2025 Crypto & Macro: A Look Back and Forward Guidance From ICONOMI

"The only thing constant is change." It's a cliché for a reason, especially when you're looking at markets. As we round out 2025, it feels like only yesterday we were grappling with the echoes of "stagflation" and trying to make sense of a world that seemed to be accelerating its pace of disruption. Now, with some distance, we can start to piece together a clearer picture of what truly unfolded in the crypto and macroeconomic realms.

For us, looking back isn't just about nostalgia; it’s about learning. Every year, the markets leave breadcrumbs, patterns, if you will, that can help us navigate the paths ahead. As someone who’s spent years sifting through the noise, we’ve found that the real insights often come from stepping back, connecting the dots, and asking, "Why did that happen?" So, let's unpack 2025.

The Macro Landscape of 2025: A Year of Shifting Sands

Remember all that talk about sticky inflation? For a while. Supply chain issues, though easing, hadn't been fully resolved, and geopolitical tensions continued to add a risk premium to energy and commodity prices. We saw a continuation of cautious monetary policy from major central banks, albeit with nuances. The Fed, for instance, showed a willingness to maintain higher rates for longer, a stance that inevitably dampened equity market enthusiasm in the first half of the year.

However, as the year progressed, we started to see the cumulative effect of these policies. Demand destruction, a harsh but necessary consequence, began to temper consumer spending. Technology, particularly in areas like AI-driven logistics and automation, also played an unsung role in improving efficiencies, slowly chipping away at cost pressures. By year-end, while not entirely quiescent, inflation had largely moved from being a runaway train to a manageable, albeit high, speed.

Global Economic Currents: Divergence and Resilience

One of the defining features of 2025 was the divergence in economic performance across major regions. The US, buoyed by a resilient labour market and continued innovation, managed to avoid a deep recession, though growth was certainly subdued. Europe, grappling with energy costs and regional conflicts, faced a tougher road, with some economies flirting with contraction.

Emerging markets presented a mixed bag. Countries with strong commodity exports often benefited from elevated prices, while those heavily reliant on imports or struggling with local political instability faced headwinds. The overarching theme was resilience – not growth, but a determined effort to navigate complex economic currents.

Geopolitical Realities and Market Impact

Geopolitics remained a significant, if less volatile, factor than crises. It felt more like a low hum of background risk rather than a series of deafening alarms.

The takeaway? 2025 reinforced the idea that economies are incredibly adaptive. They might bend, but they rarely break completely, even under considerable strain.

The Crypto Market in 2025: Maturation Amidst Volatility

Ah, crypto. Always a fascinating beast. 2025 was a year of consolidation and quiet, steady progress for the digital asset space, punctuated by moments of characteristic volatility. It wasn't the 'to the moon' year some maximalists might have hoped for, but it was absolutely a year of fundamental growth and institutional embrace.

Bitcoin's Steady Ascent and Halving Afterglow

Bitcoin, as the bellwether, performed admirably. The halving event that preceded 2025 had its expected bullish impact, but it was sustained interest from institutional players and continued development in the spot ETF space that provided a solid foundation. Bitcoin’s narrative as "digital gold" gained further traction amidst global economic uncertainty, reminding us that its value often shines brightest when traditional assets falter.

What's compelling about Bitcoin's 2025 performance isn't just the price action, but the increasing maturity of its infrastructure. Custody solutions improved, regulatory clarity (albeit slowly) increased in several jurisdictions, and the asset class became less a speculative play and more a strategic allocation for a growing number of sophisticated investors.

Altcoins: Innovation and Consolidation

Beyond Bitcoin, the altcoin market was a mixed bag, as the maturity curve for many altcoins. The euphoria of earlier cycles gave way to a more discerning market. Projects with strong fundamentals, active developer communities, and clear roadmaps fared well. Those that were all hype and no substance found themselves struggling. This consolidation is a healthy sign for the overall ecosystem, weeding out weaker projects and strengthening the core.

Our own view? This culling is necessary for long-term health. You can’t build a skyscraper on a shaky foundation.

Regulatory Evolution: A Double-Edged Sword

Regulation remained a dominant theme. While some jurisdictions adopted more progressive frameworks, others remained cautious or even restrictive. The US, in particular, continued its slow, sometimes frustrating, dance toward comprehensive crypto regulation. Yet, the very act of discussion and iteration, however imperfect, brought more clarity. This wasn’t just about enforcing rules; it was about defining where crypto fits into the existing financial landscape.

The establishment of regulatory frameworks, even imperfect ones, is a crucial step towards broader adoption. It reduces uncertainty for institutions and offers a degree of protection for retail investors. While it might constrain some of the "wild west" elements of crypto, it's a necessary compromise for mainstream acceptance.

ICONOMI Strategies in 2025: Navigating the New Normal

Note: Performance was evaluated in USD, not EUR.

The Value of Diversification: Not Just a Buzzword

The top-performing strategy on ICONOMI offers a glimpse into what worked consistently throughout the year.

