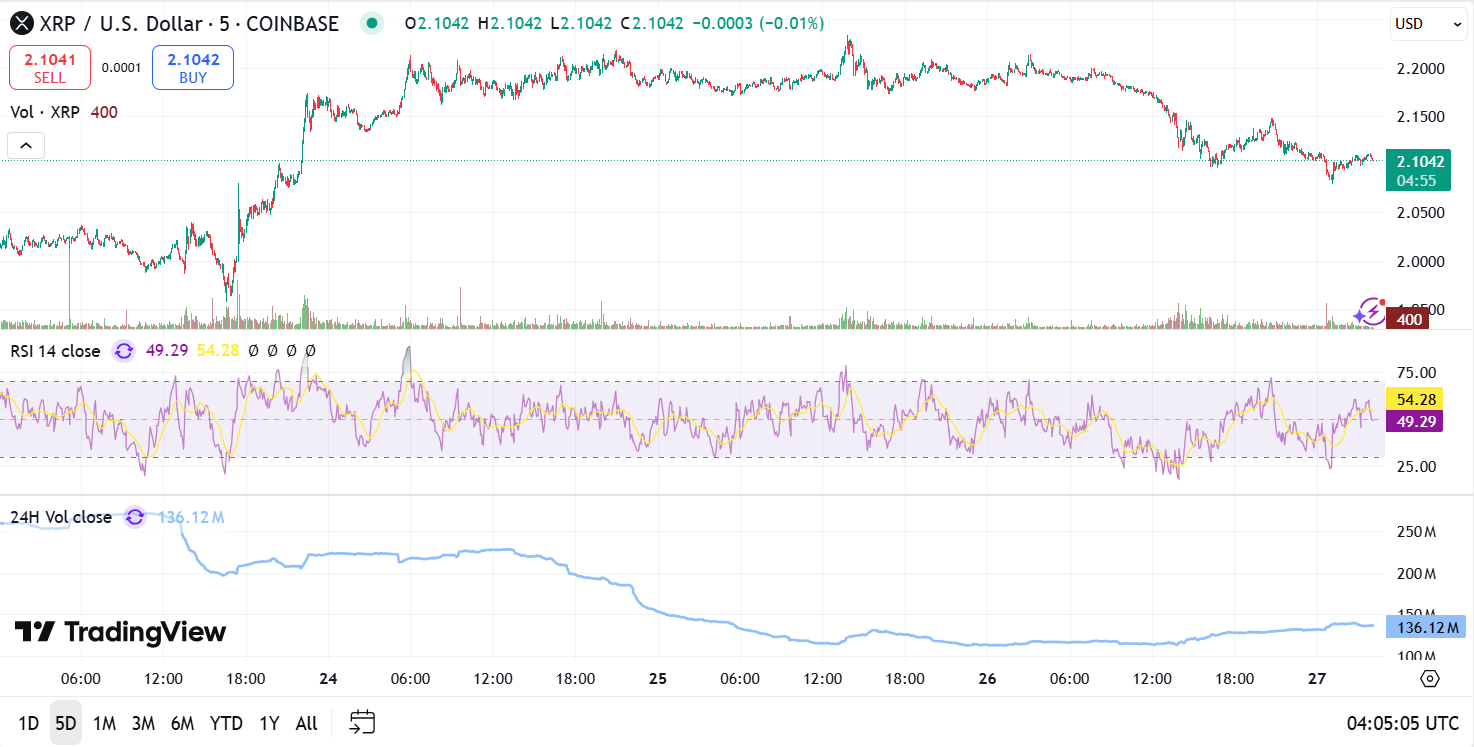

From a technical perspective, XRP has been trading around $2.10 over the past five days, showing signs of declining momentum. The RSI currently stands at 49.29, suggesting neutral territory with no strong trend in either direction. Meanwhile, volume has picked up slightly to 136.12 million, yet the price remains under the resistance zone near $2.20, where it previously rejected. The chart reflects increased volatility following the court ruling, with price action turning choppy and lacking direction. Unless XRP can break above recent highs with sustained volume, it may remain range-bound in the near term.

Galaxy Digital Expands Crypto Investment Horizon with $175M Venture Fund

Galaxy Digital has launched its first external investor-backed venture fund, securing $175 million to fuel early-stage crypto innovation. The Galaxy Ventures Fund I surpasses its initial $150 million target, reflecting strong investor appetite for startups building blockchain infrastructure, stablecoins, tokenisation solutions, and digital payments. This marks a strategic expansion for Galaxy Ventures, which has previously invested from its own balance sheet. With over 120 companies already in its portfolio, including names like Ethena and Monad, the new fund reinforces Galaxy's position as a leading backer of Web3 growth. The launch coincides with Galaxy Digital’s Nasdaq debut, a move CEO Mike Novogratz hails as pivotal in bridging traditional finance with digital asset innovation.

AI-Powered Crypto Apps See Explosive Growth as Onchain Activity Surges

AI-driven decentralised applications are rapidly reshaping the Web3 landscape, with user numbers and funding soaring in 2025. According to DappRadar, AI-related onchain activity has surged by 86% this year, supported by 4.5 million daily active wallets and $1.39 billion in funding—up 9.4% from 2024. AI apps have grown their market share to 19%, closing in on blockchain gaming’s 20%, as AI agents increasingly act as onchain copilots across DeFi, social platforms, and gaming. With Europe leading AI app usage at 26%, and significant engagement from Asia and North America, demand is now global. DappRadar suggests that AI could become the leading Web3 vertical by year-end.

Market Outlook: Continued Instability, but Long-Term Opportunity

Despite the immediate challenges facing both Ethereum and Bitcoin, long-term market fundamentals remain largely intact. The regulatory landscape is slowly maturing, with MiCA laying a framework in Europe and U.S. enforcement trends shifting under a more pro-innovation approach. The FATF’s global push for stricter compliance could also help reduce criminal misuse, building trust in the industry.

In summary, while the crypto market faces complex headwinds, the outlook for ETH and BTC remains cautiously optimistic—provided investors can weather near-term volatility and focus on long-term fundamentals.