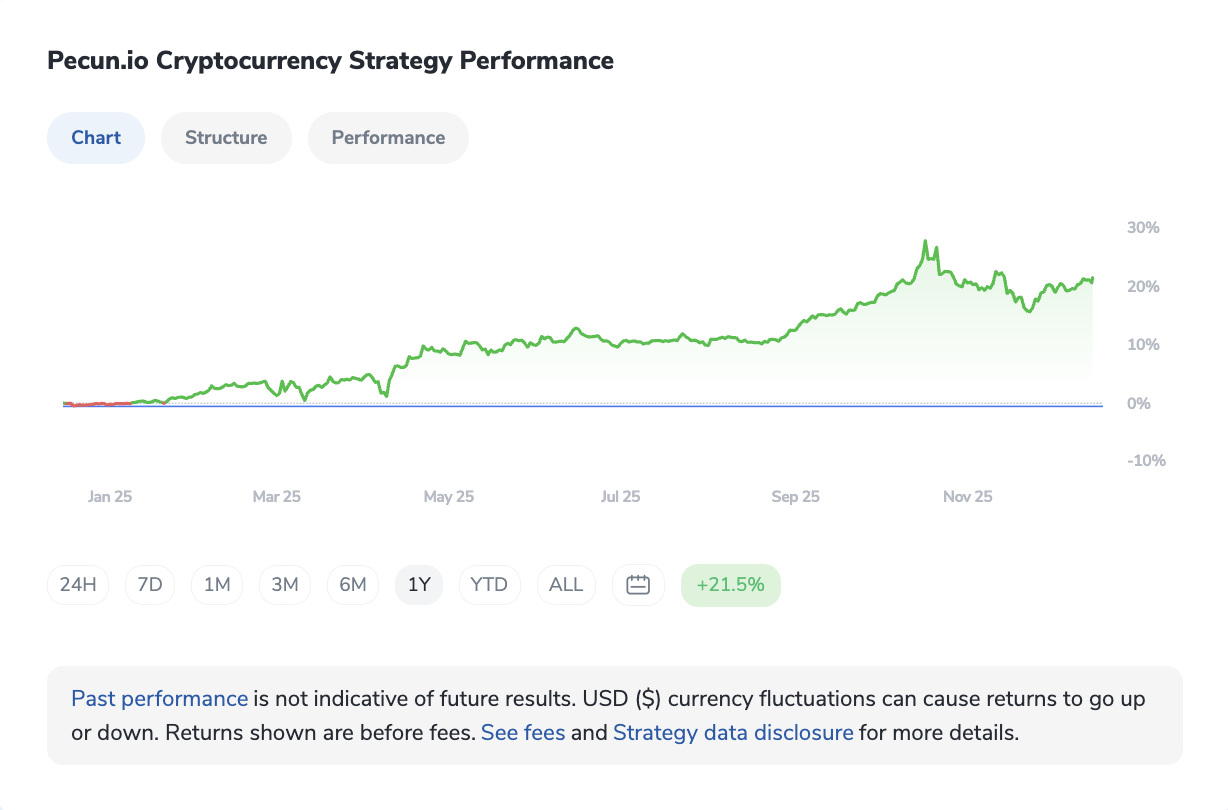

Pecun.io Cryptocurrency: Fundamentals and Long-Term Vision

Pecun.io Cryptocurrency's consistent positive return points towards a strategy grounded in strong fundamental analysis and a longer-term perspective. This isn't about chasing every new meme coin; it's about identifying projects with genuine utility, viable business models, and strong development teams.

In a year where many altcoins struggled for relevancy, a strategy focused on core innovation and real-world application would have weathered the storms better. These strategies often involve deeper research into whitepapers, tokenomics, community engagement, and adoption metrics. It's about investing in the future, not just speculating on the present.

HODLers: Stability and Selective Exposure

HODLers also stood out in 2025, delivering a positive yearly return through a stability-first approach built around a high USDC allocation paired with selective Bitcoin exposure. This positioning allowed the strategy to participate in market upside while maintaining lower overall volatility.

Its structure proved to be resilient in a year defined by consolidation and uneven altcoin performance. HODLers show how disciplined, conservative allocation can still produce attractive results during uncertain market conditions.

What We Learned From 2025's Top Performers

Looking at these top strategies, a few patterns emerge:

1. Risk Management is Paramount: No strategy can guarantee returns, but the best ones excel at managing downside risk. This means understanding position sizing, diversification, and having a clear exit strategy.

2. Adaptive, Not Reactive: The market moves fast. Successful strategies anticipate shifts, rather than simply reacting to them. This requires constant monitoring and a willingness to adjust.

3. Fundamental Strength: In the long run, projects with real utility, strong teams, and growing ecosystems tend to outperform pure speculation. This holds true in traditional markets and is increasingly true in crypto.

4. Patience and Discipline: Good strategies aren't about getting rich quickly. They are about consistent, disciplined execution over time. The "long game" almost always wins in the end.

Looking Forward: Beyond 2025

So, what does all this mean for the road ahead? 2025 was a year of transition – from a tumultuous post-pandemic era to a more stabilised, albeit still complex, economic reality.

For crypto, 2025 solidified its position as a legitimate asset.

On the macroeconomic front, while inflation may be more contained, interest rates are unlikely to revert to the near-zero levels of the past decade anytime soon. This means a sustained focus on capital efficiency, profitability, and prudent financial management for businesses. Investors will continue to seek out assets that offer a hedge against inflation and a strong risk-adjusted return.

The patterns of 2025 remind us that thoughtful preparation and intelligent adaptation are your best allies. The market isn't a one-way street, and success often comes not from predicting the unpredictable, but from building a resilient approach that can weather whatever comes next. It’s about understanding the waves, not trying to stop them.